Form 15CA of Income tax act

- Reporting under Form 15CA

- When Form 15CA is Required

- How to file form 15CA

- Purpose of Filing Form 15CA

- Implication of Filing Form 15CA

- Mode of Filing Form 15CA

- Revision of Form 15CA

Reporting under Form 15CA

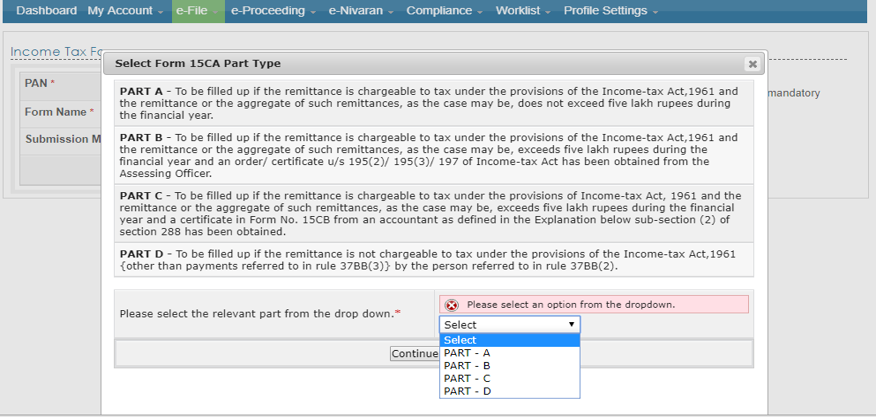

- Part A – Payment < Rs 5 lakhs

- Part B – Payment > Rs 5 lakhs + WHT Certificate

- Part C – Payment > Rs 5 lakhs

- Part D – Payment not taxable

For applicability of Part A, B or C, remittance should also be chargeable to tax under the Income Tax Act

When Form 15CA is Required

When to fill Part A of Form 15CA

- When remittance is chargeable to tax – Remittance to be made to the non-resident should be chargeable to tax under the Income Tax Act . Where the remittance is not chargeable to tax, then Part D of Form 15CA should be filed

AND

- The remittance or the aggregate remittance does not exceed Rs 5 lakhs

- When single payment does not exceed Rs 5 lakhs and the aggregate payment to be made during the FY would not exceed Rs 5 lakhs or

- When aggregate payment to be made during the FY would not exceed Rs 5 lakhs

Note – Deductors who are liable to file Part A of Form 15CA are not required to file Form 15CB

When to fill Part B of Form 15CA

- When remittance is chargeable to tax – Remittance to be made to the non-resident should be chargeable to tax under the Income Tax Act . Where the remittance is not chargeable to tax, then Part D of Form 15CA should be filed ; AND

- The remittance or the aggregate remittance exceeds Rs 5 lakhs

a) When single payment exceeds Rs 5 lakhs or

b) When aggregate payment to be made during the FY would exceed Rs 5 lakhs

AND - When certificate for Nil Withholding tax or lower withholding tax obtained

When one of the following certificates are obtained- Certificate u/s 195(2) :- by payor

- Certificate u/s 195(3) :- by payor

- Certificate u/s 197 :- by non-resident payee.

Note – Deductors who are liable to file Part B of Form 15CA are not required to file Form 15CB

When to fill Part C of Form 15CA

- When remittance is chargeable to tax – Remittance to be made to the non-resident should be chargeable to tax under the Income Tax Act . Where the remittance is not chargeable to tax, then Part D of Form 15CA should be filed and

- The remittance or the aggregate remittance exceeds Rs 5 lakhs

a) When single payment exceeds Rs 5 lakhs or

b) When aggregate payment to be made during the FY would exceed Rs 5 lakhs

Note – Deductors who are liable to file Part C of Form 15CA are required to file Form 15CB

When to fill Part D of Form 15CA

- When remittance to be made to the non-resident are not chargeable to tax under the Income Tax Act

Note – Deductors who are liable to file Part D of Form 15CA, are not required to file Form 15CB

How to file form 15CA

How to file form 15CA Part A

- After filing of Form 15CB by the Chartered Accountant the next step would be to file Form 15CA . First of all, we need to select the relevant Part of Form 15CA which need to be filed .

- Part A would be selected when the amount of remittance is chargeable to tax and it does not exceed Rs 5 lakhs . However, in such a case there is no need to obtain Form 15CB certification .

- Deductors filing Part A of Form 15CA are not required to obtain CA certificate in Form 15CB . In this Column basic details of payor should be entered like its Name, PAN /TAN , address and residential status .

- In this Column basic details of non-resident payee should be entered like its Name, PAN, address and the Country in which remittance is made .

- Amount payable before TDS (in Indian currency) :- Such amount would be taken from Form 15CB filed by the Chartered Accountant .

- Aggregate amount of remittance made during the FY including this proposed remittance :- Where the aggregate amount made during the FY exceeds Rs 5 lakhs, then Part A of Form 15CA cannot be filed . In such a case Part C of Form 15CA should be filed .

- Others :- In other columns, bank details need to be mentioned through which remittance is to be made .

Tax deducted :

a)Amount of TDS :- In this column amount of TDS in INR mentioned at Point No. 10 of Form 15CB should be reported

b)Rate of TDS :- Rate of TDS reported in Point No. 11 of Form 15CB should be mentioned here .

c)Date of deduction (DD/MM/YY) : – Date of deduction of TDS mentioned at Point No. 13 of Form 15CB should be reported here .

How to file form 15CA Part B

- Part B of Form 15CA shall be filled only if the amount payable to non-resident is chargeable to tax under the Income-Tax Act, which exceeds Rs 5 lakhs and a certificate of AO is obtained for lower or Nil withholding tax . In this Column basic details of payor should be entered like its Name, PAN /TAN , address and residential status .

- In this Column basic details of non-resident payee should be entered like its Name, PAN, address and the Country in which remittance is made .

- In this Column details of Nil or lower withholding tax certificate of non-resident should be entered. Where Nil or lower withholding tax certificate is obtained by payee then Section 195(3) or Section 197 should be selected from the drop down list . Where certificate is obtained by payor then Section 195(2) should be entered .

- Other details shall be entered from the Certificate itself . There is no need to get CA certification in Form 15CB in case non-resident payee has lower or Nil withholding tax certificate.

How to file form 15CA Part C

- When it is filed?

Part C of Form 15CA shall be filed only when remittance to be made to non-resident is chargeable to tax under the Income-Tax Act and aggregate amount of such remittance exceeds Rs 5 lakhs .

- Income exempt under DTAA

Reporting shall also be made in Part C of Form 15CA when remittance to non-resident is chargeable to tax under the Income Tax Act but such remittance is exempt from tax under the DTAA . In such a case, reporting shall not be made in Part D of Form 15CA.

Reporting shall also be made in this Part where payee or payor has obtained lower or Nil withholding tax certificate and amount of remittance exceeds Rs 5 lakhs .

How to file form 15CA Part C – Section A

- In this part basic details of payor should be entered i.e., Name , address , PAN/TAN , etc. There is no need to enter details of AO type , Range Code and AO number

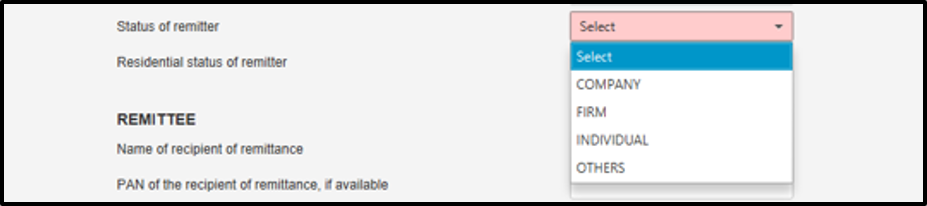

In this Column status of remitter (i.e., payor) should be entered . Thus, we need to select whether the deductor is a company , firm , Individual or others ?

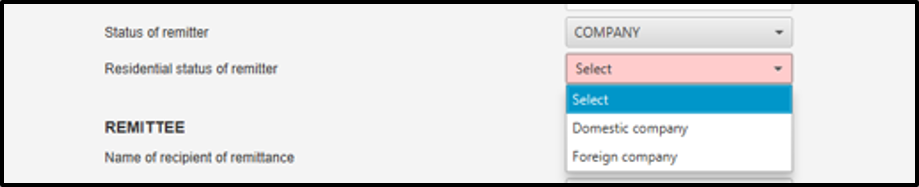

If status of remitter is chosen as company then we need to select residential status of company from the drop down list, i.e., whether it is a domestic company or foreign company.

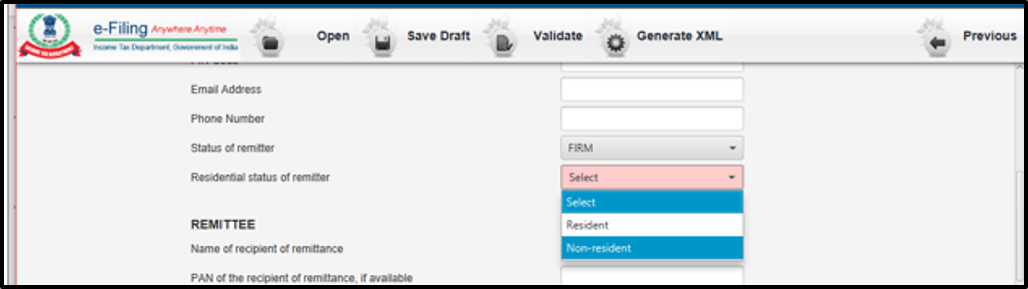

If status of remitter is chosen as a firm / Individual or others then we need to select its residential status from the drop down list, i.e., whether it is resident or non-resident .

- In this column details of PAN of non-resident payee , its Principal place of business and email address and phone number should be entered manually . Other fields should be auto filled from Form 15CB.

- In this part we need to enter the date of certificate of Form 15CB and certificate number of Form 15CB . Other fields should be auto-filled from Form 15CB .

- Where Nil or lower withholding tax certificate is obtained, then we need to enter the details which would be available from the certificate itself .

How to file form 15CA Part C – Section B

- In this column all the field would be auto-filled from Form 15CB and we need to enter only amount of income liable to tax in India in case of business receipts.

How to file form 15CA Part C – Section C

- This column is meant for verification wherein basic details of company should be entered .

Step by Step Procedure to File Form 15CA Part C

How to file form 15CA Part D

- This Part D of Form 15CA shall be filed where the remittance payable to non-resident is not chargeable to tax under the Income-Tax Act .

- Form 15CB or Form 15CA need not be filed where any remittance payable to non-resident is not taxable as it is covered undre the specified list. (E.g. In case of payment of advance on import of material from outside India there is no need to file either Form 15CB or Form 15CA as it is covered under specified list)

- Where any remittance payable to non-resident is chargeable to tax under the Income-Tax Act but exemption is available under the DTAA, then there should not be any reporting in Part D of Form 15CA . In such a case Part A or Part C of Form 15CA should be filed . (E.g. Where any payment of technical services to non-resident is taxable under the Income Tax Act but it is not taxable under DTAA due to existence of make available clause, reporting should be made in Part A or Part C of Form 15CA )

In this Column basic details of payor should be entered like its Name, PAN /TAN , address and residential status.

In this column following details should be mentioned :-

- Foreign currency in which payment is to be made would be reported here .

- Country of which the recipient of remittance is resident , should also be reported .

- Amount payable in foreign currency would be available from the invoice .

- Amount payable in INR would be calculated by multiplying the TT buying rate or RBI

Purpose of Filing Form 15CA

The purpose of filing Form 15CA is to provide following information to the Income-Tax Authority for payments to be made to the non-resident :-

- Details of remitter like Name, PAN, TAN address email-id, etc.

- Details of recipient of income like Name, PAN, TAN, Address, email-id, etc.

- Details of payment to be made to non-resident

- Country to which remittance is made

- Amount of TDS and rate of TDS as per Form 15CB

Implication of Filing Form 15CA

Payor must ensure that withholding tax is deducted as per the rate of TDS / amount of TDS mentioned in Form 15CA and 15CB

Mode of Filing Form 15CA

15CA Utility [XML uploading]

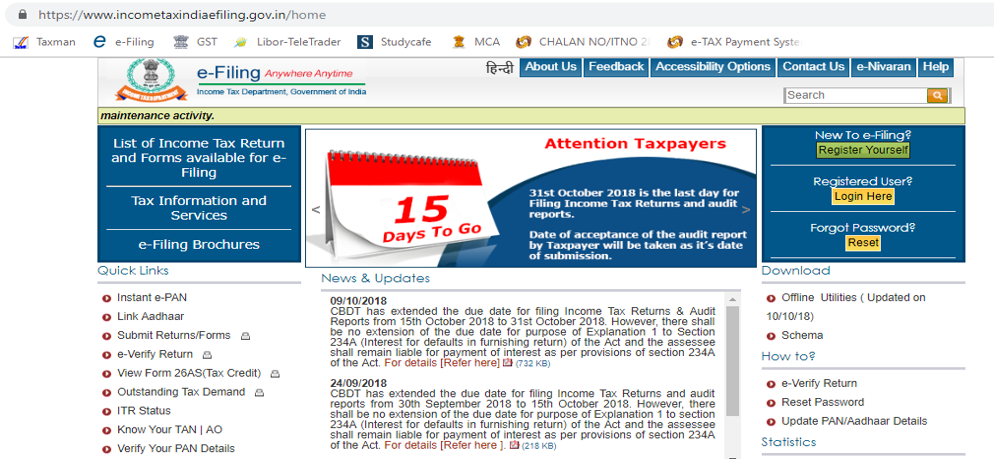

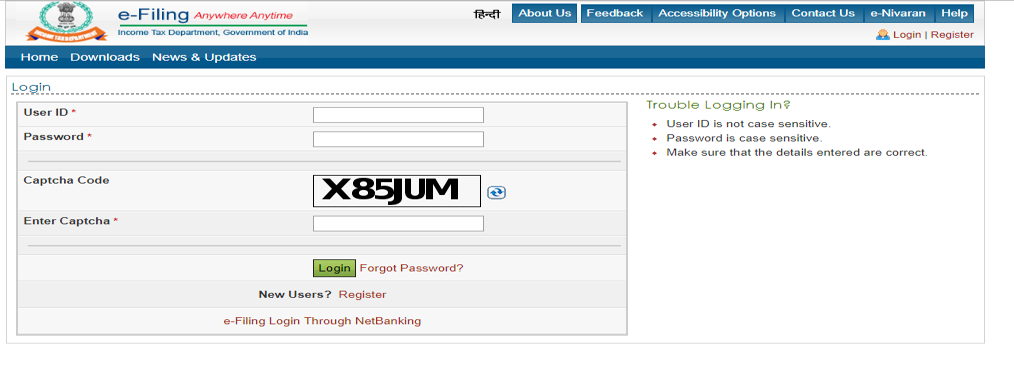

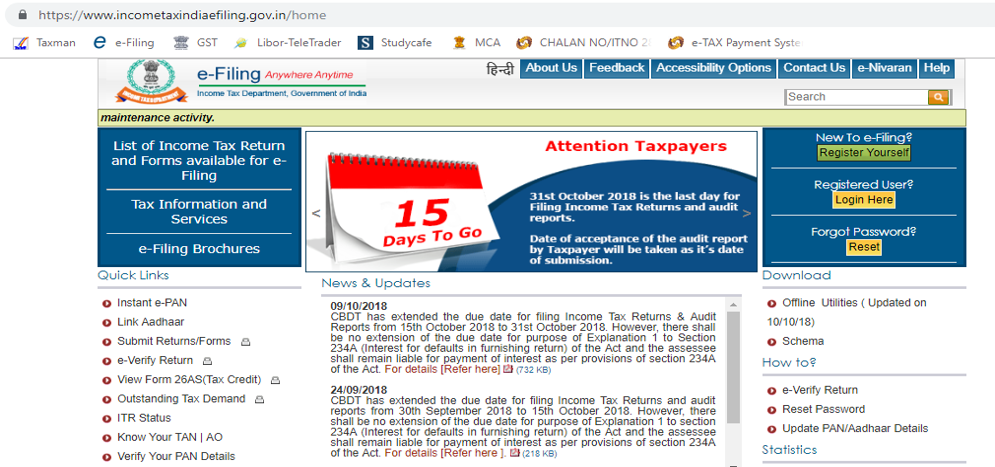

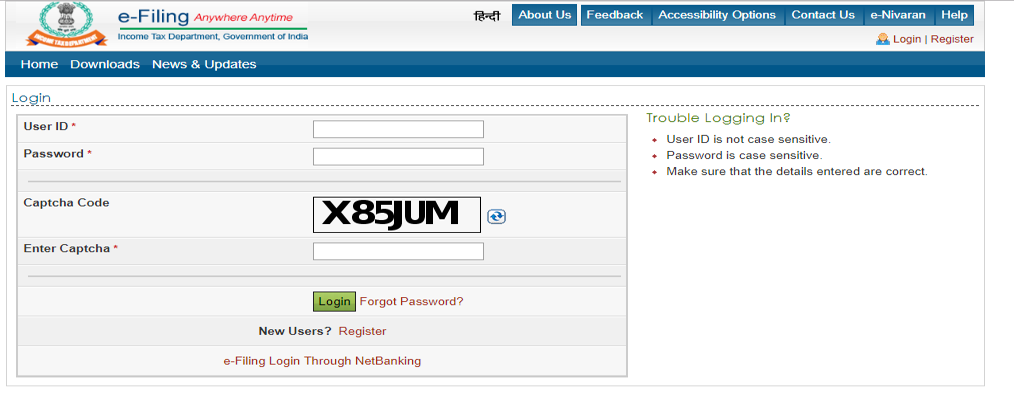

Step 1 :- We can login www.incometaxindiaefiling.gov.in by clicking on the button “Login Here”

Step 2 :- We need to enter user Id , password and captcha in order to login e-filing website

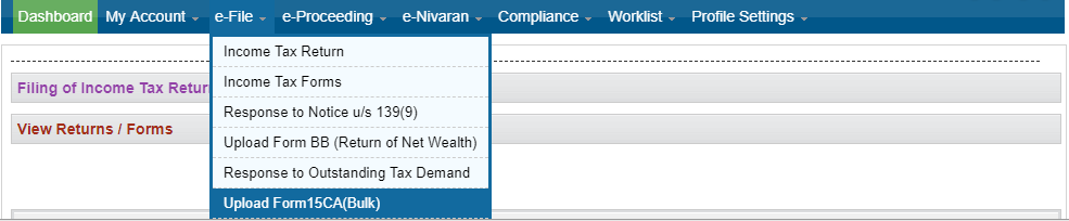

Step 3 :- We need to click on the button of “e-file” and select option of “upload Form 15CA (Bulk)”

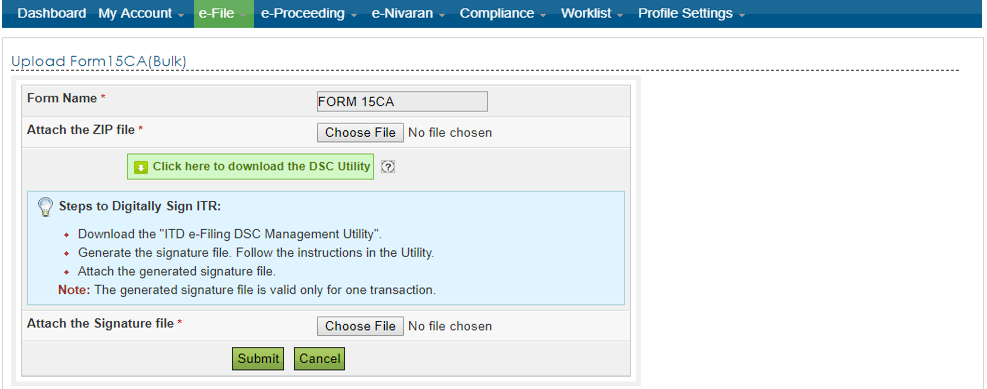

Step 4 :- We need to attach the XML file of Form 15CA and digital signature file of the authorised person of the deductor company and click on the submit button

Online preparation of 15CA

Step 1 :- We can login www.incometaxindiaefiling.gov.in by clicking on the button “Login Here”

Step 2 :- We need to enter user Id , password and captcha in order to login e-filing website

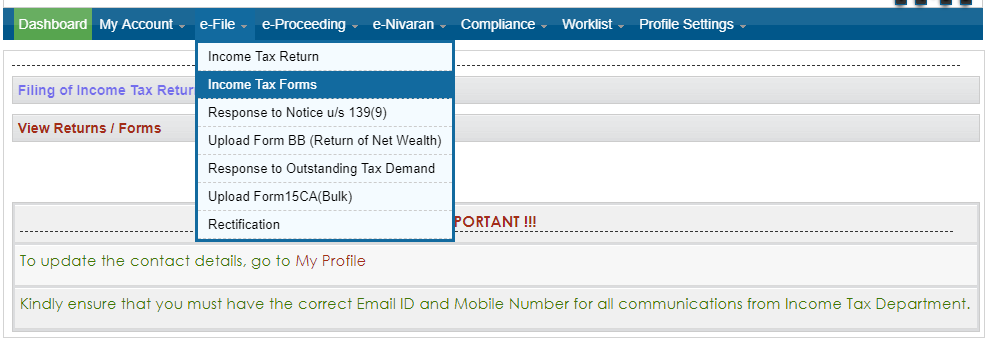

Step 3 :- We need to click on the button of “e-file” and select option of “Income Tax Forms”

Step 4 :- After we click on the button of “Income Tax Forms” this page will appear

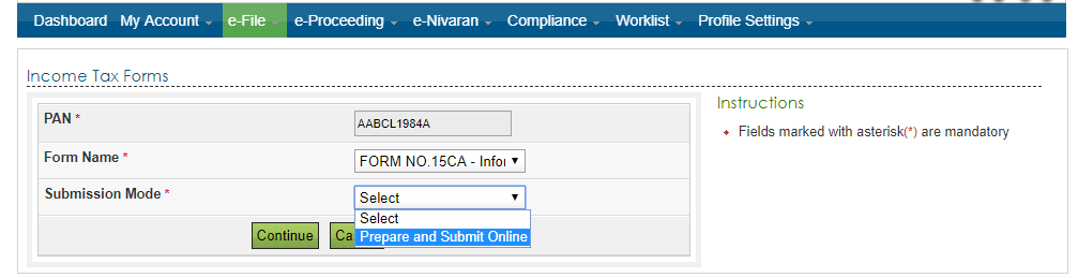

Step 5 :- Click on the button of “Form Name” and select “Form 15CA – Information for payments to Non-Resident“

Step 6 :- Click on the button of “Submission Mode” and select “Prepare and Submit Online“ and then click on the continue button

Step 7 :- Select Part A /B /C /D whichever is applicable , press continue button and then prepare that Part of Form 15CA online

Revision of Form 15CA

- There may be some error in Form 15CA which is identified by Chartered Accountant or the Bank before processing of payment to non-resident like, error in mentioning proposed date of remittance or error in selecting the relevant Part of Form 15CA or error in Form 15CB due to which Form 15CA need to be changed .

- In such a case , there is option in e-filing portal to withdraw Form 15CA within 7 working days of its submission . Thereafter , deductor is required to submit the new Form 15CA reflecting the correct position .