Double Taxation Avoidance Agreement – Article 26 – Exchange of information

In order to complete tax cases, the country may require certain information which may be available with the other Treaty partner. Article 26 provides for the information which may be exchanged and the manner in which such a request has to be made.

Comments

UN & OECD Models: Article 26(3) of the OECD Model is identically worded as Article 26(3) of the UN Model.

Article 26(3) provides circumstances under which a Contracting State is not obligated to comply with a request to provide such information.

| 4 | If information is requested by a Contracting State in accordance with this Article, the other Contracting State shall use its information gathering measures to obtain the requested information, even though that other State may not need such information for its own tax purposes. The obligation contained in the preceding sentence is subject to the limitations of paragraph 3 but in no case shall such limitations be construed to permit a Contracting State to decline to supply information solely because it has no domestic interest in such information. | If information is requested by a Contracting State in accordance with this Article, the other Contracting State shall use its information gathering measures to obtain the requested information, even though that other State may not need such information for its own tax purposes. The obligation contained in the preceding sentence is subject to the limitations of paragraph 3 but in no case shall such limitations be construed to permit a Contracting State to decline to supply information solely because it has no domestic interest in such information. |

| Comments

UN & OECD Models: It is identical to Article 26(4) of the UN Model. Article 26(4) , which has limited override over paragraph 3 , provides, that rightful request of information under this Article, would require the other Contracting State to obtain the requested information, in a manner as if the tax for which the information is requested were tax of the requested State. Such request cannot be declined solely because state requested has no domestic interest in such information. |

||

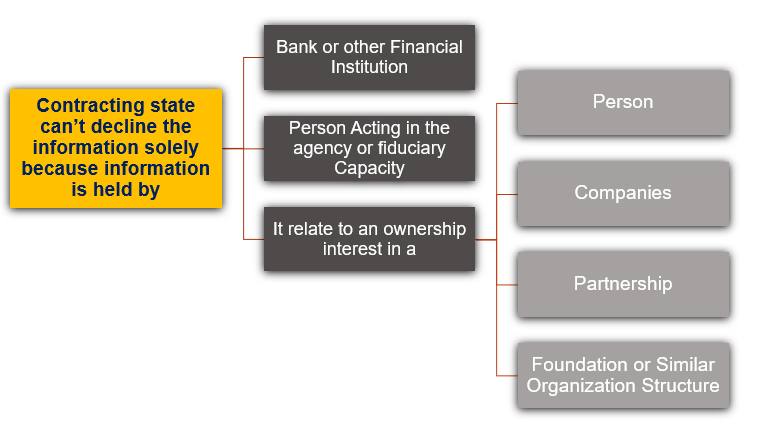

| 5 | In no case shall the provisions of paragraph 3 be construed to permit a Contracting State to decline to supply information solely because the information is held by a bank, other financial institution, nominee or person acting in an agency or a fiduciary capacity or because it relates to ownership interests in a person. | 5. In no case shall the provisions of paragraph 3 be construed to permit a Contracting State to decline to supply information solely because the information is held by a bank, other financial institution, nominee or person acting in an agency or a fiduciary capacity or because it relates to ownership interests in a person. |

| Comments

UN & OECD Models: Article 26(5) is identical to Article 26(5) of the UN Model. Article 26(5) ensures that declining of information under Para 3 cannot be used to prevent the exchange of information held by banks, other financial institutions, nominees, agents and fiduciaries, relating to the ownership interests in a person. |

||

| 6. The competent authorities shall, through consultation, develop appropriate methods and techniques concerning the matters in respect of which exchanges of information under paragraph 1 shall be made. | ||

| Comments

UN & OECD Model: Article 26(6) of the UN Model is absent in the OECD Model and the US Model. |

||

Double Taxation Avoidance Agreement – Article 26 – Exchange of information

SCOPE

- Additional rules to exchange information between Contracting States

- Assist Contracting States to implement domestic tax laws

- Facilitate application of Treaty

- Existence of criminal activity not essential to exchange information

ARTICLE 28(1) OF INDIA USA TREATY – OBLIGATION TO EXCHANGE INFORMATION

The competent authorities of the Contracting State shall exchange such information (including documents)

as is necessary for carrying out the provisions of this Convention or

of the domestic laws of the Contracting States

concerning taxes covered by the Convention insofar as the taxation thereunder is not contrary to the Convention,

in particular, for the prevention of fraud or evasion, of such taxes.

The exchange of information is not restricted by Article 1 (General Scope).

CHARACTERSTICS – ARTICLE 28 (1)

- CA may exchange information (including documents) necessary for carrying out Treaty or domestic law provisions

- Exchange shall be concerning taxes covered by the Convention, where taxation thereunder is not contrary to the Convention

- Exchange purpose may include prevention of fraud, or evasion of such taxes

- Exchange of information is not restricted by Article 1

- Information exchanged under this clause shall be dealt with as per paragraph 4 for use and maintaining secrecy

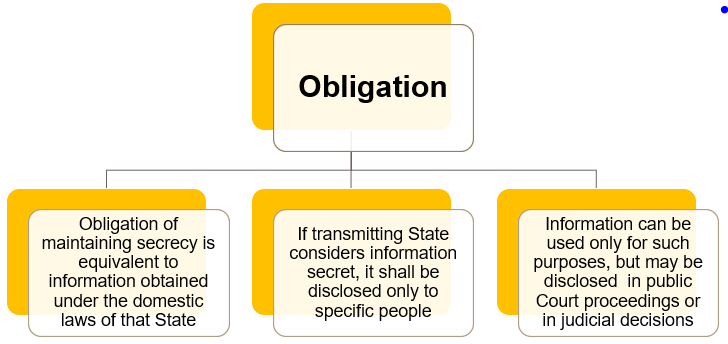

ARTICLE 28(1) OF THE INDIA USA TREATY – USE AND SECRECY OF INFORMATION

Any information received by a Contracting State shall be treated as secret

in the same manner

as information obtained under the domestic laws of that State.

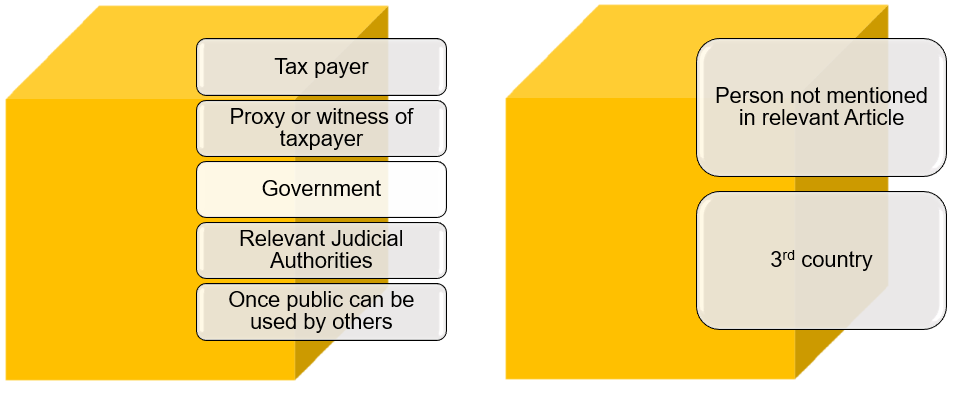

However, if the information is originally regarded as secret in the transmitting State, it shall be disclosed only to persons or authorities (including Courts and administrative bodies) involved in the assessment, collection, or administration of, the enforcement or prosecution in respect of or the determination of appeals in relation to, the taxes which are the subject of the Convention.

Such persons or authorities shall use the information only for such purposes but may disclose the information in public Court proceedings or in judicial decisions.

The competent authorities shall, through consultation, develop appropriate conditions, methods and techniques concerning the matters in respect of which such exchange of information shall be made, including, where appropriate, exchange of information regarding tax avoidance.

INFORMATION – SECRECY AND PURPOSE OF USE

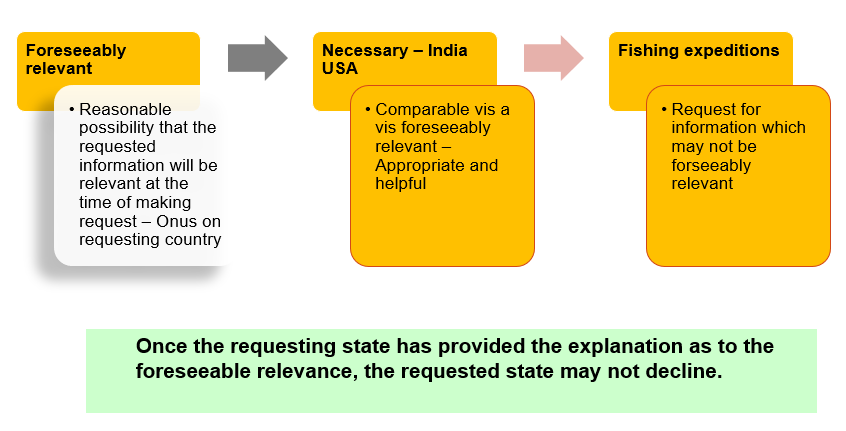

NATURE OF REQUESTED INFORMATION

DOES NOT CONSTITUTE A FISHING EXPEDITION IF

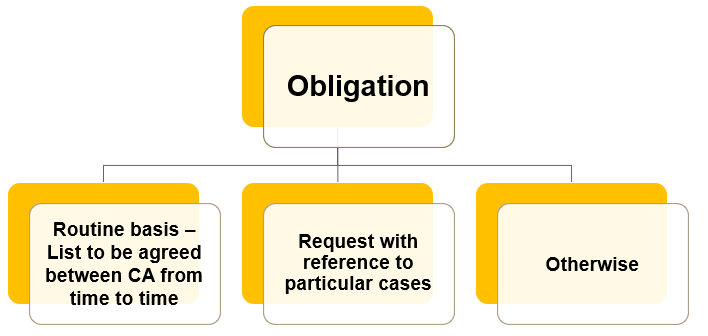

ARTICLE 28(2) OF THE INDIA USA TREATY – FREQUENCY OF EXCHANGE

The exchange of information or documents shall be

either on a routine basis or

on request with reference to particular cases or otherwise.

The competent authorities of the Contracting States shall agree from time to time on

the list of information or documents which shall be furnished on a routine basis.

FREQUENCY OF EXCHANGE OF INFORMATION AND DOCUMENTS

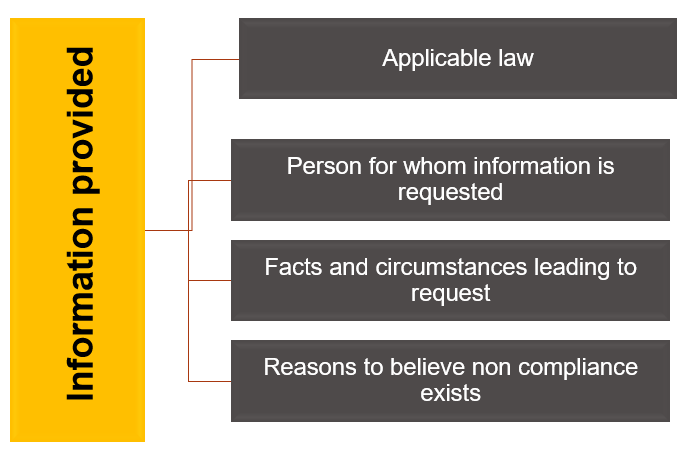

INFORMATION DISCLOSURE

ARTICLE 28(3) OF THE INDIA USA TREATY – NO OBLIGATION OF REQUESTED STATE

In no case shall the provisions of paragraph 1 be construed so as to impose on a Contracting State the obligation :

a.To carry out administrative measures at variance with the laws and administrative practice of that or of the other Contracting State;

b.to supply information which is not obtainable under the laws or in the normal course of the administration of that or of the other Contracting State;

c.to supply information which would disclose any trade, business, industrial, commercial, or professional secret or trade process, or information the disclosure of which would be contrary to public policy (ordre public).

CONTRACTING STATE NOT OBLIGED TO

- Carry out administrative measures at variance with the laws of either State

- Supply information which is not obtainable under normal course of law under either State

- Supply information which would disclose any trade or other secret

- Share information contrary to public policy

- Voluntary sharing of information on request is not prohibited

ARTICLE 28(4) OF THE INDIA USA TREATY

If information is requested by a Contracting State in accordance with this Article,

the other Contracting State shall obtain the information to which the request relates in the same manner and in the same form as if the tax of the first-mentioned State were the tax of that other State and were being imposed by that other State.

if specifically requested by the competent authority of a Contracting State, the competent authority of the other Contracting State shall provide information under this Article in the form of depositions of witnesses and authenticated copies of unedited original documents (including books, papers, statements, records accounts and writings),

to the same extent such depositions and documents can be obtained under the laws and administrative practices of that other State with respect to its own taxes.

ARTICLE 28(5) OF THE INDIA USA TREATY – TAXES COVERED UNDER ARTICLE

For the purposes of this Article, the Convention shall apply, notwithstanding the provisions of Article 2 (Taxes Covered) : –

a. in the United States, to all taxes imposed under Title 26 of the United States Code; and

b. in India, to the income-tax, the wealth-tax and the gift-tax.

DECLINE INFORMATION RELATING TO BANKING

Learn More about “Double Taxation Avoidance Agreement (DTAA)”