Section 45 of Income Tax Act provides that any profits or gains, which arise from the transfer of a capital asset , which is effected in the previous year shall be chargeable to income tax under the head “Capital gain”and shall be deemed to be the income of the previous year in which the transfer took place.

Conditions to be satisfied for chargeability of Capital gains Tax – Section 45 of Income Tax Act

Following conditions should be satisfied under Section 45 for chargeability of capital gain tax: –

- There should be a capital asset .If an asset, is not a Capital Asset, profit arising from its transfer would not be taxable under the head capital gains

- The capital asset should have been transferred .

- The transfer should have been effected in the previous year .

- There should be a profits or gain arising on transfer of such capital asset .

No capital gain tax will arise , when such gains are exempt from tax under Sections 54, 54B, 54D, 54EC, 54F, 54G, or 54GA.

In the context of a non-resident seller, any capital gains which are chargeable to tax as income of any previous year, would be eligible for any beneficial treatment, which is given to such capital gains, in terms of the Indian tax treaty, with the country, where the non-resident seller qualifies as a tax resident.

Chargeability of Capital Gains – Section 45 of income tax act – Sale of resident vs non resident

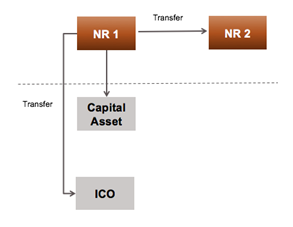

A foreign company or other non-resident is liable to capital gains tax in India,

on gains arising from transfer of a capital asset situated in India, whether such transfer is made to non-resident or a resident. Where the transfer of capital asset, is made by one non-resident to another non-resident, the purchaser of such Capital Asset is liable to withhold taxes from such payment, under the provisions of section 195 of the Income Tax Act.

EXAMPLE

Mr . Mahesh, transferred his residential house in India on March 31, 2017 , but received the sales consideration of property on April 20, 2017 . In which year would the capital gain tax liability arise?

SOLUTION : –

Capital gains will be deemed to be income of the previous year in which transfer took place . In this case, transfer took place in FY 2016-17 . Thus, capital gain tax liability will arise in FY 2016-17 and not in FY 2017-18 .

Meaning of Capital Asset – Section 2(14)

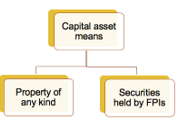

Capital asset means : –

- property of any kind held by an assessee, whether or not connected with his business or profession;

- any securities held by a Foreign Portfolio Investors (‘FPIs’) , which has invested in such securities in accordance with the SEBI regulations.

Capital Gains – Points to Consider

- Property of any kind held by assessee is a capital asset when it does not fall in negative listof capital assets (to be discussed later).

- Property includes –

- Movable assets like shares etc ;

- Immovable assets like Land, Building etc ;

- Intangible assets like Brand, Trademark, Patent etc ;

- Incorporeal rights

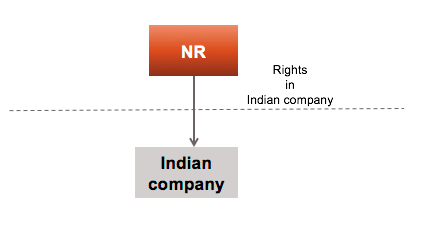

- Property also includes – any rights in or in relation to Indian company including rights of management or control or any other rights whatsoever.

Example

Emerging Equity Fund, was registered as Foreign Portfolio Investor (FPI) and made profit on sale of certain shares in Indian company during PY 2017-18 . FPI wants to show such profits as business income instead of capital gains . Whether the stand of the FPI is correct ?

Solution

Securities held by FPI are included in the definition of capital assets . Hence, income arising on their transfer would be capital gains chargeable to tax in India , subject to Treaty benefits available to the Emerging Equity Fund.

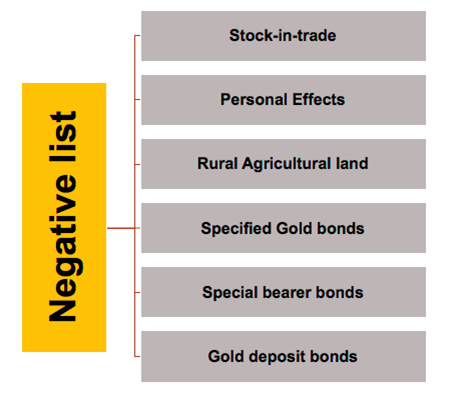

List of assets not considered as Capital Assets – Section 2(14)

The following assets are not treated as a Capital Asset, and accordingly any games arising on transfer of such assets are not liable to Tax under the head capital gains : –

Stock In Trade

The following stocks held by an assesse for the purpose of business or profession of the assessee , shall not be considered as capital asset : –

- Any stock-in-trade [other than securities held by FPIs]; or

- Consumable stores; or

- Raw materials

Personal Effects

Personal effects shall not be considered as capital asset of the assesse. The following are points worth noting in this regards : –

- It shall include movable property, including wearing apparel and furniture ;

- It should be held for personal use by the assessee or any dependent family member

- Personal effects shall not cover any immovable property held by assessee

For Example : – Refrigerator, TV, etc. should be treated as personal effects .

However, the following items are excluded from definition of personal effects, even if they satisfy the test for being personal effect discussed above :

- Jewellery; [Refer next slide for jewellery]

- Archaeological collections;

- Drawings;

- Paintings;

- Sculptures; or

- Any work of art .

Thus, aforesaid items will be treated as capital assets and accordingly, gains arising on transfer of such assets would be liable to tax as capital gains .

Definition of Jewellery

The expression ‘jewellery’ includes the following : –

- Ornaments made of gold, silver, platinum or any other precious metal; or

- Any alloy containing one or more of such precious metals

- Whether or not containing any precious or semi-precious stones

- Whether or not worked or sewn into any wearing apparel; or

- Precious or semi-precious stones,

- Whether or not set in any furniture, utensil or other article or

- Worked or sewn into any wearing apparel .

Rural Agricultural Land

Only Rural agricultural land in India is excluded from the definition of capital asset . Urban agricultural landor agricultural land situated outside India , would be treated as capital asset and capital gains arising on their transfer would be liable to tax as Capital Gains.

What is Urban Agricultural Land?

The following agricultural land, which are situated within the specified urban limits, would be considered as urban agricultural land –

- agricultural land situated in any area within the jurisdiction of a municipality or cantonment board, having population of not less than 10, 000 (according to last preceding census); or

- agricultural land , situated in any area, within such aerial distance from local limits of municipality or cantonment board, as shown hereunder –

| S.No | Population of municipality or cantonment board | Shortest aerial distance from local limits of municipality or cantonment board |

| 1 . | 10,001 – 1,00,000

(More than 10,000 but not exceeding 1,00,000) |

2 Kms (or less) |

| 2 . | 1,00,001-10,00,000

(More than 1,00,000 but not exceeding 10,00,000) |

6 Kms (or less) |

| 3 . | More than 10,00,000 | 8 Kms (or less) |

Section 45 of Income Tax Act

Sub-Section 1 – Any profits or gains arising from the transfer of a capital asset effected in the previous year shall, save as otherwise provided in sections 54, 54B, 54D, 54E, 54EA, 54EB, 54F, 54G and 54H , be chargeable to income-tax under the head “Capital gains”, and shall be deemed to be the income of the previous year in which the transfer took place.

For any queries, please write them in the Comment Section or Talk to our tax expert

Related Content

- No Exemption u/s 10 on Urban Agricultural Land – Explanation 1 to Section 2(1A)

- Short Term and Long Term Capital Assets

- Section 47 of Income tax act – Transactions not regarded as transfer

- Section 48 of Income Tax Act – Mode of Computation of Capital Gains

- Section 111a of Income tax act

- Section 112a of Income tax act