BEPS ACTION PLANS

OECD BEPS Action Plan has sets forth 15 Action Plans, which are designed to address BEPS, by bringing fundamental changes to the international tax standards.

These Action Plans are based on three core principles of Coherence, Substance and Transparency. The classification of various Action Plans based on these three principles are as under : –

Action Plan 1 – Addressing the Tax Challenges of Digital Economy

BEPS ACTION PLANS – I – COHERENCE

Coherence means the quality of forming a unified whole. Domestic tax systems , insofar as they deal with the taxation of two residents are coherent, since if one person makes a payment , that are tax deductible and result in reduction of his tax liability, the same payment results in income of the recipient. However, in case where the transaction is between two person who are resident of different countries, the country where the payor is a resident, allows a deduction of such expense, while the recipient, if he is a non resident, may not be liable to tax in the country of the payor. This would result in a situation where, the country of the payor would realize lesser revenue duty allowance of expenditure, but corresponding income will not be taxed in this country. Further, if the recipient is located in a country where no all over tax is payable, such income or part of such income may not be taxed in any country.

International coherence is required in corporate income taxation, so that we can avoid double non-taxation. BEPS Action plans which deals with the concept of coherence are as under : –

BEPS Action Plan 2 – Hybrid Mismatch Arrangement

BEPS Action Plan 3 – Controlled Foreign Company Rules

BEPS Action Plan 4 – Interest Deductions

BEPS Action Plan 5 – Harmful Tax Practices

BEPS ACTION PLANS – II – SUBSTANCE

Various tax authorities in various countries, have now increased focus on existence of substance in various International transaction. This implies that, the benefit of tax treaty would be given to taxpayers who have a particular structure due to business reason, and not merely because of tax outcomes. BEPS Action plans which deals with the concept of substance are as under : –

BEPS Action Plan 6 – Preventing Treaty Abuse

BEPS Action Plan 7 – Artificial Avoidance of PE Status Action Plan 8 – Transfer Pricing of Intangibles

BEPS Action Plan 9 – Transfer Pricing – Risk and Capital

BEPS Action Plan 10 – Transfer Pricing – High Risk Transactions

BEPS ACTION PLANS – III – TRANSPARENCY

Transparency requires, that the tax authorities have information relating to the global operations of the taxpayer, in terms of operations , people employed and Assets and liabilities used. Further in many countries, there are increase requirements whereby the taxpayers are required to disclose any aggressive Tax Planning they might have entered into. BEPS Action plans which deals with the concept of Transparency are as under : –

Action Plan 11 – Methodologies and Data Analysis

Action Plan 12 – Disclosure Rules

Action Plan 13 – Transfer Pricing Documentation

Action Plan 14 – Dispute Resolution

The Action Plan 15, calls for a multilateral instrument, that countries can use to implement the measures developed in the course of the work.

IMPLEMENTATION OF THE BEPS ACTIONS

BEPS strategies used by taxpayers, are often a result of gaps, which arise when the different tax systems of various countries are interpreted together along with the Tax Treaties entered into by such countries. Any tools which are developed to address BEPS strategies used by taxpayers, will need to address such gaps. The strategies, so developed would have to be implemented at 2 levels : –

- Overall changes in international tax systems, that are directly effective, like, work on the OECD Transfer Pricing Guidelines, Commentary to the OECD Model Tax Convention which serve as a guide to all the taxpayers around the world.

- Changes that would be implemented by individual countries, through their domestic law, bilateral treaties, or a multilateral instrument – For example, Section 94B introduced in the Finance Act 2017 was a measure introduced by the Indian government to deal with cases where excessive interest deduction were claimed by taxpayers, to related party loans or compulsorily convertible debentures.

Time frame for Action Plans

The Governments were expected to complete the necessary technical work, so that the Action Plan are largely be completed within 2 years of adoption.

Role of the G20 in BEPS Project

G20 or Group of Twenty , founded in 1999 , is an international forum , of the Governments and Central Bank governors from Argentina, Australia, Brazil, Canada, China, France, Russia, Saudi Arabia, South Africa, South Korea, Germany, India, Indonesia, Italy, Japan, Mexico, Turkey, the United Kingdom, the United States and the European Union. The main aim of G20 is to discuss policies relating to promotion of international financial stability.

BEPS has received strong and consistent support by the G20, and it is a key item on the Finance Ministers’ and Leaders’ agendas of the member countries.

BEPS Action Plan and Tax Competition

Every country is has a right over their own taxes.

However, due to aggressive tax planning by various multinational Enterprise, and setting up of dubious structure without any substance, the countries are denied of the genuine taxes due to them from activities within their jurisdiction.

The aim of the BEPS work is to restore, and strengthen sovereign taxing rights of the countries, by ensuring that they can protect their tax bases.

BEPS Action Plans intends to strengthen countries’ right by addressing tax regimes of countries that unfairly erode the tax bases of other countries or distort the location of capital and services

Risk of not addressing harmful tax practices

If the harmful tax practices are not addressed, it distorts competition between domestic business and those business that operate globally, in the favor of MNE’s .

BEPS Action Plan & “tax havens”

A tax haven is a jurisdiction, that offers favorable tax (low-tax or no-tax regime or which offer generous tax incentives resulting in No or low tax) or other conditions to its taxpayers, as relative to other jurisdictions. MNE’s use shell companies in such tax havens that do not have any operations or commercial rational other than tax savings, to stash profits offshore in these tax haven or claim tax treaty benefits that were not intended for them.

BEPS Action Plan would impact these regimes that seek to attract foreign investors without requiring any economic substance by ending use of shell companies and neutralize all schemes that artificially shift profits offshore.

Is BEPS effectively a tax increase on multinationals ?

The BEPS project is not an increase corporate taxes, but a means to address disputes between taxpayers and countries, that arises, due to practices of MNE’s that artificially separate taxable income from the activities that generate such profits. Implementation of BEPS project would provide greater certainty to business, and reinforce fairness and consistency of international tax system.

BEPS Action Plan and offshore tax evasion

BEPS focuses largely on legal tax planning techniques rather than offshore tax evasion, which is illegal.

ACTION PLAN – 1 – ADDRESS THE TAX CHALLENGE OF THE DIGITAL ECONOMY

Description of tasks and issues : –

With the increased use of digital economy, the mode of undertaking various transactions have changed significantly. Unlike the traditional transaction which took place physically at a specified location, in digital economy the transaction take place in cyberspace. This results in various taxation issues in taxation of digital economy due to the following reasons : –

- A company can have a significant digital presence in another country’s economy, but may still be not liable to tax there, as business nexus, necessary to tax income from such activities, may not be established under current international rules. For example, whatsapp has a large number of users in India, who data and usage pattern is used, to provide advertising services on other platforms available to the company. However since it does not have the physical presence or a local company in India, benefits income is liable to tax in India.

- Difficulty, in attribution of value created, to generation of marketable location relevant data through the use of digital products and services;

- Characterization of income derived from new business models, which may result in non taxation in source State. For example, various companies allow use of their database which is available online and could be either in the form of a public data, for specialised information based on experience of the company which is providing such data. In such cases the common issue is whether the payment whatsApp services would be royalty which is taxable on a gross basis even if the non resident does not have any presence in India, or business profits which are liable to tax in India only when the non resident has a permanent establishments in India.

- Problem in collection of VAT/GST with respect to the cross-border supply of digital goods and services, as in many cases the non resident may not even be registered with the tax authorities in India.

ACTION PLAN – 1 – ADDRESS THE TAX CHALLENGE OF THE DIGITAL ECONOMY

Action Plan 1 is designed to identify main difficulties posed by digital economy, in the application of existing international tax rules , and outlines method and principles which would help tax physical and digital economy at par.

At the time of BEPS project, it was felt that the digital economy is a complete economy by itself. Therefore framing separate rules, to address the tax challenges in connection with the digital economy may not be the correct approach. Instead it was agreed, that changes should be made to the existing International Tax rules through other action plans, which address the specific challenges in the context of digital economy.

Some of the other Action plans that address BEPS challenges in digital economy are as under –

Action Plan 7 : –

In article 5 – permanent establishment, there are various exceptions which are provided, which, under the traditional business models, constituted separately or auxiliary activities, and were therefore not treated as a permanent establishment in South State. One such example was, maintaining a warehouse in the source state for the purpose of delivery of goods.

While in case of brick and mortar business, maintaining a warehouse maybe only a reparatory or auxiliary activities to the overall business, in case of a non resident who sells goods in the source country through a website and delivers goods from a warehouse in the solid state, such an activity may not be an auxiliary activity.

In view of this action plan 7 suggests that modification should be made to the exceptions to definition of PE and restrict them to activities of a “preparatory or auxiliary” character in the context of digital economy. Further it was also suggested, to introduce a new anti- fragmentation rule, so that these exceptions , cannot be used as a tool to avoid PE by fragmentation of business activities among closely related enterprises.

Action Plan 3 :-

Action plan 3 provides for a new definition of CFC income, to ensure inclusion of income typically earned in digital economy, and its taxation in the jurisdiction of ultimate parent

Actions Plans 8 – 10 : –

In certain cases, many multinational Enterprise, who own valuable intangibles, transfer the legal ownership of such intangible asset to companies in tax haven. For example, let us say that Company A, which is the resident of USA owns a brand. It allows the use of such brand to an Indian company, which pays royalty to company A, which is liable for withholding tax in India. company A transfers legal ownership of such brand tour company in Switzerland. This results in lower withholding tax on India, due to the favorable provisions of the India Switzerland tax treaty.

In the context of intangibles, Actions Plans 8 – 10 provides that emphasis should be levied on substance (performing important functions, contributing important assets and controlling economically significant risks), rather than legal ownership of intangibles , as the basis of right to tax income from intangibles.

ACTION PLAN – 1 – INDIAN SCENARIO

- Finance Act, 2016 , inserted Chapter VIII relating to levy of on Equalisation Levy @ 6%, to address the challenges of Digital Economy in the context of specified online advertisement

- A person who is a non-resident not having permanent establishment in India, or a resident in India who carries out business or profession, is required to deduct Equalisation levy @ 6% for payments exceeding Rs. 1,00,000 for : –

- Online advertisement;

- Provision for digital advertising space or any other facility or service for the purpose of online advertisement;

- Any other service as may be notified by the Central Government.

ACTION PLAN – 2 – NEUTRALIZE THE EFFECTS OF HYBRID MISMATCH ARRANGEMENTS

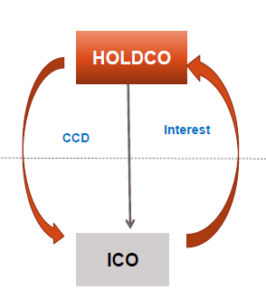

A Hybrid mismatch arrangement is an arrangement which exploits differences in the tax treatment of an entity (partnership is taxable on its own income in India whereas some countries tax income of partnership in hands of partners, while partnership is not taxable) or instrument (for example a CCD is considered a debt instrument until converted in India and interest is tax deductible, while it may be considered as equity in other jurisdiction, resulting in interest income being considered as dividend) under the laws of two or more tax jurisdictions to achieve double non-taxation, including long-term deferral.

These could be achieved through : –

- Double Deduction schemes : – Arrangements where a deduction related to the same contractual obligation is claimed for income tax purposes, in two different countries. For example, say a US company, X Inc. incorporates an investment company in Country X. Such , investment company borrows loan to invest in an Indian company and pays interest on such loan for which it claims a deduction of such interest. If the US company considers such company as a transparent company , the US company can also claim deduction of interest paid by investment company.

- Deduction / No Inclusion schemes: – Arrangements that create deduction in one country, typically for interest expenses, but avoid a corresponding inclusion in the taxable income in another country (Refer interest on CCD deduction and dividend income classification discussed above).

- Foreign Tax Credit generators: Arrangements that generate foreign tax credits , that would otherwise not be available to the same extent, or without higher corresponding taxable foreign income.

- Participation exemption regimes, wherein, if a holding company, owns more than a specified percentage of equity shares in investee company, income in the nature of interest , dividend and capital gains received from the investee company are not taxable in the hands of the holding company.

OECD/G20 BEPS Project, called for recommendations regarding the design of domestic rules , and the development of model treaty provisions that would neutralize the tax effects of hybrid mismatch arrangements.

The report has set out recommendations in following Parts : –

Part I –

Domestic Rules should be framed to neutralize the effect of hybrid mismatch arrangements. These could be achieved by providing that the taxpayer would be denied deduction in the source country for payment, to the extent the amount is not included in the taxable income of recipient in counter party jurisdiction.

Part – II

Changes to OECD Model Tax Convention to deal with dual resident entities (entities which are resident of more than one country), transparent entities (entities which are considered taxable in one jurisdiction and pass through in other jurisdiction) including hybrid entities.

These recommendations will neutralize hybrid mismatches.

RECOMMENDED AMENDMENTS

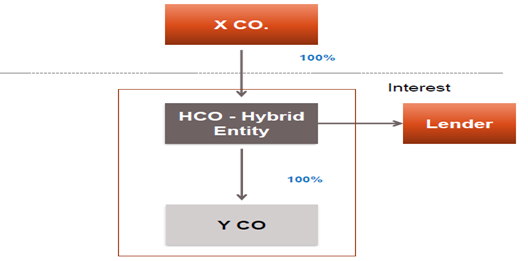

a. Denying transparency to entities where the non-resident investors’ resident country treats the entity as opaque

- X Co indirectly own Y Co

- HCO borrows funds to invest in YCO

- HCO is treated as transparent in X Co jurisdiction and is eligible for group relief in Y Co jurisdiction

Impact

- Deduction for interest is claimed by HCO

- Since HCO is treated as transparent in X Co jurisdiction, X Co. claims interest deduction in its own country as well

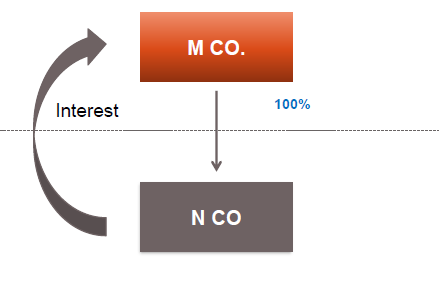

b. Denying exemption or credit for foreign underlying tax for dividends that are deductible by the payer

Facts : –

- M Co. owns N Co.

- NCO pays interest to MCO, which is deductible for tax purpose

- Such interest is treated as dividend in MCO jurisdiction.

In such a case, MCO jurisdiction can deny exemption from tax on such interest, or credit for foreign underlying tax (interest) paid in MCO jurisdiction, for dividends that are deductible by the payer

c. Denial of foreign tax credit for withholding tax, where that tax is also credited to some other entity

d. Amending CFC and similar regimes, to attribute income of foreign entities that are treated as transparent under their local law, as income of the local shareholders.

e. Domestic Anti Hybrid Rules to deny deductions to payer, where :-

-

- Such payments are not included in the recipient’s ordinary income, or

- Such payment is being simultaneously deducted by another entity.

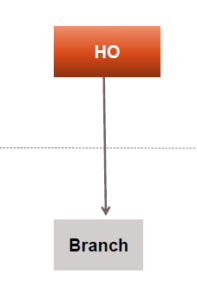

BRANCH MISMATCHES

Branch mismatches occur where jurisdictions take a different view as to the existence of, or the allocation of income or expenditure between, the branch and head office of the same taxpayer. This could be due to the manner in which the branch and head office account for a payment made by or to the branch and could be of the following five basic types : –

- Disregarded branch structures – In these cases, the branch does not give rise to a permanent establishment or other taxable presence in the branch jurisdiction

- Diverted branch payments – Branch territory recognises payment made to the branch as attributable to the head office , while the residence jurisdiction exempts the payment from taxation on the grounds that the payment was made to the branch

- Deemed branch payments – The branch is considered to have made notional payment to the head office which is tax deductible in Branch territory , but results in a mismatch in tax outcomes under the laws of the residence and branch jurisdictions

- Double deduction branch payments – Same item of expenditure gives rise to a deduction under the laws of of both the residence and branch jurisdictions

- Imported branch mismatches – The payee offsets the income from a deductible payment against a deduction arising under a branch mismatch arrangement.

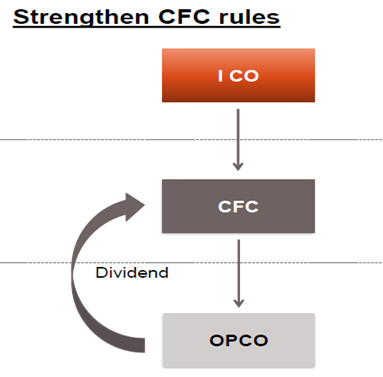

ACTION PLAN – 3 – STRENGTHEN CFC RULES CONTROLLED FOREIGN CORPORATION

CONTROLLED FOREIGN CORPORATION

In certain cases, taxpayers who have controlling interest in a foreign subsidiary, can use intermediary companies (referred to as a “Controlled Foreign Corporation” or “CFC”) to reduce their taxes, or defer the tax base of their country of residence, by shifting/retaining their income into a CFC jurisdiction.

Since a shareholder in Home Country (ICO) is not taxed on the corporation’s income until it is distributed as a dividend, it results in deferral of income

OECD Final Report does not propose a minimum standard , which should be incorporated under the Domestic tax laws or Treaty, to tackle the issue of controlled foreign company (CFC) regimes . This was due to the fact that there was fundamental disagreement over the policy of CFC regimes, in particular whether states should use the regime to protect other states’ tax bases from earnings stripping

The Action Plan on Base Erosion and Profit Shifting recommended, creation of six building blocks for the design of effective CFC rules. The same are as follows :-

- Definition of CFC, should cover not only corporate entities, but OECD also recommends application of CFC rules to non-corporate entities, if they earn income that raises BEPS concerns which are not addressed.

- CFC exemptions should be provided where the companies suffer effective tax rate in their country of location, which is equal to the tax in home countries and specification of threshold requirements

- Definition of income, are included in CFC rules, which can be suitably modified by countries

- Computation of income – CFC income should be computed as per parent’s law jurisdiction

- Attribution of income – Attribution of income should be based on control threshold and proportionate ownership

- Prevention and elimination of double taxation through credit in parent’s jurisdiction for foreign tax paid on CFC income

While these recommendations are not minimum standards, they are designed to create rules that effectively prevent taxpayers from shifting income into foreign subsidiaries.

INDIAN SCENARIO

Currently , there are no CFC rules in the Income-tax Act, 1961. CFC rules were part of the proposed Direct Tax Code , 2010 , which never saw the light of the day. However, Section 115BBD provides a concessional gross tax rate of 15% on dividends received from a specified foreign company in which the Indian company holds 26% or more in the nominal value of the equity share capital.

ACTION PLAN – 4 – INTEREST DEDUCTIONS AND OTHER FINANCIAL PAYMENTS

Multinational groups can reduce their taxes in source countries, by changing debt levels of individual group entities, through the use of intra-group financing . Such financing is normally done through use of financial instruments, which are interest deductible and escape restrictions on interest deductibility (example, compulsorily Convertible Debentures) in the Source country. This is also known as thin capitalization of companies. To address these risks, countries generally incorporate rules in domestic laws, where deduction of interest is limited, only on loans, which are in certain proportion of the equity, i.e, any interest on debt, above a particular ratio is disallowed for tax purpose. The report analyses several best practices and recommends various rules , which restrict deduction of interest. These rules are discussed as under :-

a) Group Wide Rules of interest deductions

Under these Rules, the total interest deductions, available to all the entities worldwide, within the group, is limited to the overall third-party interest expense, incurred by the group. Where the interest paid by all the entities is more than the overall third-party interest expense, the interest expense allocated to an entity should be matched with economic activity of that entity. This approach ensures that an entity’s net deductions are directly linked to the taxable income generated by its economic activities.

Fixed Ratio Rule

Under this rule, the deduction for interest available to any entity within the group, is limited to a percentage of its earnings before interest, taxes, depreciation and amortization (EBITDA). Such percentages could be between 10% and 30%. If a country does not introduce a group ratio rule, it should apply the fixed ratio rule to multinational and domestic groups without improper discrimination.

INDIAN POSITION

In India, the Fixed Ratio Rule approach has been adopted, by insertion of Section 94B by the Finance Act, 2017. Section 94B provides that interest expenses paid by an Indian company, or a Permanent establishment (“PE”) of a foreign company in India, to its Associated Enterprises shall be restricted to the lower of the following : –

- 30 percent of its earnings before interest, taxes, depreciation and amortization (EBITDA) ; or

- Interest paid or payable to Associated Enterprise.

The disallowed portion of the interest expense, will be allowed to be carried forward for eight assessment years, immediately succeeding the assessment year in which the disallowance was first made.

Combined approach – Group Wide Rules and Fixed Ratio Rule of interest deductions

The Fixed Ratio Rule, can be supplemented by a worldwide group ratio rule.

This would help an entity, whose net interest expense is above a country’s fixed ratio, to deduct interest up to the level of the net interest/EBITDA ratio of its worldwide group.

For example, consider the following example : –

Total interest paid by A Ltd. – 40

EBITDA of A Ltd. – 100

% of EBITDA allowed under domestic laws – 30

Allowable interest – 30

Disallowed interest under Fixed Ratio Rule – 10

In such a case, if the group has surplus third party interest , which is not claimed by any other entity in the group to the extent of 20, the entity can claim deduction for the interest which has been disallowed to the extent of Rs. 10.

The intragroup interest payments are also subject to the transfer pricing rules. OECD Report Aligning Transfer Pricing Outcomes with Value Creation (OECD, 2015), limit the amount of interest payable to group companies lacking appropriate substance, to risk-free return on the funding.

Updated version of BEPS Action 4 of 2016, includes further guidance on two areas:-

- Design and operation of the group ratio rule : – The report includes a detailed outline of a rule based on the net third party interest/EBITDA ratio of a consolidated financial reporting group, and provided that further work would be conducted in 2016 on elements of the design and operation of the rule.

- Deal with risks posed by the banking and insurance sectors : – The updated report examines regulatory and commercial requirements, which constrain the ability of groups to use interest for BEPS purposes, and limits on these constraints

ACTION PLAN – 5 COUNTER HARMFUL TAX PRACTICES MORE EFFECTIVELY, TAKING INTO ACCOUNT TRANSPARENCY AND SUBSTANCE

Preferential tax regimes (regime that provide reduced tax rates, tax holidays, weighted deductions, accelerated depreciation, etc, popularly known as ‘Patent Box’) are generally introduced by countries with an objective to foster innovation, and encourage development and location of intellectual property within those regimes. However, these are misused by companies to shift profits from the location in which the value was actually created to another location where they may be taxed at a lower rate.

In order to counter such harmful tax practices, BEPS Action 5, has developed a framework , which covers six categories of rulings, that could give rise to BEPS concerns in the absence of compulsory spontaneous exchange :

- Rulings related to preferential regimes ;

- Conduit rulings ;

- Permanent Establishment Rulings;

- Cross border unilateral APAs or Unilateral TP rulings ;

- Rulings resulting in downward adjustment to profits ;

- Any other type of ruling which the Forum on Harmful Tax Practices apprehends BEPS concerns

Suggest changes to the existing framework – Nexus approach, wherein the benefits under preferential “Patent Box” regimes are restricted to the extent the taxpayer contributes to the development of IP i.e. ratio of qualifying Research and Development (R&D) expenditures to total/overall R&D expenditure.

INDIAN POSITION

Nexus approach recommended by the OECD requires attribution and taxation of income arising from exploitation of Intellectual property in the jurisdiction where substantial research and development activities are undertaken instead of the jurisdiction of legal ownership.

For promoting local research and development, and make India a global hub for research and development, Finance Act, 2016 introduced concessional taxation regime for royalty income from patents.

Section 115BBF provides that income by way of royalty, in respect of a patent which is developed and registered in India (atleast 75% of the expenditure on such development should be incurred in India by the eligible assessee) , shall be taxable at the rate of 10% (plus applicable surcharge and cess).

For this purpose, expenditure means expenditure for any invention in respect of which patent is granted under the Patents Act, 1970.

Eligible assessee means a person whose name is entered on the patent register as the patentee in accordance with Patents Act, 1970 and includes every person, who is the true and the first inventor of the invention, where more than one person is registered as patentee under Patents Act, 1970 in respect of that patent

ACTION PLAN – 6 – PREVENTING TREATY ABUSE

Action 6 identifies treaty abuse, particularly, Treaty shopping, as one of the most important sources of BEPS concerns.

Treaty shopping, deprives countries of tax revenues, by allowing MNE’s, who are not a resident of a State, to claim treaty benefits in situations where these benefits were not intended to be granted (For e. g. by establishing a letterbox company in a low tax jurisdiction or jurisdiction having a favorable taxation with Source country). Countries include anti-abuse provisions in their tax treaties, including a minimum standard to counter treaty shopping.

The following approach is recommended to deal with these strategies : –

- MINIMUM STANDARD

A clear statement in the tax Treaty (in the Preamble or any other place), that the States that enter into a tax treaty intend to avoid creating opportunities for non-taxation, or reduced taxation through tax evasion or avoidance, including through treaty shopping arrangements, may be included in tax treaties.

- LIMITATION – ON – BENEFITS (LOB) RULE

A specific anti-abuse rule, limitation-on-benefits (LOB) rule, that limits the availability of treaty benefits to entities that meet certain conditions, on the legal nature, ownership, and general activities of the entity will be included in the OECD Model Tax Convention.

- PRINCIPAL PURPOSE OF TRANSACTIONS (PPT RULE)

In order to address other forms of treaty abuse, a more general anti-abuse rule based on the principal purposes of transactions or arrangements will be included in the OECD Model Tax Convention. If one of the principal purposes of transactions or arrangements is to obtain treaty benefits, these benefits would be denied unless it is established that granting these benefits would be in accordance with the object and purpose of the provisions of the treaty.

SECTION A OF THE FINAL REPORT ON ACTION PLAN 6 – TREATY ANTI-ABUSE RULES

Section A of the above report, includes new treaty anti-abuse rules, which first address treaty shopping and includes new rules to be included in tax treaties, to address other forms of treaty abuse as under : –

- Certain dividend transfer transactions intended to artificially lower WHT on dividends . This refers to cases where a non-resident increases its holding in a company, immedietly prior to declaration of dividend to get benefits of a lower rate of tax on dividends, available to shareholders owning more than a specified percentage.

- Transactions that circumvent Treaty application of source taxation of shares of companies that derive their value primarily from immovable property – Article 13(4) of various Treaties provides that gains arising from transfer of shares deriving more than 50 per cent of their value from immovable property in the Source country are taxable in the Source country. The final report has recommended to amend Article 13(4) , to cover gains from the alienation of an interest in other entities such as partnerships or trusts.

- Situations where an entity is resident of two Contracting States – Where an entity is resident of two Contracting States, it often involves tax avoidance arrangements. The final report has recommended that instead of only applying the POEM Rules, the competent authorities of the Contracting States , should determine the country of residence by mutual agreement, having regard to POEM, place of incorporation/constitution and any other relevant factor of the company.

- Situations where the State of residence exempts the income of PE situated in third States and where shares, debt-claims, rights or property are transferred to permanent establishments set up in countries that do not tax such income or offer preferential treatment to that income.

The report also addresses two specific issues related to the interaction between treaties and domestic anti-abuse rules

- A new rule that treaties do not restrict a State’s right to tax its own residents (subject to certain exceptions)

- Departure or Exit tax – If an individual/legal person, gives up the residential status of a country, in such cases, liability to tax on certain income , which has accrued for the benefit of a resident (whether an individual or a legal person) will be triggered, if the resident ceases to be a resident of that State.

SECTION B OF THE FINAL REPORT ON ACTION PLAN 6:

This Section provides that the Treaty should clearly contain the intention of the parties that it is to eliminate double taxation without creating opportunities for tax evasion and avoidance in treaty – discussed above.

SECTION C: IDENTIFYING TAX POLICY CONSIDERATIONS BEFORE ENTERING INTO A TREATY –

Section C describes policy considerations which would help countries explain their decisions, not to enter into tax treaties with certain low or no-tax jurisdictions or modification or terminate a treaty previously concluded, in the event that a change of circumstances that raises BEPS concerns related to that treaty.

ACTION PLAN – 6 – INDIAN SCENARIO

LoB clause introduced in India-Mauritius Tax Treaty – India and Mauritius have signed a protocol, to the India-Mauritius tax treaty.

Some of the key features are as under : –

- Shares acquired on or after 1.4.2017 , during the period from 1.4.2017-31.3.2019

Gains from the alienation of shares acquired on or after 1.4.2017, in a company which is a resident of India may be taxed in India @ 50% of normal tax rates on such capital gains in India, during (1.4.2017-31.3.2019) . However, benefit of reduced rate of 50% of the tax will not be available to transferor whose affairs are arranged to take advantage of concessional tax rate, shell or a conduit company (any legal entity qualifying as a resident with negligible or nil business operations or with no real and continuous business activities carried out in that Contracting State. A resident of a Contracting State is deemed to be a shell/conduit company if its expenditure on operations in that Contracting State is less than Mauritian Rs. 15,00,000 or Indian Rs. 7,00,000 in the respective Contracting State, in the immediately preceding period of 12 months before the date the gains arise.

LoB clause in India-Singapore Tax Treaty –

Through a similar Protocol, capital gains on alienation of shares would be taxable in a similar manner for India Singapore as laid out in India-Mauritius tax treaty, subject to LoB clause. Both the transition period benefit and period of expenditure test (shares acquired after 1.4.2017 and transferred before 1.4.2019) are the same (expenditure test needs to be met for the 12 month period (as against 24 months in the Singapore Treaty).

ACTION PLAN – 7 – PREVENT THE ARTIFICIAL AVOIDANCE OF PE STATUS

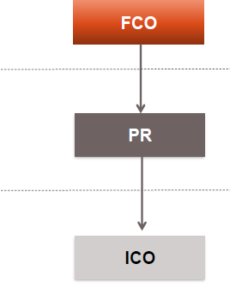

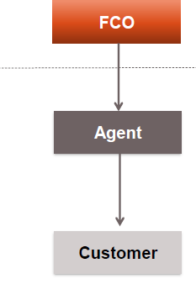

In certain cases, the existence of PE is artificially avoided through the use of Commisionaire arrangements, and through exceptions to the definition of the PE in tax Treaties.

A Commissionaire agent is an agent who represents the principal (non-resident) but concludes contracts in its own name without legally binding the non-resident. In such cases, the non-resident avoid having a dependent agent PE in Source State, by having the agent being represented as a principal, even though for all commercial and economic purpose, the agent has no authority or independent existence.

Further, a sample clause on exceptions, which do not result in a PE can be found in Article 5(7) of the India Singapore Treaty as under : –

Notwithstanding the preceding provisions of this Article, the term “permanent establishment” shall be deemed not to include :

(a) the use of facilities solely for the purpose of storage, display or occasional delivery of goods or merchandise belonging to the enterprise ;

(b) the maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of storage, display or occasional delivery;

(c) the maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of processing by another enterprise ;

(d) the maintenance of a fixed place of business solely for the purpose of purchasing goods or merchandise, or of collecting information, for the enterprise ;

(e) the maintenance of a fixed place of business solely for the purpose of advertising, for the supply of information, for scientific research, or for similar activities which have a preparatory or auxiliary character, for the enterprise.

Action Plan 7, envisages : –

- CHANGES TO THE DEFINITION OF PE

Changes to the definition of PE, so that the artificial avoidance of PE status (including through use of commissionaire arrangements and the specific activity exemptions (auxiliary activities) are avoided. In a commissionaire arrangement, a person sells products in a State in its own name but on behalf of a foreign enterprise that is the owner of these products . Since the seller does not own the products, he should not taxed on the profits derived from such sales , but on his remuneration or commission. Under the revised agency PE rule, a person who “habitually concludes contracts, or habitually plays the principal role leading to the conclusion of contracts that are routinely concluded without material modification by the enterprise”, is covered under the definition of agency PE.

- ANTI-FRAGMENTATION RULES SHOULD BE INSERTED IN TREATY,

This would ensure that PE status is not avoided by fragmentation of cohesive operating business, into smaller operations (which qualify under preparatory and auxiliary activities) or through Splitting up of contract between related parties, to avoid PE status.

- All activities of an Enterprise in a state along with activities undertaken by its closely related entities should be considered

To ascertain if the PE exists, all activities of an enterprise in a state, along with activities undertaken by its closely related entities undertaking business operation should be aggregated. Same test can be applied to ascertain if the activities undertaken by an enterprise in a state are ‘preparatory or auxiliary’.

ACTION PLAN – 8 – 10 – ALIGNING TRANSFER PRICING OUTCOMES WITH VALUE CREATION

Over several decades world-wide intragroup trade has grown exponentially. Transfer pricing rules, which are concerned with determining the arm’s length price for transactions within an MNE group , intends to ensure fair and just allocation of profits to group companies in different countries, depending on their function, asset and risk profile.

The Action Plan on Base Erosion and Profit Shifting identified that the existing international standards for transfer pricing rules can be misapplied in such a manner that they would result in outcomes, in which the allocation of profits is not aligned with the economic activity that produce the profits.

The work under Actions 8- 10 of the BEPS Action Plan has targeted this issue, to ensure that transfer pricing outcomes are aligned with value creation.

These are discussed as under : –

Moving intangibles among group members

Action Plan 8 seeks to addresses transfer pricing issues relating to controlled transactions, involving intangibles by recommending as under : –

- Broad and Clear definition of “Intangibles” should be provided ;

- Allocation of profits associated with transfer and use of intangibles, should be in line with value creation ;

- Develop special measures for transfers of “Hard to value intangibles” ;

- Updating the guidance on Cost Contribution Arrangements.

Transferring risks among, or allocating excessive capital to, group members

Action Plan 9 aims to develop rules, which would avoid BEPS, that arise due to allocation/ transfer of risks and or capital, amongst group entities.

This can be achieved through the following measures : –

- Alignment of returns in a transaction, with value creation, and not merely due to provision of capital and control;

- Determine and compare economically relevant characteristics of controlled and uncontrolled transactions, and allocation of profits based on such considerations.

- Recharacterization/ Non-recognition of actual transactions in appropriate circumstances.

Contractual allocations of risk are respected only when they are supported by actual decision-making.

Engaging in transactions which would not, or would only very rarely, occur between third parties

Action Plan 10 deals with developing rules to prevent BEPS for non-routine high risk transactions, which are generally not entered into between independent third parties. This focusses on TP guidelines for : –

- Addressing profit allocations resulting from controlled transactions which are not commercially rational,

- Targeting manner of using TP methods in such a way that it results in diverting profits from the most economically important activities of the MNE group to entities or jurisdiction where the tax is not payable or payable at a low rate; and

- Intra group payments like management fees and head office expenses, to erode tax base in the absence of alignment with the value-creation.

ACTION PLAN – 10 – OECD TP GUIDELINES FINAL REPORT 2015

OECD Transfer Pricing Guidelines provide guidance on the application of “arm’s length principle”, and they represents the international consensus on the valuation, for income tax purposes, of cross-border transactions between AE.

Recommendations

b. Analysis of contractual relations between parties in combination with the conduct of the parties

The OECD’s view is that contractual allocation of functions, assets and risks between AE’s is prone to manipulation in a manner that tax outflows can be minimised. The analysis of actual conduct of the parties, will supplement or replace the contractual arrangements if the contracts are incomplete, or are not supported by the conduct.

c. Risks and returns to be allocated to the party exercising control and having financial capacity to assume the risks –

If a party cannot exercise meaningful and specifically defined control over the risks, or does not have the financial capacity to assume the risks, such party will not be allocated those risks and consequential returns.

d. Allocation of returns to MNE group members controlling economically significant risks and contributing assets – The Report does not allocate returns to mere owner of assets , but to MNE group members which perform important functions, control economically significant risks and contribute assets.

e. Actual nature of transaction to be determined for pricing, in a case where economic substance differs from form

f. Pricing methods to ensure that the profits are allocated to the most important economic activities

INDIAN POSITION

CBDT has notified a new safe harbour regime , which has come into effect from 1st April, 2017, i.e., A.Y. 2017-18 and shall continue to remain in force for two immediately succeeding years thereafter, i.e. up to A.Y.2019-20.

“Receipt of Low Value-Adding Intra-Group Services” has been introduced as a separate category in this report and the mark up of upto 5% recommended by OECD has been adopted in safe harbor rules.

ACTION PLAN – 11 – ESTABLISH METHODOLOGIES TO COLLECT AND ANALYSE DATA ON BEPS AND THE ACTIONS TO ADDRESS IT

While MNEs take advantages of gaps in International tax rules, the scale of negative global impacts of such tax planning on government revenues has been uncertain, given the serious data limitations. In addition , BEPS causes other adverse economic effects, including competitive advantage to tax-aggressive MNEs, misdirecting foreign direct investment, and reducing the financing of needed public infrastructure through reduction in tax collection of source country government.

Following indicators of BEPS activity, highlight BEPS behaviors : –

- Higher profit rates of MNE affiliates in lower-tax countries (twice as high as their group’s worldwide profit rate on average), vis a vis the average worldwide profit rate.

- Large MNE have an estimated 4 to 8½ percentage points lower tax rates than similar enterprises operating only domestically, some of which may be due to country’s tax preferences to MNE’s

- Foreign direct investment (FDI) is increasingly concentrated. – FDI in countries with net FDI to GDP ratios of more than 200%, increased from 38 times higher than all other countries in 2005 to 99 times higher in 2012.

- Separation of taxable profits from location of value creating activity is particularly clear with respect to intangible assets.

- Royalties received by entities located in low-tax countries accounted for 3% of total royalties.

- Debt from related and third-parties are concentrated in MNE affiliates in higher statutory tax-rate countries.

LIMITATIONS OF INDICATORS AND ANALYSES OF BEPS

However, such indicators suffer from the following limitations : –

- Available data is not comprehensive across countries or companies, and often does not include actual taxes paid.

- It is difficult to separate the effects of BEPS from real economic factors and the effects of deliberate government tax policy choices.

ACTION PLAN – 12 – REQUIRING TAXPAYERS TO DISCLOSE THEIR AGGRESSIVE TAX PLANNING ARRANGEMENTS

Lack of timely, comprehensive and relevant information, may result in aggressive tax strategies, going unnoticed by tax authorities. If there were an early access to such information, tax authorities would have an opportunity to quickly respond to tax risks through informed risk assessment, audits, or changes to legislation or regulations.

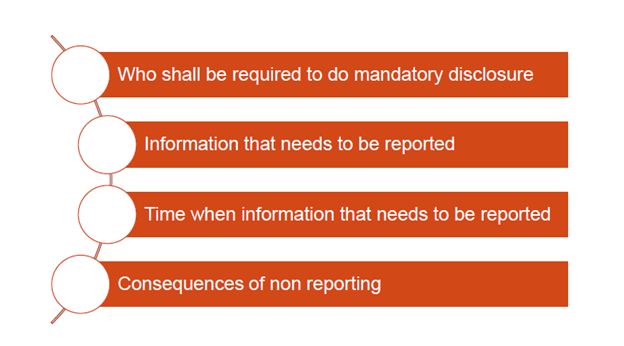

Action 12 calls for designing tools for mandatory disclosure rules, for aggressive or abusive transactions, arrangements, or structures taking into consideration the administrative costs for tax administrations and businesses and experiences of countries that have such rules.

The Report provides a modular framework that enables countries without mandatory disclosure rules, to design a regime that fits their need to obtain early information on potentially aggressive or abusive tax planning schemes and the users of such schemes.

PRINCIPLES AND OBJECTIVES OF MANDATORY DISCLOSURE REGIME

- The mandatory disclosure regime should be clear and comprehensive

- It should balance additional compliance costs to taxpayers, with benefits obtained by the tax administration.

- It should be flexibile to allow the tax administration, to adjust the system to respond to new risks

- Accurate identification of the schemes to be disclosed

- It should ensure effective use of information collected from the taxpayers under such regime

DESIGNS FEATURES OF MANDATORY DISCLOSURE REGIME

ACTION PLAN – 13 – RE-EXAMINE TRANSFER PRICING DOCUMENTATION

RE-EXAMINE TRANSFER PRICING DOCUMENTATION

The report on Action Plan 12, contains revised standards for transfer pricing documentation, to enhance transparency for tax administration, taking into consideration the compliance costs for business.

A three-tiered standardized approach to transfer pricing documentation has been developed which provides as under : –

- Master File – The Ultimate parent company is to prepare and maintain a Master File which would provide a high-level overview of group’s global business operations and transfer pricing policies. This file would be available to all relevant tax administrations.

- Local File – Local tax jurisdiction – A detailed transactional transfer pricing documentation in a “local file” specific to each country, identifying material related party transactions, amounts involved therein and the company’s analysis of the transfer pricing determinations.

- Country-by- Country (CbC) reporting – Jurisdiction of tax residence of ultimate parent – This reporting would provide aggregate jurisdiction-wide information on global allocation of MNE’s income, taxes paid, stated capital, accumulated earnings, number of employees. Other information showing the location of the economic activity within the MNE

Country-by-Country (CbC) report has to be submitted by parent entity of an international group to the prescribed authority in its country of residence, in which it has to report :-

- Annually for each tax jurisdiction in which they do business:

- Amount of revenue;

- Profit before income tax; and

- Income tax paid and accrued.

- Total employment, capital, accumulated earnings and tangible assets in each tax jurisdiction.

- For each entity within the group, which does business in a particular tax jurisdiction, indication of the business activities it engages in.

MASTER FILE: OBJECTIVE & FEATURES

The Master File would provide an overview of the MNE groups business, including :-

- Nature of its global business operations,

- Overall transfer pricing policies, and

- Global allocation of income and economic activity

This would assist tax administrations in evaluating the presence of significant transfer pricing risk.

The master file is intended to provide a high-level overview to place the MNE group’s transfer pricing practices in their global economic, legal, financial and tax context.

- Master file shall contain information which may not be restricted to transaction undertaken by a particular entity situated in particular country.

- Master file shall be furnished by each entity to the tax authority of the country in which it operates.

INDIA HAS IMPLEMENTED CBYC REGULATIONS. THESE HAVE BEEN DISCUSSED IN DETAL IN THE TRANSFER PRICING CHAPTER

ACTION PLAN – 14 – MAKE DISPUTE RESOLUTION MECHANISMS MORE EFFECTIVE

The measures developed to address BEPS, should not lead to unnecessary uncertainty for compliant taxpayers and unintended double taxation. Improving dispute resolution mechanisms is therefore an integral component of the work on BEPS issues.

Article 25 of the OECD Model Tax Convention provides that Contracting States may resolve differences or difficulties regarding the interpretation or application of the Convention on a mutually-agreed basis.

Mutual agreement procedure (MAP) is important tool for proper application and interpretation of tax treaties, and to ensure that taxpayers entitled to the benefits of the treaty are not subject to taxation by either of the Contracting States which is not in accordance with the terms of the treaty.

OBJECTIVE OF AP 14

Minimize the risks of uncertainty and unintended double taxation through

- Consistent implementation of tax Treaties;

- Effective and timely resolution of disputes regarding their interpretation or application of Treaties through MAP.

By adopting Final Report of BEPS, countries have agreed to important changes in their approach to dispute resolution, by having developed a minimum standard with respect to the resolution of treaty-related disputes and agreeing to ensure its effective implementation through the establishment of a robust peer-based monitoring mechanism that will report regularly through the Committee on Fiscal Affairs to the G20.

The purpose of minimum standards in effective implementation of MAP are as under :

- MAP related Treaty obligations are fully implemented in good faith

- MAP cases are resolved in a timely manner

- Implementation of administrative processes that promote timely resolution of treaty related disputes;

- Taxpayers can access the MAP when eligible .

ACTION PLAN 15 DEVELOP A MULTILATERAL INSTRUMENT

Some features of the current bilateral tax treaty system facilitate BEPS, and need to be addressed . Given the large number of existing bilateral tax treaties, updating the current tax treaty network is highly burdensome and time consuming process. For this reason, governments have agreed to explore the feasibility of a multilateral instrument , which would have the same effects as a simultaneous renegotiation of thousands of bilateral tax treaties.

A multilateral instrument would serve as alternative mechanism for modification of tax treaties, in line with BEPS Actions. The goal of Action 15 is to streamline the implementation of the tax treaty-related BEPS measures precedents, for modifying bilateral treaties with a multilateral instrument

It is pertinent to note that the above Action Plans are merely recommendations.

The developments on this account are as under : –

- OECD formed a group to develop Multilateral Instrument (MLI) which adopted the text of the Convention and accompanying Explanatory Statement in November 2016 . India was part of the Ad Hoc Group

- 68 countries and jurisdictions, signed the BEPS MLI at the first signing ceremony held in Paris on 7th June 2017, which countries submitted a list of their tax treaties in force that they would like to designate as Covered Tax Agreements (CTAs), i.e. to be amended through the MLI.

- MLI can modify tax treaties between two or more Parties to the Convention (as against single Treaties in case of Protocols).

For any queries, please write them in the Comment Section or Talk to our tax expert