Income deemed to accrue or arise in India – Section 9 of Income Tax Act

Activities confined to display of rough diamonds in SNZS [Explanation 1(e) to Section 9(1)(I) of Income Tax Act]

Where a foreign company is engaged in the business of mining of diamonds,

no income shall be deemed to accrue or arise in India to such foreign company from activities which are confined to display of uncut and unassorted diamonds in any special zone notified by the Central Government in the Official Gazette in this behalf.

In other words, these provisions would be applicable when the following conditions are satisfied : –

- Foreign company is engaged in the business of mining of diamonds. Benefit is not available to other categories of assessees engaged in other forms of mining , for example mineral oil, etc ;

- The limited activities of foreign company in India should be display of uncut and unassorted diamonds . Display of sorted diamonds, or display for sale are not covered under this exemption ;

- Such display is made in any special zone notified by the Central Government in the Official Gazette in this behalf.

Income through or from any Property, Asset or Source of Income in India – Section 9(1)(I) of Income Tax Act

All income which accrues or arises to a non-resident , whether directly or indirectly through or from the following, would be deemed to accrue or arise in India : –

- Any property in India or Any asset or source of income in India

Such a property (in addition to house property) could be movable property, immovable property, tangible property or intangible property. Some of the examples where these provisions could be applicable are as under : –

- Rental income of a non-resident from a building in India. Even in a case, where such property is leased to another non-resident for their business in India, such rent shall be deemed to accrue or arise in India ;

- Interest on fixed deposit with an Indian Bank ;

- Dividend from an Indian company ;

- Royalty for the use of Trademark registered in India ;

- Hire charges for the use of the machinery ;

- Rent paid outside India for the use of buildings situated in India;

- Interest on deposits with an Indian company paid outside India ;

- Royalty for use of a Brand in India, paid outside India .

Income through transfer of a Capital Asset situated in India

Capital gains , arising through or from the transfer of a capital asset situated in India, would be deemed to accrue or arise in India. In order to tax such income, the following criterion would not be relevant : –

- Whether the capital asset is movable or immovable, tangible or intangible. Gains arising from transfer of all such assets would be liable to tax in India;

- The place of registration of the document , through which any of the above assets is transferred. Such document could be registered in India or outside but if the capital asset situated in India it would be taxable in India .

For example : –

Alphabetical Inc. transferred shares of an Indian company to Beta Inc. The share transfer agreement was executed and registered in USA, and the payment for such transaction was also so credited in a US bank account. In such a case, since the capital asset is situated in India, the fact that the share transfer agreement has been executed in USA would not impact the taxability of such transaction in India.; and

The place of payment of the consideration for the transfer . Such a place could be within India or outside. In the above example, even though the payment for transaction of sale of shares was credited in a US bank account, it would not impact the taxability of such gains in India.

Assets not to be deemed to be/ Deemed to have been situated in India – Proviso to Explanation 5 to Section 9(1)(i) of Income Tax Act – Investment into FII or FPI

Under the provision of the Income Tax Act, the following assets would not be deemed to be Capital Asset situated in India : –

- Investment held by non-resident, directly or indirectly, in a Foreign Institutional Investor – (As referred to in clause (a) of the Explanation to section 115AD (for AY 2012-13 to AY 2014-15)

- Direct or Indirect Investment by non-resident, in Category-I or Category-II Foreign Portfolio Investor under SEBI (Foreign Portfolio Investors) Regulations, 2014.

This would imply, that any profits or gains arising from transfer of the above investments, will not be liable to tax in India.

Income through transfer of share/ Interest in an overseas entity, deriving substantial value from India

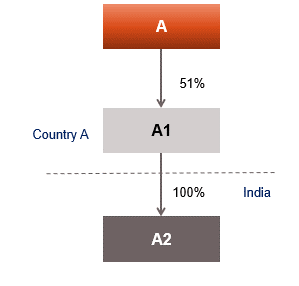

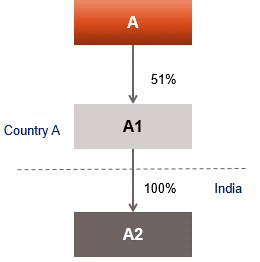

In order to understand these provisions better, let us look at the following diagram : –

In this diagram there are three companies : –

- Company A which is a foreign company holding 51% of another foreign company A1

- Company A1 which is a foreign company holding 100% of company A2, an Indian company

- Company A2, which is the operating Indian company and generates business value

When company A, wanted to incorporate an Indian company A2, it had two options : –

- Incorporate company A2 directly ;

- Incorporate company A2, by incorporating a subsidiary company A1 , which in turn Incorporates company A2 .

If company A2 would have been incorporated directly, and Company A would have sold the shares of company A2, it would have been liable to pay capital gains tax in India, since it was transfer of shares of an Indian company, which is considered as a capital asset situated in India.

However, in the second case, Company A would sell the shares of company A1, a foreign company, which may not be liable to tax in India, unless the Indian law specifically provided for transfer of shares of a foreign company, which resulted in transfer of shares of an Indian company, which derived its value from India.

In order to save taxes arising from transfer of an Indian company, many foreign companies in the past had adopted option to invest into an Indian company through an intermediary holding company in the past (A1 in this case). To curb these practices, Explanation 5 to Section 9(1)(i) was introduced wherein, profit arising on transfer of shares of a foreign company (A1) would be liable to tax in India where certain conditions are satisfied.

Let us look at these provisions in detail : –

Explanation 5 to Section 9(1)(i) of Income Tax Act

This explanation provides that the value of share or interest (ownership) in a foreign company (which constitutes a capital asset), shall be deemed to be situated in India (and therefore its transfer would attract capital gains tax in India), if it directly or indirectly derives substantial value from assets located in India. Such an asset could be shares of an Indian company or value of other assets.

1. Dividend declared by a Foreign Company outside India

However, any dividend declared by a foreign company outside India (say A1 in this example), in respect of shares which derive their value substantially from assets situated in India , would NOT be deemed to be income accruing or arising in India by virtue of the provisions of section 9(1)(i)- Circular No. 4/2015, dated 26-03-2015

Example : –

1. A Inc. transferred shares of B Pte, Singapore. Transfer of such shares would be taxable in India if : –

a. The share derives its value of more than 26% from the assets located in India.

b. The share derives its value substantially from the assets located in India.

c. The share derives its value from the activities in India.

d. The share derives its value from the management in India.

Agnostic Inc USA, is the parent of Diagnostic Pte Singapore, which in turns derive 75% of its value from its Indian subsidiary. Diagnostic Pte Singapore declared dividend of USD. 5,00,000 to Agnostic Inc USA . Comment on the taxability of such dividend ?

Solution : –

In terms of Circular No. 4/2015, dated 26-03-2015, any dividend declared by a foreign company outside India , in respect of shares which derive their value substantially from assets situated in India , would NOT be deemed to be income accruing or arising in India . Hence such dividend would not be liable to tax in India.

2. When would Share/ Interest in a Foreign Entity, derive their substantial value from India

In view of this, it becomes important to understand as to when would share /interest in a foreign entity, derive their substantial value from India . This is provided in Explanation 6 to Section 9(1)(i), which provides that the share or interest of a foreign company shall be deemed to derive its value substantially from the assets located in India, if on the specified date, the value of Indian assets –

- Exceeds Rs. 10 crore; and

- Represents at least 50% of the value of all the assets owned by the company.

In order to apply the above provisions, three conditions needs to be kept in mind : –

- The value has to be calculated only of the Indian asset. Once such value is calculated, it is to be compared with the value of the total asset of the company, whose share or interest are being transferred;

- Such value has to be calculated on the specified date ;

- Both the conditions of Indian asset value exceeding Rs. 10 crore and such value representing at least 50% of the value of all the assets owned by the company have to be cumulatively satisfied.

A. What is Specified Date for calculating value of Indian assets

Since the value of the assets has to be calculated on the specified date, it is important to understand its meaning. Specified date can be calculated under the following two scenarios : –

- If the difference between the book value of company assets on transfer date , and book value on last balance sheet date is less than 15% – Book value on Balance sheet date to be considered (comparison is based on book value)

- Any other case – Date of transfer shall be the specified date of valuation.

Steps : –

- Compute book value of company assets on transfer date

- Compute book value on last balance sheet date, preceding the date of transfer

- Compute % difference between the book value on two dates

- If difference > 15%, Book value on Date of transfer, else book value on last balance sheet date

B. Meaning of value of an asset

VALUE OF AN ASSET shall mean the “Fair market value of the asset , as on the specified date, without reduction of liabilities”, if any, in respect of the asset, determined in prescribed manner .

C. Meaning of Accounting Period

The methodology for accounting period, has to be based on what period is considered by the company for tax compliance/shareholders reporting. Two cases can arise : –

- Case A – Period other than 12 months ending on 31st March considered for tax compliance : –

If the company regularly adopts a period of 12 months ending on a day other than 31st March for : –

- tax laws compliance of territory of residence; or

- reporting to persons holding the share or interest,

12 months ending with such other day would be considered as Accounting Period.

ii. Case B –12 months Period ending on 31st March considered for tax compliance : –

In such a case, Period of twelve months ending with 31st March other day would be considered as Accounting Period.

D. The First Accounting Period

The first Accounting period of the company, would refer to the period beginning from the date of registration or incorporation of the company, and ending with the 31st March or such other day, as the case may be, following the date of such registration or incorporation.

E. Subsequent Accounting Period

For all subsequent period , successive periods of twelve months would be considered as Accounting period.

Accounting period of an entity which ceases to exist

If the company ceases to exist before , the end of any accounting period discussed above, then accounting period shall end immediately before the company ceases to exist.

Exception in case of Indirect Transfer – No management rights or ownership of less than 5% – Explanation 7 to Section 9(1)(i) of income tax act

In certain cases, the interest owned by the foreign entity in the Indian entity may be very less, even though such interest results in foreign company deriving its value substantially from India. In order to avoid such tax implications, there are certain exceptions , wherein the provisions of indirect transfer of shares would not apply.

In such cases, no income shall be deemed to accrue or arise in India, to a non-resident transferor, from transfer of interest in the foreign company. These are discussed as under : –

| Foreign company

or entity directly owns the Assets situated in India – (Facts : – A transfers shares of A1 – Indian Asset is shares of A2 ) |

AND | The transferor (A) (whether individually or along with its Associated Enterprises), at any time in the twelve months preceding the date of transfer, does not hold

• Management right or control in foreign company or entity (A1); or |

| Foreign company or

entity indirectly owns the assets situated in India (Facts : – Shareholders of A transfers shares of A) |

AND | The transferor (Shareholders of A)(whether individually or along with its Associated Enterprises), at any time in the twelve months preceding the date of transfer, does not hold

• Management right or control in foreign company or entity (A) ; or |

The case of Vodafone International Holdings B.V. v. Union of India [2012] 17 taxmann.com 202 (SC) is the classical case, in the context of International tax, which deals with transfer of shares of a foreign company, which derives its substantial value from Indian assets.. This is discussed as under : –

Vodafone’s Dutch subsidiary acquired the shares of a Cayman Island company, from a subsidiary of Hutchinson Telecommunications International Ltd. (the subsidiary was also located in the Cayman Islands). The Cayman company acquired by Vodafone owned an indirect interest in Hutchinson Essar Ltd., an Indian company through several tiers of Mauritius and Indian companies.

There were several issues involved in this landmark case, but we would limit our discussion to the issue related to indirect transfer.The primary issue in the Vodafone case was whether India had jurisdiction to tax the indirect transfer of shares of an Indian company, between two foregin companies , namely Vodafone’s Dutch subsidiary and Cayman Island company.

The verdict of the Supreme Court is given hereunder :-

- Tax Department argued before the Court that Section 9(1)(i) provision allows Department to “look through” the transfer of shares of a foreign company holding shares in an Indian company, and treat transfer of shares of the foreign company as equivalent to the transfer of the shares of an Indian company on the ground that section 9(1)(i) covers direct and indirect transfers of capital assets.

- The Court held that Section 9(1)(i) cannot be extended to cover indirect transfers of capital assets/property situate in India merely through interpretation, as this would amount to changing the very form of Section 9(1)(i) of Income tax act.

- Since the Legislature had not used the words indirect transfer in section 9(1)(i), if the word ‘indirect’ is read into section 9(1)(i) of Income Tax Act, it would render the express statutory provisions of the 4th sub-clause in section 9(1)(i) redundant, as it applies to transfers of a capital asset situate in India.

- In view of the above, the Court concluded that transfer of shares of a foreign company which owned shares in an Indian company was not liable to tax under the then existing provisions.

- Subsequently, such transfer has been made taxable in India through specific provisions discussed above, whereby indirect transfer of shares of a foreign company deriving its value substantially from India would be taxable in India.

Income from Salaries Earned in India – Section 9(1)(ii) of income tax act

If a non-resident individual has certain income, which is taxable under the head “Salaries”, it shall be deemed to accrue or arise in India, if it is earned in India.

NOTE :

- Salary income would be treated as earned in India if it is payable for services rendered in India.

- Further, “Salaries” payable for rest period or leave period , which is preceded or succeeded by services rendered in India, and forms part of the service contract of employment, shall be regarded as income earned in India.

However, even when such salaries are taxable in India, there are provisions in Tax Treaty, wherein if the total stay in India of the employee does not exceed 60 days (may vary in certain Treaties) and the employer does not claims of a deduction of such salary from its Indian taxable income, the employee is not liable to tax in India (this is generally known as short stay exemption).

Article 16(2), of the India USA Treaty dealing with such kind of provisions are as under (Bold portion added to the bare text to bring additional clarity) : –

.. remuneration derived by a resident of a Contracting State (USA) in respect of an employment exercised in the other Contracting State (India) shall be taxable only in the first-mentioned State (USA), if :

a) the recipient is present in the other State (India) for a period or periods not exceeding in the aggregate 183 days in the relevant taxable year ;

b) the remuneration is paid by, or on behalf of, an employer who is not a resident of the other State (not a resident of India) ; and

c) the remuneration is not borne by a permanent establishment or a fixed base or a trade or business which the employer (non resident) has in the other State (India).

In the following cases, salary shall be Deemed to accrue or arise outside India : –

- Services rendered on the board of ship, which is outside Indian shores ;

- Services are rendered outside India (see exception for salary payable by Government for services rendered overseas).

Salary payable by government for services rendered overseas – Section 9(1)(III) of Income tax Act

Any payments by Indian Government to an Indian citizen for services rendered outside India, may comprise of the following three payments :-

A. Salary to an Indian Citizen

Where any salary is payable by Indian Government to an Indian citizen for services rendered outside India , any salary so earned by individual would be deemed to accrue or arise in India. However, any allowance or perquisite paid abroad is exempt u/s 10(7).

B. Pension payable outside India to officials and judges by Indian Government

Any pension payable outside India , by the Government to its officials and judges , who permanently reside outside India shall not be deemed to accrue or arise in India.

Example 1 : –

Nitin was working as Software Engineer in Gurgaon based MNC and left India on April 1, 2019 to work on UK Project of MNC. He worked in UK during the previous year 2019-20. He has received all his salary outside India during the whole previous year 2019-20.

Whether such salary income would be deemed to accrue or arise in India ?

Solution : –

Salary income shall be deemed to accrue or arise in India when services are rendered in India. In this case, salary income is earned for services rendered in UK (i.e., outside India). Thus, salary income accrues or arise outside India.

Nitin would have been liable to pay tax on such foreign income in India, if he is a tax resident in India, in which case his global income would be liable to tax in India. However, in this case Nitin would be non-resident in India during the previous year 2019-20.

Example 2 : –

Mohit was working as Software Engineer in Government company in India. On April 1, 2019, the Indian Government sent Mohit to work on a project in Ache worked in UK during whole previous year 2019-20. He has received taxable salary of Rs. 50,00,000 outside India from the Indian Government during the previous year 2019-20, which includes perquisite and allowances of Rs, 10,00,000.Whether such salary income deemed to accrue or arise in India?

Solution : –

As per general rule, salary income shall be deemed to accrue or arise in India only when services are rendered in India. However, there is an exception to this principle that salary paid by Indian Government to a citizen of India would be deemed to accrue or arise in India. In view of this , Mohit’s salary would be deemed to accrue or arise in India. However, since any allowance or perquisite paid abroad is exempt u/s 10(7), only Rs. 40,00,000 shall be taxable in India.

Dividend paid by an Indian Company outside India – Section 9(1)(iv) of Income Tax Act

Dividends paid by an Indian company outside India shall be deemed to accrue or arise in India. Dividend which is accrued, but not paid is not liable for taxation under this clause.

Dividend paid by a foreign company is not liable for taxation under this clause.

Notes : –

- In respect of dividend declared and paid until 31.3.2020, the domestic company is liable to pay Dividend Distribution tax on dividend distributed to shareholders, which is thereafter exempt from tax in the hands of foreign shareholders under section 10(34). However, dividend received from a foreign company by an Indian resident is taxable.

- Dividend distribution tax under section 115-O would be payable by the Indian company.

For any queries, please write them in the Comment Section or Talk to our tax expert