Presumptive Taxation for Non residents – Introduction

In certain cases, it is difficult for the non-resident to maintain India specific books of accounts, which could be due to the nature of the business or other factors. Preparing a statement of taxable income , for complying with the tax laws of India, would require preparation of India specific accounts, and application of various provisions in the income tax act to each such transaction. In order to ease the burden of the non-resident, and provide a simple mechanism to compute the tax liability, the Indian tax laws has certain provisions for non-residents, who are engaged in specific business covered under those regulations, to offer their taxable income as a percentage of the receipts. In such cases, the deduction of Expenditure is generally not allowed. Further, specific provisions are incorporated relating to the carry forward and set off of business loss and other incidental matters in each of these cases. These provisions are discussed as under : –

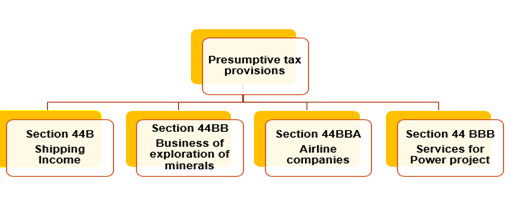

Presumptive Taxation Provisions

- Section 44B – Shipping Business

- Section 44BB – Business of Exploration of Minerals

- Section 44BBA – Airline Companies

- Section 44BBB – Services for Power Project

- Section 44C of Income Tax Act

- Section 44DA of Income Tax Act

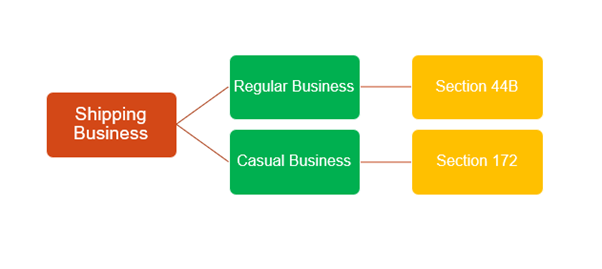

What are the presumptive tax provisions for non-residents engaged in shipping business – Section 44B and Section 172 ?

The presumptive tax provisions for non-resident engaged in shipping business, depends on : –

(a) Whether the non-resident is engaged in such business for its Indian operations on a regular basis, or

(b) Income derived by the non-resident is a one off for casual income.

Shipping Business

- Regular Business – Section 44B

- Casual Business – Section 172

Summary of Presumptive Tax Provisions Under Income Tax Act

Section 44B of Income Tax Act

Particulars – Income from shipping business on presumptive basis

Rate of presumptive income/deduction – 7.5 %

Type of business – Non-resident engaged in shipping business

Section 44BB of Income Tax Act

Particulars – Income of a non-resident engaged in the business of providing services for extraction or production of, mineral oils shall be computed on presumptive basis

Rate of presumptive income/deduction – 10% (Note: Lower profits may be claimed if assessee maintains books of account and gets them audited)

Type of business – Non-resident engaged in business of exploration of mineral oils

Section 44BBA of Income Tax Act

Particulars – Income of a non-resident engaged in the business of operation of aircraft shall be computed on presumptive basis

Rate of presumptive income/deduction – 5%

Type of business – Non-resident engaged in the business of operating of aircraft.

Section 44BBB of Income Tax Act

Particulars – Income of a foreign company engaged in the business of civil construction or the business of erection of plant or machinery or testing or commissioning thereof, in connection with turnkey power projects shall be computed on presumptive basis

Rate of presumptive taxation income/deduction – 10% (Note: Lower profits may be claimed if the assessee maintains books of account and gets them audited.)

Type of business – Foreign Company

Section 44C of Income Tax Act

Particulars – Deduction for Head office Expenditure

Rate of presumptive income/deduction – Deduction would be Lower of 5% of adjusted total income; or Head office expenses as attributable to business or profession of taxpayer in India.

Type of business – Non-resident

Section 44DA of Income Tax Act

Particulars – Royalty and fees for technical services which is effectively connected to the PE of non-resident in India Condition: Books of accounts to be maintained under section 44AA and the same to be audited under section 44AB.

Rate of presumptive income/deduction – Expenditure incurred wholly and exclusively for the business of PE and reimbursement of actual expenses by the Permanent Establishment shall be allowed as deduction.

Type of business – Non- corporate non- resident or foreign company

For any queries, please write them in the Comment Section or Talk to our tax expert