NO ALLOWANCE AND SET-OFF FOR COMPUTATION OF TOTAL UNDISCLOSED FOREIGN INCOME AND ASSET – SECTION 5

Under the provisions of the Income-Tax Act, where any unexplained money is found in the form of money, bullion, jewellery, etc, it would be charged to tax @ 60% u/s 115BBE. Further, no deduction of any expenditure , or set-off of any loss shall be allowed while computing such income. Thus, such income would be taxable at a gross rate.

Similar to these provision, the Black Money Act provides that no deduction of any expenditure or allowance, or set-off of any loss shall be allowed while computing the Black Money. It may be noted here, that the deduction shall not be allowed, even though, such deduction or set-off would have been available if such income were disclosed in the normal course while filing return of income.

EXAMPLE : –

Indian resident earns rental income of Rs. 6,50,000 (i.e., $10,000) during PY 2016-17 from property situated in UK. He did not disclose such income in his ITR of PY 2016-17. In such a case, when tax would be computed on such undisclosed foreign income, 30% standard deduction under Section 24 would not be allowed.

DEDUCTION FROM VALUE OF UNDISCLOSED ASSET OUTSIDE INDIA

In order to tax the undisclosed foreign asset under the Black Money Act, we need to determine its fair market value under Rule 3 of Black Money Rules. However, tax @ 30% shall be charged on its fair market value after allowing for certain permissible deductions from such fair market value.

It may be noted here that foreign asset could have been acquired out of income which is charged to income tax, or which is assessed or assessable under the Black Money Act. In such cases, following incomes shall be reduced from the value of the undisclosed asset located outside India : –

- Income which has been assessed to tax under the Income-tax Act prior to the AY to which the Black Money Act applies . Where any foreign asset was acquired out of undisclosed foreign income which was earned before July 1, 2015, and which has been assessed to tax under the Income-Tax Act such income shall also be reduced from the fair market value of such foreign asset, in order to determine the tax liability on such asset under the provisions of the Black Money Act.

- Income which is assessable under the Black Money Act – Where any foreign asset was acquired out of undisclosed foreign income, which is assessable under the Black Money Act, such income shall also be reduced from the value of such asset. In this context, it is important to understand the meaning of “assessable”. Suppose, Mr. H had earned certain foreign income on or after July 1, 2015, but he has not disclosed such income in his ITR , or he has not filed ITR for the period on or after July 1, 2015 . In such a case, such income would be deemed to be assessable under the Black Money Act.

Such assessable foreign income shall be reduced from the fair market value of foreign asset in order to determine the tax liability on such asset under the provisions of the Black Money Act. - Income which has been assessed to tax under the Black Money Act – Where any foreign asset was acquired out of undisclosed foreign income, which has been assessed to tax under the Black Money Act, such income shall be reduced from the fair market value of such foreign asset , in order to determine the tax liability on such asset under the provisions of the Black Money Act.

It may be noted here that aforesaid reduction would be available only when assessee furnishes evidence to the satisfaction of AO that foreign asset has been acquired out of such income.

EXAMPLE : –

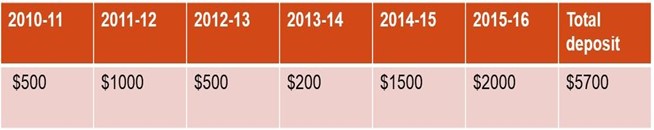

Indian resident has a foreign bank account in which certain foreign income has been deposited over several years as under:

Foreign income deposited in bank account during PY 2011-12 to 2014-15 (i.e., $ 3200) has been disclosed in the income-tax returns filed in India . Money deposited in PY 2015-16 has been earned after introduction of Black Money Act (i.e., after July 1, 2015) and would be considered in tax return of 2015-2016.

In such a case, income of PY 2011-12 to 2014-15 would constitute income assessed to tax in India , while money deposited in PY 2015-16 would be considered as income assessable to tax in India. Thus, $ 5200 should be reduced from total deposit of $ 5700 and balance of $ 500 would be charged to tax under the Black Money Act as undisclosed foreign asset.

DEDUCTION FROM VALUE OF IMMOVABLE PROPERTY OUTSIDE INDIA

In case, foreign immovable property (hereinafter referred to as foreign property) is acquired by assesse, solely out of income on which income-tax was already paid, then the fair market value of foreign property shall be Nil, and no tax would be paid under the provisions of the Black Money Act.

Let us understand this case with the help of an Example.

Suppose, Mr. L had earned foreign income of Rs 10 lakhs which was charged to tax in the PY 2009-10 in India. Mr. L had purchased foreign property of Rs 10 lakhs out of such foreign income. In the year 2017-18, such foreign property was discovered by the AO. Let’s assume that the market value of such property was Rs 1 crore on the valuation date. As the property was acquired wholly from the income which was already charged to tax, no tax would be levied on such property under the provisions of the Black Money Act.

In some cases, only part of purchase consideration used to acquire foreign property may be met out of foreign income , on which income-tax was already paid under the provisions of the Black Money Act. In such a case the propionate income shall be reduced from the value of such foreign asset.

The mechanism to compute such proportionate income is given as under :-

MV X FI

CA

Wherein MV = Market Value of asset on 1st day of FY in which it is discovered

Wherein FI = Foreign income charged to income-tax

Wherein CA = Cost of Acquisition of foreign asset

EXAMPLE

A house property located outside India was acquired by an assessee in the previous year 2009-10 for Rs 50 lakh. Out of the investment of Rs 50 lakh, Rs 20 lakh was assessed to tax in the total income of the previous year 2009-10 and earlier years.

Such undisclosed asset comes to the notice of the Assessing Officer in the year 2017-18. If the value of the asset on valuation date in the year 2017-18 is Rs 1 crore, what would be the amount chargeable to tax under the provision of BMA ?

*Amount of deduction

MV X FI

CA

= 100 lakh x 20 lakh

50 lakh.

= 40 Lakh

For any queries, please write them in the Comment Section or Talk to our tax expert