Associated Enterprises Transfer Pricing- Section 92A (1)

Transfer Pricing provisions help in determining the price in a transaction between two or more international Associated Enterprises. The provisions of the Income Tax Act, 1961 define the term “Associated Enterprises” and also provide for situations where certain entities may also be defined as a ‘Deemed Associated Enterprise’. Below is a brief outlook of the concept of Associated Enterprises Transfer Pricing- Section 92A (1):

| Principle of International Taxation | Transfer Pricing |

| Transaction between | International Parties |

| Transfer Price | Price charged between two Associated Parties |

| Governing Provision | Section 92A (1) |

| Definition of Associated Enterprise | An enterprise directly or indirectly participates in:

Of another enterprise. |

Associated Enterprises Transfer Pricing – SECTION 92A (1)

Transfer Pricing provisions are applicable for international transaction between Associated enterprise (It is also applicable on certain specified domestic transaction between Associated enterprise). Such Associated enterprise may be actual AE , where they are covered under specific provisions defining AE’s under the IT Act, 1961, or under certain circumstances may be “Deemed as Associated Enterprises” (applicable to taxpayers, who try to circumvent being covered under Associated Enterprise provisions, through the use of structures involving third parties).

As per Section 92A (1) of the Act, the following cases would be covered within the definition of Associated enterprise : –

Direct or Indirect participation in management, control or capital of another enterprise by an enterprise

An enterprise (“F1”) , which participates directly or indirectly, or through one or more intermediaries in :

- Management of the “other enterprise” (“ICO”), or

- Control of the “other enterprise” (“ICO”), or_

- Capital of the “other enterprise” (“ICO”).

Under this clause, the enterprise, which ITSELF (“F1”) participates directly or indirectly in the Management, control or capital of the other enterprise, is treated as an Associated Enterprise with the enterprise, in which it has management, control or capital (“ICO”).

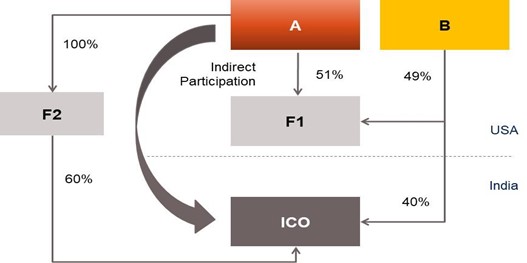

If you look at the under mentioned Diagram 1.16, the following shall be AE’s : –

- F1 participate directly in ICO in Diagram 1.16 , thus F1 and ICO are AE’s.

- In Diagram 1.17 : –

- F1 participate indirectly in M, and therefore, F1 and M are AE’s.

- F1 participate directly in F2, and thus F1 and F2 are AE’s .

- Further, F2 participate directly in M, and therefore even the two entities are also AE’s .

Diagram 1.16

Diagram 1.17

Direct or Indirect participation in management, control or capital of another enterprise jointly by one or more enterprise

If one or more persons (“A and B”), participates directly or indirectly, or through one or more intermediaries in : –

- Management of two different enterprises;

- Control of two different enterprises;

- Capital of two different enterprise.

Under this clause , where one or more person (Participant/s), participate directly or indirectly in the Management, control or capital of another enterprise, the participants, between themselves (“A and B”), would be treated as Associated Enterprise.

If you look at the under mentioned diagram 1.18, A and B shall be AE’s of ICO , since both of them participate in the capital of ICO : –

- A participate indirectly in ICO for more than 26%, and thus A and ICO are AE’s (60% stake) .

- B participate directly in ICO for more than 26%, and thus B and ICO are AE’s (40%) .

Diagram 1.18

Definition of the Term Enterprise

Section 92F(iii) provides that enterprise means a person and certain specified Permanent Establishment of a person who is currently engaged in any activity, or has been engaged in any activity or is proposed to be engaged in any activity directly by itself or through one or more of its units or divisions or subsidiaries, which may be located at the same place where the enterprise is located or at a different place or places. Such activity may relate to any of the following : –

- Production, storage, supply, distribution, acquisition or control of articles or goods, or know-how, patents, copy rights, trade-marks, licences, franchises or any other business or commercial rights of similar nature or any data, documentation, drawing or specification relating to any patent, invention, model, design, secret formula or process, of which the other enterprise is the owner or in respect of which the other enterprise has exclusive rights, or

- Provision of services of any kind, or in carrying out any work in pursuance of a contract, or in investment, or providing loan or in the business of acquiring, holding, underwriting or dealing with shares, debentures or other securities of any other body corporate.

For any queries, please write them in the Comment Section or Talk to our tax expert