OBJECTIVE OF INTRODUCTION OF SECTION 94A OF INCOME TAX ACT

The main objective of Section 94A of the Income Tax Act, 1961 is to discourage assessees from entering into transactions with persons located in countries or territories which do not exchange tax information with India.

NOTIFIED JURISDICTIONAL AREA – SECTION 94A

The Central Government may notify any country or territory outside India as a Notified Jurisdictional Area (NJA), if such country or territory does not share tax information with India.

Till now India has only notified Cyprus as notified jurisdictional area on November 01, 2013 for not sharing tax information with India (vide notification no. SO3307(E) dated November 01, 2013).

However, Cyprus was removed from the list of NJA on December 14, 2016 (vide notification no. SO4033 (E) dated December 14, 2016)

APPLICABILITY OF TP PROVISIONS ON TRANSACTIONS ENTERED WITH PERSONS LOCATED IN NJA – SECTION 94A

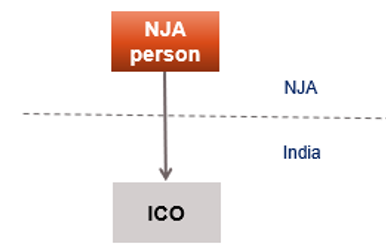

If the assessee enters into a transaction where one of the parties to the transaction is a person located in a NJA then :

- all parties to the transaction would be deemed as AE;

- Such transaction would be deemed to be international transaction as per section 92B; and

- All the provisions of transfer pricing would be attracted in case of such transactions.

NOTE : –

- In the above case the benefit of permissible variation between the ALP price and Transfer price (as per second proviso to section 92C(2)) would not be available.

- Transaction may be in the nature of

- purchase, sale or lease of tangible or intangible property or

- provision of service or

- lending or borrowing money or

- any other transaction having a bearing on the profits, income, losses or assets of the assessee including a mutual agreement or arrangement for allocation of common expenditure.

PERSON LOCATED IN NJA – SECTION 94A OF INCOME TAX ACT

Person located in a NJA shall include

- a person who is a resident of the NJA; or

- a person, not being an individual, which is established in the NJA; or

- Permanent establishment of any person (other than person resident/ established in NJA) in the NJA.

Note:-

As per section 92F(iiia) Permanent establishment includes a fixed place of business through which business of the enterprise is wholly or partly carried on.

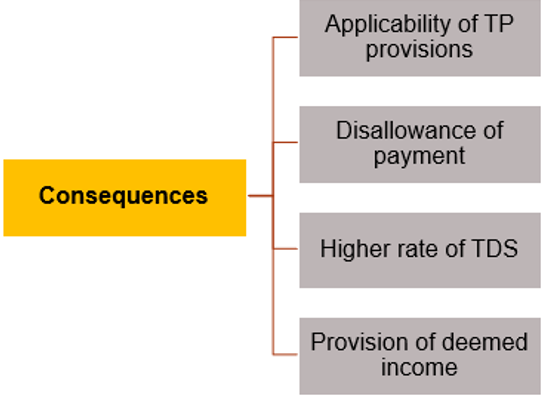

Consequences of declaration of any country as NJA – Section 94A

NOTE : –

- Consequences of declaration of any country as NJA :

- TP provision would apply where one of the parties in transaction located in NJA.

- Payment made to person located in NJA would be disallowed (unless certain conditions are satisfied).

- Payment made to person located in NJA would attract higher rate of TDS.

- Any receipt from the person located in NJA would be deemed as income of recipient (unless certain conditions are satisfied).

DISALLOWANCE OF PAYMENT MADE TO PERSON LOCATED IN NJA – SECTION 94A

- Any payment made to financial institution shall be disallowed unless the assessee authorizes the CBDT or any other income tax authority acting on CBDT behalf to seek information of assessee from such financial institution.

- Any other expenditure or allowance, including depreciation, arising from the transaction with a person located in a NJA shall be unless the assessee maintains or furnishes prescribed information.

TDS APPLICABILITY ON PAYMENT MADE TO PERSON LOCATED IN NJA – SECTION 94A

Where payment is made to a person located in NJA then TDS shall be deducted at the highest of the following rates :

- rates specified in the relevant provision of the Income-tax Act, 1961; or

- rate or rates in force; or

- 30%.

Note :-

As per section 2(37A) rate or rates in force means rate specified in the –

- Income-Tax Act, 1961 ; or

- The Finance Act ; or

- Tax treaty (DTAA),

whichever is applicable.

RECEIPT FROM PERSONS LOCATED IN NJA DEEMED TO BE INCOME OF RECEIPINT/BENEFICIAL OWNER – SECTION 94A

Where assessee has received or credited any sum from a person located in a NJA then it shall be deemed as income of the assessee/beneficial owner for that PY. However, such deeming provision would not apply where the assessee explains the source of such income in the hands of payer or beneficial owner.

RECEIPT FROM PERSONS LOCATED IN NJA DEEMED TO BE INCOME OF RECEIPINT- SECTION 94A OF INCOME TAX ACT

EXAMPLE : –

CBDT has notified Country X as NJA u/s 94A on April 01, 2017 due to lack of effective exchange of tax information with India. On August 01, 2017, Mr. A has received a loan of Rs. 10,00,000 from his Uncle Mr. C who is resident of Country X. Since Mr. A has received money from a person located in NJA, such money would be deemed as income of Mr. A if he fails to explain the source of income in the hands of his Uncle Mr. C

CONSEQUENCES OF DECLARATION OF ANY COUNTRY AS NJA – SECTION 94A

EXAMPLE 1 : –

ICO (Indian Co.) sells product X to FCO located in NJA @ Rs. 3,00,000. It sells same quality of product X to FCO1 @ Rs. 3,50,000. Discuss the tax implication u/s 94A ?

SOLUTION : –

If the assessee enters into a transaction where one of the parties to the transaction is a person located in NJA then

- all parties to the transaction would be deemed as AE;

- Such transaction would be deemed to be international transaction as per section 92B; and

- All the provisions of transfer pricing would be attracted in case of such transactions.

Since FCO is located in NJA, ICO and FCO would be deemed as AE and transaction of sale of product to FCO would be deemed as international transaction. Sale of product X @ Rs. 3,50,000 would be comparable uncontrolled transaction. Thus it would be considered to arrive at income arising from international transaction.

EXAMPLE 2 : –

ICO received technical services from FCO located in NJA @ Rs. 3,00,000. The rate of TDS on Fees for technical services u/s 115A is 10%. In this case, discuss the tax implications u/s 94A.

SOLUTION : – As per the provision of section 94A the rate of TDS in respect of any payment made to a person located in the NJA, on which tax is deductible at source, will be the higher of the following rates –

- rates specified in the relevant provision of the Income-tax Act, 1961; or

- rate or rates in force; or

- 30%.

The amount of TDS is Rs. 30,000 (10%) as per normal provision of the Income Tax Act, 1961. Since the payee (FCO) is located in a NJA, a higher rate of TDS of 30% would be attracted. Accordingly the amount of TDS under Section 94A would be Rs. 90,000 (30%).

For any queries, please write them in the Comment Section or Talk to our tax expert.

You can also view more Article on international Tax at our Index Page of International Tax.