Applicability of MAT on Foreign Companies – Section 115JB of Income Tax Act 1961

Under the provision of the Income Tax Act, where the tax payable by the company as per the provision of the IT Act, is less than MAT, the company is liable to pay a minimum income tax equivalent to MAT.

Tax payable by the company as per the provision of the IT Act is calculated on the basis of Income Tax Act, which allows for various deductions from the profit of the company.

Minimum alternate tax (“MAT”) is income tax, which is payable by Companies, based on their book profits. Such book profit is calculated on the basis of financial statements prepared under the Companies Act, 2013 , after making certain prescribed adjustments as per Section 115JB of the IT Act.

Section 115JB , which deals with MAT, generally covers even foreign companies under, obligation to pay MAT, if the income-tax payable on the total income of such foreign companies, as computed under the Income-tax Act, 1961 is less than 18.5%of their book profit (subject to exemptions discussed subsequently).

In such a case, the tax payable by the foreign company shall be @ 18.5%.

SURCHARGE, will be added @ 2%, where the total income exceeds Rs. 1 crore but does not exceed Rs. 10 crore, and 5% where the total income exceeds Rs. 10 crore.

EDUCATION CESS @2% AND SECONDARY AND HIGHER EDUCATION CESS@ 1% shall be added on the aggregate of income-tax and surcharge.

Non Applicability of MAT on Foreign Companies – Explanation 4 to Section 115JB of Income Tax Act 1961

Explanation 4 to Section 115JB , inserted retrospectively effect from 01.04.2001 provides that the provisions of MAT would not be applicable in the following cases :-

CASE 1 : WHEN THERE IS DTAA BETWEEN INDIA AND THE COUNTRY OF RESIDENCE OF THE TAXPAYER : –

The foreign company , would not liable to MAT if it is a resident of a country or a specified territory with which India has a DTAA, and such foreign company, does not have any PE in India in accordance with the provisions of such DTAA .

CASE 2 : WHEN THERE IS NO DTAA

The foreign company is not liable to MAT if it is a resident of a country with which India does not have DTAA provided such foreign company is not required to seek registration under any law relating to companies, which is in force for the time being .

These provisions are summarised as under : –

MAT on Foreign Companies – Section 115JB of Income Tax Act 1961 – Example: –

FCO (USA) has earned certain business income of Rs 10 lakhs during FY 2017-18 from ICO. Whether such royalty income would be liable to MAT in following scenarios:-

Scenario 1: FCO has PE in India.

Scenario 2: FCO does not have PE in India.

Solution : –

Scenario 1 : –

If there is a DTAA between India and country of residence of FCO, and FCO does not have a PE in India, FCO would not liable to MAT. In this case, while there is a Treaty between India and USA, since FCO has a PE in India, business income would be liable to MAT.

Scenario 2:

Since there is a Treaty between India and USA, and FCO does not has a PE in India, FCO would not be liable to MAT on its business income in India.

MAT on Foreign Companies – Section 115JB of Income Tax Act 1961 – Example: –

FCO was located in Country X and India does not have DTAA with Country X. FCO has earned short-term capital gains of Rs 10 lakhs during FY 2017-18 from sale of shares of ICO. FCO is not required to be registered in India under any other law relating to companies in India. Whether such capital gain would be liable to MAT?

Solution :

Since India does not have a DTAA with Country X, and FCO is not required to be registered in India under any other law relating to companies in India , MAT provisions would not be applicable on FCO.

MAT on certain Capital Gains and Royalty etc.

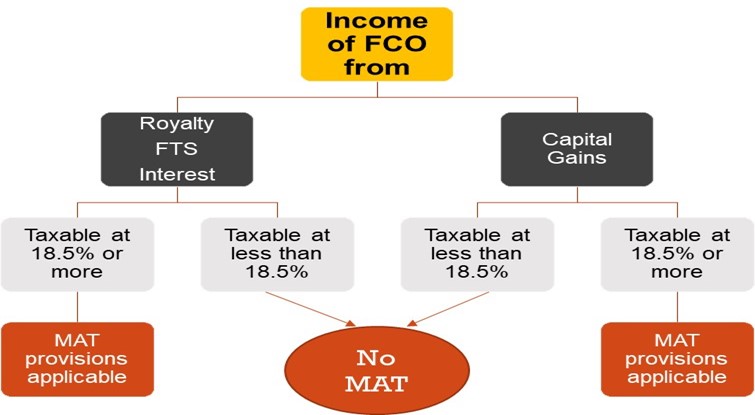

A foreign company which is liable to pay MAT, make also has certain income in the nature of royalty, capital gains etc, which may not be connected to the PE of the foreign company in India. In such a case, these income may be liable to tax at a flat rate. Since MAT may be payable at a rate which is different from search flat rate, these income and corresponding expenditures are generally excluded in computation of MAT, where these are credited to the profit and loss account and are chargeable to tax at a rate lower than the rate specified in section 115JB.

Accordingly, in case of a foreign company which is liable to pay MAT, in computing its book profits for the purpose of MAT, such book profits shall be reduced by the following amounts which are credited to the profit and loss account , and where the income-tax payable is at a rate lower than the rate specified in section 115JB (i.e., less than 18.5%) : –

- Any income by way of capital gains on transactions in securities or

- Interest, royalty or fees for technical services chargeable to tax at the rates specified in Chapter XII,

- Any corresponding expenditure (i.e., expense incurred to earn capital gains, interest, royalty, etc.) will be added back, if the same is debited to profit and loss account.

The summary of these provisions is as under : –

MAT on Foreign Companies – Section 115JB of Income Tax Act 1961 – Example: –

FCO earned royalty income of Rs 20 lakhs from ICO during the FY 2017-18, which was credited to the profit and loss account. Such royalty is taxable at concessional rate of 10% under DTAA. Whether such royalty income is liable to MAT ?

Solution : –

Any income earned by FCO by way of royalty shall not be liable to MAT if they are chargeable to tax at rate which is less than 18.5%. In this case, the royalty is taxable at 10%, i.e., less than 18.5%. Thus, such royalty income would not be liable to MAT. It should be reduced from the book profits while calculating MAT.

MAT on Foreign Companies – Section 115JB of Income Tax Act 1961 – Example: –

FCO earned short-term capital gains of Rs 20 lakhs from sale of shares of ICO during the FY 2017-18. Such capital gains are exempt in India under DTAA. Whether such capital gains are liable to MAT?

Solution : –

Any income earned by FCO by way of capital gains shall not be liable to MAT if they are chargeable to tax at less than 18.5%. In this case, the capital gain is not taxable at all . Thus, such capital gain would not be liable to MAT. It should be reduced from the book profits while calculating MAT.

MAT on Foreign Companies – Section 115JB of Income Tax Act 1961 – Example: –

In the Example 1, assume that FCO has incurred expenditure of 50,000 to earn such royalty income, which is debited to the profit and loss account. Other facts remain unchanged. What would be its impact on MAT calculation?

Solution : –

Any expense incurred to earn royalty, etc., which is excluded while computing MAT,will be added back to book profit. In this case expenditure of Rs 50,000 will be added back in book profit while calculating MAT.

AMT/MAT on unit located in an International Financial Service Center

Section 115JC of the Act provides for alternate minimum tax at the rate of 18.50% of adjusted total income in the case of a non-corporate person.However, in case of a unit located in an International Financial Service Center, the alternate minimum tax under section 115JC shall be charged at the rate of 9%.

MAT Applicability on Specified Foreign Company

Explanation 4A to Section 115JB , has been inserted by Finance Act, 2018, and provides that the MAT provision shall not be applicable to a foreign company (including for any of earlier previous years), if the total income of the foreign company, comprises solely of profits and gains from business referred to in following sections, and such income has been offered to tax at the rates specified in the said sections –

- Section 44B (Special provision for computing profits and gains of shipping business in the case of non-residents ), or

- Section 44BB (Special provision for computing profits and gains in connection with the business of exploration, etc., of mineral oils ) or

- Section 44BBA (Special provision for computing profits and gains of the business of operation of aircraft in the case of non-residents) or

- Section 44BBB (Special provision for computing profits and gains of foreign companies engaged in the business of civil construction, etc., in certain turnkey power projects)

Relief from Liability of Minimum Alternate tax (MAT) for company in Corporate Insolvency – Inserted by the Finance Act, 2018

For the purpose of computing book profit under Section 115JB, certain positive and negatives adjustments are required be made to the net profit as shown in profit and loss account . Section 115JB provides for a deduction from net profit in respect of the amount of loss brought forward or unabsorbed depreciation, whichever is less as per books of account. Consequently, where the loss brought forward or unabsorbed depreciation is Nil, no deduction is allowed. This non-deduction is a barrier to rehabilitating companies seeking insolvency resolution.

Finance Act, 2018 has amended the existing Section 115JB to provide that the aggregate amount of unabsorbed depreciation and loss brought forward shall be allowed to be reduced from the book profit, if a company’s application for corporate insolvency resolution process under the Insolvency and Bankruptcy Code, 2016 has been admitted by the Adjudicating Authority.

MAT on Foreign Companies – Section 115JB of Income Tax Act 1961 – Example: –

XYZ India Ltd. has no unabsorbed depreciation during the AY 2018-19 in the books of account. However, it has unabsorbed business loss of Rs 1,00,000 in such AY. XYZ India Ltd. has applied for corporate insolvency resolution process and such application was admitted . In this case XYZ India is entitled to reduce unabsorbed business loss of Rs 1,00,000 from the book profits while computing MAT.

Dividend Distribution Tax on Dividend pay outs to unit holders in an equity – Oriented Fund [Section 115R]

An equity oriented Mutual Fund , is liable to pay additional income-tax at the rate of ten per cent on any income distributed by it. Mutual fund is liable to charge dividend distribution tax , even when dividend is paid to a unit holder of equity-oriented fund who is non-resident Individual or foreign company.For this purpose, equity-oriented fund will have the same meaning assigned to it in the new section 112A of the Act.The rate of dividend distribution tax is further increased by surcharge of 12% and health and education cess of 4%.

For any queries, please write them in the Comment Section or Talk to our tax expert