What is Transfer Price ?

Although we have had a brief glimpse of the principle of transfer pricing, the question still remains: What is Transfer Pricing? MNEs with their Associated Enterprises enter into transactions at a price that are generally lower than the actual market price. Furthermore, MNEs set up business plans in order to avoid paying taxes at economies which have a higher tax rate and instead can get away with paying taxes at Nil rate or a lower rate. This reduces tax liability on the enterprises and results in tax evasion and other unscrupulous activities.

Transfer Pricing was introduced as an international principle to address these issues. Let’s take a look at this concept briefly:

| Principle of International Taxation | Transfer Pricing |

| Transaction between | International Parties |

| Transfer Price | Price charged between two international parties |

| Factors determining Transfer Price |

|

| Common Transactions between Group Companies within a MNE |

|

What is Transfer Pricing?

Different countries have different rules on taxation, in terms of tax rates, tax exemptions etc. For example, in the above Case, X Ltd. operates in Country A, wherein the tax rates are 30% while its subsidiary C incorporated in Country Y is liable to tax at the rate of 10%. Further many countries do not tax certain income like Capital gains, dividend etc (for example Singapore), whereas other countries like India impose tax on such income.

While in case of unrelated entities, transactions are normally carried out at prices which are driven by commercial considerations, and therefore result in equitable tax in various jurisdictions, in case of Multi National Enterprises having several group companies across various tax jurisdiction, transaction between group companies, may be structured in a manner, whereby the maximum profits accrue in jurisdiction with low/ Nil rates of taxes (in the above example, profits were artificially shifted to Country Y, where tax rate is 10%), thereby reducing the taxable income of Country A. This is achieved through artificial clauses in contracts and transacting business at prices, which are entered into to take benefit of lower tax rates , without any commercial reasons.

The concept of Transfer Pricing was introduced to curb such malpractices and ensure that taxes are paid in the jurisdiction, where the economic activity actually takes place.

Transfer Pricing Concept

Transfer Pricing on a whole, is the process of arriving at the price for goods and services, which are transacted between entities which are under a common control (Head Office and branches / Legal companies) of a large enterprise, where such entities could be in the same or different country, under the assumption that they were independent parties.

In other words, Transfer Pricing involves the following : –

- Transactions between controlled legal entities

There is /are transactions between controlled entities (branches /companies) within a MNE. Such transactions could be of various kinds which are discussed in Para 4.2

- Location of Entities

Such controlled legal entities / branch of an MNE may be in the same country (in such a case domestic Transfer Pricing provisions are applicable) or different countries (for International Transaction).

- Arriving at Transfer price on assumption of independence amongst parties

Transfer Pricing involves arriving at the price for goods and services under the assumption that the group entities of an MNE are independent entities, and are charging price from other group entities, based on commercial considerations.

For example, if a parent company of a multinational group, sells goods to its subsidiary company in other Country, the price of such transaction would be tested under Transfer Pricing guidelines and the price so arrived under TP guidelines would be used to arrive at taxable income under the assumption that parent and customer are independent parties .

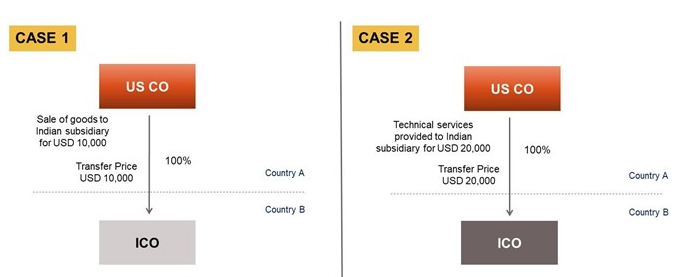

TRANSFER PRICE – DIAGRAM 1.7

DIAGRAM 1.7

Transfer price is the price of goods/services between Associated Enterprise

In both the cases, discussed above, the USCO has sold certain goods to the Indian Company or provided technical services to the Indian company. The purpose of Indian Transfer Pricing regulation in such a case would be to ensure that the deduction claimed by the Indian Company towards payment to the US company as purchase price of the goods/ consideration for services are at arm’s length. Any excess deduction would be disallowed to the Indian company and its taxable income would be increased to that extent.

Common Business Transactions, Between Group Companies Within a MNE

Some of the most , common business transactions, between group companies within a MNE are as under : –

- Purchase or Sale Transactions or use of Property –

- Purchase, sale or lease of tangible or intangible property like shares, house or commercial building etc ; or

- Use of intangible property like Brand, Trademark, royalty etc

- Service Transactions – Availing or Provision of services like Business Process outsourcing, Knowledge process outsourcing , managerial , technical or consultancy services. Such services can be either technical or non-technical in nature ; or

- Financing Transactions – Lending or borrowing money

- Investment Transactions – Investment in Shares, Debentures (non-convertible/ convertible), Preference shares (non-convertible/ convertible), Bonds etc.

The fact that the arm’s length price is different from the transaction price , does not necessarily mean that there has been any under invoicing or over invoicing by the parties . Even where application of Transfer Pricing results in a different arm’s length price, the price which are actually charged in a transaction , can be the same as amount of money received or paid by two entities . A different arm’s length price simply means that for computing income tax arising from a transaction, taxable income has to be computed on an amount which is different from the transaction price, which is agreed between related parties.

Let us now look at some examples to understand this concept : –

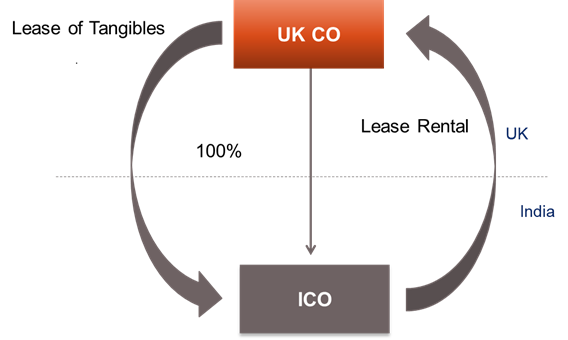

a) Lease of tangible equipment – Diagram 1.8

Facts : –

LMP India Private Limited (India) acquires equipment on lease from its parent Zigzag Co., International (UK) at a lease rental of USD 10,000 per month. The amount is accrued on monthly basis and the payment is made at the end of each quarter.

Diagram 1.8

Analysis : –

This is a transaction of lease of tangible property. Thus, arm’s length price of such leasing transaction would be determined under Transfer Pricing provisions.

The deduction of lease rentals in the hands of LMP India would be based on the arm’s length price of the lease rentals.

Additional Practical Knowledge

Further, Zigzag Co may also be liable to pay taxes on such income in India (which may be withheld by LMP India as TDS) and undertake necessary income tax return (ITR) filings/ Tax Audit/ Transfer Pricing compliance in India. Lease rental may generally constitute Royalty income taxable at gross rate of 10% under the IT Act or 10/15% under Treaty, or Business Income in case of PE of Non-resident in India, assuming certain applicable conditions in each such case are satisfied .

Tax rate may be subject to applicable surcharge and cess under the IT Act . Generally rates given in Treaty are including surcharge and cess .

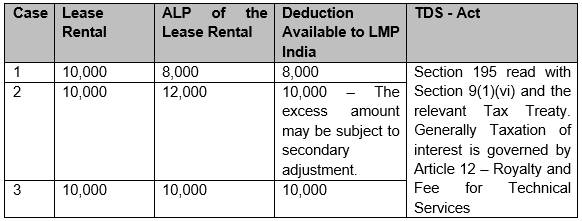

b) Lending and borrowing – Diagram 1.8

ABC Ltd. (India) borrows USD 10,000 from its parent, ABC International Ltd. (UK) at an interest rate of 3% p.a. The risk of foreign exchange fluctuation shall be borne by ABC India .

Diagram 1.9

Analysis : –

In this case, the transaction is of lending or borrowing of money. Thus, arm’s length price of interest rate would be determined under Transfer Pricing provisions. The deduction of interest expenses in the hands of the Indian company would be based on the arm’s length price of the interest.

Additional Practical Knowledge .-

Further, ABC International Ltd. (UK) may also be liable to pay taxes on such income in India (which may be partly/entirely withheld by ABC Ltd. as TDS) and undertake necessary income tax return (ITR) filings [ITR filing exemption may be available u/s 115A(5)] where specified interest is the only income of ABC International Ltd. (UK) and appropriate taxes have been deducted _/ Tax Audit/ Transfer Pricing compliance in India. Interest income may be taxable as the provision of IT Act or Treaty, whichever, are more beneficial, or Business Income in case of Business Connection/PE of Non-resident in India (generally applicable on Banking companies having a branch in India), , assuming certain applicable conditions in each such case are satisfied.

Tax rate may be subject to applicable surcharge and cess under the IT Act . Generally rates given in Treaty are including surcharge and cess .

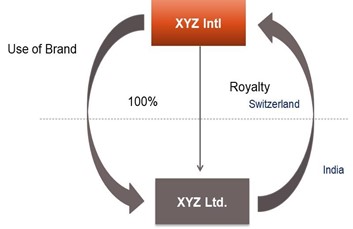

c. Use of brand – Intangible Property – Diagram 1.10

XYZ Ltd. India is owned by ABC UK, and it makes royalty payment to XYZ. International, in which its parent, ABC UK, owns 51% equity shares, towards the use of Brand, which is used for manufacturing products by XYZ Ltd. India.

In this case, the transaction is for use of an intangible asset.

Thus, arm’s length price of royalty payments would be determined under Transfer Pricing provisions. For deductibility scenarios, please refer example on lease of intangible equipment.

Diagram 1.10

Additional Practical Knowledge

Further, XYZ Intl. may also be liable to pay taxes on such income in India (which may be withheld by XYZ Ltd. as TDS) and undertake necessary income tax return (ITR) filings/ Tax Audit/ Transfer Pricing compliance in India. Payment for use of brand may generally constitute Royalty income taxable at gross rate of 10% under the IT Act or 10/15% under Treaty, or Business Income in case of PE of Non-resident in India, assuming certain applicable conditions in each such case are satisfied.

Tax rate may be subject to applicable surcharge and cess under the IT Act . Generally rates given in Treaty are including surcharge and cess .

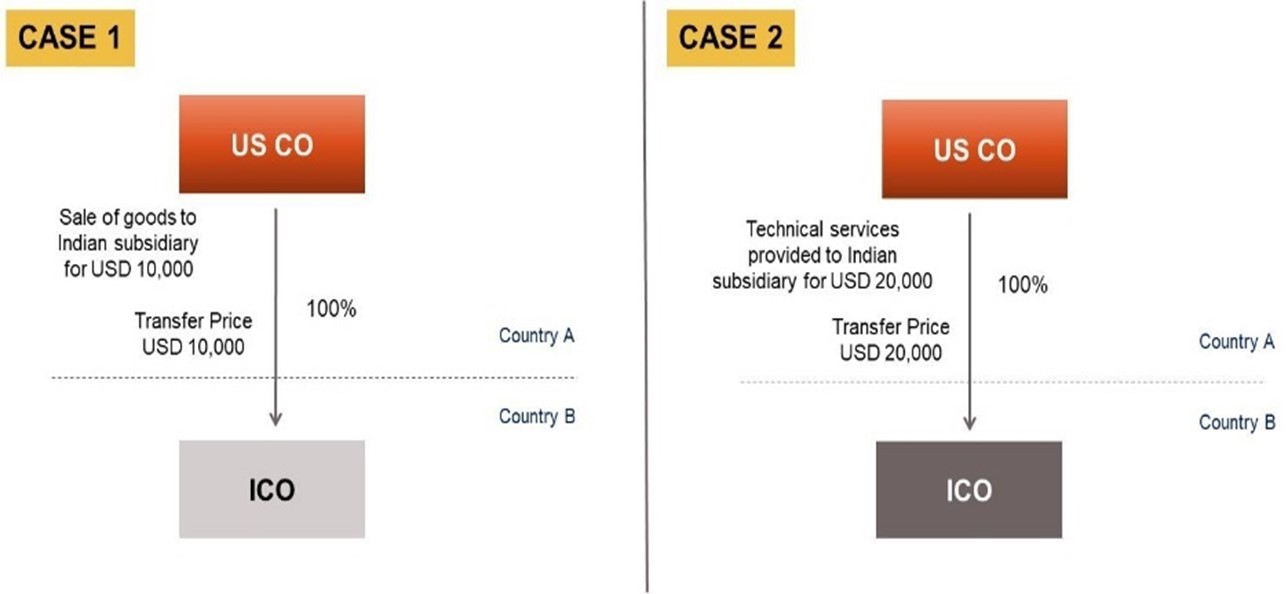

d. TRANSACTION – SALE OF GOODS/ SUPPLY OF SERVICES – Diagram 1.11

Diagram 1.11

Facts

USCO has sold certain goods to its wholly owned subsidiary ICO . The arm’s length price of such purchase would be determined under Transfer Pricing provisions.

USCO has also provided technical services to ICO . Thus, arm’s length price of such services would be determined under Transfer Pricing provisions.

Additional Practical Knowledge

In certain cases, if the property in goods is passed outside India and the Non-resident does not have a business connection/ PE in India, income from sale of goods to Indian company may not be liable to tax in the hands of US CO.

For technical services, USCO may also be liable to pay taxes on such income in India (which may be withheld by ICO as TDS) and undertake necessary income tax return (ITR) filings/ Tax Audit/ Transfer Pricing compliance in India. Payment for technical services may be taxable at gross rate of 10% under the IT Act or 10/15% under Treaty, or Business Income in case of PE of Non-resident in India, assuming certain applicable conditions in each such case are satisfied.

Tax rate may be subject to applicable surcharge and cess under the IT Act . Generally rates given in Treaty are including surcharge and cess .

For any queries, please write them in the Comment Section or Talk to our tax expert