What is International Tax Law?

International tax law , in the context of taxation , are the laws, which apply to tax income from activities, that takes place in two or more countries.

International tax law, can be found in either of the following : –

International Tax Agreements – What are International Tax Agreements ?

There are various type of international tax agreements, which can include the following : –

- Double Taxation Avoidance Agreements (DTAAs or Tax Treaty or Tax Conventions ) are the most common international tax agreements, which are entered into between two or more countries . DTAA are generally broader in their application, and covers taxation of various type of income including business profit, capital gains, income from immovable property and other income. The DTAA’s may be between two countries (Bilateral DTAA) or between more than two countries (multilateral).

- Other international agreements

Where the number of transactions entered into between residents of two countries are limited, or they have other agreements which deal with a particular aspect, certain provisions may be included in those agreements. Such agreement may deal with : –

- Taxation of particular types of income, like shipping and air transport;

- Any particular tax, such as social security; and

- Exchange of information and mutual administrative assistance in collecting taxes between two countries.

Domestic tax laws

Domestic tax laws, may seek to tax entities which operate within their jurisdiction in respect of income of non-residents and cross-border transactions, that has some nexus to the local jurisdiction. In India, the provisions of the Income Tax Act constitutes the domestic tax laws.

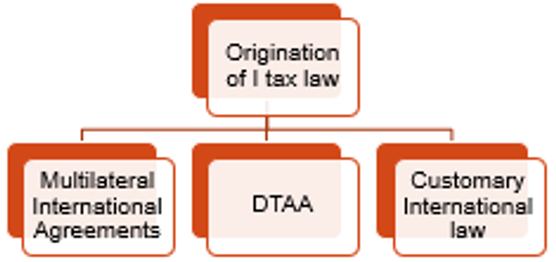

How did the International Tax Law originate ?

INTERNATIONAL TAX ORIGINATES FROM FOLLOWING : –

Multilateral international agreements

Multilateral International agreements, are treaties, between three or more nations. In case of such agreements, each of the party to the agreement has the same obligations, to all other parties. However, the obligations could be restricted, if there are specific reservations or provisions to this effect in the agreement.

For example – Vienna Convention on Law of Treaties (VCLT) – It has been discussed in detail in the later part of this chapter

Double Tax Avoidance Agreement (DTAA)

DTAAs (Comprehensive or Limited), including Protocols to DTAA, Memorandum of Understanding(MOU), and Exchange of information, etc. , forming part of the DTAA – These concepts are discussed in detail in later part of this chapter.

Customary international law and general principles of law

Customary international law is not a written law. Customary international law, is the aspect of international law that is derived from customs and convention.

A rule of customary law, has two elements : –

- There must be widespread and general practice of following such laws by various countries ;

- The law should be carried out by countries in such a way, that a belief exists that this practice is obligatory by the existence of a Customary international law rule requiring it.

Example – Principles of law in national legal systems, judicial decisions and the practices of international organizations.

General principles of law

General principles of law, refers to principles of fairness and justice, which are applied in legal systems around the world, including general principles of law like laches, good faith and impartiality of judges. Such general principles of law are found in decisions of international tribunals and national courts, international law publications of eminent scholars.

For any queries, please write them in the Comment Section or Talk to our tax expert