Need for Transfer Pricing

With the advent of globalisation, transactions across borders have increased manifold, thus operating outside the jurisdiction of domestic laws. Within an unregulated environment, tax evasions and other such unscrupulous activities are bound to happen. In order to prevent such mis-happenings the principle of Transfer Pricing was introduced. Let’s take a brief glance at this concept.

Bird’s Eye view of the ‘Principle of Transfer Pricing’

| Principle of International Taxation | Transfer Pricing |

| Transaction between | International Parties |

| Need for Transfer Pricing | To determine price of a transaction based on globally accepted principles and estimate quantum tax |

| Factors required for Determination of Right and Quantum of Tax | |

|

|

| Determination of Price | Price arrived at after application of Transfer Pricing principle |

Business transaction, by a company, can spread over more than one country. For example, if a US company , which has a factory in New York, sells shoes to an Indian customer, it may earn income which is a result of manufacturing activity in USA, and customer located in India. If both India and US want to tax some portion of income earned by the US company, the issue of double taxation would arise. Such transaction can be : –

- Within the same enterprise (For example, US Head Office selling goods to an India Branch) ;or

- Between two different enterprise, who may be related to each other (Associated Enterprise) or may not be related to each other (Independent Enterprises).

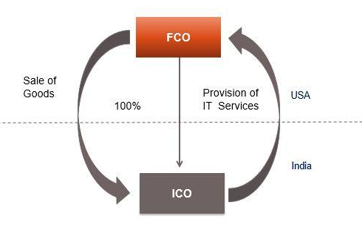

Lets understand this aspect with the following Diagram 1.1, where Alpha Inc. a US Co, has following transaction with its wholly owned subsidiary Saarthak India Private Limited (SIPL) : –

- Sale of goods by Alpha Inc. to SIPL or Purchase of goods by SIPL from Alpha Inc. ;

- Provision of IT services by SIPL to Alpha Inc. or Availing of services by Alpha Inc. from SIPL ;

Diagram 1.1

In all such transaction , both India and US, would want to tax the income arising from such transaction on the ground that either the seller is located in their jurisdiction, or the customer is located in their jurisdiction. To determine the right and quantum of tax of a particular country, the following step are taken : –

1. Determine the country which has the right to tax a particular income

The right to tax is generally, governed by the respective domestic laws of India and US, and the Tax Treaty ( Double Taxation Avoidance Agreement “DTAA”) between these two countries.

2. Determine the price of a transaction to arrive the profits earned by an Enterprise (particularly for related party transaction)

The issue that normally arises in determination of quantum of tax is, what should be the price, which should be considered as a benchmark, for taxation of income or allowance of expenditure ? The price should be such as would allow both the countries, to arrive at the profits, which should be taxable in either or both of these countries, and help them determine the fair tax , that should be paid by Alpha Inc. and SIPL. This issue is resolved through the method of Transfer Pricing, wherein, a price is determined on the basis of certain globally accepted principles, which serves as a benchmark for taxation of income or allowance of expenditure.

For any queries, please write them in the Comment Section or Talk to our tax expert