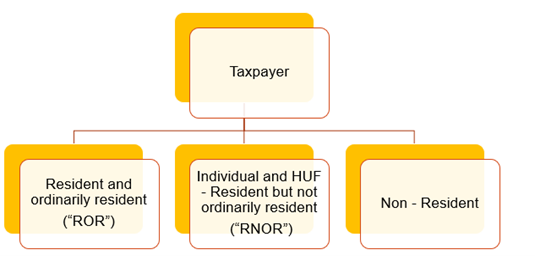

Bird’s Eye view of the ‘Residential Status- Section 6’

| Concept of taxation | Non-Resident Taxation |

| Provision of Income Tax Act, 1961 | Section 6- Residential Status |

Residential Status Section 6 – The quantum and applicability of tax on a person, depends upon the Residential Status of such person. Under the Income Tax Act, 1961 : –

- Person who are resident and ordinarily resident for income tax purpose are liable to pay tax on their global income (i.e., Indian income and foreign income).

- Person who are resident but not ordinarily resident in India are liable to pay tax on Indian sourced income, and following foreign income : –

– Business income where business is controlled wholly or partly from India.

– Income from profession which is set-up in India. - Person who are non-resident are taxable only for their Indian sourced sourced income.

Residential Status Section 6

As discussed above, taxpayers are classified as resident or non-resident for tax purpose. In case of individuals and HUF, resident taxpayers are further categorised as : –

- Resident and ordinarily resident; and

- Resident but not ordinarily resident.

- Non Resident

Let us look at the Residential Status of each of the category of Person :-

For any queries, please write them in the Comment Section or Talk to our tax expert