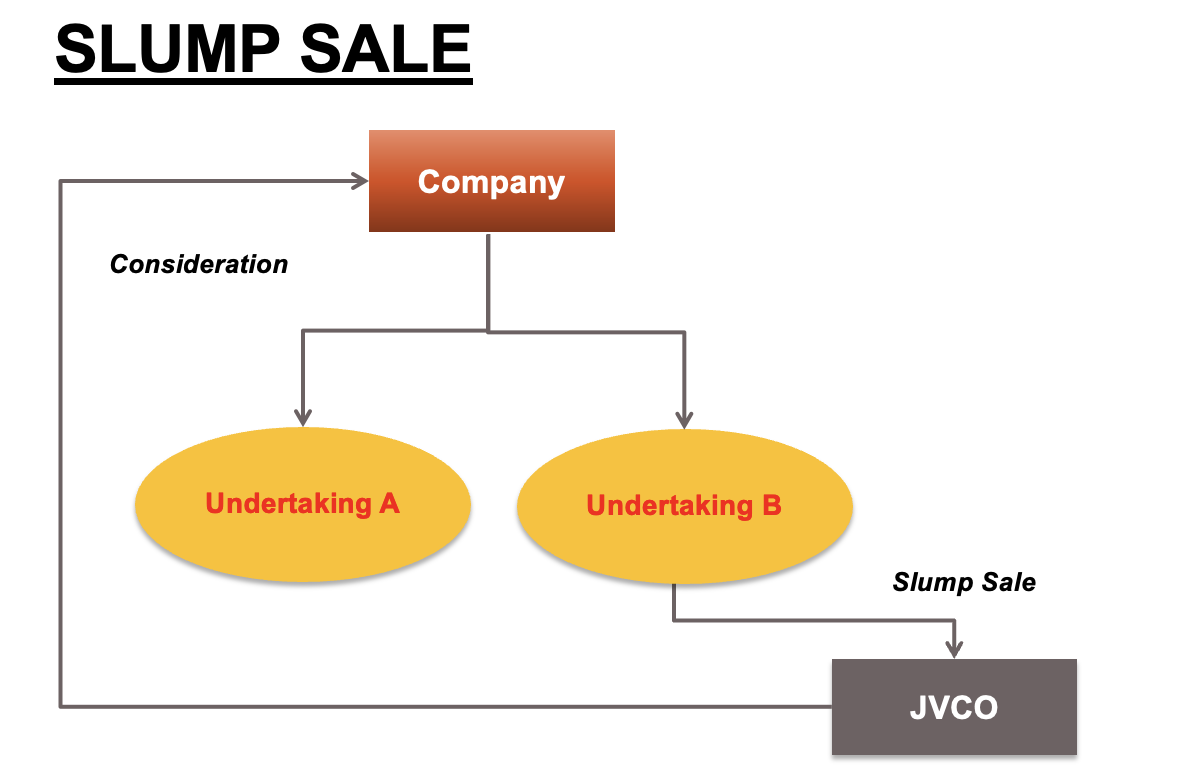

Slump Sale

Slump Sale Meaning ‘Slump sale’ meaning, relevant for Section 50B of the Income Tax Act, considers the following important aspects : – There is a transfer of one or more undertaking The transfer may be by any means (for cash consideration or through an exchange of shares/ other form of consideration) The transfer is for … Read more