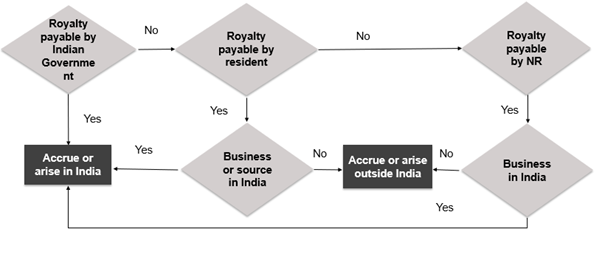

Bird’s Eye view of the ‘Deemed to Accrue or Arise of Royalty Income’

| Concept of taxation | Non-Resident Taxation |

| Provision of Income Tax Act, 1961 | Section 9(1)(vi) |

| Provision deals with | Deemed to accrue or arise of royalty income |

DEEMED ACCRUAL/ARISING OF ROYALTY INCOME – SECTION 9(1)(vi) OF INCOME TAX ACT

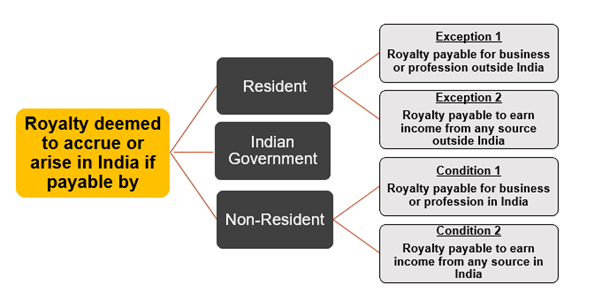

Royalty payable to the non- resident , could be from the following payors : –

- Royalty payable by Indian government

- Royalty payable by resident to non-resident

- Royalty payable by one non-resident to another non-resident

The circumstances under which such royalty is deemed to accrue or arise in India are discussed as under : –

A. ROYALTY PAYABLE BY INDIAN GOVERNMENT DEEMED TO ACCRUE OR ARISE IN INDIA – SECTION 9(1)(vi) OF INCOME TAX ACT

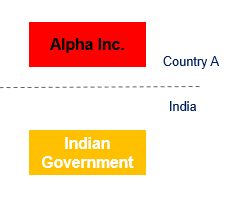

Under section 9(1)(vi), royalty payable by the Indian Government to any non-resident, shall always be deemed to accrue or arise in India, without any exception. In such a case, the government could be the Central government or the State government

B. ROYALTY PAYABLE BY RESIDENT DEEMED TO ACCRUE OR ARISE IN INDIA – SECTION 9(1)(VI) OF INCOME TAX ACT

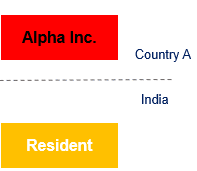

Under section 9(1)(vi) of Income Tax Act, royalty payable by a person , who is a resident in India, to a non-resident , shall be deemed to accrue or arise in India , unless it falls under the following two exceptions : –

- Where it is payable for the transfer of any right or the use of any property or information or for the utilization of services for the purposes of a business or profession carried on by such person outside India.

- Where it is payable for the purposes of making or earning any incomefrom any source outside India.

C. ROYALTY PAYABLE BY NON-RESIDENT DEEMED TO ACCRUE OR ARISE IN INDIA – SECTION 9(1)(VI) OF INCOME TAX ACT

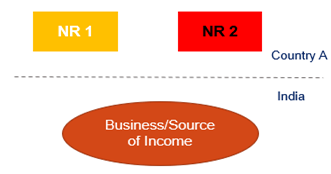

Royalty payable by a one non-resident to another non-resident shall be deemed to accrue or arise in India only when any of the following conditions are satisfied : –

- Royalty is payable in respect of any right, property or information used for purposes of a business or profession carried on in India or

- Royalty is payable in respect of services utilized for purposes of a business or profession carried on in India; or

- Royalty is payable for the purposes of making or earning any income from any source in India.

ROYALTY DEEMED TO ACCRUE OR ARISE IN INDIA – SECTION 9(1)(vi) OF INCOME TAX ACT – SUMMARY OF THE PROVISIONS

ROYALTY DEEMED TO ACCRUE OR ARISE IN INDIA – SECTION 9(1)(vi) OF INCOME TAX ACT– DECISION FLOW CHART TO CONSIDER TAXABILITY IN INDIA

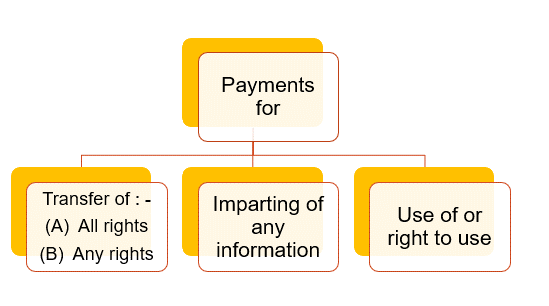

MEANING OF ROYALTY – EXPLANATION 2 TO SECTION 9(1)(vi) OF INCOME TAX ACT

For the purpose of this clause, the term Royalty can be made in the form of recurring payments, or a lump sum payment. Generally in the Tax Treaties that India has entered into, only recurring payments are considered as royalty. However, any consideration which would be chargeable to tax as ‘Capital Gains’ in the hands of the non-resident would not be considered as royalty. This would cover cases where ownership rights in respect of a capital asset (say a Brand etc) is transferred by a non resident .

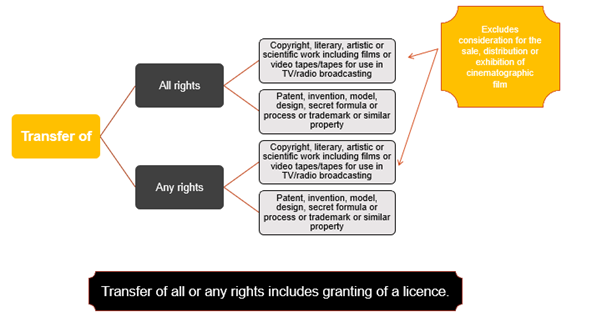

The following payment are considered as royalty under the Income Tax Act : -: –

- Consideration for the transfer of all or any rights including the granting of licensee respect of a patent, invention, model, design, secret formula or process or trade mark or similar property;

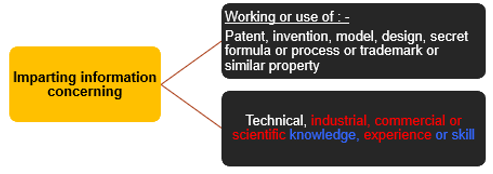

- Consideration for the imparting of any information concerning the working of, or the use of, a patent, invention, model, design, secret formula or process or trade mark or similar property.

- Consideration for the use of any patent, invention, model, design, secret formula or process or trade mark or similar property;

- Consideration for the imparting of any information concerning technical industrial, commercial or scientific knowledge, experience or skill;

- Consideration for the use or right to use any industrial, commercial or scientific equipment but not including the amounts referred to in section 44BB;

- Consideration for rendering of any service, in connection with the activities listed in the preceding bullets .

The definition of ‘royalty’ is wide enough to cover both ` royalties as well as copyright royalties.

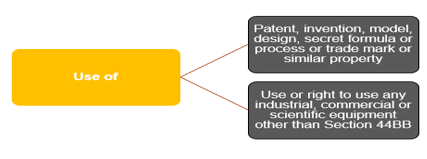

Meaning of Royalty – types of payments covered – Explanation 2 to Section 9(1)(vi)

Royalty for Transfer of all or any rights

Imparting of any information concerning

Use of or right to use

PAYMENT FOR COMPUTER SOFTWARE – EXPLANATION 4 TO SECTION 9(1)(VI)

There were contrary views of the judiciary on the Taxability of shrink-wrapped software, wherein various Courts held it as royalty (on the reasoning that there was transfer of copyright embedded in software), but certain Courts had contrary views. A shrink-wrapped software is a commercial, off-the-shelf software, which is sold in retail, unlike certain specially-developed software written by a firm’s own or hired programmers.

Finance Act, 2012 amended the royalty definition, and inserted Explanation 4 with retrospective effect from June 1, 1976. This Explanation, which was clarificatory (i .e ., Explanation is applicable with retrospective effect) in nature, provided that the words “transfer of all or any rights in respect of any right, property or information” includes transfer of all or any right for use or right to use a computer software (including granting of a licence) irrespective of the medium through which such right is transferred .

A. MEANING OF COMPUTER SOFTWARE

“Computer software” means any computer programme recorded on any disc, tape, perforated media or other information storage device and includes any such programme or any customised electronic data.

B. LUMPSUM PAYMENT FOR COMPUTER SOFTWARE ALONGWITH HARDWARE

Where a resident makes lumpsum royalty payments to a non –resident, such payment shall not be deemed to accrue or arise in India , provided the following conditions are satisfied : –

- Payments are made by a resident for the transfer of all or any rights (including the granting of a licence) in respect of computer software supplied by a non-resident manufacturer along with computer hardware ; and

- Such supplies are made under any scheme approved by the government under the policy on computer software export, software development and training, 1986

C. WITHHOLDING TAX UNDER SECTION 195

Where the payment for use or right to use computer software, falls within the definition of royalty as per the IT Act, the Payor is required to withhold tax u/s Section 195 , unless such payments do not meet the definition of “Royalty”, under the relevant Double Taxation Avoidance Agreements . In case where the payment is made to a non-resident, who is a tax resident of a country with which India does not have a tax treaty, then such payment would be chargeable to Tax under the IT Act , and the provision of withholding Tax under section 195 would be applicable if the payment constitutes royalty under the IT Act.

EXEMPTION FROM TDS ON SOFTWARE PAYMENTS – Notification No .21/2012 dated 13 .6 .2012

In certain cases, an Indian company (Lets say X Ltd.) may acquire a software from a non-resident, or another resident supplier. At the time of such acquisition, X Limited , would have deducted TDS on such payment under section 195 (NR supplier) or under section 194J (resident supplier). In order to ensure that any subsequent transfer of such software from X Ltd. to another resident supplier does not attract the tax incidence, it is provided that where payments are made to resident-transferor for acquisition of software, no TDS shall be deducted under Section 194J , provided all of following conditions are satisfied –

- Tax has been deducted u/s 194J or 195 under any previous transfer of such software;

- Software is acquired in a subsequent transfer without any modification by the transferor; and

- Transferee obtains a declaration from the transferor, that tax has been deducted as above along with the PAN of the transferor

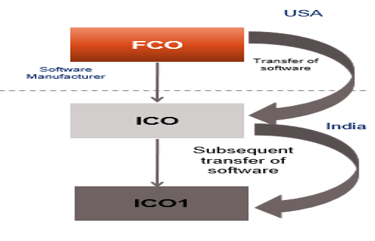

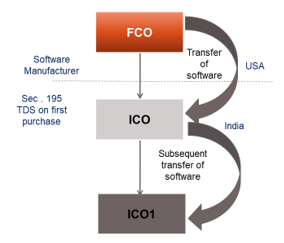

EXAMPLE 1

FCO (Foreign company) is manufacture of software in USA . It transferred the software to ICO (Indian company) on which TDS has been deducted by ICO under Section 195 . Whether TDS liability would arise when ICO subsequently transfers such software, without any modifications to another Indian company (ICO1) ?

Solution

- No TDS liability would arise on subsequent transfer of software to ICO1, provided it obtains a declaration from ICO that tax has been deducted on software payments by ICO under Section 195, along with copy of PAN of ICO.

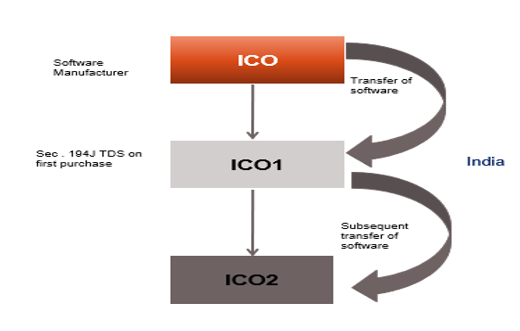

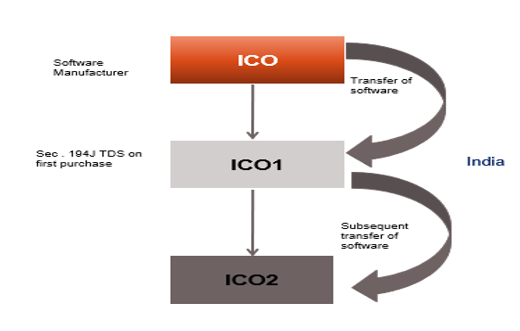

EXAMPLE 2

ICO (Indian company) is manufacture of software in India . It transferred the software to ICO1 (Indian company) on which TDS has been deducted under Section 194J by ICO1 .Whether TDS liability would arise when ICO1 subsequently transfers such software without any modifications to another Indian company (ICO2) ?

SOLUTION

No TDS liability would arise on subsequent transfer of software due to exemption provided under Notification No. 21/2012 dated 13.06.2012. In order to get benefit of exemption Notification ICO2 needs to obtain declaration from ICO1 that tax has been deducted on software payments by ICO1 on any previous occasion under Section 194J, along with copy of PAN of ICO1.

Example 3

ICO (Indian company) is manufacture of software in India . It transferred the software to ICO1 (Indian company) on which TDS has been deducted under Section 194J .Whether TDS liability would arise when ICO1 subsequently transfers software after modifications to another Indian company (ICO2) ?

Solution

Benefit of exemption notification is available on subsequent transfer of software only when subsequent transfer is made without any modification . In this case, software is subsequently transferred after modifications . Thus, TDS liability would arise under Section 194J on subsequent transfer of software and ICO 2 would be under an obligation to withhold TDS .

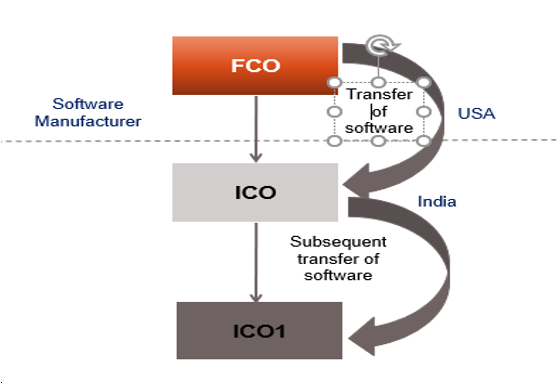

Example 4

FCO (Foreign company) is manufacture of software in USA . It transferred the software to ICO (Indian company) on which TDS has been deducted under Section 195 . Whether TDS liability would arise when ICO subsequently transfers software after modifications to another Indian company (ICO1) ?

Solution

Benefit of exemption notification is available on subsequent transfer of software only when subsequent transfer is made without any modification .

In this case, software is subsequently transferred after modifications . Thus, TDS liability would arise under Section 194J on subsequent transfer of software and ICO 1 would be under an obligation to deduct TDS .

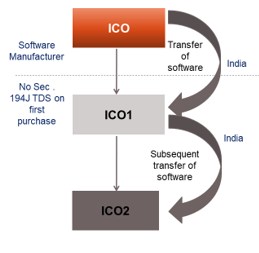

Example 5

- ICO (Indian company) is manufacturer of software in India .

- It transferred the software to ICO1 (Indian company) on which TDS has not been deducted under section 194J .

- Whether TDS liability would arise when ICO1 subsequently transfers software to another Indian company (ICO2) ?

Solution

TDS liability would arise under Section 194J on subsequent transfer of software. Benefit of exemption notification would not be available when tax has not been deducted under Section 194J on any previous occasion .

Example 6

FCO (Foreign Company) is manufacturer of software in USA .

It transferred the software ICO (Indian Company) on which TDS has not been deducted under Section 195 .

Whether TDS liability would arise when ICO subsequently transfers software to another Indian Company (ICO1) ?

Solution

TDS liability would arise under Section 194J on subsequent transfer of software and benefit of exemption Notification would not be available when tax has not been deducted under Section 195 on any previous occasion .

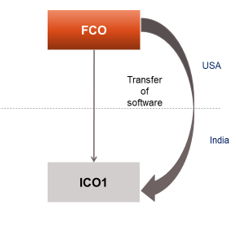

Example 7

FCO (Foreign company) is manufacturer of software in USA .

It transferred the software to ICO (Indian company) .

Whether TDS liability would arise under Section 195 ?

Solution

In this case software is directly acquired from manufacturer and there is no previous transfer of software . Thus, benefit of exemption notification would not be available. TDS liability would arise under Section 195 on purchase of software . However, TDS liability would arise only when such payment falls within the definition of royalty, given under DTAA between India and USA.

ROYALTY – EXPLANATION 5 TO SECTION 9(1)(vi) OF INCOME TAX ACT

Finance Act, 2012 inserted Explanation 5 to Section 9(1)(vi) [with retrospective effect from June 1, 1976] . The explanation provides that royalty includes and has always included (i .e ., inclusion with retrospective effect) payment of consideration from a resident to a non-resident, in respect of any right, property or information, whether or not,

- the possession or control of such right, property or information is with the payor;

- such right, property or information is used directly by the payer;

- the location of such right, property or information is in India .

This explanation was added, to overrule certain existing decisions, wherein it was held, that any payment made by an Indian company, for the use of a transponder, which was in geostationary Orbit outside the Indian orbits, and which was not above the Indian Air space, would constitute as royalty.

Let us understand this with the help of this example :-

Example

In this case, customer –

- Does not acquire the physical possession of transponder but simply uses its transmission capacity;

- Satellite is operated by lessor;

- Location of such satellite is not in India;

- Transponder is not directly used by customer

Whether such transponder leasing agreement would fall in the definition of royalty u/s 9(1)(vi) ?

Solution

As per Explanation 5 to Section 9(1)(vi) inserted by the Finance Act, 2012, consideration for any right, property or information would be deemed as royalty even if –

- The possession or control of such right, property or information is not with the payor;

- Such right, property or information is not used directly by the payor;

- The location of such right, property or information is not in India .

In the given case, the possession of such transponder is not with payor, transponder is not used directly by payor and location of such transponder is not in India . However, after insertion of Explanation 5, these are no longer the relevant criterion to determine the taxability of royalty income. Hence, the payment in such case, may fall in the definition of Royalty under Section 9(1)(vi) . However, definition of DTAA would also need to be considered and only if such payment also amount to royalty within the definition given under the relevant Royalty, would such income be liable to tax in India. For example, Article 12(3) of the India USA Treaty provides that royalty shall mean , amongst other aspects, … payments of any kind received as consideration for the use of, or the right to use, any industrial, commercial, or scientific equipment. In such a case, payment for transponder, being a scientific equipment may qualify as royalty income under the India USA Treaty as well.

Meaning of process – Explanation 6 to section 9(1)(vi) of Income Tax Act

The Finance Act, 2012 inserted an Explanation 6 [with retrospective effect from June 1, 1976] to provide that the term “process” includes, and shall be deemed to have always included transmission by satellite (including up-linking, amplification, conversion for down-linking of any signal), cable, optic fibre or by any other similar technology, whether or not such process is secret .

Example

FCO was owner of satellites which were placed in geostationary orbit. It entered into a transponder leasing agreement with TV channels (ICO) who desired to utilize the transponder capacity available on its satellite to relay their signals.The transponder through which uplink and downlink takes place in desired area is a process. Whether such process would fall in the definition of royalty under Section 9(1)(vi)?

Solution

The consideration paid by TV channels is for the purpose of using the process . Definition of royalty does not require that the process should be secret .

Thus, consideration paid to satellite owner for using the process of up-linking and downlinking would be deemed as royalty under the Income Tax Act .

However, definition of DTAA would also need to be considered for seeking exemption if any.

For any queries, please write them in the Comment Section or Talk to our tax expert