Computation of Income having regard to the ALP- Section 92

Transfer Pricing provisions have ushered in a new era of regulating cross border transactions between Associated enterprises and addressing issues such as tax evasion, base erosion, etc. The Arm’s Length Price Principle helps in determining the price of a transaction between two unrelated parties. However indiscriminate application of this principle can result in base erosion. Determination of the price in a transaction is essential to calculate the tax liability. Therefore it is important to understand the Computation of Income having regard to the ALP- Section 92. Let’s take a look:

| Principle of International Taxation | Transfer Pricing |

| Transaction between | International Parties |

| Transfer Price | Price charged between two international Associated Enterprises |

| Arm’s Length Price Principle | Price charged between two unrelated parties |

| Provision governing Transfer Pricing in India | Section 92, Income Tax Act, 1961 |

| Types of transactions covered under Section 92 |

|

COMPUTATION OF INCOME HAVING REGARD TO THE ALP – SECTION 92 OF INCOME TAX ACT – APPLICABILITY OF ARM’S LENGTH PRINCIPLE

Section 92 of the IT Act, provides the nature of transaction which would be covered within the scope of Indian Transfer Pricing provisions. In certain cases, application of Indian Transfer Pricing provision may results in loss of revenue to the Indian government (“Base Erosion”). In such a case, even though a particular transaction may be covered under TP , the provision would not be applied.

According to the provision of Section 92 of the IT Act, the following transactions would be covered under Transfer Pricing : –

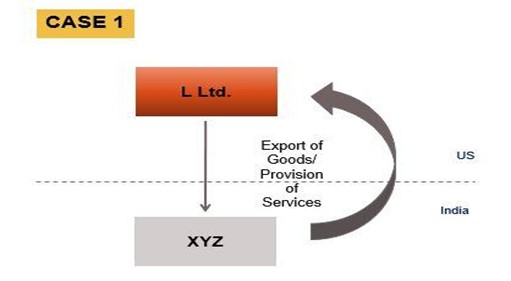

A. COMPUTATION OF INCOME ARISING FROM INTERNATIONAL TRANSACTION – DIAGRAM 1.13

Any income arising from an international transaction shall be computed on the basis of arm’s length price. For example, income from the following transaction, would be computed having regards to the arm’s length price :-

- Income from export of goods by an Indian company, to its non-resident Associated Enterprise (includes parent company, companies under common control etc);

- Income from Services provided by an Indian company, to its non-resident Associated Enterprise.

- Income by way of interest on loan given by an Indian company, royalty income earned by Indian company for use of brand etc.

DIAGRAM 1.13

B. ALLOWANCE OF AN EXPENSE/INTEREST UNDER INTERNATIONAL TRANSACTION

The allowance for any expense / allowance for interest as an expenditure, shall also be computed on the basis of arm’s length price of such expense/interest, for computing taxable income .

- Interest on Loan /Debentures paid by an Indian company to its non-resident AE;

- Payment of royalty by an Indian company to its non-resident AE;

- Expense incurred by an Indian company, towards service received from foreign AE,

- Import of goods by an Indian company, from its non-resident AE;

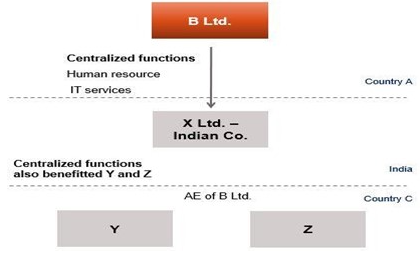

C. ALLOCATION OR APPORTIONAMENT OF COST OR EXPENSES UNDER A MUTUAL AGREEMENT – DIAGRAM 1.14

The cost or expenses allocated or apportioned between Associated enterprises under a mutual agreement or arrangement shall be at arm’s length price.

B Ltd., a foreign company, and an Associated Enterprise of X Ltd. , an Indian company, carries out certain centralized functions like Human Resource, obtaining finance, IT services etc., for several group companies, including X Ltd. and incurs various cost in provision of such services like salaries to its employees, IT cost etc. It proposes to allocate a part of such cost to X Ltd., Allocation of Cost of such centralized functions between X Ltd., Y and Z, shall be made, having regard to the arm’s length price of services obtained by each of these enterprises, using common basis, like time spent by common resource, etc.

Note : –

Any excess amount charged by B Ltd. over and above the fair value of services obtained by X Ltd. would not be allowed as a deduction to X Limited under the Indian Transfer Pricing provisions.

DIAGRAM 1.14

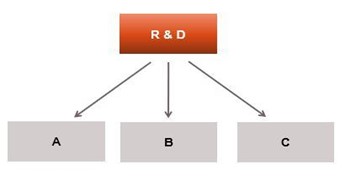

D. CONTRIBUTION TO ANY COST, EXPENSES FOR OBTAINING BENEFIT/SERVICE DIAGRAM 1.15

Sometimes more than one foreign company, may agree to jointly develop an asset through research, or set up some common facility whose benefit may be obtained by all the members who are contributing to the setting up of such facility. In such a case, any contribution to any cost, expenses to a common pool, for obtaining any benefit/service/facility by the Indian Company from its foreign AE, shall be allowed on the basis of the ALP of such benefit/service/facility . If the payment made is disproportionate , to the value of the benefit obtained by the Indian Company, such excess shall not be allowed as deduction for Indian tax purposes.

EXAMPLE: –

- Facts : – Associated enterprises A, B and C agreed to carry out a joint activity, such as research and development, which would help them improve product quality.

DIAGRAM 1.15

- TP implications

In this case, cost allocation will be made amongst associated enterprises having regard to the arm’s length price of the benefit from such research obtained by each of the entities.

BASE EROSION CONCEPT – NON-APPLICABILITY OF ARM’S LENGTH PRINCIPLE

- The purpose of Transfer Pricing provisions is to arrive at the arm’s length price for related party transactions, that results in computation of correct profits, and ensures that profits taxable in India are not understated (or losses are not overstated) by declaring lower receipts , or higher expenditure or other deductions, as compared to the price, which would have been declared by persons , who would enter into similar transactions with unrelated parties under same or similar circumstances.

- This prevents shifting of profits by MNE’s in overseas jurisdiction , through manipulation of prices charged by their overseas entities, or paid by Indian entity to overseas related parties in international transactions, thereby eroding the country’s tax base.

However in certain cases, application of the Transfer Pricing provisions, may result in reduction of profits taxable in India , either due to the fact that the arm’s length receipt is lower than actual receipt, or arm’s length expense is more than actual price charged in transaction. In such cases, Transfer Pricing provision are not required to be applied where the adoption of the arm’s length price would result in a decrease in the overall tax incidence in India in respect of the parties involved in the international transaction.

Note :-

The principle of arm’s length price shall not apply where its applicability would result in reducing the income or increasing the loss.

EXAMPLE: –

ABC Ltd. purchased goods at USD 200 per unit from its AE in USA. However, it was purchasing the same material at USD 250 per unit from independent third party located in USA. Evaluate whether the Arm’s Length Price (ALP) should be USD 200 or USD 250 ?

SOLUTION: –

In this case, arm’s length price, would be the price charged by an independent third party in similar transactions under same or similar circumstances, which is USD 250 per unit. If ABC. Ltd applies such price, it would be entitled to claim deduction for USD 250, which would increase the purchasing cost of ABC Ltd. and consequently, reduce its taxable profits by USD 50 per unit.

Thus, Transfer Pricing provisions would not be applied in this case and the actual transaction price of USD 200 per unit will be considered as the arm’s length price for computation of income.

Case Study 1 – Transfer Pricing – Applicability of Base Erosion Concept

The case of Alpha Inc. was undertaken for scrutiny assessment u/s 143(2). Given the large number of international transaction, the AO referred the case to the Transfer Pricing Officer to determine the arm’s length price of the international transactions. Keeping in mind the provisions of Base Erosion, you are required to comment whether the following adjustments proposed by the Transfer Pricing officer can be validly made : –

| Situation | Transaction | Amount determined by Assessee

(Rs. in crores) |

Amount

Proposed by TPO |

| 1. | Purchase of raw-materials | 250 | 200 |

| 2. | Payment of royalty | 10 | 12.5 |

| 3. | Sale of finished goods | 100 | 125 |

| 4. | Interest-free loan obtained | – | 15 |

| 5. | Receipt of fee for Technical Services | 125 | 155 |

| 6. | Guarantee fees paid to Holding Company | 1.5 | 1.25 |

Solution

The Transfer Pricing provisions are intended to ensure that profits taxable in India are not understated (or losses are not overstated) by declaring lower receipts, or higher expenditure or other deductions, than those, which would have been declared by persons entering into similar transactions with unrelated parties in the same or similar circumstances. However, in certain cases, application of the Transfer Pricing provisions, may result in : –

- Reduction of profits taxable in India ; or

- Increase the expenses, allowable as a deduction for Indian tax purposes.

In all such cases, Transfer Pricing provision are not required to be applied where the adoption of the arm’s length price would result in a decrease in the overall tax incidence in India in respect of the parties involved in the international transaction. The Base Erosion concept provides that the principle of arm’s length price shall not apply where its applicability would result in reducing the income or increasing the loss.

In the present case, the impact of Transfer pricing adjustment proposed to be made by the TPO are as under : –

| Situation | Transaction | Impact of the Proposed Adjustment |

| 1. | Purchase of raw-materials | Increase in Taxable Profit by Rs. 5 |

| 2. | Payment of royalty | Reduction in Taxable Profit by Rs. 2.5 |

| 3. | Sale of finished goods | Increase in Taxable Profit by Rs. 15 |

| 4. | Interest-free loan obtained | Reduction in Taxable Profit by Rs. 15 |

| 5. | Receipt of fee for Technical Services | Increase in Taxable Profit by Rs. 30 |

| 6. | Guarantee fees paid to Holding Company | Reduction in Taxable Profit by Rs. 0.25 |

In Situation 2, 4 and 6 and above, the proposed adjustment by the TPO shall result in reduction of the overall tax liability. In view of this, the Base Erosion concept shall apply, and accordingly the TPO shall not make any adjustment to the price proposed by the assessee. However, in all the other cases, since the proposed adjustment results in an increase in the overall tax liability, the TPO can make the proposed adjustment.

Case Study – Applicability of Transfer Pricing and Base Erosion

Identify whether transfer pricing provisions would be applicable on the following transactions : –

- Interest free loan given to the Indian company by its parent

- Interest free loan given by the Indian company to its wholly owned subsidiary in Japan

- Free laptops provided by Alpha USA to who is Associated Enterprise, B Ltd India

- Machinery provided by Beta Pty Singapore, to its wholly owned subsidiary in exchange of BPO services provided by the WOS.

Solution

Transfer Pricing regulations are designed to prevent shifting of profits, by manipulating prices charged by overseas entity or paid by Indian entity in international transactions, thereby eroding the country’s tax base. However in certain cases, application of the Transfer Pricing provisions, may result in reduction of profits taxable in India or increase the expenses, allowable as a deduction for Indian tax purposes. In such cases, Transfer Pricing provision are not required to be applied where the adoption of the arm’s length price would result in a decrease in the overall tax incidence in India in respect of the parties involved in the international transaction. In view of this, the specific comments are as under : –

| Particulars | Amount |

| Interest free loan given to the Indian company by its parent | NA – Charging of interest would reduce taxable profits of Indian entity. |

| Interest free loan given by the Indian company to its wholly owned subsidiary in Japan |

Applicable – Charging of interest would increase taxable profits of Indian entity. |

| Free laptops provided by Alpha USA to who is Associated Enterprise, B Ltd India | NA – Charging of depreciation of price of laptops would reduce taxable profits of B Ltd India |

| Machinery provided by Beta Pty Singapore, to its wholly owned subsidiary in exchange of BPO services provided by the WOS. | Applicable – Charging of service fee for BPO services would increase taxable profits of Indian entity. Benchmarking machinery cost would ensure adequate depreciation is charged that would impact taxable profits of Indian entity. |

For any queries, please write them in the Comment Section or Talk to our tax expert