Article 4 – Concept of Residence in Tax Treaties – Double Taxation Avoidance Agreement

Article 4 – General Structure

Importance of concept of residence

This Article provides the criteria as to who shall be considered a resident of a Contracting State. In case the application of such a criteria results in dual residency, the rules of determining the residential status of a person (tie breaker rule) are generally provided in the tax Treaty.

Article 4 – Resident

- Article 4, provides an exhaustive definition of the term resident, and provides that resident means

- any person who is liable to tax in a State under the laws of that State

- by reason of his domicile, residence, place of management or any other criterion of a similar nature (UN Model includes “place of incorporation” to the list of criteria for residency while OECD Model specifically provides that a recognized pension fund shall be considered as a resident.

- Residents also includes that State and any political subdivision or local authority thereof.

- Resident, does not include any person, who is liable to tax in a State in respect of only income from sources in that State or capital situated therein.

- Additionally, US Model explains the term ‘resident of a contracting state’ in Article 4(2) which Article, is missing in UN and OECD Model conventions.

ARTICLE 4 – RESIDENT – Liable to tax therein

Article – 4(2) – The breaker individual

Applicability

ARTICLE 4 – Residence – GENERAL STRUCTURE

Article 4 provides the criteria, as to who or which person, shall be considered a resident of a Contracting State. In case the application of such a criterion results in dual residency, the rules of determining the residential status of a person (tie breaker rule) are generally provided in the tax Treaty.

Generally, Article 4 comprises of the following sub-sections : –

- Article 4(1) – Definition of Resident ;

- Article 4(2) – Tie breaker Rule for an Individual ; and

- Article 4(3) – Tie breaker Rule for a Company.

IMPORTANCE OF CONCEPT OF RESIDENCE

The concept of residence is often used for the following purpose (Assume we are referring to the India USA Treaty) : –

- Determine the scope of Application of Treaty , i.e, who shall be considered resident of a country, since the Treaty between two countries generally applies to person who are resident of one (India or USA) or both (India and USA) the Contracting States.

- Allocate Taxing Rights between Treaty partners (India and USA) in respect of taxation of various income, i.e , whether a particular income shall be taxed only in India, only in USA or both in India and USA, and if its taxed in both the countries, what shall be the maximum tax that can be levied by the Source Country, where the income originates.

- Ascertaining Fiscal Domicile of an entity

- Resolving Double taxation cases

(i) Dual Residence cases, i.e, where the same person is resident of both the countries ; and

(ii) Double taxation – Where same income is taxable in both the State of Source and State of Residence .

Learn More about “Article 4 – Concept of Residence in Tax Treaties” – Subscribe International Tax Course

ARTICLE – 4(1) OF THE OECD MODEL TAX CONVENTION

For the purposes of this Convention, the term “resident of a Contracting State” means any person who, under the laws of that State, is liable to tax therein by reason of his domicile, residence, place of management or any other criterion of a similar nature, and also includes that State and any political subdivision or local authority thereof, as well as a recognized pension fund that State. This term, however, does not include any person who is liable to tax in that State in respect only of income from sources in that State or capital situated therein.

ARTICLE – 4(1) OF THE UN MODEL TAX CONVENTION

For the purposes of this Convention, the term “resident of a Contracting State” means any person who, under the laws of that State, is liable to tax therein by reason of his domicile, residence, place of incorporation, place of management or any other criterion of a similar nature, and also includes that State and any political subdivision or local authority thereof. This term, however, does not include any person who is liable to tax in that State in respect only of income from sources in that State or capital situated therein.

Paraphrasing the above definition, one can say that Article 4, provides an exhaustive definition of the term “Resident”, and provides that resident means

-

- Any person who is liable to tax in a State (India or USA) under the laws of that State (India or USA)

- by reason of his domicile, residence, place of management or any other criterion of a similar nature (UN Model includes “place of incorporation” to the list of criteria for residency, while OECD Model specifically provides that a recognized pension fund shall be considered as a resident.

- Residents also includes that State (India or USA) and any political subdivision (say a State in India (Maharashtra) or USA) or local authority thereof (local authority in India or local authority in USA) .

- Resident, does not include any person, who is liable to tax in a State in respect of only income from sources in that State or capital situated therein. For example, an Indian company is liable to tax in India on its global income. However, a US company, may be liable to tax in India (assuming that they do not have an office, PE or dependent agent in India) only on income from sources in India, and would therefore not qualify as a resident of India.

Learn More about “Article 4 – Concept of Residence in Tax Treaties” – Subscribe International Tax Course

ARTICLE – 4(1) OF THE INDIA AUSTRIA TREATY

For the purposes of this Convention, the term “resident of a Contracting State” means

any person who,

under the laws of that State,

is liable to tax therein

by reason of his domicile, residence, place of incorporation, place of management or any other criterion of a similar nature, and

also includes that State and

any political subdivision or local authority thereof.

This term, however, does not include any person who is liable to tax in that State in respect only of income from sources in that State or capital situated therein.

KEY FEATURES OF ARTICLE 4(1)

ARTICLE – 4(1) OF THE INDIA USA TREATY

For the purposes of this Convention, the term “resident of a Contracting State” means any person who, under the laws of that State, is liable to tax therein by reason of his domicile, residence, citizenship, place of management, place of incorporation, or any other criterion of a similar nature, provided, however, that :

(a) this term does not include any person who is liable to tax in that State in respect only of income from sources in that State; and

(b) in the case of income derived or paid by a partnership, estate, or trust, this term applies only to the extent that the income derived by such partnership, estate, or trust is subject to tax in that State as the income of a resident, either in its hands or in the hands of its partners or beneficiaries.

CATEGORIES OF TAXPAYERS COVERED

PERSON WHO IS LIABLE TO TAX IN A STATE BY CERTAIN SPECIFIED REASON

SOVEREIGN FUNDS ?

COLLECTIVE INVESTMENT VEHICLES ?

RESIDENT/RESIDENT OF OTHER CONTRACTING STATE – ADBUL RAZAK

PERSON – ARTICLE 3(1)(A)

India USA Treaty

the term “person” includes an individual, an estate, a trust, a partnership, a

company, any other body of persons, or other taxable entity

INTERPLAY OF ARTICLE 4(1) AND IT ACT

LIABLE TO TAX THEREIN

- Only person liable to tax under Contracting State are covered – Azadi Bachao SC

- “Tax” means one of taxes covered in Article 2

- “Therein” means in the State where he is a resident

WHEN COULD AN ENTITY NOT BE LIABLE TO TAX ?

INDIVIDUAL – LIABLE TO TAX ?

ARTICLE – 4(1) OF THE INDIA UAE TREATY

For the purposes of this Agreement the term ‘resident of a Contracting State’ means:

(a) …… ; and

(b) in the case of the United Arab Emirates: an individual who is present in the UAE for a period or periods totalling in the aggregate at least 183 days in the calendar year concerned, and a company which is incorporated in the UAE and which is managed and controlled wholly in UAE.

PARTNERSHIP – LIABLE TO TAX ?

PENSION FUNDS, CHARITABLE TRUSTS – WHETHER LIABLE TO TAX ?

EXCLUSIONS: –

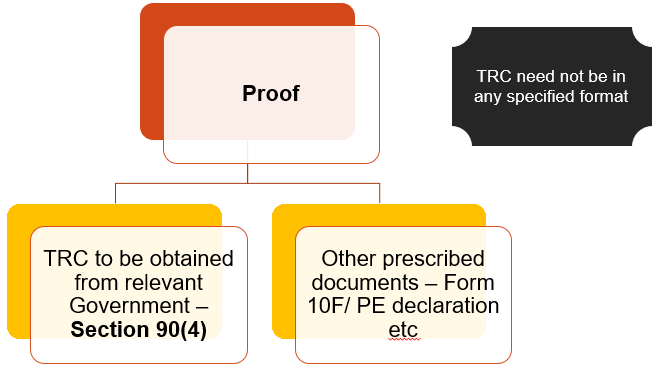

PROOF OF BEING “RESIDENT” OF CONTRACTING STATE

INFORMATION REQUIRED IN FORM 10 F

- Status of Tax payer

- PAN Number

- Nationality (in case of resident) or Country or Specified territory of incorporation or registration (in case of others)

- Assessee’s Tax Identification Number / Unique Number in the country or specified territory of residence

- Period of Residential Status (as mentioned in the Tax Residency Certificate)

- Address in the country or specified territory outside India, during the period for which the TRC obtained is applicable.

ARTICLE – 4(2) OF INDIA – USA TREATY – TIE BREAKER INDIVIDUAL

Where by reason of the provisions of paragraph 1 an individual is a resident of both Contracting States, then his status shall be determined as follows:

(a) He shall be deemed to be a resident only of the State in which he has a permanent home available to him; if he has a permanent home available to him in both States, he shall be deemed to be a resident only of the State with which his personal and economic relations are closer (centre of vital interests);

(b) If the State in which he has his centre of vital interests cannot be determined, or if he has not a permanent home available to him in either State, he shall be deemed to be a resident only of the State in which he has an habitual abode;

(c) If he has an habitual abode in both States or in neither of them, he shall be deemed to be a resident only of the State of which he is a national;

(d) If he is a national of both States or of neither of them, the competent authorities of the Contracting States shall settle the question by mutual agreement.

ARTICLE – 4(2) – TIE BREAKER INDIVIDUAL

PERMANENT HOME

CENTRE OF VITAL INTEREST

HABITUAL ABODE

HABITUAL ABODE – FACTORS CONSIDERED BY INDIAN COURTS

NATIONALITY

Learn More about “Article 4 – Concept of Residence in Tax Treaties” – Subscribe International Tax Course

ARTICLE – 4(3) – TIE BREAKER RULE – PERSON OTHER THAN AN INDIVIDUAL

Where by reason of application of paragraph 1 a

person other than an individual is a resident of both

Contracting States, then it shall be deemed to be a

resident only of the State in which its place of

effective management is situated

ARTICLE – 4(3) OF INDIA-USA TREATY

Where by reason of the provisions of paragraph 1

a person other than an individual

is a resident of both Contracting States,

then it shall be deemed to be a resident only of the State

in which its place of effective management is situated.

APPLICABILITY

WHEN A COMPANY CAN BE TAXED IN TWO STATE

PLACE OF EFFECTIVE MANAGEMENT

Place where

Key management and commercial decision

Necessary for the conduct of overall business

Are made

RELEVANT FACTORS

- Meeting of Board of Directors

- Place of CEO/ Senior members functioning

- Location of Headquarter

RELEVANT FACTORS

- Place where accounting records are kept

- Country governing legal status of the company

- Location of Headquarters

PROTOCOL TO INDIA – BELARUS TREATY

With reference to Article 4, it is understood that when establishing the “place of effective management” as used in paragraph 3 of Article 4, circumstances which may, inter alia, be taken into account are

the place where a company is actually managed and controlled,

the place where the decision making at the highest level on important policies essential for the management of a company takes place,

the place that plays a leading part in the management of a company from an economic and functional point of view and

the place where the relevant accounting books are kept.

INDIAN GUIDELINES ON POEM

PERIOD OF STAY

OTHER FACTORS

Learn More about “Article 4 – Concept of Residence in Tax Treaties” – Subscribe International Tax Course

ARTICLE – 4(2) OF THE OECD & UN MODEL– TIE BREAKER INDIVIDUAL

Where by reason of the provisions of paragraph 1 an individual is a resident of both Contracting States, then his status shall be determined as follows :

- he shall be deemed to be a resident only of the State in which he has a permanent home available to him;

- if he has a permanent home available to him in both States, he shall be deemed to be a resident only of the State with which his personal and economic relations are closer (centre of vital interests);

- if the State in which he has his centre of vital interests cannot be determined, or if he has not a permanent home available to him in either State, he shall be deemed to be a resident only of the State in which he has an habitual abode;

- if he has an habitual abode in both States or in neither of them, he shall be deemed to be a resident only of the State of which he is a national;

- if he is a national of both States or of neither of them, the competent authorities of the Contracting States shall settle the question by mutual agreement.

CASE STUDY 1 – CENTER OF VITAL INTEREST (PENDING)

Facts :

- A is an Indian national;

- A was working in Dubai for several years, living with his wife and children (studying in Dubai school)

- Derived rental income from India, which was less compared to the employment income

Issue

- Whether COVI of X was India or Dubai

Held

- COVI of X was in India

CASE STUDY 2 – CENTER OF VITAL INTEREST (PENDING)

Facts :

- “U” is an Indian national;

- “U” was deputed to USA, while his children underwent education in India and his family stayed with in laws;

Issue

- Whether COVI of U was India ?

Held

- COVI of U was in India

RETENTION OF TWO HOUSES (PENDING)

What if X, resident of State A , moves to State B (where he has a permanent home) and retains his permanent house in State A as well ?

What is he does not have a permanent home in either of the State ?

Learn More about “Article 4 – Concept of Residence in Tax Treaties” – Subscribe International Tax Course