Double Taxation Avoidance Agreement – Article 14 Independent Personal Services

UN Model

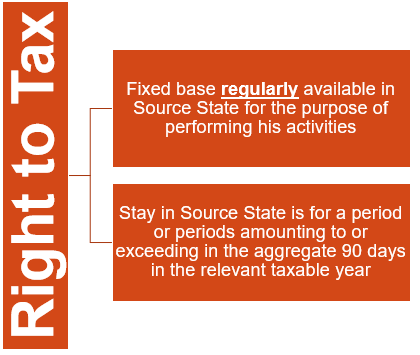

1. Income derived by a resident of a Contracting State in respect of professional services or other activities of an independent character shall be taxable only in that State except in the following circumstances, when such income may also be taxed in the other Contracting State:

(a) If he has a fixed base regularly available to him in the other Contracting State for the purpose of performing his activities; in that case, only so much of the income as is attributable to that fixed base may be taxed in that other Contracting State; or

(b) If his stay in the other Contracting State is for a period or periods amounting to or exceeding in the aggregate 183 days in any twelve-month period commencing or ending in the fiscal year concerned; in that case, only so much of the income as is derived from his activities performed in that other State may be taxed in that other State.

2. The term “professional services” includes especially independent scientific, literary, artistic, educational or teaching activities as well as the independent activities of physicians, lawyers, engineers, architects, dentists and accountants.

Learn More about “Double Taxation Avoidance Agreement – Article 14 Independent Personal Services” – Subscribe International Tax Course

What is covered under Article 14 Independent Personal Services Double Taxation Avoidance Agreement

Article 7 – Activities falling under Article 14 are specifically covered there and not under Article 7

Exception : –

If an activity is carried on as a commercial activity – Clifford Chance, UK v. DCIT

Article 15 – Covers services rendered by employees which are excluded from Article 14.

Taxation of a teacher – Difference Capacities

Teacher

- Independent services as an individual – Article-14

- Salaried employment – Article-15

- Payment by Government – Article-19

Applicability of Article 14 Independent Personal Services?

Applicability

- Company

- Firm

- Individual

Application of article 14 to non individuals

| Treaty with | Clause | Remarks |

| USA | Income derived by a person who is an individual or firm of individuals (other than a company) who is a resident of a Contracting State… | Article 15(1) clearly states that it does not apply to a company. |

| Germany | Income derived by an individual who is a resident of a Contracting State… | Article 15(1) clearly states that it does not apply to non individuals. |

| UK | Income derived by an individual, whether in his own capacity or as a member of a partnership, who is a resident of a Contracting State… | Linklaters LLP v ITO – Article 15 applies only to individuals and not to partnership firms. (ITAT)

Clifford Chance v DCIT – Article 15 applies to a partnership firm. MSEB v DCIT – The Mumbai Tribunal applied Article 15 of India-UK Tax Treaty, to a UK partnership firm and supported its decision of applying Article 15 to “non individuals”. DIT v Paper Products Ltd – Article 14 was applied to a company. |

Payments to FCO in respect of the furnishing the activities of Independent contractor

Fact: ICO made payments to FCO in respect of the furnishing the activities of Independent contractor.

FCO paid remuneration to the Independent contractor for performing the activities for ICO.

Issue: Whether Article 14 shall be applied for payments made by ICO to FCO?

Held: Payments made to an FCO in respect of the furnishing activities of Independent contractor shall be covered under Articles 7 read with Article-5.

The remuneration paid by the FCO to the independent contractor who performed the activities shall be covered under Article 14.

Application of article 14 to non individuals

| Unfavorable Ruling | Held |

| CIT v Sweta Estates Pvt Ltd | Article 14 was applied to a company, |

| XYZ/ ABC Equity Fund | AAR observed that gains from shares pertaining to a fixed base available to Mauritius-based company in India for the purpose of performing independent personal services may be taxed in India suggesting that a company can have a “fixed base” and it can render independent personal services. |

Fiscally Transparent Partnership – Linklaters LLP

Issue:

Whether Fiscally Transparent Partnership can claim the benefits of the treaty?

Held:

Allowed a fiscally transparent partnership of UK to claim treaty benefits in India.

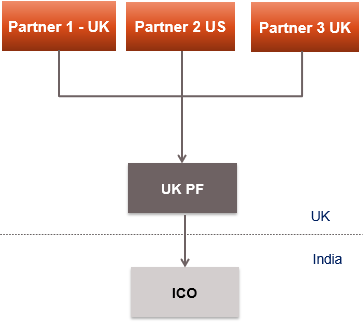

Fiscally Transparent Partnership – Partners not present in Source State

Fact:

Partner 1 is a partner of UK based fiscally transparent partnership firm. He performs professional services in India.

Issue:

Whether Article 14 is applicable only to the partner 1 of a fiscally transparent partnership, who actually provides the services in State S?

Held:

Partner 2 of US and Partner 3 of UK is to be regarded as present in India during the days on which, although they are not present, partner 1 of UK is so present and performs services in in India.

Right of source state to tax independent personal services income

Article 14(2) – Fixed Base

Is it similar to PE ?

Fixed Base is not defined but the analogy of PE can be applied herein as well

Should it be occasional ?

No, it should be regularly available (at the disposal of) to the IPS provider

What characterizes fixed base ?

Place from which an IPS provider can provide his services – Key centre of activities in Source State

Who has the right to tax ?

Country of residence has the right to tax such income unless it falls under exceptions

Purpose of stay?

Stay for all purposes, whether personal, employment or professional has to be aggregated.

Multiple counting ?

No, it should be regularly available (at the disposal of) to the IPS provider

What characterises fixed base ?

Place from which an IPS provider can provide his services – Key centre of activities in Source State

Who has the right to tax ?

Country of residence has the right to tax such income unless it falls under exceptions

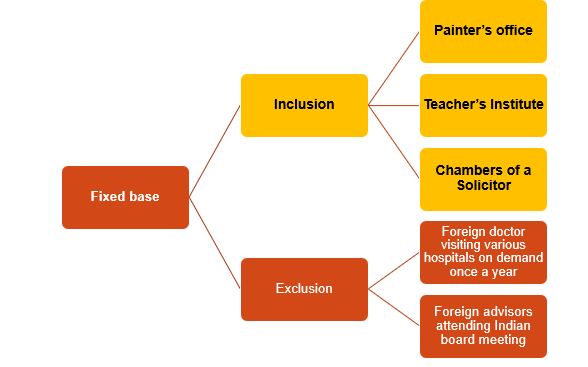

Fixed Base – Protocol to the india belarus treaty

For purposes of this Agreement, it is understood that the term “fixed base”

includes a fixed place such as

an office

or a room

or any other place

regularly available to him

through which the activity of a person performing independent personal services

is wholly or partly carried on.

Examples of fixed base – Inclusion Or Exclusion

Fixed base:-

(A) Inclusion

(B) Exclusion

(A) Inclusion:-

- Painter’s office

- Teacher’s Institute

- Chambers of a Solicitor

(B) Exclusion:-

- Foreign doctor visiting various hospitals on demand once a year

- Foreign advisors attending Indian board meeting

Article 15(2) – India – USA treaty

The term “professional services” includes

independent scientific, literary, artistic, educational or teaching activities

as well as the

independent activities of physicians, surgeons, lawyers, engineers, architects, dentists and accountants.

Article 15(2) – India – USA treaty – Independent Activities

Covers:-

Independent activities

- Scientific

- Literary

- Artistic

- Educational/ Teaching

Article 15(2) – India – USA treaty – Independent Activities of

Covers:-

Independent activities of

- Physicians

- Surgeons

- Lawyers – Tax, Corporates lawyers

- Engineers – For erection/ assembly/ drawing

- Architects – Including Painter/ Sculpture

- Dentists

- Accountants – Auditors

What is not covered in article 14 Independent Personal Services?

- Income from industrial activities

- Income from commercial activities

- Salary payments covered under Article 15 (Dependent Personal Services)

- Independent activities covered under specific provisions of Article 16 (non-employee director) and Article 17 (Artistes and Sportsmen)

- Payments to an enterprise in respect of rendering services of employees or other personnel

When are activities covered under dependent personal services

| Rulings | Held |

| Yashoda Super Speciality | Doctors working exclusively for a hospital, but having a choice to come at their will and without any employee benefit like gratuity etc, were not employees. |

| Max Mueller Bhavan | Teachers working for an educational institute were employees , even if the agreement referred to them as part time honorary teachers. |

| St Stephen’s Hospital | Doctors were employees, as they had to come when requested, were paid a fixed amount and had to comply with service regulations of hospital. |

Learn More about “Double Taxation Avoidance Agreement – Article 14 Independent Personal Services” – Subscribe International Tax Course