Functions, Assets and Risk Analysis

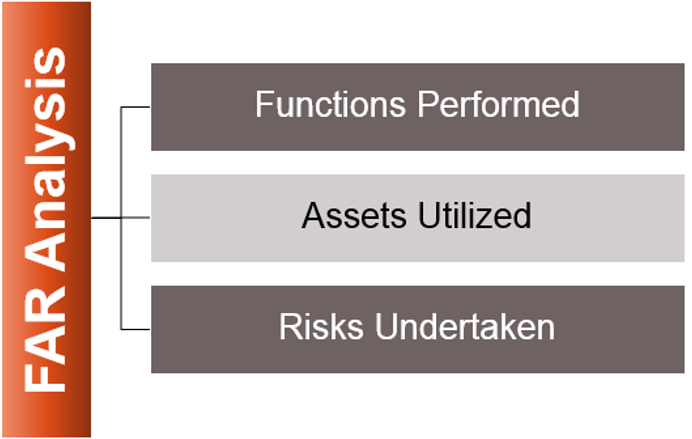

Another method that can be used for calculating the transfer price in an international transaction between Associated Enterprises is the Functions, Assets and Risk Analysis Method. It is quite broad and dynamic since it takes into account the various business models (functions, assets and risks) of an enterprise involved in an international transaction, while determining the transfer price.

Bird’s Eye view of the ‘Functions, Assets and Risk Analysis’ Method (also referred to as FAR Analysis).

| Principle of International Taxation | Transfer Pricing |

| Transaction between | International Parties |

| Transfer Price | Price charged between two Associated Enterprises |

| Arm’s Length Price Principle | Price charged between two unrelated parties |

| Components of FAR Analysis |

|

| Types of Risks Involved |

|

FUNCTIONS, ASSETS AND RISK (FAR) ANALYSIS TRANSFER PRICING

DIAGRAM 1.49

Functions, Assets and Risk (‘FAR’) analysis, is the method of finding and organizing facts about the business of a MNE in terms of the following, which may be assumed by different entities in the International Transaction –

a) All the functions performed by MNE in an international transaction ; ,

b) All the assets used (tangible as well as intangible assets) in performing such transaction ;

c) All risks assumed by business in respect of such transaction;

d) Division of functions performed , assets used and risks assumed (“FAR”) among the various AEs in the given transaction; and

e) Relative importance of each function in the overall value chain.

Steps : –

- Identify the functions performed , assets used and risks assumed by each of the Enterprise in a controlled related party transaction are identified

- Determine the tested party in a controlled related party transaction ;

- Find another Enterprise, which performs same or similar functions, uses same or similar assets and same or similar risks in an independent uncontrolled transaction . For example, a manufacturer of software cannot be compared with a BPO service provider, as he performs different functions, employs different kind of assets and undertakes different type of risks. However, software service provider can be compared with another software service provider.

COMPONENTS OF FAR ANALYSIS

FAR ANALYSIS HELPS IN CHARACTERIZATION OF THE ENTITY (BASED ON WHICH THE TESTED PARTY IS DECIDED), AND UNDERSTANDING ENTIRE VALUE CHAIN OF BUSINESS.

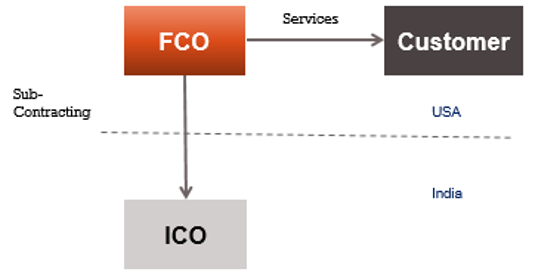

A. COMPONENTS OF FAR ANALYSIS – FUNCTIONS PERFORMED

In any transaction, various entities may perform different functions. For example, in case of an Indian company providing IT services to its US parent, the Indian company is the service provider while the US parent is the service recipient . Similarly, if an Indian company providing IT services , use the Brand or IP of the US parent to provide services to third party customers, for any brand payment and use of technology, different role are played by the Indian company and the US parent. While performing FAR analysis, the functions performed by different parties to the transaction are analysed to ascertain, which Enterprise performs, the more important and significant activities, and which Enterprise carries out normal routine activities.

As a general rule, functions which add more value to the transactions, are expected to fetch higher returns, and accordingly, the enterprise performing important function, should receive a higher return out of the total Returns.

The importance of a particular function in a given transaction would depend on the nature of business of an entity . For example, in case of a company engaged in providing business process outsourcing (BPO) services, telecalling on behalf of clients to provide customer support, would be the most important function, as the entire revenue depends on this function. However, in case of a manufacturer of goods, customer support would be an important but not the most important function.

Some of the important functions , generally observed, and examined in a transaction are as under : –

- Manufacturing, production or assembly work ;

- Research and development;

- Purchasing of goods and materials management;

- Supervision;

- Business process management/ Administrative functions

- Budgeting

- Marketing and Distribution

- Warehousing and inventory management

Once such principle functions are identified, we compare such functions performed in an uncontrolled transaction to determine the extent of comparability.

B. COMPONENTS OF FUNCTIONS, ASSETS AND RISK (FAR) ANALYSIS – ASSETS EMPLOYED

In order to carry on the business operations, each Enterprise, uses some assets. In the above example, to provide IT services, a company may use computers, technological IP etc. Whether the company is engaged in the manufacturing of commodities or provision of services, they would use some assets to perform business activities. A comparison of such an asset base, used by the different companies in performing the international transaction, needs to be carried out for the purpose of FAR analysis.

Comparability of both, the assets used by the Assessee and comparable entity, as well as the classification of such assets, into tangible as well as intangible asset, is an important criterion to determine mark up which should be applied in a given transaction. Where one Enterprise, uses tangible assets, and another Enterprise uses intangible assets, the two may either be not comparable, or may require suitable adjustment to the prices, to ascertain the markup to be applied to a given transaction.

Generally, an enterprise, which uses tangible assets (like Plant & Machinery, Furniture & Fixture, Computers etc.) , should obtain routine/ normal profits on such assets. However, an enterprise owning intangible assets (like technical know-how, trademarks, patents, etc.) , would expect contribution of super normal growth in profits of an enterprise, by such assets .

C. COMPONENTS OF FAR ANALYSIS – RISK ASSUMED

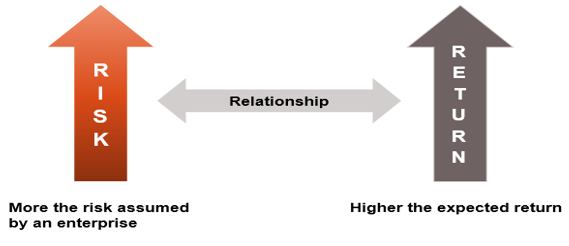

This step involves identification of degree of risk taken by each party, in a given transaction.

In any transaction, between two multinational Enterprises, the extent of risk Borne by one of the parties to a transaction may be higher than the risk Borne by the other party. For example, in case of a foreign company which outsourcers some of its customer support services to an Indian subsidiary, and remunerate Indian subsidiary on a cost plus basis, the entire risk of business operation may be borne by the foreign parent. Therefore, a larger profit would need to be attributed to the parent company, as it assumes the entire business risk. Extent of profit , which would be earned by one party, would be the rewards for risk assumed by such party. Risk and rewards are directly proportional. i.e. more the risk, higher the return, and lower the risk assumed, lower the return expected.

DIAGRAM 1.51

COMMON RISK INVOLVED IN THE BUSINESS

- CREDIT RISK : –

Generally, every company grants some credit period to its customer. If the customer fails to pay the amount due to the Seller/Service provider , such loss may be borne by one, or more than one parties to a transaction depending on the terms of the contract between the parties. Thus there is always a risk relating to non-payment of dues by the customers. The party which bears such risk, should be attributed some part of the profit for bearing such risk.

- MARKET RISK : –

Market risk arise due to increase in competition, relative pricing pressures due to business environment/competition, change in customer’s needs and demand patterns resulting in a product being no longer required, inability to grow and develop in a market etc. The party which bears such market risk, should be attributed some part of the profit for bearing such risk.

- FINANCIAL RISK : –

Financial risks, relates to money management, which involves decisions on : –

- which customers should be given credit , and the period for which credit should be given ?

- Extent of debt liability , i.e what should be the loan taken by a company for given level of operations ?

- Customer dependence, i.e., whether major income is received from one or two clients, who may default on payments ?

In case of MNE’s, such risk may generally be borne by the parent company. In such a case, some profits should be attributed to the parent company for bearing such financial risk.

- FOREIGN EXCHANGE RISK : –

In case, the country where an enterprise produces products/ from where it provides services has a different currency, as compared with the country of the customer, there may be certain losses/gains which an Enterprise may incur/earn, due to foreign exchange fluctuation between the time when the expenses incurred or billings are done, and the time when the payments are made for expenses/ funds are actually realised from the customer. For example, suppose A Ltd. an Indian company sells goods worth USD 500 to Beta Inc., a US company on 1.4.2020 when the exchange rate is USD 1 = INR 75, it is expecting receipt of Rs. 37,500 if the money is received on the same date. However, if it actually receives USD 500 on 30.4.2020 when the exchange rate is USD 1 = INR 80, it would receive Rs. 40,000 and gain Rs. 2,500. As against this, if the exchange rate on 30.4.2020 is USD 1 = INR 70, it would receive Rs. 35,000 and loose Rs. 2,500. Risk relating to impact on profits, arising due to fluctuation in foreign exchange rates may only be borne by one of the parties to the transaction. In such a case, some profits should be attributed to the company bearing such risk.

- CAPACITY UTILIZATION RISK : –

Capacity utilization risk refers to risk , relating to loss of profits due to unutilized capacity. Many a times due to lack of demand in the market, or an availability of qualified manpower, a company may not be able to produce at full capacity. For example due to lockdown in various countries due to COVID 19, the companies are unable to produce or produce at full capacity. In such a case, a reduced production results in losses to the company. The party who bears such loss should be attributed some part of the profit for bearing such risk.

- ATTRITION RISK : –

The party which bears the risk associated with losing key Managerial Personnel and Key employees, which contribute to the enterprise’s success, should be attributed some part of the profits for bearing such risk.

- INVENTORY RISK : –

In case of a business enterprise, there is normally a time lag between production and sale of goods. However, since the demand maybe uncertain, normally every company produces and maintains certain minimum level of inventory. One or more parties in a transaction may bear the risk associated with management of inventory, like overstocking or slow/non-moving inventory. In certain cases, where inventory is not sold, the enterprise may be forced to bear a loss of margin on the inventory, or incur additional costs to dispose-of the same. Again, due to Coronavirus situation and restriction on movement of cargo amongst countries/states, various inventories, particularly the one which is perishable has been destroyed/lost value. Some profits should be attributed to the entity for bearing such risk.

CONTRACT TERMS – ASCERTAINING RISK

The contract terms between assessee and its AE, help in determining risk assumed by each party (out of the risk discussed above). Once the relative risk are identified, the risk assumed by the tested party (selected as per methods discussed above) are compared with the risk assumed by the comparable party in an uncontrolled independent transaction. Such risk identification facilitates adjustments, based on differences in risks that are undertaken by the parties in a controlled transaction as compared to uncontrolled transaction.

For example , captive service provider operating on cost-plus basis for an Associated Enterprise (eg the parent company) would have lower risk relating to receivable, marketing and credit risk, which are otherwise borne by normal service provider, who operates in an independent business. Therefore the amounts of profit, which such a captive service provider would be expected to earn would be lower than the normal service provider.

FUNCTIONS, ASSETS AND RISK (FAR) ANALYSIS – ADVANTAGES

In FAR analysis , “economically significant” functions performed, risks assumed, and assets employed should be considered (i.e. such functions, assets and risks that are likely to have an impact on cost/expenses, prices, profits arising in a transaction) for comparison.

FAR analysis helps in : –

- Determining the nature of functions performed by the assessee and AE(s) ;

- Determining true and correct characterization of the entities (Tested Party/ Others);

- Selection of most appropriate method for Transfer Pricing analysis; and

- Establishing comparability and undertaking economic adjustments.

ILLUSTRATIVE LIST OF FUNCTIONS, ASSETS AND RISK (FAR) ANALYSIS FOR DIFFERENT ENTITIES

| Activity | Manufacturer | Trader | Service provider |

| Functions | • Product manufacturing • Quality control • Research & Development • Purchasing • Inventory management • Logistics • Product strategy and design • Marketing • Sales • Customer support • Budgeting • Administration |

• Purchasing • Inventory management • Logistics • Marketing • Sales • Customer support • Budgeting • Administration |

• Budgeting • Project management • Invoicing • Training • Quality control • Design of services |

| Assets | • Plant & Machinery • Office equipment • Land & Building • Warehouse • Vehicles • Patents • Technical knowhow • Trademarks, etc. |

• Office equipment • Land & Building • Vehicles • Warehouse |

• Office equipment • Land & Building • Vehicles • Trademarks • Brand name • Logos, etc. |

| Risks | • Product liability risk • Business risk • Inventory risk • Scheduling risk • Credit and collection risk • Foreign exchange fluctuation risk |

• Business risk • Inventory risk • Foreign exchange fluctuation risk • Credit and collection risk |

• Business risk • Credit and collection risk • Foreign exchange fluctuation risk • Service liability risk • Idle time risk |

For any queries, please write them in the Comment Section or Talk to our tax expert