Authority for Advance Rulings (AAR)

CONCEPT OF ADVANCE RULING

Sometimes, a person, who enters into a transaction, may not be sure relating to the amount of tax he may have to pay, on the income which he earns out of such transaction. In order to obtain certainty, regarding the tax treatment of such income, a non-resident, has an option to obtain an advance ruling in India, which outlines, the tax, which would be payable on income arising out of such transactions.

Simply speaking, advance ruling is a mechanism , through which, parties to a transaction, can approach Authority for Advance Ruling (“AAR”) , to decide what will be the tax implications, of a particular transaction. This method, avoid tax litigation, as the ruling is binding on the party which obtains it, as well as the tax authorities.

From the perspective of the Indian payor, it gives them certainty on the amount of taxes which are to be withheld from the payment to the non-resident.

WHO CAN OBTAIN AN ADVANCE RULING AND COVERED TRANSACTIONS

The Authority for Advance Rulings (‘AAR’), gives a ruling to either of the following : –

- Non – Resident , including a person, who is acting as an agent of the non-resident.

The applicant should be a non- resident, during the relevant accounting year. The fact that he subsequently becomes a resident, would not make any difference to the eligibility to make an application ; or

- Specified resident: –

Certain public sector companies – Refer Para

Other resident applicant for determining their tax liability on transactions with Resident or Non-Resident valuing INR 100 Crores or more – Refer Para

The transaction, in relation to which the Ruling is provided could be

- Transaction which has been undertaken in the past ; or

- A future

Once such Ruling is given, it brings upfront clarity, with regard to the taxability of income arising from such transaction to the applicant. The scheme of Advance Rulings reduces potential disputes between the Income-tax authorities and the taxpayers.

WHAT IS AN ADVANCE RULING ?

We have already discussed that advance ruling is a mechanism through which,parties can approach Authority for Advance Ruling (AAR) , to decide the tax implications of a particular transaction. Now we will analyses the definition of advance ruling given in the Income-Tax Act.

As per Section 245N(a) advance ruling means –

i. A determination by the Authority in relation to a transaction which has been undertaken or is proposed to be undertaken by a non-resident Applicant :-

Where the non-resident has undertaken any transaction (past), or proposes to undertake any transaction, and he is not sure about the taxability of such transaction in India, such non-resident may apply to Authority for Advance Ruling to determine the tax liability arising out of such transaction.

Suppose, Mr. Gary is a tax resident of Singapore, and he plans to sell shares of an Indian company to another non-resident based out of USA. However, he is not clear about taxability of such capital gains in India, as per the Tax treaty between India and Singapore / Income-Tax Act, 1961. Gary can make application before Authority for Advance Ruling in order to determine the taxability of such capital gains in India.

ii. A determination by the Authority in relation to the tax liability of a non-resident arising out of a transaction which has been undertaken or is proposed to be undertaken by a resident applicant with such non-resident

Where the non-resident has undertaken any transaction or proposed to undertake a transaction with the person resident in India, then the Authority for Advance Ruling may determine taxability of such transaction in India.

iii. A determination by the Authority in relation to the tax liability of a resident applicant, arising out of a transaction which has been undertaken or is proposed to be undertaken by such applicant, and such determination shall include the determination of any question of law or of fact specified in the application

The Authority for Advance Ruling initially determined the tax liability of non-resident only. However, with effect from October 1, 2014, the Finance Act, 2014 inserted a specific provision permitting specified residents , to approach Authority for Advance Ruling to determine their tax liability arising out of past transaction or future transaction.

CBDT vide Notification No. 73/2014, dated 28-11-2014, has notified the following as such specified class of resident to include a resident person, in relation to his tax liability arising out of one or more transactions valuing Rs100 crore or more in total , which has been undertaken or proposed to be undertaken.

Suppose, Mr. A is a resident in India and has sold shares of a Netherlands company to a US buyer, for a total consideration of 120 crores, Mr. A can approach Authority for Advance Ruling in order to determine his tax liability arising out of such transactions.

In this case the Authority for Advance Ruling may also determine any question of law or fact as specified in the application.

iv. A determination or decision by the Authority in respect of an issue relating to computation of total income which is pending before any income-tax authority or the Appellate Tribunal and such determination or decision shall include the determination or decision of any question of law or of fact relating to such computation of total income specified in the application;

v. A determination or decision by the Authority whether an arrangement, which is proposed to be undertaken by any person being a resident or a non-resident, is an impermissible avoidance arrangement as referred to in Chapter X-A or not:

Where there is any proposed arrangement by a resident or non-resident person, the application can be made before the Authority for Advance Ruling to determine whether GAAR provisions are applicable on such transaction.

ENABLING PROVISIONS

The provisions of law, pertaining to Authority for Advance Rulings (AAR) are as follows : –

- Chapter XIX – B of the Income Tax Act, 1961 – Section 245N to 245V;

- Rules 44E and 44F of the Income-tax Rules,1962 ; and

- the Authority for Advance Ruling (Procedure) Rules, 1996 [‘Rules’].

ILLUSTRATION–1

MNC Ltd. UK, is a worldwide leader in manufacturing car engines and after support services for such engines. It intends to sell such engines goods to IMI Private Limited, an Indian company, which manufactures automotives. The contract involves supply of engines and providing after sales support services, which would be provided from the factory premises of IMI Private Limited . MNC Ltd. UK , and IMI are not sure, whether the income arising from such sale and after sale support services would be taxable in India. Can MNC Ltd obtain an AAR Ruling ? Why should IMI Private Limited be interested in getting such ruling for MNC Ltd. UK ?

SOLUTION

Authority for Advance Rulings, gives a ruling to a non-resident relating to transaction which is proposed to be undertaken. Hence, MNC Ltd. UK can obtain an AAR Ruling . IMI Private Limited would be interested in getting such ruling for MNC Ltd. UK, since it is under a legal obligation to withhold tax from such payments. If it does not withhold taxes, and Indian Government is unable to recover such taxes from MNC Ltd. UK, it shall be liable for the following consequences : –

- TDS can be recovered from IMI, considering it as an agent of MNC UK ;

- It shall be liable for interest for non-deduction of TDS @ 1% per month from the date such tax was deductible till the date such tax is deducted;

- It may be liable for penalty for default in deduction of TDS

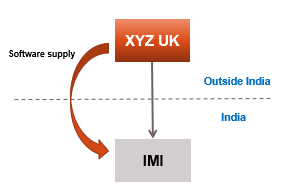

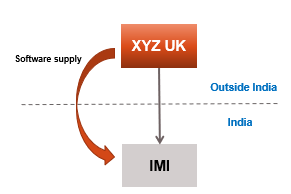

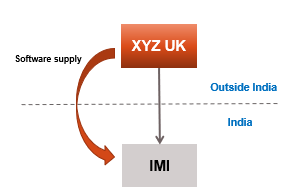

ILLUSTRATION – 2

XYZ Ltd UK, has been supplying software since FY 2016-17 to IMI Private Limited, an Indian company for a total consideration exceeding Rs. 200 crores per year . There are no income tax proceedings pending against XYZ Ltd UK, in respect of any transaction in India. Can XYZ Ltd UK, obtain an Advance Ruling during FY 2018-19, assuming the sales are likely to exceed Rs. 200 crores in this FY as well ? Alternatively, where IMI sells such goods to another unrelated Indian company for Rs. 225 crores, can IMI Private Limited, an Indian company obtain an Advance Ruling to determine its own tax liability ?

SOLUTION

The Authority for Advance Rulings (‘AAR’), gives a ruling to a non-resident relating to transaction which has been undertaken, provided certain conditions are satisfied.

Given that there are no income tax proceedings pending against XYZ Ltd UK, and assuming other such conditions are satisfied(refer Pragraph<<>>), XYZ Ltd UK can obtain an AAR Ruling.

IMI Private Limited can obtain an AAR Ruling to determine its own tax liability, assuming it falls within the definition of “specified person”, given that the transaction value is more than Rs. 100 Crores. For the definition of specified person, refer Paragraph

IMPORTANCE OF AUTHORITY FOR ADVANCE RULING

- To bring tax certainty into transactions

- To minimize controversy and litigation and Associated cost

- To bring tax certainty into transactions

- To give more consistency in the application of the law

- To achieve a more coordinated system

- Deal with undesirable impact of GAAR

There are various advantages of advance ruling. Some of these are discussed as under : –

- Tax Certainty

The party entering into a transaction, knows, the tax implication once an advance Ruling has been obtained for such transaction. Given that such rulings are also binding on tax authorities, it brings certainty, of tax payable on a given transaction.

- Avoids Litigation

Given that the tax implications are known in advance, it helps in avoiding unnecessary litigation, and the cost associated with such litigation.

- Brings Consistency in the application of law

A ruling once given can also be applied in subsequent years as well on the same issue, if there is no change in law or facts. Thus, it will bring consistency in taxation matters.

- Deal with undesirable impact of GAAR

Introduction of General Anti-Avoidance Regulations (‘GAAR’), has led to an increase in uncertainty for the taxpayers.

The form in which GAAR, is generally incorporated in tax laws, is broad and can be interpreted in various ways. It may be applied by tax officers to genuine business transactions, which are entered for legitimate business purpose. To avoid such application, a taxpayer can approach AAR, which would result in greater demand for advance rulings.

ADVANTAGES OF AUTHORITY FOR ADVANCE RULING

- Ascertain Tax implications beforehand and planning business

- Ascertain Tax implications for a resident applicant

- Time bound resolution

- Complex issue resolution

- Binding nature& Continuity of Ruling

ASCERTAIN TAX IMPLICATIONS PRIOR TO TRANSACTION

AAR enables the non-residents, to ascertain the income tax liability of a proposed transaction, beforehand (i.e, even before making an investments or entering into any actual transactions in India). Hence, the non-resident can plan their investments, considering the tax cost, based on the AAR Ruling. This would help them to evaluate, whether a given transaction generates sufficient after tax returns on investment, as are required by non-resident investor. Further such a Ruling, also helps the non-resident investor to avoid long-drawn litigation.

ASCERTAIN TAX IMPLICATIONS FOR A RESIDENT APPLICANT

Where a resident applicant, enters into a transaction with the non-resident, he can determine the tax liability of non-resident with whom he may transact. This would be particularly helpful in case of contract where the tax liability of the non-resident is to be borne by the resident applicant.

TIME BOUND RESOLUTION

The Authority is to pronounce its ruling within a statutory time limit of six months of the receipt of the application. This helps in providing a time bound resolutions instead of long term litigations. However, in certain cases, it has been noted that the rulings may take more than 6 months.

COMPLEX ISSUES RESOLUTION

Generally, issues relating to International tax are complex, and involve not only the interpretation of the Income Tax Act, 1961, but also, interpreting double taxation avoidance agreements (DTAA). In many cases, there may be a difference in opinion , between the parties to a transaction, or between taxpayer and tax authorities. Such issues can be resolved, through the process of advance ruling.

BINDING NATURE

The rulings of the Authority, are binding on the applicant as well as the Commissioner, and the income-tax authorities subordinate to him. This avoid unnecessary litigation, as both the taxpayer and tax authorities, are bound by such ruling.

CONTINUITY OF RULING TO FUTURE YEARS

Once the ruling has been obtained on a given set of facts, the taxpayer may be sure about his liability not only for one year, but for all the years covered under the transaction unless there is a change in the facts or law.

However, in case there is a change in any of the facts, basis which the ruling was obtained, or the provision of law change, which impact the tax position, the ruling will not apply.

ILLUSTRATION – 3

LMN Ltd UK, proposes to sell clothes to Surya Private Limited, an Indian company for a total consideration of Rs. 100 crores during FY 2018-19 . There are no income tax proceedings pending against Surya Private Limited in India. Which parties can obtain an Advance Ruling during FY 2018-19 ? What are the advantages of such an advance ruling to various parties ?

Both LMN Ltd UK and Surya Private Limited can obtain an Advance Rulings for the proposed transaction to determine the tax liability of LMN Ltd UK. Please refer the discussion above for advantages of such an advance ruling to various parties.

COMPOSITION OF THE AAR

The AAR constituted by Central Government shall consist of : –

a) Chairman, who has been a Judge of the Supreme Court or the Chief Justice of a High Court or Judge of a High Court for at least seven years.

b) Vice-chairman, who has been a judge of High Court;

c) Member from the Indian Revenue Service(IRS), who is qualified to be a member of the Central Board of Direct Taxes or member from the Indian Customs and Central Excise Service, who is, or is qualified to be, a member of the Central Board of Excise and Customs; and

d) Member from the Indian Legal Service (ILS) who is, or is qualified to be, an Additional Secretary to the Government of India.

LOCATION OF THE AUTHORITY FOR ADVANCE RULING, SALARY AND ALLOWNACES OF THE EMPLOYEES

The Authority shall be located in the National Capital Territory of Delhi and its benches shall be located at such place as the Central Government may, by notification specify.

The salaries and allowances payable to, and the terms and conditions of service of the Members have been prescribed by the Government of India.

The Authority functions as an independent quasi-judicial body , and is deemed to be a Civil Court , for the purposes of section 195 of the Code of Criminal Procedure, 1973.

POWERS OF THE AUTHORITY [SECTION 245U]

The Authority for advance Ruling has powers vested with the Civil Court , in respect of the following matters : –

- Discovery and inspection,

- Enforcing the attendance of any person, including any officer of a banking company ;

- Examining on oath, issuing commissions and

- Compelling the production of books of accounts and other documents.

The AAR is deemed to be a Civil Court , for the purposes of section 195 of the Code of Criminal Procedure, 1973 . Every proceeding before the AAR shall be deemed to be a judicial proceeding under the Indian Penal Code.

WHO CAN MAKE AN APPLICATION

a. NON-RESIDENTS

Non-residents can make application to the AAR, in order to determine the tax implications of transactions which they have already undertaken , or future transactions which are proposed to be undertaken by them.

There is no threshold limit for approaching AAR when an application is made by a NR. This implies that the non-resident can make an application to the AAR, irrespective of the amount of tax involved in a particular transaction.

Further, residents can also approach AAR for determining the tax liability of a non-resident, arising out of transaction undertaken by such resident with the non-resident.

b. RESIDENTS

A resident applicant can approach Authority for Advance Rulings (AAR) for determining tax liability in following cases : –

- Resident’s tax liability on transactions entered by it either with : –

- Resident ; or

- Non-Resident.

The threshold limit for approaching AAR for resident is transaction valuing INR 100 Crores or more. Such provision has already been discussed in detail at Para 3 this chapter

- A resident applicant can also approach AAR for determining tax liability of the non-resident arising out of the transaction entered into by him. Such provision has already been discussed at Para 3 of this chapter.

c. PUBLIC SECTOR UNDERTAKINGS (PSU)

PSUs can approach AAR in respect of an issue relating to computation of total income which is pending before the tax authority or the appellate authority.

However, an application for Advance Ruling cannot be made for the purpose of determination of Fair Market Value.

GAAR TRANSACTIONS COVERED WITHIN THE AMBIT OF MEANING OF “ADVANCE RULING”

A resident or Non-resident applicant can also approach AAR, to determine, whethera transaction which is proposed to be undertaken, is an impermissible avoidance arrangement. This would imply, that, an application for AAR cannot be made to ascertain whether a past transaction would be an impermissible avoidance arrangement for the purpose of GAAR.

Case Study

UVX Inc. USA, owns certain shares in an Indian company. It entered into certain discussion with a Private Equity investor, to sell such shares for USD 500 million. Based on the advise received from it’s tax Advisors, it was ascertained that such a transfer would result in a tax liability of USD 100 million in India . However under the domestic laws of USA, there was no tax payable on such capital gains, since UVX Inc. had sufficient brought forward losses. Under such circumstances, it’s tax Advisors came up with a plan whereby immediately before such a transfer, it would contribute such shares as a gift to its wholly owned subsidiary in Singapore, which would then sell such shares. Under the new facts, the gains arising on such transfer, would be exempt from tax in India, under the India Singapore treaty. However, UVX Inc. , is not sure, whether such a stand would be accepted by the Indian tax authorities. What would be your view to help UVX Inc., such that it gets certainty regarding its tax liability in India? What would be the advantage of your advise to UVX , to avoid litigation in future with tax authorities ?

Solution : –

Under the Indian laws, a Non-resident applicant can approach Authority for Advance Rulings (AAR), to determine, whethera transaction which is proposed to be undertaken, is an impermissible avoidance arrangement. We would advise UVX to approach AAR and obtain certainty on tax implications of proposed rearrangement advised by tax advisors. Once such Ruling is obtained, it is binding on the Commissioner, and the income-tax authorities subordinate to him. This avoid unnecessary litigation.

QUESTIONS IN AN ADVANCE RULING

One of the important aspect of an advance ruling is, what questions can be asked, by the applicant, in such a ruling ? This is important because this decides, the scope as well as the utility of the advance ruling. The following should be noted in regards to, what questions can be asked by the applicant : –

- The applicant can raise more than one question in one application.

- The questions may be on points of law as well as on points relating to facts pertaining to the income-tax liability (i.e. considering the provisions of the Act and/or the relevant DTAA). Mixed question of law and fact can also be included in the application.

- The question raised in the application, should arise out of the statement of facts given with the application.

- Complex question may be divided into two or more simple questions.

- The questions should be so drafted that each question is capable of a brief answer.

- No ruling will be given on a purely hypothetical or academic question.

- Questions not specified in the application cannot be urged.

- Normally, a question is not allowed to be amended , but in deserving cases the Authority may allow amendment of one or more questions.

WHEN AN ADVANCE RULING CANNOT BE SOUGHT ?

In the following cases, in advance ruling cannot be sought : –

- QUESTION IS PENDING BEFORE OTHER AUTHORITIES

In case the question raised in the application, is already pending before any income-tax authority, Tribunal or any Court,the Authority cannot allow application.

For e.g. a notice for initiation of assessment proceedings may be regarded as pendency of proceedings and may create an application invalid before AAR.

- QUESTION INVOLVES DETERMINATION OF FAIR MARKET VALUE OF ANY PROPERTY

No application can be made before the AAR on questions, relating to the determination of fair market value of any property, movable or immovable.

- TRANSACTION IS DESIGNED PRIMA FACIE FOR TAX AVOIDANCE

The application would not succeed, if it relates to a transaction , which is designed prima facie for the avoidance of income-tax. Only the prima facie impression created in the mind of the Authority on the facts stated before it, that transaction is undertaken to avoid income tax is sufficient cause for rejecting the application. It is not necessary to refer the detailed facts of the case to determine whether a particular transaction is designed to avoid income tax.

- OTHER CASES

Questions cannot be raised with respect to quantification of income of a taxpayer or for determination of arm’s length price under Indian Transfer Pricing regulations.

Case Study

Alpha Inc. USA, earned royalty income for use of brand from an Indian company. In the past, it claimed that the royalty income was not taxable in India. This time was not accepted by the Indian tax authorities, who passed or negative order against Alpha Inc. This order was appealed against by Alpha Inc. and the matter was currently pending with Income Tax appellate Tribunal. Alpha Inc wanted to make an application with your authority for advance ruling, on whether such income was liable to tax in India. Comment such application is maintainable ?

Solution

In case the question raised in the application, is already pending before any income-tax authority, Tribunal or any Court, the Authority cannot allow application. Hence the application of Alpha inc., is not maintainable and would not be allowed by the authority for advance ruling.

APPLICATION FOR ADVANCE RULINGS – RULES

In relation to the Application filed by eligible applicant the following rules, shall apply : –

- Application for advance ruling should be in prescribed form and manner, stating the question on which the advance ruling is sought

- Application shall be in quadruplicate and accompanied by following fees:-

| Category of applicant | Category of case | Fee |

| · Non-resident for his own tax liability;

· Resident for tax liability of Non-resident; and · Resident for his own tax liability |

Amount of one or more transaction, entered into or proposed to be undertaken, in respect of which ruling is sought: – i. Does not exceed Rs. 100 Crore ii. Exceed Rs. 100 Crore but does not exceed Rs. 300 Crore iii. Exceeds Rs. 300 Crore |

Rs. 2 Lacs |

| Rs. 5 Lacs | ||

| Rs. 10 Lacs | ||

| PSUs | In any case | Rs. 10,000 |

- Applicant can withdraw his application within 30 days of the date of application. However, based on judicial proceedings, the AAR can allow the withdrawal of application even after 30 daysof the date of application.

PROCEDURE TO BE FOLLOWED IN CASE OF AN APPLICATION BEFORE AAR

Once, a proper application has been filed before the Authority for Advance Rulings, the following procedure shall be followed : –

Step I: Authority for Advance Rulings shall forward a copy of application to Commissioner to ascertain whether the case is pending or not, and if necessary call for the records.

Step II: AAR may allow or reject the application. In case application is rejected following points should be noted: –

- Before rejecting the application, an opportunity of being heard shall be given to the applicant.

- Reason for rejection shall be given in the order.

- Copy of order shall be sent to the applicant and to the CIT.

- No appeal is possible against order of rejection

Step III: After allowing application and examining the information placed before it, AAR pronounces its Advance Ruling on the question specified in the application.

Step IV: On request of applicant before pronouncing its Advance Ruling, AAR shall provide an opportunity of being heard to the applicant, either in person or through an authorized representative.

Step V: AAR shall pronounce its Advance ruling in writing within 6 months from the date of receipt of application.

Step VI: A copy of the Advance Ruling pronounced by AAR shall be sent to applicant and to the Commissioner.

OTHER POINTS

- DEATH OF THE CHAIRMAN OR INABILITY TO DISCHARGE FUNCTION BY THE CHAIRMAN

Where there is a vacancy in the office of the chairman, by the reason of his death, resignation or otherwise, the senior most Vice-Chairman shall act as the Chairman until new chairman enters upon his office to fill such vacancy in accordance with provisions of the Act.

Further, in case the Chairman is unable to discharge his functions owing to absence, illness or any other reason, the senior most Vice-Chairman shall discharge the functions of chairman until the chairman resumes his duties.

- IMPACT OF VACANCY OR DEFECT IN THE CONSTITUTION OF AUTHORITY

No advance ruling of the Authority for Advance Rulings or proceedings of the Authority for Advance Rulings can be questioned or treated as invalid, on the account of vacancy or defect in the constitution of authority.

- PENDING APPLICATION BEFORE AAR AND PROCEEDING ON ISSUES COVERED THERE IN BY INCOME TAX AUTHORITIES

No income tax authority or ITAT shall proceed to decide any issues in respect of which an application has been made by the Applicant.

- BINDING NATURE OF RULING OF AAR

The advance ruling pronounced by Authority is binding on : –

– The applicant who had sought it, in respect of the transaction in relation to which the ruling had been sought; and

– On the Commissioner and authorities subordinate to him.

- ADVANCE RULING SOUGHT BY APPLICANT BY FRAUD OR MISREPRESENTATION OF FACTS

Where the AAR finds that Advance Ruling is sought by applicant by fraud or misrepresentation of facts, then it may declare such ruling to be void-ab-initio by an order and all the provisions of the Act shall apply, as if such advance ruling has never been made.

- APPEAL AGAINST ORDER OF AAR

The order of AAR giving its opinion is a final order and no appeal is possible against such an order.

For any queries, please write them in the Comment Section or Talk to our tax expert