Non Resident Taxation MCQ International Taxation are covered in this Article. Non Resident Taxation MCQ Test contains 107 questions. Answers to MCQ on Non Resident Taxation are available after clicking on the answer.

MCQ on Non Resident Taxation – International Taxation

1. Which of the following is the basis of taxing Cross – Border transactions: –

a. Residence of the taxpayer

b. Where is the Source of income

c. Both A and B

d. Neither A nor B

Answer

Answer: c. Both A and B

2. Under Residence based taxation, taxation of an individual is based on : –

a. Country of their residence

b. Whether the source of income is in or outside the country of residence

c. Both A and B

d. Neither A nor B

Answer

Answer: a. Country of their residence

3. Under Residence based taxation, taxation of an companies is based on : –

Place where they are incorporated or

Place of Effective Management

a. Both A and B

b. Neither A nor B

Answer

Answer: a. Both A and B

4. POEM stand for

a. Place of Effective Management

b. Place of residence of Effective Manager

c. Place of Employee Matters

d. Place of Employee Management

Answer

Answer: a. Place of Effective Management

5. Assessee includes : –

a. Individual, HUF, Firm, Company, AOP/BOI, etc.;

b. Any person by whom any Tax is payable under the Income Tax Act

c. Any person by whom penalty or interest is payable under the Income Tax Act

d. All of the above

Answer

Answer: d. All of the above

6. Assessee includes person in respect of whom any proceedings have been undertaken for : –

a) Assessment of his income or loss incurred by him ;

b) Assessment of income or loss incurred by any other person, for whom he is assessable

c) Assessment of refund due to him or any other person

d) All of the above

Answer

Answer: d) All of the above

7. A, is a non-resident Indian who moved out of India in 2013-14. He did not file his return since he moved out of India . The tax Department issued a notice to A to file return of income under the belief that he had taxable income based on information available with them from third party assessment. Whether, A is an assesse within the meaning of Income Tax Act, 1961 ?

a. Yes

b. No

Answer

Answer: a. Yes

8. Alco Inc. is a foreign company which derived certain royalty income/ taxable business income during 2016-17. It did not file its tax return for the said year, even though the due date of filing return expired. The tax Department issued a notice to Alco Inc. to file return of income. Whether, Alco Inc. is an assesse within the meaning of Income Tax Act, 1961 ?

a. Yes

b. No

Answer

Answer: a. Yes

9. Assessee includes : –

a. Persons Deemed to be an assessee (e.g. representative assesses u/s 160 for non-resident)

b. Persons Deemed to be an Assessee in default [ under section 201(1) for non-deduction/ non deposit of tax, under Section 218 for non-deposit of advance tax ]

c. Both A and B

d. Neither A nor B

Answer

Answer: c. Both A and B

10. Which of the following is included within the definition of Person: –

a) Individual;

b) Hindu Undivided Family

c) Company;

d) All of the above

Answer

Answer: d) All of the above

MCQ on Non Resident Taxation – International Taxation

11. Which of the following is included within the definition of Person: –

a) Firm;

b) An Association of Persons or Body of individuals ;

c) A Local Authority ;

d) All of the above

Answer

Answer: d) All of the above

12. What would be the “Assessment year” if income is received on September 30, 2017 : –

a. 2016-17

b. 2017-18

c. 2018-19

d. Neither of the above

Answer

Answer: c. 2018-19

13. What would be the “Assessment year” if income is received on March 30, 2017 : –

a. 2016-17

b. 2017-18

c. Neither of the above

Answer

Answer: b. 2017-18

14. What would be the “Assessment year” if income is received on September 30, 2016 : –

a. 2016-17

b. 2017-18

c. Neither of the above

Answer

Answer: b. 2017-18

15. What would be the “Previous year” if income is received on September 30, 2017 : –

a. 2016-17

b. 2017-18

c. Neither of the above

Answer

Answer: b. 2017-18

16. What would be the “ Previous year” if income is received on October 30, 2016 : –

a. 2016-17

b. 2017-18

c. Neither of the above

Answer

Answer: a. 2016-17

17. Assessment Year —— Previous year : –

a. Precedes

b. Succeeds

c. Is simultaneous with

Answer

Answer: b. Succeeds

18. What would be the Assessment Year for Previous year 2016-17 : –

a. 2016-17

b. 2017-18

c. 2018-19

Answer

Answer: b. 2017-18

19. What would be the Assessment Year for Previous year 2017-18 : –

a. 2016-17

b. 2017-18

c. 2018-19

Answer

Answer: c. 2018-19

20. What would be the Assessment Year for Previous year 2015-16 : –

a. 2016-17

b. 2017-18

c. 2018-19

Answer

Answer: a. 2016-17

MCQ on Non Resident Taxation – International Taxation

21. What would be the Previous year for Assessment Year 2016-17 : –

a. 2016-17

b. 2017-18

c. 2015-16

Answer

Answer: c. 2015-16

22. What would be the Previous year for Assessment Year 2017-18 : –

a. 2016-17

b. 2017-18

c. 2018-19

Answer

Answer: a. 2016-17

23. What would be the Previous year for Assessment Year 2015-16 : –

a. 2016-17

b. 2014-15

c. 2018-19

Answer

Answer: b. 2014-15

24. Domestic company means a company which is : –

a) An Indian company; or

b) Company which has made prescribed arrangements for the declaration and payment of dividends (including dividend on preference shares) within India, out of its income taxable in India.

c) Both A and B

d) None of the above

Answer

Answer: c) Both A and B

25. Alpha Inc, a company incorporated in USA , has made prescribed arrangement for the declaration and payment of dividends within India . Alpha Inc would be a

a. Foreign company for Indian Income Tax Act purpose

b. Domestic company for Indian Income Tax Act purpose

Answer

Answer: b. Domestic company for Indian Income Tax Act purpose

26. XYZ India Private Limited, is a company incorporated in India , but its place of effective management is in UAE. XYZ India would be a

a. Foreign company for Indian Income Tax Act purpose

b. Domestic company for Indian Income Tax Act purpose

Answer

Answer: b. Domestic company for Indian Income Tax Act purpose

27. A person who is a Resident in India , should be so covered with the provision of

a. Section 6

b. Section 9

c. Section 90

Answer

Answer: a. Section 6

28. “Non-resident’’ means

a. a person who is not a “resident”;

b. a person who is a “resident”,

c. For the purposes of Section 92, Section 93 and Section 168 includes a person who is not ordinarily resident within the meaning of clause (6) of section 6.

d. Both A and C

Answer

Answer: d. Both A and C

29. A, is a NRI, who is resident but not ordinarily resident within the meaning of Section 6(6). He received dividend from an Indian company where he owns 51%. For the purpose of Transfer Pricing provisions, he would be considered a : –

a. Non resident

b. Resident

Answer

Answer: a. Non resident

30. Alpha Inc., a company incorporated in USA , has an Indian subsidiary, Beta India Private Limited. Alpha Inc. sold the shares of Beta India to Gama Singapore. Such a sale: –

a. Would constitute a transfer and liable to Capital gains tax in India;

b. Would constitute a transfer and liable to Capital gains tax in India, subject to any Treaty benefits

c. Would not constitute a transfer and would not be liable to Capital gains tax in India

Answer

Answer: b. Would constitute a transfer and liable to Capital gains tax in India, subject to any Treaty benefits

MCQ on Non Resident Taxation – International Taxation

31. Alpha Inc., a company incorporated in USA , has an Indian subsidiary, Beta India Private Limited. Alpha Inc. exchanged the shares of Beta India with shares of Gama Singapore. Such a transaction : –

a. Would constitute a transfer and liable to Capital gains tax in India;

b. Would constitute a transfer and liable to Capital gains tax in India, subject to any Treaty benefits

c. Would not constitute a transfer and would not be liable to Capital gains tax in India

Answer

Answer: b. Would constitute a transfer and liable to Capital gains tax in India, subject to any Treaty benefits

32. Alpha Inc., a company incorporated in USA , has an Indian subsidiary, Beta India Private Limited. Beta India did a capital reduction of its shares whereby it reduced the face value from Rs. 10 to Rs. 5 and paid Alpha Inc. Such a transaction : –

a) Would constitute a transfer and liable to Capital gains tax in India;

b) Would constitute a transfer and liable to Capital gains tax in India, subject to any Treaty benefits

c)Would not constitute a transfer and would not be liable to Capital gains tax in India

Answer

Answer: b) Would constitute a transfer and liable to Capital gains tax in India, subject to any Treaty benefits

33. Alpha Inc., a company incorporated in USA , had an office in India which constituted its PE. In order to construct a Railway track, the Government acquired the building where the office was situated and paid Alpha Inc., Rs. 10 crores. Such a transaction : –

a. Would constitute a transfer and liable to Capital gains tax in India;

b. Would constitute a transfer and liable to Capital gains tax in India, subject to any Treaty benefits

c. Would not constitute a transfer and would not be liable to Capital gains tax in India

Answer

Answer: b. Would constitute a transfer and liable to Capital gains tax in India, subject to any Treaty benefits

34. Alpha Inc., a company incorporated in USA was engaged in manufacturing and selling software. It has an Indian subsidiary, Beta India Private Limited. Alpha Inc., changed its business to a dealer in shares and converted shares of Beta India , which was a capital asset into stock in trade. Such a transaction : –

a) Would constitute a transfer and liable to Capital gains tax in India;

b) Would constitute a transfer and liable to Capital gains tax in India, subject to any Treaty benefits

c)Would not constitute a transfer and would not be liable to Capital gains tax in India

Answer

Answer: b) Would constitute a transfer and liable to Capital gains tax in India, subject to any Treaty benefits

35. Income tax is chargeable on income earned during the previous year. Which of the following can be exceptions to this Rule : –

a. Section 172,

b. Section 174

c. Section 174A,

d. Section 175

e. All of the above

Answer

Answer: e. All of the above

36. Income-tax in respect of income chargeable to tax under section 4(1) of the IT Act, is payable by way of : –

a) Tax deducted at source

b) Advance Tax

c) Self Assessment Tax

d) All of the above

Answer

Answer: d) All of the above

37. The rates of tax payable by Foreign companies as per Income Tax Act, 1961 is : –

a. 40%.

b. 30%.

c. 25%

Answer

Answer: a. 40%.

38. The rates of surcharge payable by a Foreign company as per Income Tax Act, 1961 is : –

a. Surcharge @ 2% of such income-tax, where the total income exceeds Rs. 1 crore but does not exceed Rs. 10 crores.

b. 5% of such income tax where total income exceeds Rs. 10 crores.

c. Both of the above

d. None of the above

Answer

Answer: c. Both of the above

39. The rates of cess tax payable by foreign companies as per Income Tax Act, 1961 is : –

a. Education Cess of 2%

b. Secondary and Higher Education Cess (SHEC) of 1%,

c. Both of the above

d. None of the above

Answer

Answer: c. Both of the above

40. Resident taxpayers are liable to pay tax on their : –

a. Global income

b. Only India sourced income

c. Only Foreign income.

Answer

Answer: a. Global income

MCQ on Non Resident Taxation – International Taxation

41. Non – Resident taxpayers are liable to pay tax on their : –

a. Global income

b. Only India sourced income

c. Only Foreign income.

Answer

Answer: b. Only India sourced income

42. On the basis of their Residential Status, taxpayers are classified into : –

a. Resident and not ordinarily resident

b. Non Resident

c. Resident and ordinarily resident

d. Either of the above

Answer

Answer: d. Either of the above

43. An individual is said to be resident in India in any previous year, if he satisfies any — of the basic conditions : –

a. One

b. Both

c. Both the Basic conditions and atleast one additional condition

Answer

Answer: a. One

44. Which one of the following is not a basic condition to determine residential status of an individual : –

a) He has been in India during the previous year for a total period of 182 days or more ;

b) He has been in India during the previous year for a total period of 182 days or less ;

c) He has been in India during the 4 years immediately preceding the previous year for total period of 365 days or more and has been in India for at least 60 days in the previous year .

d) Both A and C

Answer

Answer: d) Both A and C

45. An individual is said to be non resident in India in any previous year, if he satisfies any — of the basic conditions : –

a. One

b. Both

c. None

Answer

Answer: a. One

46. Abraham, an Indian citizen, left India during previous year 2016-17, for the purpose of employment outside India on August 31, 2016. He was in India during the 4 years immediately preceding the previous year for total period of more than 365 days . He would be a : –

a. Resident in India

b. Non Resident in India

Answer

Answer: b. Non Resident in India

47. Relan, an Indian citizen, left India during previous year 2016-17, as a member of the crew of an Indian ship for the purposes of employment outside India, on September 15, 2016. He was in India during the 4 years immediately preceding the previous year for total period of more than 365 days . He would be a : –

a. Resident in India

b. Non Resident in India

Answer

Answer: b. Non Resident in India

48. Samir , an Indian citizen was living outside India since 2012 and comes on a visit to India in previous year 2016-17 for 180 days. In such a case, he would be : –

a. Resident in India

b. Non Resident in India

Answer

Answer: b. Non Resident in India

49. A PERSON IS SAID TO BE OF INDIAN ORIGIN if : –

a. He was born in undivided India or

b. Either of his parents were born in undivided India

c. Either of his grandparents were born in undivided India.

d. All of the above

Answer

Answer: d. All of the above

50. A person , who is a resident, is said to be RESIDENT AND ORDINARILY RESIDENT if he satisfies —- of the additional conditions specified under section 6(6) : –

a. One

b. Both

c. None

Answer

Answer: b. Both

MCQ on Non Resident Taxation – International Taxation

51. Which one of the following is the additional conditions specified under section 6(6) for a resident to be resident and ordinarily resident : –

a) Individual has been resident in India in 2 out of 10 previous years immediately preceding the relevant previous year.

b) Individual has been resident in India in 3 out of 10 previous years immediately preceding the relevant previous year.

c) Individual has been resident in India in 4 out of 10 previous years immediately preceding the relevant previous year.

Answer

Answer: a) Individual has been resident in India in 2 out of 10 previous years immediately preceding the relevant previous year.

52. Which one of the following is the additional conditions specified under Section 6(6) for a resident to be resident and ordinarily resident : –

a) Individual has during the 7 previous years preceding the relevant previous year been in India for a period of 730 days or more.

b) Individual has during the 7 previous years preceding the relevant previous year been in India for a period of 830 days or more.

c) Individual has during the 8 previous years preceding the relevant previous year been in India for a period of 730 days or more.

Answer

Answer: a) Individual has during the 7 previous years preceding the relevant previous year been in India for a period of 730 days or more.

53. An individual is said to be a resident but not ordinarily resident (RNOR) if he —– any of the additional conditions

a. Fails to satisfy

b. Satisfies

Answer

Answer: a. Fails to satisfy

54. Which of the following can be RNOR/ROR : –

a) Individuals and

b) HUFs

c) Company

d) Both A and B

Answer

Answer: d) Both A and B

55. Residential status is to be determined on : –

a) Every five years

b) Year to Year basis

c) Initial Year of incorporation

d) Both A and B

Answer

Answer: b) Year to Year basis

56. “Stay in India” to determine residential status includes : –

a. Stay in the territorial waters of India

b. Stay in a ship or boat moored in the territorial waters of India

c. Date of departure as well as the date of arrival in India

d. All of the above

Answer

Answer: d. All of the above

57. Which of the following are not relevant in determining the residence of an individual for income-tax purpose : –

a. Citizenship, place of birth or domicile.

b. Whether period of stay is continuous

c. Whether stay is at the usual place of residence, business or employment of the individual.

d. All of the above

Answer

Answer: d. All of the above

58. Rahul is a Indian citizen working at a MNC in Mumbai. He was given an opportunity to work on an assignment in UK for such MNC. He had never visited any foreign country earlier and left India on June 30, 2016. His residential Status for Fy 2016-17 would be ?

a) Resident

b) Non Resident

c) Resident but not ordinarily resident

Answer

Answer: b) Non Resident

59. Jerry is a foreign citizen outside India, who is a person of Indian origin. He comes on visit to India on January 1, 2017. He left India on April 1, 2017. His residential Status for FY 2016-17 would be ?

a) Resident

b) Non Resident

c) Resident but not ordinarily resident

Answer

Answer: b) Non Resident

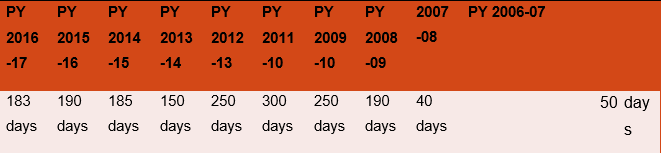

60. Ramesh is working in MNC located at Gurgaon. He had taken foreign visit on various occasion due to company’s work. However, he had not taken any foreign visit during he previous year 2017-18. His stay in India during the last 7 years is given as under :-

His residential Status for FY 2016-17 would be ?

a) Resident

b) Non Resident

c) Resident but not ordinarily resident

d) Resident and Ordinarily resident

Answer

Answer: d) Resident and Ordinarily resident

MCQ on Non Resident Taxation – International Taxation

61. The basis of determining the period of stay in India for an Indian citizen, being a crew member is governed by CBDT has vide, Notification No. 70/2015 dated 17.8.2015, inserted Rule 126 in the Income-tax Rules, 1962. Which of the following is true for excluding period of stay in India : –

a) Exclusion Period commences from – Date entered into Continuous Discharge Certificate, in respect of joining the ship by the said individual

b) Exclusion Period ends on Date entered into the Continuous Discharge Certificate ,in respect of signing off by that individual from the ship

c) Both the above

d) None of the above

Answer

Answer: c) Both the above

62. Out of the following persons, who would be resident in India if the control and management of their affairs is situated wholly or partly in India : –

a. HUF,

b. FIRM,

c. AOP/BOI,

d. LOCAL AUTHORITIES AND ARTIFICIAL JURIDICAL PERSONS

e. All of the above

Answer

Answer: e. All of the above

63. Out of the following persons, who would be a non resident in India if the control and management of their affairs is situated wholly outside India : –

a. HUF,

b. FIRM,

c. AOP/BOI,

d. LOCAL AUTHORITIES AND ARTIFICIAL JURIDICAL PERSONS

e. All of the above

Answer

Answer: e. All of the above

64. Control and Management of HUF is with : –

a. Its Karta

b. Owner

c. Any member of the family

d. None of the above.

Answer

Answer: a. Its Karta

65. Control and Management of Firm/AOP is with its : –

a. Partners/Members.

b. Lender

c. Any member of the partners family

d. None of the above.

Answer

Answer: a. Partners/Members.

66. An HUF, which is resident in India, can be : –

a. Resident and Ordinarily Resident

b. Resident and not Ordinarily Resident

c. Non Resident

d. All of the above

Answer

Answer: d. All of the above

67. Whether an HUF, is a Resident and Ordinarily Resident in India, would be dependent upon : –

a. whether the Karta of Resident HUF satisfies the additional conditions applicable to Individuals ;

b. Residential status of the HUF

c. Both the above

d. None of the above

Answer

Answer: c. Both the above

68. Inder, a non resident, is a Karta of Resident HUF. The HUF would be : –

a. Resident and Ordinarily Resident

b. Resident and not Ordinarily Resident

c. Non Resident

Answer

Answer: b. Resident and not Ordinarily Resident

69. Maninder, a resident and ordinarily resident, is a Karta of Resident HUF. The HUF would be : –

a. Resident and Ordinarily Resident

b. Resident and not Ordinarily Resident

c. Non Resident

Answer

Answer: a. Resident and Ordinarily Resident

70. Suvinder, is a Karta of Resident HUF. 1. He was a resident of India in 3 previous years out of 10 previous years immediately preceding relevant previous year and stayed in India during last 5 previous year immediately preceding relevant previous year for 740 days . The HUF would be : –

a. Resident and Ordinarily Resident

b. Resident and not Ordinarily Resident

c. Non Resident

Answer

Answer: a. Resident and Ordinarily Resident

MCQ on Non Resident Taxation – International Taxation

71. Firms, Association of persons, Local Authorities and other artificial juridical persons can be : –

a. Resident and Ordinarily Resident

b. Resident and not Ordinarily Resident

c. Non Resident

d. Resident

e. Both c and d

Answer

Answer: e. Both c and d

72. The head office of XYZ, HUF was situated in UK. What would be the residential status of HUF for PY 2017-18 when affairs of HUF are managed from UK ?

a. Resident and Ordinarily Resident

b. Resident and not Ordinarily Resident

c. Non Resident

d. Resident

Answer

Answer: c. Non Resident

73. The head office of XYZ, HUF was situated in UK. What would be the residential status of HUF for PY 2017-18 when affairs of HUF are managed from partly from India ?

a. Resident and Ordinarily Resident

b. Resident and not Ordinarily Resident

c. Non Resident

d. Resident

Answer

Answer: d. Resident

74. If the Karta is a resident of India, determine its residential Status if the Karta of HUF is present in India for more than 730 days during the preceding 7 years and is also resident in India in 8 years out of preceding 10 years ?

a. Resident and Ordinarily Resident

b. Resident and not Ordinarily Resident

c. Non Resident

d. Resident

Answer

Answer: a. Resident and Ordinarily Resident

75. The importance of residential status of a company is that : –

a. For Resident companies, global income is taxable ;

b. For Non Resident companies, India sourced income is taxable

c. Both A and B

d. Neither A nor B

Answer

Answer: c. Both A and B

76. Until ASSESSMENT YEAR 2016-17 , a company is said to be resident in India in any previous year, if it is

a. an Indian Company ; or

b. During that year, the control and management of its affairs is situated wholly in India.

c. Place of Effective Management (‘POEM’), in that year, is in India.

d. Both A and B

Answer

Answer: d. Both A and B

77. From ASSESSMENT YEAR 2017-18 , a company is said to be resident in India in any previous year, if it is

a. An Indian company;

b. During that year, the control and management of its affairs is situated wholly in India.

c. Place of Effective Management (‘POEM’), in that year, is in India.

d. Both A and C

Answer

Answer: d. Both A and C

78. “Place of effective management” means a place where key management, and commercial decisions

a. that are necessary for the conduct of the business of an entity as a whole are in appearance made.

b. that are necessary for the conduct of the business of an entity as a whole are in substance made.

c. that are necessary for the financing of business of an entity as a whole are in appearance made.

d. that are necessary for the conduct of the general operations of an entity as a whole are in substance made.

Answer

Answer: b. that are necessary for the conduct of the business of an entity as a whole are in substance made.

79. POEM, is an —- test to determine, whether a company incorporated in a foreign jurisdiction, is a tax resident of another country.

a. Internationally acceptable

b. India based

c. Both A and B

d. Neither A nor B

Answer

Answer: a. Internationally acceptable

80. Most of the Indian tax treaties recognize the POEM concept as a —- to determine residence of a company, for avoidance of double taxation : –

a. Basic rule

b. Tie-breaker rule

c. General rule

d. None of the above

Answer

Answer: b. Tie-breaker rule

MCQ on Non Resident Taxation – International Taxation

81. Tie-breaker rule , in the context of Treaty , is applied where : –

a. A person could be a Resident of both the Treaty partner countries

b. A person is liable to pay tax in both the Treaty partner countries

c. Where income may be taxable under two or more Article

d. None of the above

Answer

Answer: a. A person could be a Resident of both the Treaty partner countries

82. To ascertain POEM applicability, the companies are classified into : –

a) Companies engaged in “Active Business Outside India”,

b) Companies engaged in “Active Business in India”,

c) Companies not engaged in “Active Business Outside India”.

d) Both A and C

Answer

Answer: d) Both A and C

83. POEM of companies engaged in “Active Business Outside India” (ABOI) shall be presumed to be outside India if : –

a. Majority of the Board meeting are held outside India;

b. Majority of the Board meeting are held in India;

c. All the Board meeting are held outside India;

d. Both A and C

Answer

Answer: d. Both A and C

84. In case of Alpha Inc. majority of the Board meeting are held in USA. However, the Board of the company was a paper Board and all the decision were taken by Beta India private Limited , the Holding company of Alpha Inc. The POEM of Alpha Inc. in such a case would be : –

a. In India;

b. In USA, since the majority of Board meeting are held in USA;

c. Both India and USA

d. Neither A nor B

Answer

Answer: a. In India;

85. In case of Alpha Inc. majority of the Board meeting are held in USA. However, the Board of the company was a paper Board and all the decision were taken by AGMG, India, a professional firm that managed the business of Alpha Inc. The POEM of Alpha Inc. in such a case would be : –

a) In India;

b) In USA, since the majority of Board meeting are held in USA;

c) Both India and USA

d) Neither A nor B

Answer

Answer: a) In India;

86. FCO satisfies the test of Active Business Outside India. During the year 5 meetings of its Board of Directors were held of which 2 were held in India and 3 outside India.However, Board of Directors are not exercising powers of management and such powers are being exercised by ‘Indian holding Company’ (IHC) . The POEM of FCO would be : –

a. In India;

b. Outside India

c. Both India and Outside India

d. Neither A nor B

Answer

Answer: a. In India;

87. Hardbank Japan is wholly owned subsidiary of ICO. Parent company (i.e., ICO) laid down principles of supply chain functions. Such principles are laid down for the entire group of companies. Board of Directors of Hardbank follows such principle of supply chain functions. Board of Directors of Hardbank are —- their powers of management?

a. Not exercising

b. Exercising

Answer

Answer: b. Exercising

88. Which of the following global policy of the entire group (not being specific to any entity or group of entities), laid down by parent entity, if followed by the Board of Directors , shall not result in the Board of Directors not exercising their powers of management, for the purpose of ascertaining Place of Management of a company : –

a. Pay roll functions,

b. Accounting,

c. Human resource (HR) functions,

d. All of the above

Answer

Answer: d. All of the above

89. Which of the following global policy of the entire group (not being specific to any entity or group of entities), laid down by parent entity, if followed by the Board of Directors, shall not result in the Board of Directors not exercising their powers of management, for the purpose of ascertaining Place of Management of a company : –

a) IT infrastructure and network platforms,

b) Supply chain functions,

c) Routine banking operational procedures,

d) All of the above

Answer

Answer: d) All of the above

90. For companies not engaged in “Active Business Outside India”, the determination of POEM would involve which of the following :-

a) Identifying the person(s) who actually make the key management and commercial decisions for the conduct of the company as a whole.

b) Determine the place where these decisions are, in fact, being made.

c) Both A and B

d) Neither A nor B

Answer

Answer: c) Both A and B

MCQ on Non Resident Taxation – International Taxation

91. POEM of Foreign Company would be outside India where : –

a. Key management decisions are taken outside India.

b. Key commercial decisions are taken outside India.

c. Key management and commercial decisions are taken outside India.

d. Key management and commercial decisions are taken in India.

Answer

Answer: c. Key management and commercial decisions are taken outside India.

92. In determining POEM, which of the following is more important : –

a. Place where management/commercial decisions are taken

b. Place where management/commercial decisions are implemented.

c. Place where Directors reside

d. None of the above

Answer

Answer: a. Place where management/commercial decisions are taken

93. A company shall be said to be engaged in ‘Active Business Outside India’ if it satisfies which of the the following conditions:

a) Its passive income is 50% (or less) of its total income;

b) less than 50% of its total asset are situated in India;

c) Both A and B

d) Neither A nor B

Answer

Answer: c) Both A and B

94. A company shall be said to be engaged in ‘Active Business Outside India’ if it satisfies which of the the following conditions:

a. less than 50% of total number of employees are situated in India or are resident in India;

b. the payroll expenses incurred on such employees is less than 50% of its total payroll expenditure.

c. Both A and B

d. Neither A nor B

Answer

Answer: c. Both A and B

95. For the purpose of determining Active Business Outside India, the average of the data of which of the following years would be considered : –

a. the previous year and two years prior to that

b. the previous year

c. Last two years

d. None of the above

Answer

Answer: a. the previous year and two years prior to that

96. In case the company has been in existence for less than two years, for the purpose of determining Active Business Outside India, the data of which of the following years would be considered

a. Data of period of existence of the company;

b. Last 6 months, if the company exists for more than 6 months;

c. Last 12 months , if the company exists for more than 12 months

d. None of the above

Answer

Answer: a. Data of period of existence of the company;

97. For the purpose of determining Active Business Outside India , where the accounting year for tax purposes, in accordance with laws of country of incorporation of the company, is different from the previous year, then, data of the accounting year of the Foreign Company that — shall be considered : –

a. ends during the relevant previous year and two accounting years preceding previous year

b. ends during the relevant previous year and last accounting year preceding previous year

c. Both A and B

d. Neither A nor B

Answer

Answer: d. Neither A nor B

98. FCO is located in Mauritius. Its accounting year for tax purposes is 1 July – 30 June of every year. Which year’s data should be used in order to apply ‘Active Business Outside India’ test for FY 2016-17?

a. 2015-16 – July 1, 2015 to June 30, 2016,

b. 2014-15 – July 1, 2014 to June 30, 2015 and

c. 2013-14 – July 1, 2013 to June 30, 2014.

d. All of the above

Answer

Answer: d. All of the above

99. Passive income of a company shall be aggregate of : – (EG)

a. Income from the transactions where both the purchase and sale of goods is from/ to its Associated Enterprises.

b. Income from the transactions where purchase is from Associated Enterprise but sale is not to an Associated Enterprise;

c. Income from the transactions where purchase is not from Associated Enterprise but sale is to an Associated Enterprise;

d. All of the above

Answer

Answer: a. Income from the transactions where both the purchase and sale of goods is from/ to its Associated Enterprises.

100. Passive income of a company shall be include : –

a. Income by way of royalty ;

b. Income by way of dividend ;

c. Income by way of capital gains ;

d. All of the above

Answer

Answer: d. All of the above

MCQ on Non Resident Taxation – International Taxation

101. Passive income of a company shall exclude : –

a. All Interest income

b. Interest income of banking companies

c. Interest income of public financial institutions

d. Both B and C

Answer

Answer: d. Both B and C

102. Passive income of a company shall include : –

a. Rental income.

b. All Interest income

c. Both A and B

d. Neither A nor B

Answer

Answer: a. Rental income.

103. To constitute , Passive income : –

a. It should be between two Associated Enterprises;

b. It need not be between two AE’s

c. Involvement of AE is not necessary

d. Both B and C

Answer

Answer: d. Both B and C

104. Income for the purpose of CFC, is to be : –

a. Computed for tax purpose in accordance with the laws of the country of incorporation.

b. Taken as per the books of account, where the laws of the country of incorporation do not require separate computation for tax purposes.

c. Both A and B

d. Neither A nor B

Answer

Answer: c. Both A and B

105. In case of company, incorporated in USA, passive income will be computed as per the taxation laws of —-

a. USA

b. India

c. IFRS

d. None of the above

Answer

Answer: b. India

106. To compute number of employees for cfc purpose,

a. The average of the number of employees as at the beginning and at the end of the Year are taken

b. The average number of employees as at the beginning of the Year are taken

c. The average number of employees as at the end of the Year are taken

d. The average number of employees for the last two years are taken

Answer

Answer: a. The average of the number of employees as at the beginning and at the end of the Year are taken

107. The term Payroll , for the purpose of ascertaining determining Active Business Outside India POEM includes –

a) Cost of salaries,

b) Wages and Bonus

c) Other employee compensation like related pension and social costs borne by the employer

d) All of the above

Answer

Answer: d) All of the above