Meaning of Transfer Price

Economies around the world in order to encourage healthy competition and inflow of foreign funds have liberalised their regulations and have provided environments for international transactions. The quintessence of each transaction: Price. The price at which international transactions take place is called Transfer Price. Let’s take a look to better understand the meaning of Transfer Price.

| Principle of International Taxation | Transfer Pricing |

| Transaction between | International Parties |

| Transfer Price | Price charged between two international parties |

| Arm’s Length Price Principle | Price charged between two unrelated parties |

All transactions between two independent unrelated entities take place at a certain price (unless it is a case of gift or sample).

Transfer Price, means the price, which is charged between two or more entities [Associated Enterprises (‘AEs’)] / two or more parts of a Multinational Enterprise (“MNE”) , which are operating in different countries.

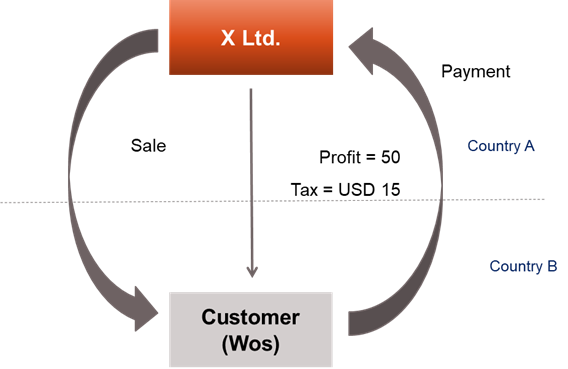

Let us understand this with the help of the following example – Diagram 1.5 : –

Diagram 1.5

Facts : –

X Ltd. , foreign company operates in Country A, where the Corporate tax rates are 30%. It intends to sell goods costing USD 100 to its Wholly Owned Subsidiary (“WOS”) in Country B for USD 150 ? It sells similar goods to third party independent customers at USD 250.

Issue : – What is the Transfer Price ?

In this case, USD 150 is the Transfer Price, i.e the price at which the transaction has taken place. However, this price is not the price at which X Ltd. has sold the goods to an independent company in Country B. The price at which X Limited sells similar goods to third party independent customers at USD 250, is generally known as Arm’s Length Price.

Use of Transfer Price to Minimise Taxes

Companies can use Transfer Pricing techniques to minimise their taxes. Let us understand this with the help of the following example : –

Example 1 : – Direct sale to ultimate customer in Country B

X Ltd. operates in Country A, wherein the tax rates are 30%. It intends to sell goods costing USD 100 to a customer in Country B for USD 150 . Let us assume that USD 150 is the arm’s length price of goods sold by X Limited .

Case I – If goods are sold directly to a customer in Country B – Diagram 1.6

In such a case, its profit would be: –

= (Sale Price – Cost)

= USD 150 – USD 100

= USD 50

Tax = 30% of profit = 30% of USD 50 or USD 15

However by changing the mode and steps, of the transaction, X Ltd. can reduce its taxes. This is discussed as under :

Case II – If goods are sold in Country B through a subsidiary in another country, where tax rates are lower

Diagram 1.6

To save taxes, X Ltd. can incorporate a subsidiary in Country Y, namely C Ltd., where tax rate is 10% . It sold such goods to C, for USD 125. C Ltd. then in turn, sold the goods to buyer in Country B for USD 150.

In such a case, tax is computed as under: –

Total Tax = (Tax in Country A) + (Tax in Country Y)

= (125 – 100) *30 + (150 – 125) *10%

= 7.5 + 2.5 = USD 10

X Ltd. saved USD 5 in taxes (USD 15 in CASE I Vs. USD 10 in CASE II) by selling goods via subsidiary C Ltd. located in Country Y

For any queries, please write them in the Comment Section or Talk to our tax expert