Introduction to Non-Resident Taxation

Although extensive literature has been provided for the taxation of Residents of India, taxation of non-residents is just as important. This article introduces the reader to the concept of ‘non-resident’ and other terms that he will encounter while learning about this concept and its other facets. It also further delves into the taxation of Non-Resident under the Income Ta Act, 1961.

Bird’s Eye view of the ‘Introduction to Non-Resident Taxation’

| Concept of taxation | Non-Resident Taxation |

| Base of taxation |

|

Taxation of non-residents in any country, in respect of Cross – Border transactions, can be taxed based on the following criteria : –

- Residence of the taxpayer – Residence based taxation

- Source of income – Source based taxation

Let us discuss both of them in detail : –

RESIDENCE BASED TAXATION

Under Residence based taxation, taxation is based on place of residence of the taxpayer.

- Natural Person or individuals,

Natural Person or individuals, are generally taxable in the country of their residence/domicile, regardless of the source of income (i.e., even if source of income is outside the country of residence). For example, individuals who are resident in India are taxed in India and their global income.

- Companies

Companies are taxable at the place where they are incorporated or where they have Place of Effective Management (POEM) (which is considered as their place of residence).

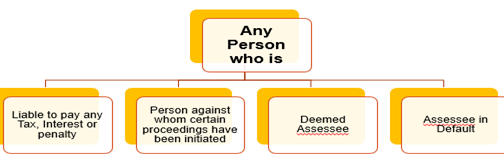

DEFINITION OF ASSESSEE – SECTION 2(7)

Under the Income Tax Act, 1961 (IT Act, 1961) assessee means any person (i.e., Individual, HUF, Firm, Company, AOP/BOI, etc.), who are liable to pay any Tax or any other sum of money (i.e., penalty or interest) under the IT Act.

Further, assessee also “INCLUDES” the following categories of person : –

- Person in respect of whom any proceedings have been undertaken for(whether or not ultimately tax is found payable from him)

- Assessment of his income or loss incurred by him ;

- Assessment of income or loss incurred by any other person, for whom he is assessable (“Esate of a Deceased person ”) ;

- Assessment of refund due to him or any other person

- Persons who is deemed to be an assessee (e.g. representative assesses u/s 160 for non-resident) under the IT Act.

- Persons Deemed to be an Assessee in default for the following : –

- Non-deduction/ Deduction but non deposit of tax – Section 201(1)

- Non-deposit of advance tax – Section 218

DEFINITION OF PERSON – SECTION 2(31)

Person includes seven categories of tax payers : –

- Individual;

- Hindu Undivided Family

- Company;

- Firm;

- An Association of Persons or Body of individuals ;

- A Local Authority ; and

- Every Artificial Juridical person not falling above, idol or deity.

NOTE :

The term ‘Person’ is important as the charge of income-tax is on every ‘Person’.

DEFINITION of ASSESSMENT YEAR – SECTION 2(9)

“Assessment year” meansperiod of twelve months starting from April 1 of every year, and ending on March 31 of next year ( Period of Assessment Year is fixed by the Statute ).

NOTE :

The year in which income is earned is Previous Year, and such income is taxable in the immediately following year which is the Assessment Year .

Income earned in the Previous Year 2017-18 is taxable in the Assessment Year 2018-19.

DEFINITION OF PREVIOUS YEAR – SECTION 3

Generally, period commencing from April 1, and ending on subsequent March 31 , immediately preceding the Assessment Year is considered as the Previous Year for income tax purposes. However, it shall also depend on whether the business in respect of which previous year is to be determined is an existing business/ source of income, or a new business source of income. In such cases the previous year will be ascertained as under : –

a) Continuing business /Existing source of income – In this case Previous year means 12 months immediately preceding the Assessment Year

b) New business – In case of a new business or profession, previous year shall begin on the date of setting-up of business or profession and ending with 31st March of said financial year.

c) New source of income – In case of a new source of income, the previous year shall begin from the date new source of income comes into existence and ending with 31st March of said financial year.

DEFINITION of DOMESTIC COMPANY – SECTION 2(22a)

Domestic company means a company which is : –

- An Indian company; or

- Company which has made prescribed arrangements for the declaration and payment of dividends (including dividend on preference shares) within India, out of its income taxable in India.

Prescribed arrangement for declaration and payment of dividend in India means : –

- Share register for all shareholders are maintained by the company at its principal place of business in India;

- Annual General Meeting (“AGM”) is held only at a place within India (where accounts of the relevant previous year are passed and dividend in respect thereof is declared); and

- The dividend declared is payable within India to all shareholders

DEFINITION OF FOREIGN COMPANY – SECTION 2(23a)

Foreign company means a company which is not a domestic company.

In other words, Foreign company means a company

- Which is not an Indian company; or

- Which has not made prescribed arrangement of the declaration and payment of dividends within India.

Even a Branch of a foreign company is liable to tax in India at the same rate at which the foreign company is taxable.

DEFINITION OF INDIA – SECTION 2(25a)

“India” means the

- territory of India , referred to in Article 1 of the Constitution,

- its territorial waters, seabed and subsoil underlying such waters,

- Continental Shelf,

- Exclusive Economic Zone of India; or

- Any other specified maritime zone and the air space above its territory and territorial waters.

NOTE :

Specified Maritime Zone means the maritime zone as referred to in the Territorial Waters, Continental Shelf, Exclusive Economic Zone and other Maritime Zones Act, 1976.

DEFINITION of RESIDENT – SECTION 2(42)

Resident means a person who is resident in India within the meaning of Section 6.

A person who is president of India can be either : –

- Resident and ordinarily resident of India

- Resident but not ordinarily resident of India

These aspects have been dealt with in detail in the subsequent part of this chapter.

DEFINITION of NON-RESIDENT – SECTION 2(30)

“Non-resident’’ means a person who is not a “resident”. For the purposes of following Section, no-resident also includes a person who is not ordinarily resident within the meaning of Section 6(6) : –

- Section 92

Section 92 provides that income from international transaction between a resident and a non-resident shall be computed having regard to the arm’s length price. For this purpose the non-resident includes a ‘resident but not ordinarily resident assessee’.

- Section 93

Section 93 deals with cases, where an assessee makes an attempt to avoid payment of income-tax by transactions, which result in transfer of income to non-residents. For this purpose, the non-resident includes a ‘resident but not ordinarily resident assessee’.and

- Section 168

It provides for taxability of income of deceased in the hands of executor. In such a case, an executor can be deemed to be resident or non-resident . The non-resident here includes a ‘resident but not ordinarily resident assesse.

EXAM TIPS : –

In case the question relates to Section 92, Section 93 or Section 168 of IT Act, a person who is a resident but not ordinarily resident, would also be considered a non- resident.

DEFINITION OF TRANSFER – SECTION 2(47)

“Transfer” in relation to a capital asset, includes the following –

- Sale, exchange or relinquishment of an asset; or

- Extinguishment of any rights in an asset – For example – Buy Back of shares ; or

- The compulsory acquisition of an asset thereof under any law; or

- Conversion of capital asset into stock in trade; or

- Maturity or redemption of a zero coupon bond; or

- Possession of an immovable property in consideration of part-performance of a contract referred to in Section 53A of the Transfer of Property Act, 1882; or

- Any transaction which has the effect of transferring an immovable property which satisfied following conditions:

- Transferor is a member of co-operative society/company/AOP.

- By virtue of his membership, he has allotted an immovable property or he will be allotted an immovable property.

- The membership right is transferred which has the effect of transferring, or enabling the enjoyment of the aforesaid immovable property.

CHARGE OF INCOME TAX – SECTION 4(1)

Where any Central Act enacts that income-tax shall be charged for any assessment year at any rate or rates,income-tax at that rate or those rates shall be charged for that year in accordance with, and subject to the provisions of this Act in respect of the total income of the previous year of every person [Section 4(1)].

CHARGE OF INCOME-TAX FOR INCOME PERTAINING TO OTHER THAN THE PREVIOUS YEAR – PROVISO TO SECTION 4(1)

In certain cases, to avoid loss of revenue where the business ceases to exist/or the recipient of income may be a non-resident who may not come back to India, the provision of the Act provide that income-tax is to be charged in the year when such income is earned. In such case, income tax can be charged during AY on income other than the income earned during the corresponding previous year. Certain examples of such cases are the provisions of Sections 172, 174, 174A, 175 and 176.

DEDUCTION OF TAX OR PAYMENT OF ADVANCE TAX – SECTION 4(2)

Where an income is chargeable to tax under section 4(1), income-tax shall be deducted at source (i.e., TDS) or paid in advance (i.e., advance tax), as per the provision of the Income Tax Act, 1961.

RATES OF TAX, SURCHARGE AND CESS FOR FOREIGN COMPANIES AS PER INCOME TAX ACT, 1961

- Foreign Companies are taxable at the rate of 40%. This rate would be further increased by : –

- Surcharge @ 2% of such income-tax, where the total income exceeds Rs. 1 crore but does not exceed Rs. 10 crores.

- 5% of such income tax where total income exceeds Rs. 10 crores.

- Education Cess and Secondary and Higher Education Cess (SHEC) of 2% and 1%, respectively(ON INCOME TAX + SURCHARGE)

- Non-corporate Non-residents – Tax rates applicable to residents would apply to such non-corporate non-residents.

- However, the higher basic exemption limit for resident senior citizens and super senior citizens would not be available for non-resident individuals.

For any queries, please write them in the Comment Section or Talk to our tax expert