Section 194EE – Payment in respect of deposit under national savings scheme, etc.

Key aspects to be considered for TDS under Section 194EE of the Income Tax Act are as under : –

Issues

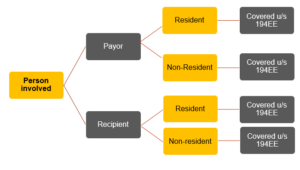

- Which Payor are liable to deduct tax under Section 194EE of Income Tax Act ? Who should be the Recipient .

- Whether payment qualifies as Deposit under National Savings Scheme, etc.

- Minimum Threshold for deduction of taxes, and Exemptions and Non Deduction Cases

Parties involved in transaction

Section 194EE – Provision under IT Act, 1961

Any person responsible for paying to any person any amount standing to the credit of such person under National Savings Scheme (to which Section 80CCA was applicable) together with interest accrued thereon, shall, at the time of payment of such sum deduct an amount equal to 10% .

Rate of TDS

Section 194EE requires deduction of TDS at the rate of : –

- 10% on Payment of amount standing to the credit of such person under National Savings Scheme (No Surcharge or Cess)

- 20% (if PAN is not provided by recipient) – Section 206AA

- Rate provided in the lower WHT certificate obtained u/s 197 (Not Applicable)

Payments exempt from tax deduction of TDS under Section 194EE

The following payments are exempt from deduction of tax as per Section 194EE of Income Tax Act : –

- Amount or aggregate of such Payment is less than Rs. 2,500 during the Financial Year ;

- Payment is made to the legal heirs of the deceased assessee

- Declaration under Form No. 15G/15 H cases – Provided PAN are provided

TDS Sections

- Section 192 of Income tax act

- Section 193 of Income tax act

- Section 194 of Income tax act

- Section 194B of Income tax act

- Section 194C of Income tax act

- Section194EE of Income tax act

- Section 194H of Income tax act

- Section 194I of Income tax act

- Section 194IA of Income tax act

- Section 194 J of Income tax act

- Section 194K of Income tax act

- Section 194LD of Income tax act

- Section 194LBB of Income tax act

- Section 194M of Income tax act

- Section 194N of Income tax act

- Section 194O of Income tax act

- Section 194Q of Income tax act

- Section 194R of Income tax act