The tax dispute resolution mechanism under transfer pricing in India consists of the following forums : –

- DRP or Appeal before the Commissioner of Income Tax (Appeals);

- Income Tax Appellate Tribunal;

- The High Court / Supreme Court;

- Safe Harbour Rules;

- Advance Pricing Agreement; and

- Mutual Agreement Procedure

DISPUTE RESOLUTION PANEL – [SECTION 144C] – FEATURES

FEATURES OF DRP ARE LISTED BELOW : –

- CBDT has constituted a panel [DRP] comprising of three Principal Commissioners or Commissioners of Income-tax.

- The following assessees are Eligible assessees for filing objections before the DRP:-

- Foreign Company.

- Any person in whose case variation arises on account of order of Transfer Pricing Officer, passed, under Section 92CA(3).

- The AO shall, forward a “proposed assessment order (draft order)” to the eligible assessee if he proposes to make [on or after 1st October, 2009] any variation in the income or loss returned which is prejudicial to the interest of such assessee.

- Assessee can file objections against the draft order with the DRP within 30 days of the receipt of the draft order.

- Where any objections are received from assessee, DRP shall issue directions for guidance of the AO to enable him to complete the assessment (after considering draft order, all objections, evidence, etc.). Such direction should be issued within nine months from the end of the month in which the draft order is forwarded to the eligible assessee.

- Before issuing any such directions, DRP may : –

- make further enquiry itself; or

- cause any further enquiry to be made by any income tax authority and report the result of such enquiry to DRP.

- The Dispute Resolution Panel may : –

- confirm the additions proposed by AO;

- reduce the additions proposed by AO; or

- enhance the additions proposed by AO

- in the draft order.

Note : – DRP cannot set aside any proposed variation or issue any direction for further enquiry and passing of the assessment order.

- Upon receipt of such direction of DRP, the Assessing Officer shall complete the assessment in accordance with such direction, within one month from the end of the month in which the direction is received without providing any further opportunity of being heard to the assessee.

- Such order of the Assessing Officer is directly appealable before the Tribunal.

PROCEDURE TO BE FOLLOWED BY ASSESSEE UNDER DRP ROUTE

DISPUTE RESOLUTION MECHANISM – APPEAL BEFORE THE COMMISSIONER OF INCOME TAX (APPEALS) – [SECTIONS 246A, 249 & 250]

Appeal may be made before CIT(A) against : –

- Assessment order passed u/s 143(3) or 144 of the IT Act.

- Intimation u/s 143(1).

- Reassessment order u/s 147 or 150 (re-computation).

- Assessment or reassessment in search cases u/s 153(A).

- Rectification Order u/s 154.

- Assessment or reassessment order under Section 92CD(3)

NOTES : –

- Section 150 deals with assessment/ re-assessment/ re-computation is made in order to give effect of any finding or direction contained in an order passed by any Income tax authority or by a court.

- Section 153A prescribes assessment procedure in case of search and seizure.

- Section 92CD(3) deals with assessment/ re-assessment/ re-computation of total income by the AO where APA has been entered by the assessee.

- AO to determine ALP u/s 92C(3).

- Appeal before CIT(A) has to be filed within 30 days of receipt of assessment order alongwith demand notice issued by the AO.

- Filing fee is to be paid at the time of filing appeal.

- The CIT(A) cannot set-aside the order passed by the Assessing Officer

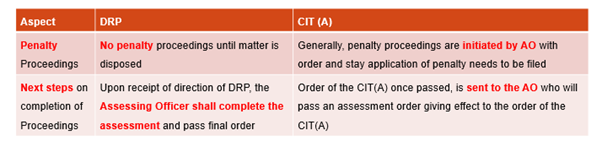

KEY DIFFERENCES BETWEEN THE DRP AND THE APPEAL PROCESS BEFORE THE CIT (A)

| Aspect | DRP | CIT (A) |

| Constitution | Case heard by 3 Commissioners | Case heard by a single Commissioner |

| Time limit for filing

objections/ Appeal |

Objections should be filed within 30

days of receipt of the draft AO order |

An appeal may be filed within 30 days of the date on which intimation of concerned order is served |

| Condonation of delay | No condonation | Condonation at the discretion of CIT(A) |

| Filing Fees | Nil | Rs 250 to Rs 1,000, depending upon assessed income |

| Stay of demand | Automatic stay as the order is a draft order | Stay application to be filed with the Tax Officer, and if rejected, demand is to be paid (as deducted by AO) |

| Time limit for completion | DRP should issue direction within 9 months from the end of the month in which the draft order is forwarded to the assessee | May be decided within a year from the end of the financial year in which such appeal is filed |

| Penalty Proceedings | No penalty proceedings until matter is disposed | Generally, penalty proceedings are initiated by AO with order and stay application of penalty needs to be filed |

| Next steps on completion of Proceedings | Upon receipt of direction of DRP, the Assessing Officer shall complete the assessment and pass final order | Order of the CIT(A) once passed, is sent to the AO who will pass an assessment order giving effect to the order of the CIT(A) |

KEY DIFFERENCES BETWEEN THE DRP AND THE APPEAL PROCESS BEFORE THE CIT (A)

NOTE :

The CBDT’s press release, dated 30.12.2015, mandates electronic filing of appeal before CIT(Appeals) for persons who are required to file the return of income electronically.

DISPUTE RESOLUTION MECHANISM – APPEAL BEFORE THE INCOME TAX APPELLATE TRIBUNAL [SECTIONS 253 & 254]

Features of the appeal process before the Income Tax Appellate Tribunal are listed below:

Once the AO’s order is issued after giving effect to DRP directions or CIT(A), an appeal can be filed with the Income-tax Appellate Tribunal (‘the Tribunal’) within a period of 60 days from the date on which the order sought to be appealed against is communicated to the assessee or the Principal Commissioner or Commissioner

- The Principal Commissioner or Commissioner of Income-tax can direct Assessing officer to file an appeal before Tribunal on a matter where the CIT(A) has held in favour of the assessee.

- If any demand is payable pursuant to the DRP directions, a stay application will need to be filed with the AO requesting for a stay of demand, where order is passed.

- If the stay application is rejected by AO, the demand is either to be paid by the assessee or assessee can prefer a stay application before the Tribunal.

- The Tribunal should pass order after hearing arguments from both the assessee and the Revenue authorities.

- After order of Tribunal is issued, AO shall pass an order giving effect to ITAT and consequential demands would be paid off by assessee/ refund would be issued to Assessee.

DISPUTE RESOLUTION MECHANISM – APPEAL BEFORE THE HIGH COURT [SECTION 260A]

- Assessee or revenue aggrieved by any order passed by the Tribunal may file appeal before High Court.

- Appeal can be filed by the aggrieved –

- Principal Chief Commissioner; or

- Chief Commissioner; or

- Principal Commissioner; or

- Commissioner; or

- Assessee

Appeal should relate to question of law : –

- HC shall admit appeal if it is satisfied that the case involves a ‘substantial question of law’, and

- Appeal shall be heard by at least 2 judges of the High Court.

- Substantial Question of Law implies that the appeal related to

-

- Debatable issue;

- Issue not settled by Law of Land;

- Issue not settled by a binding precedent;

- Has a material bearing on decision of the case

TIME LIMIT : –

- Appeal can be filed within 120 days from the date of receipt of the Tribunal’s order

- Jurisdiction of High Court is decided on the basis of the location of AO who has passed the disputed order in a particular case.

DISPUTE RESOLUTION MECHANISM – APPEAL BEFORE THE SUPREME COURT [SECTIONS 261 & 262]

- Appeal can be filed with Supreme Court against order of the High Court (within 90 days of the service of judgment under Code of Civil Procedure, 1908) provided High Court certifies that the case is fit for appeal before the Supreme Court.

- However, if High Court refuses to certify it to be a fit case, then special leave petition (SLP) can be made before the Supreme Court under Article 136 of the Constitution.

- Any Decision of Supreme Court becomes the Law of the Land

DISPUTE RESOLUTION MECHANISM – THE MONETARY TAX LIMITS

The monetary tax limits for Departmental appeal before ITATs, HCs and SCs are as follows : –

| Appeal by revenue authorities | Monetary limit of tax |

| Before ITAT | Rs. 10,00,000 |

| Before High Court | Rs. 20,00,000 |

| Before Supreme Court | Rs. 25,00,000 |

For any queries, please write them in the Comment Section or Talk to our tax expert