Advance Pricing Agreement (APA) Transfer Pricing

a) An Advance Pricing Agreement (APA) is an agreement between a tax payer/applicant and the CBDT,

i) which determines the arm’s length price of future intercompany transactions; or

ii) determines the manner in which ALP is to be computed.

b) APA can also be used for existing intercompany transactions (i.e., under roll back provisions of APA).

c) APA provisions are contained in Section 92CC and Section 92CD of the Income-tax Act, 1961 and Rules 10F to 10T of the Income-tax Rules, 1962.

Application of Advance Pricing Agreement (APA) – Binding Nature

Once an APA has been entered into with respect to an international transaction, the arm’s length price with respect to that international transaction, will be determined only in accordance with the APA, for the period specified in the APA.

Note – Such APA is binding on Persons and it Authorities.

Types of Advance Pricing Agreement (APA) – Unilateral, Bilateral and Multilateral

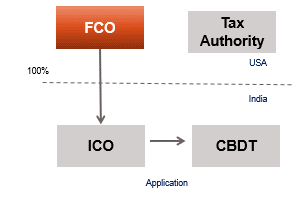

Types of APA – Unilateral APA

- Unilateral APA is an Agreement between the assessee (applicant) and CBDT;

- It does not involve any Treaty Partner (i.e., foreign authority);

- It does not guarantee that the Arm’s Length Price/ Transfer Pricing method determined under APA shall be accepted by the country of residence of foreign AE. Accordingly, it does not completely eliminate double taxation risk.

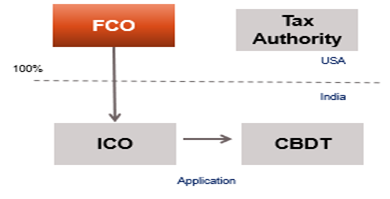

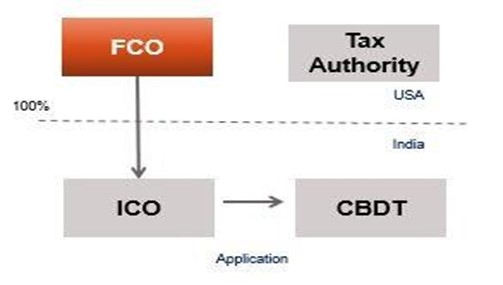

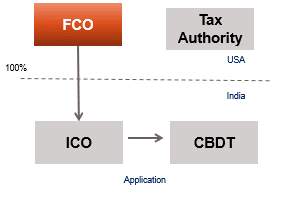

Types of APA – Bilateral APA

Bilateral APA is an agreement between Applicant (i.e., assessee), Foreign AE, Foreign authority, and CBDT

Note :

- In bilateral APA, applicant is required to make an application with competent authority of India and simultaneously the applicant or its AE should also apply to Competent Authority of other Country.

- The two competent authorities are required to reach an arrangement through Mutual Agreement Procedure (to be discussed later), which has to be accepted by applicant before bilateral APA can be entered into.

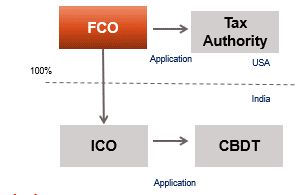

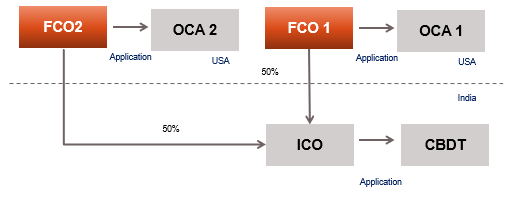

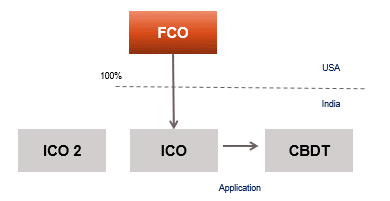

Types of APA – Multilateral APA

involves Applicant (i.e., the taxpayer), Two or more AEs, Two or more foreign tax authorities, and CBDT

Note :

- In Multilateral APA, applicant is required to make an application with competent authority of India and simultaneously the applicant or its AE should apply to competent authorities of the other Countries.

- CBDT has to reach an arrangement through MAP with competent authorities of more than one Country. Mutual Agreement Procedure has to be accepted by applicant before multilateral APA can be entered into.

Requirements to request for Bilateral or Multilateral APA

Request for bilateral or multilateral APA can be accepted by the Indian competent authority on satisfaction of following conditions:

- India has a tax treaty (i.e., DTAA) with the Other Contracting State, and such treaty has an Article on ‘Mutual Agreement Procedure’ (MAP);

- Corresponding APA program is also there in the other country.

Advantages of Advance Pricing Agreement (APA) Program

The APA program is designed to provide following advantages : –

- Certainty over determination of ALP of covered international transaction;

- Flexibility in developing practical approaches for complex transfer pricing issues;

- Reduce risk of potential double taxation via Bilateral and Multi-lateral APA;

- Reduce compliance costs by eliminating the risk of transfer pricing audit and resolving time consuming litigation;

- Reduce the burden of record keeping, as required documentation of the APA are known in advance.

Purpose of APA – Section 92CC

The APA shall be entered into

for the purpose of determination of

the arm’s length price or

specifying the manner (i.e., method of determining arm’s length price)

in which arm’s length price shall be determined,

in relation to international transaction.

Note – APA is not applicable for Specified Domestic Transactions

Manner of Determination of ALP in Advance Pricing Agreement – Section 92CC

The manner for determination of

arm’s length price in the APA, may include

CUP, TNMM, RPM, etc. [as defined in section 92C(1)] or

any other method, with necessary adjustments or variations as may be decided in APA.

ALP Of International Transaction in case of APA – Section 92CC

In case an APA has been entered into

in respect of any international transaction,

the arm’s length price of that transaction shall be determined

in accordance with that APA

Example : –

ICO (Indian company) , which avails consulting services from its foreign AE, has entered into an APA with CBDT and ALP under APA was determined at Rs. 10 lakh under APA.

- Whether Assessing officer can challenge such arm’s length price and make reference to transfer pricing officer (u/s 92CA) to determine arm’s length price of such transaction ?

- Whether Assessing officer can challenge arm’s length price determined under APA on the ground that arithmetic mean method under Section 92C is not used, where more than one price is available ?

Applicability of Advance Pricing Agreement – Section 92CC

Solution : –

The provisions of the APA shall override the provisions of section 92C or section 92CA, which are normally applicable for determination of arm’s length price. Thus, the Assessing officer cannot challenge arm’s length price determined under APA on aforesaid grounds.

Validity Period of APA – Section 92CC

The APA shall be valid for the period specified therein subject to a maximum period of more than 5 consecutive previous years.

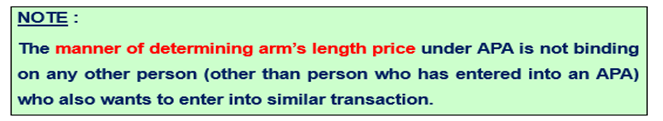

Binding Nature of Advance Pricing Agreement (APA) – Section 92CC

The APA shall be binding on : –

a) The person who has entered into an APA, in respect of the transaction specified in APA; and

b) The Principal Commissioner or Commissioner and the income-tax authorities subordinate to him, in respect of the said person and the said transaction.

Example : –

ICO (Indian Company) entered into APA with CBDT to determine arm’s length price of Silk Cotton, to be imported from Foreign Company (UK). ICO 1 (another Indian company) wants to import same silk cotton from its Foreign Company (UK). ICO 1 wants to adopt same method as determined under APA of ICO with CBDT.

Analyse the followings situations :

- Whether ICO1 can adopt method specified in APA ?

- What would be your answer if ICO1 is a subsidiary of ICO ?

Applicability of APA (Advance pricing Agreement) – Section 92CC

Solution : –

- APA is binding only on the applicant who has entered into an APA and not on any other person. Thus, ICO1 cannot adopt method specified in APA entered by ICO.

- APA is binding only on the applicant who has entered into an APA and not on any other person. Therefore, answer will remain same even if ICO1 is a subsidiary of ICO.

Applicability of APA in case of change in law or facts – Section 92CC

The APA shall not be binding on the applicant or income-tax authorities if there is

- any change in law ; or

- any change facts

which have impact on such APA.

Conditions to declare APA as void AB initio – Section 92CC

If the CBDT finds that the APA has been obtained

by the person

by way of fraud or

misrepresentation of facts,

the CBDT may declare such APA to be void ab initio,

with the approval of Central Government.

CONSEQUENCES OF DECLARATION OF AN APA AS VOID AB INITIO – SECTION 92CC

Declaration of an APA (ADVANCE PRICING AGREEMENT) as void ab initio has following repercussions :

a) IT Act provisions would be applicable to applicant, assuming the APA was never entered.

CONSEQUENCES OF DECLARATION OF AN APA AS VOID AB INITIO – SECTION 92CC

EXAMPLE : –

ICO has entered into an APA with CBDT for international transactions on 31.12.2016, during PY 2016-17. Such APA was declared as void ab initio by CBDT during PY 2017-18 on September 30, 2017 . Whether ICO can adopt the transfer pricing method declared in APA while computing its taxable income of AY 2017-18 ?

SOLUTION : –

When APA is declared as void-ab-initio then, all the provisions of the Act shall apply to such person, as if such APA had never been entered into. Thus, such APA would be void from the beginning when such APA was entered into (i.e., from PY 2016-17). Accordingly, the ICO cannot adopt the transfer pricing method arrived at in the APA while computing its taxable income of AY 2017-18.

Declaration of an APA as void ab initio has following repercussions :

b. The period beginning with the

date of such APA and

ending on the date of order declaring the APA as void ab initio,

shall be excluded

for the purpose of computation of period of limitation

under the Act (viz., period of limitation specified in the

Section 153, 153B, etc).

ICO has made APA with CBDT on October 30, 2018 for international transactions entered with foreign subsidiary during the PY 2017-18. However, it was discovered that the ICO has misrepresented certain facts and accordingly, such APA was declared as void-ab-initio by CBDT on November 20, 2018. Calculate the period of limitation for completing scrutiny assessment under Section 143(3) for AY 2018-19 ?

SOLUTION : –

As per Section 153 of the IT Act, scrutiny assessment should be completed within 18 months from the end of AY in which income was assessable [For AY 2018-19]. Thus, the normal time-limit to complete the scrutiny assessment for AY 2018-19 is September 30, 2020.

However, the period beginning with the date of APA and ending on the date when APA was declared as void-ab-initio (i.e., 21 days) should be excluded from the limitation period under Section 153. Thus, the normal time-limit under Section 153 (i.e., September 30, 2020) would be further extended by 21 days. The extended period to complete assessment would be October 21, 2020.

PROCEEDING DEEMED TO BE PENDING IN CASE OF ADVANCE PRICING AGREEMENT (APA) – SECTION 92CC

If an application is made by a person for entering into an APA, then, the proceeding in respect of such person shall be deemed to be pending.

APA RULES

Advance Pricing Agreement Scheme has been prescribed for the purpose of section 92CC vide Notification No.36/2012 dated 30.8.2012 and Notification No.23/2015 dated 14.3.2015. The CBDT has prescribed rules specifying an APA Scheme.

PERSON ELIGIBLE TO APPLY FOR APA (ADVANCE PRICING AGREEMENT) – RULE 10G

Any person

- who has undertaken an international transaction; or

- is contemplating to undertake an international transaction, shall be eligible to enter into an APA under these rules.

Note :- APA is not Applicable for Specified Domestic Transactions.

PRE-FILING CONSULTATION UNDER ADVANCE PRICING AGREEMENT – RULE 10H

a) Any person proposing to enter into an APA may,

by an application in writing,

make a request for a pre-filing consultation

in the Form No. 3CEC

to the Director General of Income-tax (International Taxation).

b) The pre-filing consultation shall be for the purpose of :

- Determining the scope of the Advance Pricing agreement;

- Identifying transfer pricing issues which could be covered under APA;

- Whether the given international transaction is suitable for the agreement;

- Discussion on broad terms of the agreement.

c) The pre-filing consultation shall :

- not bind the CBDT or the proposed applicant to initiate APA process;

- not be deemed to mean that the person has applied for entering into an APA.

APPLICATION FOR ADVANCE PRICING AGREEMENT – RULE 10I

- An eligible person can apply for APA in Form No. 3CED (proof of payment of requisite fee required).

- Such application shall be furnished to :

- Director General of Income-tax (International Taxation) in case of unilateral APA and

- to the competent authority in India in case of Bilateral or Multilateral

TIME LIMIT FOR FILING ADVANCE PRICING AGREEMENT – RULE 10I

The APA application may be filed at any time –

- Before the first day of PY relevant to the first AY for which the application is made, in respect of transactions of a continuing nature from dealings that are already occurring; or

- before undertaking the transaction in respect of remaining transactions.

EXAMPLE 1 : –

ICO has undertaken transaction for sale of product A to its foreign subsidiary during the PY 2015-16, 2016-17 and 2017-18. It intends to apply for APA for same transaction, to be undertaken in the PY 2018-19. Determine the time limit for filing APA application ?

SOLUTION : –

In this case transaction of sale of Product A to foreign subsidiary is continuing in nature as the ICO has undertaken the same transaction in the PY 2015-16, 2016-17 and 2017-18. Hence ICO shall file the application for APA till March 31, 2018.

EXAMPLE 2 : –

In the previous example assume that the ICO has not undertaken transaction of sale of product A to its foreign subsidiary in any of the preceding years. If other fact remain same, determine the time limit for filing of APA application for the FY 2018-19?

SOLUTION : –

In this case ICO needs to file the APA application before the date of proposed transaction.

APPROVAL OF CENTRAL GOVERNMENT

The APA shall be entered into by the CBDT with the applicant after taking approval from the Central Government.

TERMS OF APA – RULE 10M – INCLUSIONS IN AN APA (ADVANCE PRICING AGREEMENT)

a) An APA may among other things, include :

- Covered international transactions covered by the APA;

- agreed transfer pricing methodology, if any;

- Determination of arm’s length price, if any;

- Definition of any relevant term to be used in agreed TP methodology/ determination of ALP.

- Critical assumptions i.e., the factors and assumptions that are so critical and significant that neither party will continue to be bound by the agreement, if any of the factors or assumptions is changed;

- Rollback provision referred to in Rule 10MA [i.e., APA terms would be applicable for preceding 4 years];

- The conditions, if any, other than provided in the Act or these rules.

TERMS OF APA – RULE 10M – CHANGE IN CONDITIONS/ CRITICAL ASSUMPTIONS

- The APA shall not be binding on the Board or the assessee if

- there is a change in any of critical assumptions or

- failure to meet conditions subject to which the APA has been entered into.

- In such a case the agreement can be revised or cancelled, as the case may be.

- The binding effect of agreement, shall cease, only if any party has given due notice of the concerned other party or parties.

Furnishing of annual compliance report – Rule 10-O

The assessee shall furnish an

annual compliance report in quadruplicate in

Form No. 3CEF

to Director General of Income-tax (International Taxation) for

each year covered in the agreement, within

- 30 days of the due date of filing income-tax return for that year, or

- within 90 days of entering into an APA, whichever is later.

EXAMPLE 1 : –

On August 1, 2018, ICO entered into an APA with CBDT for AY 2018-19. Determine the due date of filing of compliance report by ICO ?

SOLUTION : –

Compliance report shall be filed by the applicant

within 30 days of the due date of filing income-tax return (December 30, 2018) , or

within 90 days of entering into an APA (October 30, 2018) ,

whichever, is later.

Step I : Count 30 days from the due date of filing of income-tax returns – December 30, 2018

Step II : Count 90 days from the date of entering into an APA – October 30, 2018.

Due date mentioned in Step I (i.e., December 30, 2018) is after the due date mentioned in Step II (i.e., October 30, 2018). Thus, the compliance report shall be filed by the applicant till December 30, 2018.

EXAMPLE 2 : –

In the previous example, assume that ICO has entered into an APA on October 31, 2018 for AY 2018-19. Determine the due date of filing of compliance report by ICO ?

SOLUTION : –

Step I : Count 30 days from the due date of filing of income-tax returns – December 30, 2018;

Step II: Count 90 days from the date of entering into an APA – January 29, 2019.

Due date mentioned in Step I (i.e., January 29, 2019) is after the due date mentioned in Step I (i.e., December 30, 2018). Thus, the compliance report shall be filed by the applicant till January 29, 2019.

COMPLIANCE AUDIT OF THE AGREEMENT – RULE 10P

- The Transfer Pricing Officer having the jurisdiction over the assessee shall carry out the compliance audit of the APA for each of the year covered in the agreement. For this purpose, the Transfer Pricing Officer may require the assessee to –

- to substantiate compliance with the terms of the agreement, including satisfaction of the critical assumptions, correctness of the supporting data or information and consistency of the application of the transfer pricing method;

- submit any information, or document, to establish compliance with the terms of the agreement.

- The compliance audit report shall be furnished by the Transfer Pricing Officer within 6 months from the end of the month in which the Annual Compliance Report is received by the Transfer Pricing Officer.

EXAMPLE : –

On November 1, 2018, ICO submitted the annual compliance report for APA entered for AY 2018-19. Determine the due date of filing of compliance audit report by the TPO ?

SOLUTION : –

The compliance audit report shall be furnished by the Transfer Pricing Officer within six months from the end of the month in which the Annual Compliance Report is received by the Transfer Pricing Officer.

Thus, the due date of filing of compliance audit report by the transfer pricing officer would be May 31, 2019.

FAQ’S ON ANNUAL COMPLIANCE AUDIT

QUESTION 9 OF FAQ’S ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

Will there be compliance audit for roll back ? Would critical assumptions have to be validated during compliance audit ?

ANSWER : –

Since rollback provisions are for past years, ALP for the rollback years would be agreed after full examination of all the facts, including validation of critical assumptions. Hence, compliance audit for the rollback years would primarily be to check if the agreed price or methodology has been applied in the modified return.

REVISION OF AN APA (ADVANCE PRICING AGREEMENT) – RULE 10Q

Who can request revision ?

An APA, may be revised by the CBDT either

- suo moto or

- on request of the assessee or

- the competent authority in India or

- the Director General of Income-tax (International Taxation)

When can the revision be done ?

The revision can take place in following situations : –

- change in critical assumptions or failure to meet a condition, subject to which the APA was entered into;

- change in law that modifies any matter covered by the APA, but is not of the nature which renders the agreement to be non-binding ; or

- request from competent authority in the other country requesting revision of APA, in case of bilateral or multilateral agreement.

OPPORTUNITY OF BEING HEARD :

Except in case where the assessee has made request for revision of APA, it shall not be revised, unless

- an opportunity of being heard has been provided to the assessee and

- the assessee is in agreement with the proposed revision.

Applicability of revised APA (ADVANCE PRICING AGREEMENT) : –

The revised APA shall include the date till which the original agreement is to apply and the date from which the revised APA is to apply.

CANCELLATION OF AN APA (ADVANCE PRICING AGREEMENT) – RULE 10R

a) An agreement shall be cancelled by the CBDT for any of the following reasons : –

- compliance audit reveals assessee’s failure to comply with the APA terms;

- Failure to file the annual compliance report in time;

- Material errors in the annual compliance report furnished by the assessee; or

- the assessee disagrees with the proposed revision in APA or

- Rule 10RA(7) – When applicant had opted for APA with rollback provision and failed to give effect to rollback rules;

CANCELLATION OF AN APA – RULE 10R – FAQ

QUESTION 6 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

Rule 10RA(7) states that in case effect cannot be given to the rollback provision of an agreement in accordance with this rule, for any rollback year to which it applies, on account of failure on the part of applicant, the agreement shall be cancelled. It is to be clarified as to whether the entire agreement is to be cancelled or only that year for which roll back fails ?

ANSWER : –

The procedure for giving effect to a rollback provision is laid down in Rule 10RA. Subrules (2), (3), (4) and (6) of the Rule specify the actions to be taken by the applicant in order that effect may be given to the rollback provision. If the applicant does not carry out such actions for any of the rollback years, the entire agreement shall be cancelled.

CANCELLATION OF AN APA – RULE 10R

b. The CBDT shall give an opportunity of being heard to the assessee, before proceeding to cancel an application of APA.

c. The order of cancellation of the agreement

- shall be in writing and

- shall provide reasons for cancellation and for non-acceptance of assessee’s submission.

- specify the effective date of cancellation of the agreement, where applicable.

d. The order declaring the agreement as void ab initio, on account of fraud or misrepresentation of facts,

- shall be in writing and

- shall provide reason for such declaration and for non-acceptance of assessee’s submission.

OPERATION OF TRANSFER PRICING PROVISIONS IN CASE OF PENDING APA APPLICATION

Mere filing of an application for an APA shall not prevent the operation of Chapter X (i.e., transfer pricing provisions) of the Act for determination of arms’ length price till the APA is entered into.

NEGOTIATION IN CASE OF APA (ADVANCE PRICING AGREEMENT)

The negotiation between

the competent authority in India and the competent authority of other country or countries,

in case of bilateral or multilateral APA,

shall be carried out in accordance with the provisions of the tax treaty between India and the other country or countries.

PROVISION FOR ROLL BACK IN APA SCHEME – SECTION 92CC

In order to reduce pending as well as future litigation in respect of the transfer pricing matters, section 92CC(9A) provides for roll back mechanism in the APA scheme.

The CBDT has, vide Notification No.23/2015 dated 14.3.2015, prescribed conditions, procedure and manner for determining the arm’s length price or for specifying the manner in which arm’s length price is to be determined in an APA.

ROLL BACK MECHANISM – RULE 10MA

The APA may provide for determining the

arm’s length price or

specify the manner in which arm’s length price shall be determined

in relation to the international transaction

entered into by the person during the rollback year

EXAMPLE : –

ICO enters into an APA for the AY 2018-19 for international transaction with foreign AE. In this case the roll back year means AY 2017-18, 2016-17, 2015-16 and 2014-15.

CONDITIONS FOR APPLYING FOR ROLLBACK PROVISIONS – RULE 10MA

The APA shall contain rollback provision in respect of an international transaction subject to the following conditions : –

- The international transaction undertaken in roll back years should be same as the international transaction to which the APA (other than the rollback provision) applies;

QUESTION 2 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

Rule 10MA(2)(i) mandates that the rollback provision shall apply in respect of an international transaction that is same as the international transaction to which the agreement (other than the rollback provision) applies. It is not clear what is the meaning of the word “same”. Further, it is not clear whether this restriction also applies to the Functions, Assets, Risks (FAR) analysis ?

ANSWER : –

The term same international transaction implies that the transaction in the rollback year has to be of same nature and undertaken with the same associated enterprise(s), as proposed to be undertaken in the future years and in respect of which agreement has been reached. In the context of FAR analysis, the restriction would operate to ensure that rollback provisions would apply only if the FAR analysis of the rollback year does not differ materially from the FAR validated for the purpose of reaching an agreement in respect of international transactions to be undertaken in the future years.

EXAMPLE 1 : –

ICO wants to import silk from its foreign AE (UK) during the PY 2017-18. For said purpose it enters an APA with rollback provision. Whether roll back provision would apply for AY 2016-17 during which the silk was imported by ICO from its another foreign AE (USA) ?

SOLUTION : –

As per Question 2 of FAQs issued by CBDT, Roll back provision in APA would be made applicable for preceding four years only when international transaction undertaken in roll back years is of same nature and undertaken with same AE as proposed to be undertaken in future years in APA.

In this case import of silk was made with foreign AE located in USA during AY 2016-17. However, under APA same international transaction is proposed to be made with a different AE located in UK.

Thus, the roll back provision would not be applicable for silk imported during AY 2016-17.

EXAMPLE 2 : –

In above Example, suppose silk was imported from AE located in UK during the AY 2016-17. Whether rollback provision would be apply to such transaction?

SOLUTION : –

Roll back provision in APA would apply in AY 2016-17 as same international transaction was undertaken in AY 2016-17 with same AE, as proposed to be undertaken in PY 2017-18 under APA.

- the return of income for the relevant rollback year has been or is furnished by the applicant before the due date as specified in Explanation 2 of section 139(1) [i.e., income-tax return of rollback year has been furnished on or before November 30 of the relevant AY].

Whether applicants, who have filed belated returns under section 139(4) or revised return under section 139(5) of the Act would be eligible for roll back ?

SOLUTION

W.e.f. AY 2017-18, belated return can also be revised u/s 139(5). Thus now revise return can be filed under the following situations:

- When the original return was filed within due date prescribed under section 139(1).

- When the original return was filed under section 139(4).

Hence, applicant would be entitled for roll back in the year in which he has revised the original return which was filed within due date u/s 139(1).

However, rollback provisions will not be available in case of a return of income filed under section 139(4) because it is a return which is not filed before the due date.

- The Transfer Pricing report in respect of the international transaction had been furnished by applicant in Form No. 3CEB.

EXAMPLE 1 : –

ICO enters into an APA for AY 2018-19 , and filed its income-tax return for AY 2017-18 (i.e., roll back year) on November 30, 2017, but did not file Form No. 3CEB for AY 2017-18. Can ICO avail benefit of roll-back provision for international transaction undertaken in AY 2017-18?

SOLUTION : –

Since ICO has failed to file the transfer pricing report in the year of rollback (i.e., AY 2017-18), it cannot avail benefit of rollback provision in such year.

EXAMPLE 2 : –

In previous example, assume that ICO has entered into same transaction in AY 2016-17 and it had filed both income tax return and the transfer pricing report for AY 2016-17 on due date. Other facts remain unchanged.

Can it avail benefit of rollback provision in AY 2016-17 (rollback year) , even though it had not filed transfer pricing audit report in AY 2017-18 (another rollback year)?

SOLUTION : –

Benefit of rollback would be available in AY in which conditions related to rollback are satisfied. There is no need to satisfy such conditions in all the preceding 4 years of rollback. Thus, ICO can avail benefit of rollback in AY 2016-17, even when such benefit is not available in AY 2017-18.

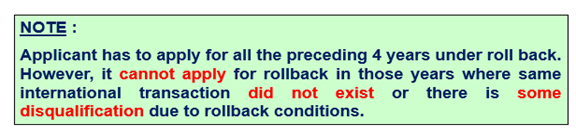

- The applicability of rollback provision has been requested by the applicant for all the rollback years (i.e., preceding 4 years) in which the same international transaction (i.e., the nature of international transaction should be same as proposed to be undertaken in APA) has been undertaken by the applicant.

QUESTION 3 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

Rule 10MA(2)(iv) requires that the application for rollback provision, in respect of an international transaction, has to be made by the applicant for all the rollback years in which the said international transaction has been undertaken by the applicant. Clarification is required as to whether rollback has to be requested for all four years or applicant can choose the years out of the block of four years ?

ANSWER : –

The applicant does not have the option to choose the years for which it wants to apply for rollback. The applicant has to either apply for all the four years or not apply at all. However, if the covered international transaction(s) did not exist in a rollback year or there is some disqualification in a rollback year, then the applicant can apply for rollback for less than four years.

EXAMPLE 1 : –

ICO wants to enter into an APA with rollback provision for international transaction to be undertaken in AY 2018-19. It had entered into same transaction in AYs 2017-18, 2016-17, 2015-16 and 2014-15. Whether it can request for rollback provision only for AY 2016-17 and AY 2015-16?

SOLUTION : –

As per Question No. 3 of FAQ issued by CBDT, the Applicant has to apply for rollback for all the four preceding years. Otherwise it can opt for APA without rollback provision. Thus, ICO cannot apply for rollback only in two preceding years.

EXAMPLE 2 : –

In the above example, assume that ICO had entered into following international transactions in preceding years:

| AY | Particulars |

| 2018-19 | Entered into same international transaction which is proposed to be undertaken in AY 2019-20 in APA and satisfies all conditions of rollback provisions |

| 2017-18 | Entered into different international transaction but satisfies all conditions of rollback provisions |

| 2016-17 | Entered into same international transaction but does not satisfies all conditions of rollback provisions |

| 2015-16 | Entered into same international transaction which is proposed to be undertaken in AY 2019-20 in APA and satisfies all conditions of rollback provisions |

If other facts remain unchanged then determine the rollback years for which benefit of APA could be availed by ICO ?

SOLUTION : –

As per Question No. 3 of FAQs issued by CBDT, benefit of rollback provision would be available in those years in which same international transaction has been entered and conditions of rollback provisions have been satisfied.

In this case benefit of rollback would be available only for AYs 2018-19 and 2015-16.

Application seeking rollback in Form 3CEDA

the applicant has made an application seeking rollback in Form 3CEDA in accordance with sub-rule (5);

QUESTION 11 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

For already concluded APAs, will new APAs be signed for rollback or earlier APAs could be revised?

ANSWER : –

The second proviso to Rule 10MA(5) provides for revision of APAs already concluded to include rollback provisions.

NON-APPLICABILITY OF ROLLBACK PROVISION

Rollback provision shall not be provided in respect of an international transaction for a rollback year, if,-

- Appellate Tribunal has passed an order on determination of arm’s length price of the said international transaction for the said year at any time before signing of the agreement; or

EXAMPLE : –

ICO has to make APA application for international transaction of royalty to be entered into with its subsidiary (UK) during the AY 2018-19. It had also entered into same international transaction of royalty with its subsidiary in AY 2014-15. However, determination of arm’s length price of said transaction of royalty has been subject matter of appeal and Tribunal has decided such issue for AY 2014-15. Whether ICO can apply for rollback for such transaction of royalty in AY 2014-15 ?

SOLUTION : –

ICO cannot apply for rollback in APA for AY 2014-15 as determination of arm’s length price of royalty has been decided by Tribunal. Thus, ICO can apply for rollback provision for only three AYs 2015-16, 2016-17 and 2017-18.

- the application of rollback provision has the effect of reducing the total income or increasing the loss, as the case may be, of the applicant as declared in the return of income of the said year.

QUESTION 5 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

Rule 10MA(3)(ii) provides that rollback provision shall not be provided in respect of an international transaction for a rollback year if the application of rollback provision has the effect of reducing the total income or increasing the loss, as the case may be, of the applicant as declared in the return of income of the said year. It may be clarified whether the rollback provisions in such situations can be applied in a manner so as to ensure that the returned income or loss is accepted as the final income or loss after applying the rollback provisions.

ANSWER : –

For example, if the declared income is Rs 100, the income as adjusted by the TPO is Rs 120, and the application of the rollback provisions results in reducing the income to Rs 90, then the rollback for that year would be determined in a manner that the declared income Rs 100 would be treated as the final income for that year.

MANNER FOR DETERMINING ARM LENGTH PRICE TO BE THE SAME FOR ROLLBACK YEARS AND OTHER PREVIOUS YEARS

Where the rollback provision specifies

the manner in which arm’s length price shall be determined

in relation to an international transaction

undertaken in any rollback year then

such manner shall be the same as the

manner which has been agreed to be provided

in the APA.

QUESTION 8 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

Rule 10MA(1) provides that the agreement may provide for determining ALP or manner of determination of ALP. However, Rule 10MA(4) only specifies that the manner of determination of ALP should be the same as in the APA. Does that mean the ALP could be different ?

ANSWER : –

Yes, the ALP could be different for different years. However, the manner of determination of ALP (including choice of Method, comparability analysis and Tested Party) would be same.

FILING APPLICATION FOR ROLLBACK PROVISION

The applicant may furnish along with the application for APA, the request for rollback provision in Form No. 3CEDA with proof of payment of an additional fee of Rs 5 lakh.

PROCEDURE FOR GIVING EFFECT TO ROLLBACK – RULE 10RA

Rule 10RA provides the “Procedure for giving effect to rollback provision of an APA as follows:

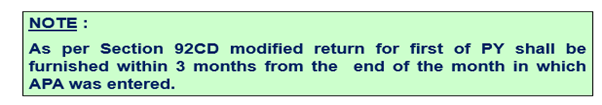

- The applicant shall furnish modified return of income [referred to in section 92CD] in respect of a rollback year along with the proof of payment of any additional tax arising as a consequence of and computed in accordance with the rollback provision.

- The modified return shall be furnished along with the modified return of first of the previous years for which the Agreement has been requested for in the application.

EXAMPLE : –

On December 10, 2018, ICO concluded an APA with rollback provision for AY 2018-19. Determine the time limit for filing modified returns for AYs 2018-19, 2017-18 (rollback year), 2016-17 (rollback year), 2015-16 (rollback year) and 2014-15 (rollback year).

SOLUTION : –

The modified return shall be furnished within 3 months from the end of the month in which APA was entered. Thus, modified return of AY 2018-19 shall be furnished till March 31, 2019 along with modified returns of AYs related to rollback years (i.e., AY 2014-15 to AY 2017-18).

QUESTION 12 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

For already concluded APAs, where the modified return has already been filed for the first year of the APA term, how will the time-limit for filing modified return for rollback years be determined ?

ANSWER : –

The time to file modified return for rollback years will start from the date of signing the revised APA incorporating the rollback provisions.

- WITHDRAWAL OF EXISTING PENDING APPEAL FOR ROLL BACK YEARS: –

If any appeal filed by the applicant

is pending before the

Commissioner (Appeals), Appellate Tribunal or the High Court

for a rollback year,

on the issue which is the subject matter of the rollback provision,

the said appeal to the extent of the subject covered under the APA

shall be withdrawn by the applicant

before furnishing the modified return. - WITHDRAWAL OF APPEAL BY PRINCIPAL COMMISSIONER/ COMMISSIONER : –

If any appeal filed by the

Assessing Officer or the Principal Commissioner or Commissioner

is pending before the Appellate Tribunal or the High Court

for a rollback year, on the issue which is subject matter of the

rollback provision for that year, the said appeal to the

extent of the subject covered under the APA,

shall be withdrawn by the

Assessing Officer or the Principal Commissioner or the Commissioner,

as the case may be, within three months of filing of modified return by the applicant.

QUESTION 4 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

Rule 10MA(3) states that the rollback provision shall not be provided in respect of an international transaction for a rollback year if the determination of arm’s length price of the said international transaction for the said year has been the subject matter of an appeal before the Appellate Tribunal and the Appellate Tribunal has passed an order disposing of such appeal at any time before signing of the agreement. Further, Rule 10 RA(4) provides that if any appeal filed by the applicant is pending before the Commissioner (Appeals), Appellate Tribunal or the High Court for a rollback year, on the issue which is subject matter of the rollback provision for that year, the said appeal to the extent of the subject covered under the agreement shall be withdrawn by the applicant.

There is a need to clarify the phrase “Tribunal has passed an order disposing of such appeal” and on the mismatch, if any, between Rule 10MA(3) and Rule 10RA(4) ?

ANSWER : –

The reason for not allowing rollback for the international transaction for which Appellate Tribunal has passed an order disposing of an appeal is that the ITAT is the final fact finding authority and hence, on factual issues, the matter has already reached finality in that year. However, if the ITAT has not decided the matter and has only set aside the order for fresh consideration of the matter by the lower authorities with full discretion at their disposal, the matter shall not be treated as one having reached finality and hence, benefit of rollback can still be given. There is no mismatch between Rule 10MA(3) and Rule 10RA(4).

- INFORMING THE APPELATE AUTHORITY : –

The applicant,

the Assessing Officer or

the Principal Commissioner or

the Commissioner, shall inform

the Dispute Resolution Panel or

the Commissioner (Appeals) or

the Appellate Tribunal or

the High Court, as the case may be,

the fact that an APA containing rollback provision has been entered into

along with a copy of the same as soon as it is practicable to do so.

PROCEDURE FOR GIVING EFFECT TO ROLLBACK – RULE 10RA- CANCELLATION OF APA

In Case effect cannot be given to the Rollback Provision of an Agreement in Accordance with this rule, for any rollback year to which it applies, on account of failure on the part of applicant, the agreement shall be cancelled.

EXAMPLE : –

On December 20, 2017, ICO has concluded an APA with rollback provision for AY 2017-18. ICO has filed the modified return for AY 2017-18 on March 31, 2018. However, it did not file the modified returns for rollback years (i.e., AYs 2016-17, 2015-16, 2014-15 and 2013-14) till March 31, 2018. What are the consequences of this default ?

SOLUTION : –

The modified return shall be furnished within 3 months from the end of the month in which APA was entered. Thus, modified return of AY 2017-18 shall be furnished till March 31, 2018 along with modified returns of AYs related to rollback years (i.e., AY 2013-14 to AY 2016-17).

In this case, the entire APA shall be cancelled as the applicant failed to file the modified return of rollback years within 3 months from the end of the month in which APA was entered.

MISCELLANEOUS FAQS ON ROLLBACK PROVISION

QUESTION 7 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

If there is a Mutual Agreement Procedure (MAP) application already pending for a rollback year, what would be the stand of the APA authorities? Further, what would be the view of the APA Authorities, if MAP has already been concluded for a rollback year?

ANSWER : –

If MAP has been already concluded for any of the international transactions in any of the rollback year under APA, rollback provisions would not be allowed for those international transactions for that year but could be allowed for other years or for other international transactions for that year, subject to fulfilment of specified conditions in Rules 10MA and 10RA. However, if MAP request is pending for any of the rollback year under APA, upon the option exercised by the applicant, either MAP or application for roll back shall be proceeded with for such year.

QUESTION 10 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

Whether applicant has an option to withdraw its rollback application? Can the applicant accept the rollback results without accepting the APA for the future years?

ANSWER : –

The applicant has an option to withdraw its roll back application even while maintaining the APA application for the future years. However, it is not possible to accept the rollback results without accepting the APA for the future years. It may also be noted that the fee specified in Rule 10MA(5) shall not be refunded even where a rollback application is withdrawn.

QUESTION 13 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

In case of merger of companies, where one or more of those companies are APA applicants, how would the rollback provisions be allowed and to which company or companies would it be allowed ?

ANSWER : –

The agreement is between the Board and a person. The principle to be followed in case of merger is that the person (company) who makes the APA application would only be entitled to enter into the agreement and be entitled for the rollback provisions in respect of international transactions undertaken by it in rollback years. Other persons (companies) who have merged with this person (company) would not be eligible for the rollback provisions.

To illustrate, if A, B and C merge to survive as C and C is the APA applicant, then the agreement can only be entered into with C and only C would be eligible for the rollback provisions. A and B would not be eligible for the rollback provisions. To illustrate further, if A and B merge to form a new company C and C is the APA applicant, then nobody would be eligible for rollback provisions.

QUESTION 14 OF FAQS ISSUED BY CBDT VIA CIRCULAR NO. 10/2015, DATED 10.06.2015 : –

In case of a demerger of an APA applicant or signatory into two or more companies (persons), who would be eligible for the rollback provisions?

ANSWER : –

The same principle as mentioned in the previous answer, i.e., the person (company) who makes an APA application or enters into an APA would only be entitled for the rollback provisions, would continue to apply. To illustrate, if A has applied for or entered into an APA and, subsequently, demerges into A and B (two entities), then only A will be eligible for rollback for international transactions covered under the APA. As B was not in existence in rollback years, availing or grant of rollback to B does not arise.

PROCEDURE FOR GIVING EFFECT TO AN APA (ADVANCE PRICING AGREEMENT) – SECTION 92CD

i. In case a person has entered into an APA and

prior to the date of entering into such APA,

he has furnished the return of income

for assessment year to which the APA applies,

then, such person shall,

within a period of 3 months

from the end of the month in which the said APA was entered into,

furnish a modified return,

notwithstanding any contrary provision contained in section 139.

EXAMPLE : –

On December 30, 2017, ICO has concluded an APA with rollback provision for AY 2017-18. However, it has already filed the income-tax return on November 30, 2017 for AY 2017-18. What is the procedure for giving effect to APA?

SOLUTION : –

ICO has to file the modified income-tax return for AY 2017-18 till March 31, 2018 along with the return for rollback years.

- Modifications can only be made in income-tax return on account of such APA.

- All other provisions of this Act shall apply as if the modified return is a return furnished under section 139, unless anything to the contrary is provided.

- If the assessment or reassessment proceedings for an assessment year to which the APA applies have been completed before the expiry of period allowed for furnishing of modified return, the Assessing Officer shall, in a case where modified return is filed as per the provisions of this section, proceed to assess or reassess or re-compute the total income of the relevant assessment year having regard to and in accordance with the APA.

Such order for assessment or reassessment or re-computation of total income shall be passed within a period of 1 year from the end of the financial year in which the modified return was furnished. This shall apply notwithstanding the period of limitation contained under section 153 or 153B or 144C.

The appeal against such order shall lie to Commissioner (Appeals) [Section 246A] - Where the assessment or reassessment proceedings for an assessment year to which the APA applies, are pending on the date of filing of modified return, the Assessing Officer shall proceed to complete the assessment or reassessment proceedings in accordance with the APA taking into consideration the modified return so furnished.

In this case, the time period of completion of pending assessment or reassessment [given under section 153 or 153B or 144C] shall be extended by 12 months. This shall apply notwithstanding the period of limitation contained under section 153 or 153B or 144C. - The assessment or reassessment proceedings shall be deemed to have been completed where :

- an assessment or reassessment order has been passed; or

- no notice has been issued under section 143(2) till the expiry of the limitation period provided under the said section.

For any queries, please write them in the Comment Section or Talk to our tax expert