Special Provision for Computing Profits and Gains of the Business of Operation of Aircraft in the case of Non – Residents – Section 44BBA of Income Tax Act

| Section | Section 44BBA of Income tax act |

| Particulars | Income of a non-resident engaged in the business of operation of aircraft shall be computed on presumptive basis. |

| Rate of presumptive income/deduction | 5% |

| Type of business | Non-resident engaged in the business of operating of aircraft. |

The provision of Section 44BBA are discussed as under : –

Eligible Assessee – Section 44BBA of Income Tax Act

Non-resident engaged in the business of operation of aircraft. If the non-resident is engaged in the business of leasing of aircraft, such provisions would not be applicable.

It is not mandatory, for a person who is engaged in the business of operations of aircrafts, to follow the provisions of Section 44BBA. Such a person can opt to be governed by the normal provisions of Income Tax Act, and maintain the required books of accounts and other documents, for the purpose of arriving at its taxable income in India.

Presumptive Tax Rate – Section 44BBA of Income Tax Act

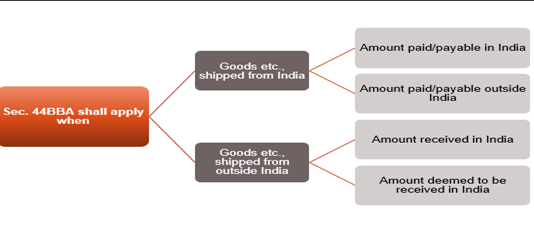

Income from such business, is calculated at 5% of the following amounts:

- Amount paid or payable, in India or outside India, to the tax payer or to any person on his behalf on account of carriage of passenger, livestock, mail or goods from any place in India ; and

- Amount received in India or deemed to be received in India by or on behalf of the taxpayer on account of carriage of passenger, livestock, mail or goods from any place outside India.

NOTE : –

In computing presumptive income under Section 44BBA, no deduction of any expenditure would be allowed from such presumptive income. However, the provisions relating to set-off/carry-forward of losses and deductions under Chapter VI-A would be available to the assesse.

Further , if the tax liability is borne by the Indian entity, it shall be taxable as a perquisite.

Summary of Taxable Income Under Section 44BBA of Income Tax Act

Section 44BBA of Income tax act – Example 1

Mr. Roy, a non-resident, operates an aircraft. He received the following amounts while carrying on the business of operation of aircrafts for the year ended 31.3.2020 :

- Rs 1 crores in India from carriage of passengers from Mumbai.

- Rs 3 crore in Singapore on account of carriage of goods from Gujrat.

- Rs 3 crores in India on account of carriage of passengers from Malaysia.

- Rs 1 crore in Malaysia on account of carriage of passengers from Malaysia.

The total expenditure incurred by Mr. Roy for the purposes of the business during the year ending 31.3.2020 was Rs 2 Crores. Compute the income of Mr Roy chargeable to tax in India under the head “Profits and gains of business or profession” for the AY 2020-21 and compute his tax liability ?

Solution –

As per the provisions of Section 44BBA, presumptive income from business of operation of aircraft (on account of carriage of passenger/goods) would be 5% of the aggregate of the following amounts

- Amount paid or payable in India or outside India on account of the carriage of passengers/goods from any place in India; and

- Amount received or deemed to be received in India on account of the carriage of passengers/goods from any place outside India.

The income of Mr. Roy chargeable to tax in India under the head “Profits and gains of business or profession” is worked out hereunder : –

| Particulars | Amount (in crores) |

| Amount received in India on account of carriage of passengers from Mumbai | 1 |

| Amount received in India on account of carriage of goods from Gujrat | 3 |

| Amount received in India on account of carriage of passengers from Malaysia | 3 |

| Amount received in Malaysia on account of carriage of passengers from Malaysia (Note 1) | Nil |

| Total Freight | 7 |

| Presumptive Income (7*5%) | 0.35 |

| Tax Liability | |

| Income Tax | 0.8625 |

| Surcharge | 0 |

| Health and Education cess @ 4% | 0.0345 |

| Total Tax Liability | 0.897 |

Note 1 : Sum collected outside India (i.e., Malaysia) for carriage of passengers outside India (i.e., Malaysia) would not be taxable in India.

Note 2: Expenditure of Rs 2 crores would not be deducted while calculating the presumptive income.

Section 44BBA of Income tax act – Example 2 : –

What would be your answer in case the business was carried on by a foreign company?

Solution –

In case of foreign company, the same rules would apply as section 44BBA is available to both corporate and non-corporate taxpayers who operate aircraft, who are non-resident. The tax liability however shall be as under : –

Note 1

| Particulars | Amount (in crores) |

| Presumptive Income (7*5%) | 0.35 |

| Tax Liability | |

| Income Tax | 0.14 |

| Surcharge | 0 |

| Health and Education cess @ 4% | 0.0056 |

| Total Tax Liability | 0.1456 |

Section 44BBA of Income tax act – Example 3

What would be your answer in case the business was carried on by a resident.

Solution –

Provisions of presumptive taxation of Section 44BBA would not be applicable as this provision is applicable only for non-residents.

For any queries, please write them in the Comment Section or Talk to our tax expert