Valuation of an Undisclosed Asset located outside India – Section 3(2)

In order to determine the tax liability on various undisclosed foreign assets, it is important to determine their fair market value. Foreign assets include bank account outside India, shares, bullion, jewellery, archeological collections , financial interest in any entity etc. The Fair market value of any undisclosed foreign asset (including financial interest in any entity) shall be determined as per Rule 3 of Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Rules, 2015.

Let’s discuss valuation rules of various foreign assets in detail.

VALUATION OF FOREIGN BANK ACCOUNT – RULE 3(1)

In order to find out the fair market value of foreign bank account, we need to determine the aggregate of all deposits made in the such bank account, since the date of opening of such account. However, any deposit made in the account , which are from withdrawal proceeds from such account, shall not be considered while computing such fair market value.

Suppose, Mr. A had opened a Bank Account in USA in 2010 and such undisclosed bank account is discovered by AO in June 2017. In that case, aggregate of all deposits made in such account from 2010 till June 2017 shall be considered , to determine the fair market value of such foreign bank account.

However, if Mr. A has made total deposits of $ 50,000 till the date of discovery of the account, but out of such deposits, $ 2,000 deposited during 2015 were out of an earlier withdrawal of $ 10,000 from such bank account. In such a case, the fair value of such bank account would be $ 48,000 (i.e, total deposits ($50,000) – Deposits from earlier withdrawal from such account ($2,000).

| S.No | Particulars | Amount |

| 1 | Aggregate of all deposits made in the such bank account, since the date of opening of such account | A |

| 2 | Less – Deposit made in the account , which are from withdrawal proceeds from such account | B |

| Total | A-B |

EXAMPLE 1

An Indian resident has a foreign bank account since 2008 in which undisclosed income has been deposited over several years as under :

He has spent the money in the account over these years and current balance is $500 on March 31, 2016.

Determine the value of foreign bank account on which Indian resident is liable to pay tax under the Black Money Act ?

SOLUTION: –

Tax on undisclosed asset is required to be paid on its fair market value as per Rule 3(1) . In case of a bank account, the fair market value is the sum of all the deposits made in the account computed in accordance with Rule 3(1) . Therefore, the fair market value of such deposit would be USD 5, 700 on which tax would be paid under the Black Money Act.

Note: It has been assumed that the deposits were not made from proceeds of withdrawal from such foreign bank account.

VALUATION OF BULLION, JEWELLERY OR PRECIOUS STONE – RULE 3(1)

The fair market value of bullion, jewellery or precious stone shall be the higher of the following : –

- Its cost of acquisition; or

- The price it would ordinarily fetch if sold in the open market (i.e., market price) on the valuation date.

For the purpose of determining the fair market value of bullion, jewellery or precious stone, we need to ascertain their cost of acquisition and its market price on the valuation date.

While the cost of acquisition of such asset, would be readily available, the market price of such bullion or jewellery would be computed based on a report from valuer, who should be recognized by the Government of a country or territory outside India (or its agency) wherein such foreign asset was located.

Further , one should note that the market price of such asset will be determined on the basis of its market price on the valuation date, and not on the date of acquisition .

Suppose, Mr. B had acquired a bullion or jewellery in 1995 when its market price was $ 2,000, but currently, its market value has increased to $ 30,000 on the valuation date. For the purpose of BMA, we will consider market price of $ 30,000 on the valuation date, for the purpose of levying tax on such undisclosed foreign asset.

The relevant date, for determining the market value of the asset under Rule 3(1) would be April 1 of the relevant previous year. Thus, if any undisclosed foreign asset is discovered by AO in June 2017, then its market value as on April 1, 2017 would be considered.

Example

Mrs. A is an Indian tax payer. She had acquired certain jewellery in 2005 at a cost of $ 12,000. During the course of search and seizure, in the tax authorities recovered documents which evidenced the ownership of such jewellery, and it was found that the source of investment in such jewellery was not available with Mrs. A. The current , market value of the jewellery was $ 30,000 on the date of search i.e June 30, 2018, while at the beginning of the financial year such value was $ 25,000 . What will considered as the market price of such jewellery, for the purpose of levying tax on such undisclosed foreign asset ?

Solution

The relevant date, for determining the market value of the asset under Rule 3(1) would be April 1 of the relevant previous year. Thus, if any undisclosed foreign asset is discovered by AO in June 2018, then its market value as on April 1, 2018 would be considered, i.e $ 25,000

VALUATION OF ARCHAEOLOGICAL COLLECTIONS, DRAWINGS, PAINTINGS, SCULPTURES OR WORK OF ART- RULE 3(1)

The fair market value of archaeological collections, drawings, paintings, sculptures or work of art shall be higher of : –

- Its cost of acquisition ; or

- The price it would ordinarily fetch if sold in the open market (i.e., market value) on the valuation date .

For the purpose of valuation of archaeological collections, drawings, paintings, sculptures or work of art , we need to obtain a report from valuer, who should be recognized by the Government of a country or territory outside India (or its agency) wherein such foreign asset was located.

The relevant date, for determining the market value of the asset under Rule 3(1) would be April 1 of the relevant previous year.

Example

Sahira, is an Indian tax payer and a renowned actress. Her love for paintings is very well known and she is considered to have acquired several paintings from various countries over the years. She performs in various shows outside India and earned income . During the course of search and seizure, the tax authorities recovered documents which evidenced the ownership of various paintings in the name of Sahira, which were not disclosed as assets in the balance sheet prepared for income tax purposes in India . Further she was unable to explain the source of investment in such paintings. Since such painting did not had an immediate resellers market, the tax authorities engage the services of an authorised valuer overseas , who estimated the fare value of search paintings as $ 300,000 on the date of search i.e September 30, 2018. It is estimated that over the last 6 months, there has been an appreciation of 20%, in the cost of such paintings. What will considered as the market price of such paintings, for the purpose of levying tax on such undisclosed foreign asset ?

Solution

The relevant date, for determining the market value of the asset under Rule 3(1) would be April 1 of the relevant previous year. Thus, if any undisclosed foreign asset is discovered by AO in September 2018, then its market value as on April 1, 2018 would be considered. Given that the value on the date of search is $ 300,000, and it is estimated that over the last 6 months, there has been an appreciation of 20%, in the cost of such paintings, the value on April 1, 2018 would be $ (300,000/120*100) = $ 250,000.

VALUATION OF QUOTED SHARES AND SECURITIES- RULE 3(1)

Before discussing the valuation mechanism of quoted shares and securities. We need to first understand the meaning of quoted shares. Quoted shares, generally refers to listed shares or shares, the price of which is quoted or available.

As per Explanation 1 to Rule 3 “Quoted share or security” means the share or security which has a meaningful volume of trading on an ongoing basis on an established securities market where such share or security is regularly quoted by dealers and they do purchase or sell share from / to customers who are not related to the dealer in the ordinary course of a business.

“Meaningful volume of trading on an on-going basis” with respect to each class of shares means : –

- Trades in each such class are effected, other than in de Minimis quantities, on one or more established securities markets on at least sixty business days during the prior calendar year; and

- The aggregate number of shares in each such class that are traded on such market or markets during the prior year are at least 10% of the average number of shares outstanding in that class during the prior calendar year.

The fair market value of quoted shares and securities shall be higher of :

- Their cost of acquisition; or

- The price , which is determined in the following manner:

- Where there is trading in such shares and securities – The average of the lowest and highest price of such shares and securities, quoted on any established securities market on the valuation date.

For example, if the valuation date is April 1, 2018, and there is trading in such securities on the valuation date, then average of highest and lowest price quoted on the valuation date would be taken.

Suppose, the highest and lowest price of shares on stock exchange on such date is Rs 40 and Rs 50. Average of such prices (i.e., Rs 45) would be taken and it shall be compared with the cost of acquisition of such securities. If the cost of acquisition is Rs. 40, Rs. 45 shall be taken as the fair market value of quoted shares and securities, but if the cost of acquisition is Rs. 50, Rs. 50 shall be taken as the fair market value of quoted shares and securities.

- Where there is no trading in such shares and securities – The average of the lowest and highest price of such shares and securities on any established securities market on a date immediately preceding the valuation date, when such shares and securities were traded on such securities market.

This method would be applicable when there is no trading in such securities on any established stock exchange on the valuation date. In such a case, the average of highest and lowest price of such security immediately preceding the valuation date , when there was trading in such securities on that date.

Suppose, valuation date of securities is April 1, 2018 but there is no trading in such securities on such date. However, there is trading in such securities on stock exchange as on March 10, 2018. The highest and lowest price of such securities on March 10, 2018 is Rs 50 and Rs 60. Now average price of Rs 55 would be taken and it shall be compared with the cost of acquisition of such securities. If the cost of acquisition is Rs. 50, Rs. 55 shall be taken as the fair market value of quoted shares and securities, but if the cost of acquisition is Rs. 60, Rs. 60 shall be taken as the fair market value of quoted shares and securities.

As per Explanation 1 to Rule 3, “Established securities market” means an exchange , that is officially recognized and supervised by a Governmental entity in which the market is located. Such exchange should have an annual traded value of shares exceeding USD 1 billion on the exchange (or a predecessor exchange) during each of the 3 calendar years immediately preceding the calendar year in which the determination is being made.

VALUATION OF UNQUOTED SHARES AND SECURITIES- RULE 3(1)

Explanation 1 to Rule 3 of the Black Money Rules, defines “Unquoted share and security” means share or security which is not a quoted share or security . Generally, these are known as unlisted shares.

The valuation of unquoted shares and securities should be determined on basis of –

- Cost of acquisition ; or

- Fair market value on the valuation date, whichever is higher

In case of unlisted shares, quoted price of stock exchange is not available. Thus, we need to determine its fair market value on the basis of the financial statement. The is formula to determine the fair market value of unquoted shares is as under:

Fair market value on the valuation date =

Where A denotes –

Book value of all the assets (other than bullion, jewellery, precious stone, artistic work, shares, securities and immovable property) as reduced by, –

- Less : – Any amount of income-tax paid, if any, less the amount of income-tax refund claimed, if any ; and

- Less : – Any amount shown as asset including the unamortized amount of deferred expenditure which does not represent the value of any asset

It may be noted that for the purpose of above computation, only book value of assets as shown in balance sheet shall be considered. For assets in the nature of bullion, jewellery, precious stone, artistic work, shares, securities and immovable property, if these are reflected in the Balance sheet, their book value shall be reduced from the book value of total assets shown in the balance sheet. This is due to the fact that the market value of such assets (as computed under the provision of BMA) would be considered for valuation purposes.

Unamortized amount of deferred expenditure (like Miscellaneous expenditure not written off ) shall also be reduced from the book value of all assets.

“B” denotes fair market value of bullion, jewellery, precious stone, artistic work, shares, securities and immovable property as determined in the manner provided in this rule.

L denotes book value of liabilities, excluding :

- Value of Paid-up Equity shares;

- Amount set apart for payment of dividends (preference shares and equity shares) ;

- Reserves and surplus (positive or negative) other than depreciation reserves;

- Provision for tax, other than (income tax paid – income-tax refund claimed – MAT credit carried forward) ;

- Provisions for meeting unascertained liabilities ;

- Contingent liabilities (excluding dividends payable on cumulative preference shares) ;

PE denotes total amount of paid up Equity share capital (as shown in the balance sheet)

PV denotes paid up value of Equity shares

Example : –

From the following, compute the fair value of shares of XYZ Limited, an unlisted company in Cayman Island for the purpose of BMA. The Cost of acquisition may be assumed as USD 20,000 and the ownership of Indian party can be taken at 30% by Indian party. Conversion of USD and INR can be taken as USD 1 = Rs. 70.

| Asset | Book value | Fair Value as on April 1 on valuation date |

| Plant and Machinery

|

50,000 | 70,000 |

| Furniture | 70,000 | 70,000 |

| Undisclosed Jewellery | 50,000 | 80,000 |

| Undisclosed Drawings and Paintings | 60,000 | 55,000 |

| Deferred expenditure | 10,000 | 10,000 |

| Advance Income Tax (Net of refund due) | 50,000 | 50,000 |

| Total | 240,000 | 335,000 |

| Liabilities | ||

| Current Liabilities | 90,000 | 90,000 |

| Paid-up value of Equity shares – Fully Paid | 20,000 | 20,000 |

| Reserves and surplus | 100,000 | 100,000 |

| Provision for tax | 30,000 | 30,000 |

| Total Liabilities | 240,000 | 240,000 |

Contingent liabilities amounting USD 20,000 were also existing .

Solution

Fair market value on the valuation date =

Computation of Fair market value on the valuation date =

For (A + B – L)

| Asset | Book value | |

| Plant and Machinery

|

50,000 | |

| Furniture | 70,000 | |

| Undisclosed Jewellery | 80,000 | Higher of COA or FMV |

| Undisclosed Drawings and Paintings | 60,000 | Higher of COA or FMV |

| Deferred expenditure | Not an asset | |

| Advance Income Tax (Net of refund due) | Not an asset | |

| Total | 260,000 | 335,000 |

| Liabilities | ||

| Current Liabilities | 90,000 | 90,000 |

| Paid-up value of Equity shares; | Not a Liability | |

| Reserves and surplus | Not a Liability | |

| Provision for tax | Not a Liability | |

| Net Asset | 150,000 |

Fair market value on the valuation date =

Share of Indian party = 30% of 150,000 = 45,000

FMV of shares = Higher of COA or FMV

Higher of $20,000 or $45,000 = $45,000

VALUATION OF UNQUOTED SHARES AND SECURITIES (OTHER THAN EQUITY SHARES) – RULE 3(1)

In the preceding paragraph, we had discussed the valuation mechanism of unquoted equity shares . Let us now discuss the valuation mechanism of unquoted shares (other than equity shares, like preference shares).

The valuation of unquoted shares and securities (other than equity shares) shall be the higher of the following –

- Its cost of acquisition; or

- The price it would ordinarily fetch if sold in the open market (i.e., Market Price) on the valuation date .

In order to determine the market price of such unquoted shares, the assessee may obtain a report from a valuer. Such valuer should be recognized by the Government of a country or specified territory outside India (or any of its agencies) under any regulation or law.

VALUATION OF AN INTEREST OF A PERSON IN A PARTNERSHIP FIRM /AOP /LLP – RULE 3(1)

A person may have any interest in a partnership firm or LLP or AOP , which is located outside India and which constitutes an undisclosed foreign asset. Suppose, Mr. C has 33.33% interest in a partnership firm located abroad. In such a case, value of such interest needs to be determined to tax it under the provision of the Black Money Act.

Let us understand the steps involved to value such interest with the help of an example : –

Suppose, net assets of the firm are Rs 1,00,000 on the valuation date. There are three partners in the firm, namely. Mr. A, Mr. B and Mr. C. Share of Mr. C is 33.33% in such firm. We need to determine the valuation of C’s share in such firm. Let us assume that the capital contribution of such partners are as under : –

| Particulars | Mr. A | Mr. B | Mr. C |

| Capital | Rs 20,000 | Rs 20,000 | Rs 20,000 |

| As per Agreement for dissolution | 30% | 30% | 40% |

The step-by-step mechanism to calculate share of interest of member is given as under:-

Step 1 : –

Determine the net asset of the firm, AOP or LLP on the valuation date. The Net assets of the firm or AOP shall be (A+B-L). In this case, we have assumed such net assets to be Rs. 100,000.

Step 2 : –

Allocate net wealth of the firm, AOP or LLP as equivalent to its capital, shall be allocated amongst partners in the proportion of capital contributed by partners.

The capital of the partners is Rs. 60,000. Therefore, net wealth up to Rs 60,000 shall be allocated amongst partners and the share of C would be Rs 20,000.

Step 3 : –

Remaining Net asset shall be allocated in the following manner : –

Remaining Net wealth is Rs 40,000 (1,00,000 – Rs 60,000).

Since the partners have an agreement for dissolution of firm, the remaining Net wealth of Rs 40,000 shall be distributed amongst A, B and C in the ratio of 30:30:40 as per dissolution agreement. The share of C shall be Rs. 16,000 (40% of 40,000).

It may be noted , that in absence of such agreement for dissolution, the profit-sharing ratio would have been considered for allocation of remaining net wealth. In such a case, share of C would have been 33.33% of Rs. 40,000 or 13,333.

Step 4 : –

The total of amount allocated to partner or member in Step 2 and Step 3 shall be treated as the value of the interest of that partner or member in the partnership or AO. In the present case, the total amount allocated to C (i.e., Rs 20,000 + 12,000) shall be treated as value of his interest in the firm.

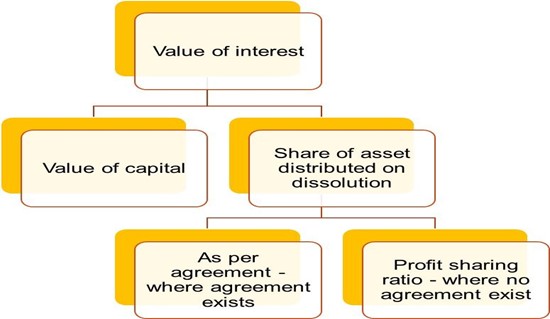

SUMMARY OF METHOD TO COMPUTE VALUE OF INTEREST IN PARTNERSHIP

TRANSFER OF ASSETS BEFORE VALUATION DATE

In certain cases, a person may transfer an asset (other than a bank account) before the valuation date, either for adequate consideration, or for inadequate consideration. In such a case, the value shall be calculated as under : –

VALUATION OF AN ASSET (OTHER THAN BANK ACCOUNT) TRANSFERRED BEFORE THE VALUATION DATE – RULE 3(2)

WHERE ASSET WAS TRANSFERRED FOR ADEQUATE CONSIDERATION:

Where an asset (other than a bank account) was transferred before the valuation date, fair market value of such asset shall be higher of –

- Its cost of acquisition or

- Sale price

WHERE ASSET WAS TRANSFERRED WITHOUT CONSIDERATION OR INADEQUATE CONSIDERATION

If asset (other than bank account) was transferred without consideration or for inadequate consideration before the valuation date, the fair market value of such asset shall be higher of –

- Its cost of acquisition ; or

- Fair Market Value on the date of transfer (and not on the valuation date)

VALUATION IN CASE OF ACQUISITION OF ASSET OUT OF CONSIDERATION OF OLD ASSET OR BANK ACCOUNT – RULE 3(3)

As discussed in the preceding paras, the valuation of undisclosed foreign bank account and other foreign assets would be determined as per Rule 3. However, in certain cases, a person may acquire a new assets out of : –

- Funds withdrawn from such foreign bank account which are invested in another foreign asset ; or

- Proceeds from transfer of old asset , which are used to purchase another foreign asset.

In such a case, it should be noted that there will be no change in the valuation mechanism of the new asset. However, in order to avoid double taxation, any such funds which have been utilized to acquire the new asset, shall be reduced from the market value of such bank account or such old foreign assets, as determined under Rule 3(1) or Rule 3(2), as the case may be, of Black Money Rules.

Let us understand this situation with the help of an illustration :-

Suppose, Mr. X has made total deposits of $ 3,00,000 in his undisclosed foreign bank account. He has made withdrawal of $1,00,000 from such bank account and purchased a flat outside India.

Generally, for valuation of foreign bank account, we do not consider withdrawals from such bank account. However, in this case such withdrawal would be reduced from the fair market value of such undisclosed foreign bank account. Thus, value of such foreign bank account would be $ 2,00,000 ($3,00,000 – $ 1,00,000).

In other words, where a new asset has been acquired or made out of consideration received on account of transfer of an old asset or withdrawal from a bank account, then the fair market value of the old asset or the bank account, determined as per Rule 3(1) and Rule 3(2) shall be reduced by the amount of the consideration invested in the new asset .

EXAMPLE : –

An undisclosed foreign house property (H1) was bought in 1997 for Rs 20 lakh. It was sold in 2001 for Rs 25 lakh rupees which were deposited in a foreign bank account . In 2002 another house property (H2) was bought for Rs 30 lakh.

The investment in H2 was made through withdrawal from the bank account.

H2 has not been transferred before the valuation date and its value on the valuation date is Rs 50 lakh. The value of bank account as computed under Rule 3(1)(e) is Rs 70 lakh.

Determine the fair market value (FMV) of the undisclosed assets ?

SOLUTION:

RATE OF CURRENCY CONVERSION TO DETERMINE FAIR MARKET VALUE OF AN ASSET – RULE 3(4)

Generally, the fair value of undisclosed foreign asset is determined in foreign currency. Such fair market value of foreign asset may be determined either in one of the permitted currency of RBI (like US dollar) or in any other currency , which may not be permitted currency of RBI. For Indian tax purpose, to levy income-tax on such black money (i.e., fair value of undisclosed asset), such value has to be converted into INR. The methodology for such determination shall depend on whether the fair market value of foreign asset is determined in RBI permitted currency or other currency. These are discussed as under : –

Case 1:- Where fair market value of foreign asset is determined in one of the permitted currency of RBI

Where fair market value of foreign asset is determined in one of the RBI permitted currencies under FEMA (like US dollar), then such fair market value shall be converted into Indian currency using the RBI reference rate of such foreign currency on the valuation date.

Suppose, the fair market value of foreign asset is $ 1,000 on the valuation date and the RBI reference rate is 1 INR = $ 70 on the such date, the fair market value of such asset would be INR. 70,000 (1000*70).

Case 2 :- Where fair market value of foreign asset is determined in any other currency which is not permitted currency of RBI

Where fair market value of foreign asset is not determined in one of the RBI permitted currencies under FEMA, then such fair market value shall be converted into US dollar on the valuation date. Such conversion shall be made on the basis of rate specified by the Central Bank of the country or jurisdiction in which the asset is located (or any regulated bank under that country if central bank does not specify rate). Finally, such fair value in USD would be converted into INR on the date of valuation.

Suppose, foreign asset is located in Country A , wherein currency “X” is used. Now fair market value of asset is determined as 1,000,000 X. The conversion rate specified by Central bank of Country A is 1X= 0.10 USD on the valuation date. On conversion into USD, such fair value would be USD 100000 (1000000*0.10).

Suppose, the RBI reference rate on the date of valuation is 1USD = Rs 60. Now the fair market value of such asset would be Rs 6,000,000 (100,000*60).

VALUATION DATE FOR DETERMINING THE MARKET VALUE OF ASSET UNDER RULE 3(1)– EXPLANATION 1 TO RULE 3

The relevant date for determining the market value of the asset under Rule 3(1) would be 1sApril of the previous year (other than asset declared under Section 59). In respect of asset declared under Section 59, the relevant date shall be July 1, 2015. Section 59 provided for declaration by a person , of any undisclosed asset located outside India and acquired from income chargeable to tax under the Income-tax Act , for AY 2015-16 or earlier years, for which such person —

- has failed to furnish a return under section 139 of the Income-tax Act;

- has failed to disclose in a return of income furnished by him under the Income-tax Act before the date of commencement of this Act;

RELEVANT DATE FOR CONVERSION OF CURRENCY TO DETERMINING THE MARKET VALUE OF ASSET UNDER RULE 3(1) – EXPLANATION 1 TO RULE 3

In order to determine the market value of assets under Rule 3(1), the relevant date of valuation for

- Conversion of foreign currency (one of the RBI permitted currency) into Indian currency ; or

- Conversion of foreign currency into US dollar and thereafter into Indian currency would be 1st April of the previous year.

For any queries, please write them in the Comment Section or Talk to our tax expert