Specified Domestic Transaction under Transfer Pricing – Section 92ba of Income tax act

Transfer Pricing on Income From Domestic Related Party Transactions – [Section 92(2A)]

Specified Domestic Transactions were covered under transfer pricing regime to –

- Determine income from domestic related party transactions ; and

- Determine reasonableness of expenditure between domestic related parties.

- Section 92(2A) provides that,

any allowance for an expenditure or interest or allocation of any cost or expense or

any income in relation to the specified domestic transaction

shall be computed having regard to the arm’s length price

except

if such allowance for expense or interest

reduces the income chargeable to tax or

increases the loss.

Meaning of “Specified Domestic Transaction” – Section 92BA of Income Tax Act

Specified domestic transaction has been defined to mean any of the following transactions (other than international transaction), namely,-

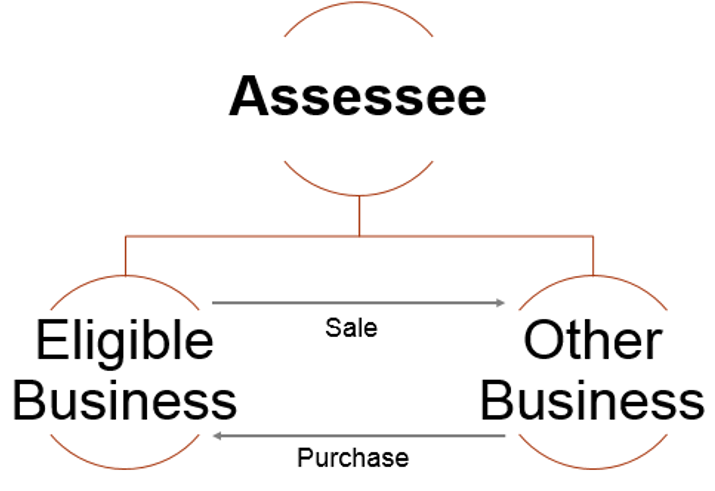

a) Inter-unit transfer of goods and services at less than fair market value on the date of transfer by an undertaking or unit or enterprise or eligible business to other business carried on by the assessee or vice versa [Section 80A].

Meaning of “Specified Domestic Transaction” – [Section 92BA of Income Tax Act] – Eligible Business

It means any business wherein following deductions were claimed : –

- Deduction in respect of profit and gains of enterprise engaged in infrastructure development [Section 80-IA].

- Deduction in respect of profit and gains of an enterprise engaged in SEZ development [Section 80-IAB].

- Deduction in respect of profit and gains of an undertaking other than infrastructure development [Section 80-IB].

- Deduction in respect of undertakings in certain SEZ [Section 80-IC].

- Deduction in respect of profit and gains from business of Hotels and convention centres in specified areas [Section 80-ID].

- Deduction in respect of undertakings in North Eastern States [Section 80-IE].

- Deduction in respect of business of collecting and processing of bio-degradable waste [Section 80JJA].

- Deduction in respect of employment of new workmen [Section 80JJAA]

- Deduction in respect of certain income of offshore banking units and international financial service centre [Section 80LA].

- Deduction in respect of income of co-operative society [Section 80P]

b) Inter-unit transfer of goods or services between eligible business and other business at less than fair market value on the date of transfer [Section 80-IA(8)];

c) Business between the assessee carrying on eligible business and other person, where business transacted produces more than ordinary profits in eligible business [as referred to section 80-IA(10)]

Eligible Business : –

It means any business wherein following deductions were claimed:

- Deduction in respect of profit and gains of enterprise engaged in infrastructure development [Section 80-IA].

- Deduction in respect of profit and gains of an enterprise engaged in SEZ development [Section 80-IAB].

- Deduction in respect of profit and gains of an undertaking other than infrastructure development [Section 80-IB].

- Deduction in respect of undertakings in certain SEZ [Section 80-IC].

- Deduction in respect of profit and gains from business of Hotels and convention centres in specified areas [Section 80-ID].

- Deduction in respect of undertakings in North Eastern States [Section 80-IE].

d) Transaction under Chapter VI-A or section 10AA, where provisions of section 80-IA(8) or section 80-IA(10) are applicable;

e) Any other prescribed transaction.

Threshold For Specified Domestic Transaction

The aggregate of SDT transactions entered into by the assessee in the previous year should exceed a sum of Rs 20 crore, to be considered as specified domestic transaction.

Example : –

B Private limited was engaged in the business of Hotels and claimed exemption under Section 80-ID. BB Private ltd. was group concern of B but it is not claiming any profit linked deduction. BB private limited has used the hotel space of B private limited for certain event and paid Rs 15 crores. Whether such transaction would be covered as specified domestic transaction, assuming B does not have any other specified transactions ?

Solution : –

The aggregate SDT entered into by the assessee in the previous year should exceed a sum of Rs 20 crore to be considered as specified domestic transaction. Thus, such transaction could not be considered as specified domestic transaction.

Computation of Arm’s Length Price and Income of a specified Domestic Transaction [Section 92 & 92C]

The arm’s length price in respect of the specified domestic transaction shall be computed under section 92 (Computation of income) and 92C (Computation of ALP) as they apply to the international transaction.

Maintenance of Information and Documents and Furnish report of an Accountant [Section 92D & 92E]

The provisions of section 92D and 92E relating to maintenance of information and documents and furnish report of audit have been made applicable to a specified domestic transaction as they apply to an international transaction.

Note :

Where aggregate value of international transaction does not exceed Rs 1 crores, there is an exemption from maintenance of information and documents. There is no such exemption in case of specified domestic transactions. However, the provisions of specified domestic transactions would apply only when aggregate value of transaction during the year exceed Rs 20 crores.

Example : –

Two domestic companies (i.e., part of same group) entered into a transaction of Rs 15 crores during the previous year 2016-17. Whether they are required to maintain documents and furnish audit report under Section 92E ?

Solution : –

The aggregate value of transactions entered during the previous year 2016-17 are less than Rs 20 crores. Thus, such transaction could not be considered as specified domestic transaction. Since such transaction are outside the purview of specified domestic transaction, there is no need to maintain documents and furnish audit report.

Penalty Provisions Applicable To Specified Domestic Transactions

| Section | Nature of default | Quantum of penalty |

| 271BA | Failure to furnish Transfer Pricing Report (Form 3CEB) under section 92E | Rs. 1,00,000 |

| 271AA | Failure to keep and maintain information and documents as per section 92D | 2% of value of each specified domestic transaction |

| Failure to report specified domestic transaction | ||

| Furnishing of incorrect information or documents | ||

| 271G | Failure to furnish information or documents within prescribed time under section 92D(3) | |

| 270A | Failure to report any specified domestic transaction (It would constitutes misreporting of Income) | 200% of tax payable |

Market value to be the Arm’s Length Price of goods or services in a Specified Domestic Transaction [Section 80A & 80-IA(8)]

Section 80A(6) provides that where the goods or services held for the purpose of the undertaking or unit or enterprise or eligible business are transferred to any other business carried on by the assessee or vice-versa, the transfer price of such goods and services shall be determined at the market value of such goods or services as on the date of transfer.

“Market value” is defined in Clause (iii) of Explanation to section 80A(6) to mean arm’s length price as defined under section 92F of such goods or services, if aggregate value of all such transaction specified in section 92BA of Income tax act exceeds Rs 20 crores.

For Section 80-IA(8), market value, shall mean –

- Open market price; or

- Arm’s length price as defined under section 92F.

Profit from transactions between an assessees carrying on “Eligible Business” and other assessees to be determined as per Arm’s Length Price [Section 80 IA(10)]

The Assessing Officer is empowered to make an adjustment while computing the profit and gains of the eligible business where –

-

- A transaction between the assessee carrying on the eligible business under section 80-IA ; and

- any other person

is so arranged that the transaction produces excessive profits to the eligible business.

If the aforesaid arrangement is a specified domestic transaction referred to in section 92BA of Income Tax Act, profit of such transaction shall be determined having regard to arm’s length price as defined under section 92F.

Market value to be the Arm’s Length Price of Goods or Services in a Specified Domestic Transaction [Section 80A & 80-IA(8)]

Example : –

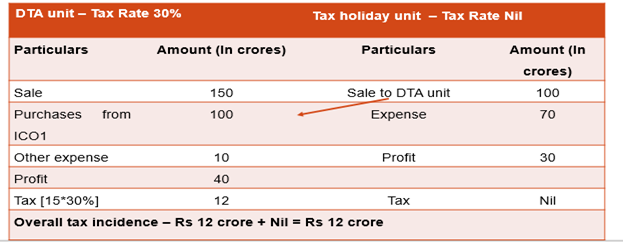

In given example, both the DTA unit and Tax holiday unit, are under common ownership and are related parties for the purpose of specified domestic transactions.

Situation 1 : Transaction at fair market value

Market value to be the Arm’s Length Price of Goods or Services in a Specified Domestic Transaction [Section 80A & 80-IA(8)]

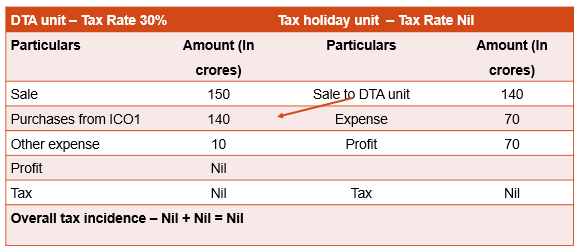

Situation 2 : Transaction at more than fair market value for shifting of profit to tax holiday unit

Note : Tax holiday unit has sold goods to DTA unit at Rs 140 crore instead of its fair market value of Rs 100 crore. This arrangement has been made in order to shift profit from DTA unit to tax holiday unit. Accordingly, the DTA unit has claimed higher deduction and such excessive profits were not taxable in the hands of Tax holiday unit.

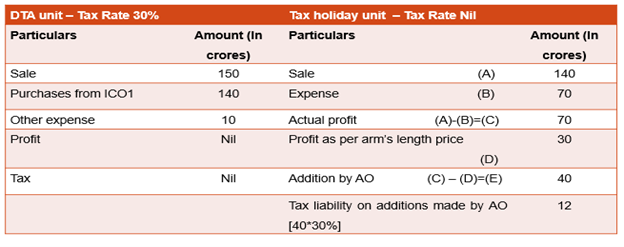

Market value to be the Arm’s Length Price of Goods or Services in a Specified Domestic Transaction [Section 80A & 80-IA(8)]

How aforesaid loophole under Situation 2 is curbed after introduction of provisions of specified domestic transactions?

Transfer pricing Rules for Specified Domestic Transactions [Notification No. 41/2013 Dated 10.06.2013]

With effect from A.Y 2013-14, the transfer pricing rules for international transactions have been suitably amended and made applicable specified domestic transactions as well.

Definition of “Associated Enterprise” [Rule 10A]

“Associated Enterprise” shall –

- have the same meaning as assigned to it in section 92A; and

- in relation to a specified domestic transaction entered into by an assessee, include –

-

- Persons referred to in section 40A(2)(b) for transaction referred to in section 40A(2)(a);

- Other units or undertakings or businesses referred to in section 80A or section 80-IA(8);

- Any other person referred to in section 80-IA(10) in respect of a transaction referred to therein;

- Other units, undertakings, enterprises or business of such assessee, or other person referred to in section 80-IA(10) or 10AA or the transactions referred to in Chapter VI-A to which the provisions of section 80- IA(8) or section 80-IA(10) are applicable.

Definition of “Enterprise” [Rule 10A]

“Enterprise” includes a unit, or an enterprise, or an undertaking or a business of a person who undertakes such transaction.

Determination of ALP under Section 92C – [Rule 10B]

Following methods are prescribed for determination of arm’s length price in relation to an international transaction : –

-

- Comparable Uncontrolled Price (‘CUP’) method;

- Resale Price Method

- Cost Plus Method

- Profit Split Method

- Transactional Net Margin Method

- Any other Method

Such methods shall also be made applicable to determine arm’s length price of specified domestic transactions.

Most Appropriate Method – [Rule 10C]

Rule 10C(1) provides that the most appropriate method shall be the method : –

- Which is best suited to facts and circumstances of each particular international transaction, and

- Which provides the most reliable measure of an arm’s length price in relation to the international transaction, as the case may be].

Rule 10C(2) specifies the factors to be taken into account in selecting the most appropriate method.

SUCH RULE HAS NOW BEEN MADE APPLICABLE FOR SPECIFIED DOMESTIC TRANSACTIONS AS WELL.

Transfer Pricing Rules For Specified Domestic Transactions

Information and documents to be kept and maintained under section 92D [Rule 10D] : –

As per Rule 10D(1), every person who has entered into an international transaction shall be required to maintain certain information and documents. However, there is an exemption from maintenance of information and documents where aggregate value of international transaction is Rs 1 crore or less.

NOW SUCH INFORMATION AND DOCUMENTS SHOULD ALSO BE KEPT AND MAINTAINED FOR SPECIFIED DOMESTIC TRANSACTIONS. HOWEVER, NO SUCH EXEMPTION IS AVAILABLE IN CASE OF SPECIFIED DOMESTIC TRANSACTIONS.

Transfer pricing Rules for Specified Domestic Transactions

Report from an accountant to be Furnished under Section 92E : –

Every person who enters into an international transaction during a previous year is required to obtain a report from a chartered accountant and furnish such report on or before due date of filing of return of income in Form No.3CEB. This provision is also made applicable for specified domestic transactions as well.

Amendments made by the Finance Act, 2017

The existing provisions of Section 92BA of Income tax act provided that any expenditure for which payment is required to be made to related persons under Section 40A(2)(b) were also considered as specified domestic transaction. With effect from AY 2017-18, with a view to reduce the domestic transfer pricing compliance burden, payments under Section 40A(2)(b) are specifically excluded from Section 92BA of Income tax act.

Provisions of specified domestic transaction will now be applicable only if one of the entities involved is claiming profit linked deduction (i.e., Section 80-IA, 80-IB, 80-IC, 10AA, etc).

Such amendment has given relief to taxpayers which were liable to domestic transfer pricing even when both the related parties were taxable at same rate of 30% and there was no shifting of profits in order to save tax of overall group.

Example : –

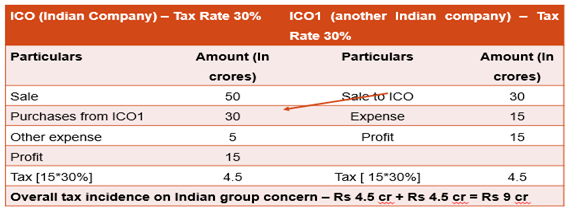

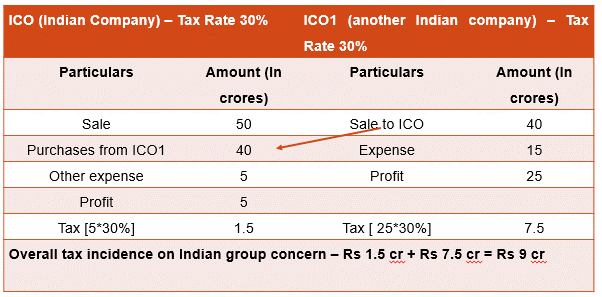

ICO and ICO1 are part of same group concern, i.e., both are related parties.

Situation 1 : Transaction at fair value

Situation 2 : Transaction at more than fair value

In both the situations the overall tax incidence comes out to be same even when there is transfer of goods from ICO1 to ICO at more than fair value. With effect from AY 2017-18, such transactions could not be considered as specified domestic transactions since non of the entities are claiming profit linked deduction.

Example : –

Indian company (ICO) paid salary of Rs 30 crores to its director during the PY 2016-17. Whether such payment would be considered as specified domestic transaction ?

Solution : –

Payment made to director would be considered as payment to related person under Section 40A(2)(b). However, with effect from AY 2017-18 payments under Section 40A(2)(b) are specifically excluded from Section 92BA. Thus, provisions of specified domestic transaction would not apply in this situation.

For any queries, please write them in the Comment Section or Talk to our tax expert