Double Taxation Avoidance Agreement – Article 11 Taxation of Interest

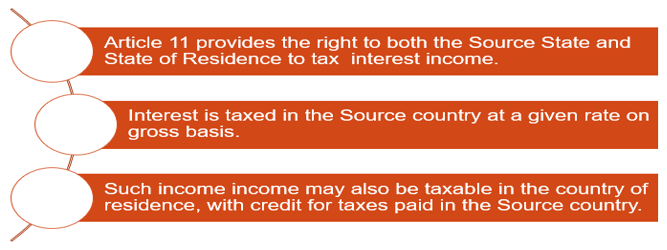

This Article provides the right to both the countries in respect of taxation of interest. Generally, the interest is taxed in the sourced country at a given rate on gross basis. Thereafter such income may be taxable in the country of residence with credit for taxes paid in the sourced country.

| Article/Para No. | OECD Model Tax Convention on Income and on Capital 2017 | UN Model Convention 2017 | |||||||||||||||

| 11 | INTEREST | INTEREST | |||||||||||||||

| 1 | Interest arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other State. | Interest arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other State. | |||||||||||||||

| Article 11 (1) of the OECD and UN Model provides that the Source State may tax interest income arising in such State , and the residence State also has a right to tax interest.

The term “Paid”, used in the Article should not be restricted to physical payment , but may also be extended to performance in kind or set off amounts. |

|||||||||||||||||

| 2 | However, interest arising in a Contracting State may also be taxed in that State according to the laws of that State, but if the beneficial owner of the interest is a resident of the other Contracting State, the tax so charged shall not exceed 10 per cent of the gross amount of the interest. The competent authorities of the Contracting States shall by mutual agreement settle the mode of application of this limitation. | However, such interest may also be taxed in the Contracting State in which it arises and according to the laws of that State, but if the beneficial owner of the interest is a resident of the other Contracting State, the tax so charged shall not exceed ___ per cent (the percentage is to be established through bilateral negotiations) of the gross amount of the interest. The competent authorities of the Contracting States shall by mutual agreement settle the mode of application of this limitation. | |||||||||||||||

| ARTICLE 11 – INTEREST

Interest is taxed in both, the Source State as well as the Resident State, where the right of the Source State is limited to a concessional rate. Article 11(2) of the OECD Model differs from Article 11(2) of the UN Model to the extent that it provides that the tax in State S “shall not exceed 10% of the gross amount of interest”, but the UN Model leaves this percentage to be established through bilateral negotiations. To get the concessional rate of tax, the recipient of interest should be: a) a beneficial owner of Interest; and b) a resident of other Country. |

|||||||||||||||||

|

3 |

The term “interest” as used in this Article means income from debt-claims of every kind, whether or not secured by mortgage and whether or not carrying a right to participate in the debtor’s profits, and in particular, income from government securities and income from bonds or debentures, including premiums and prizes attaching to such securities, bonds or debentures. Penalty charges for late payment shall not be regarded as interest for the purpose of this Article. | The term “interest” as used in this article means income from debt-claims of every kind, whether or not secured by mortgage and whether or not carrying a right to participate in the debtor’s profits, and in particular, income from government securities and income from bonds or debentures, including premiums and prizes attaching to such securities, bonds or debentures. Penalty charges for late payment shall not be regarded as interest for the purpose of this article. | |||||||||||||||

| This paragraph provides for an exhaustive definition of interest. The definition of interest in OECD and UN Model is similar.

Interest has been defined to mean income from debt claims of every kind. The OECD commentary excludes application of this definition to non-traditional financial instruments without underlying debt, like interest rate swaps. Penalty charges for late payment are excluded from interest but Contracting States can agree otherwise |

|||||||||||||||||

| 4 | The provisions of paragraphs 1 and 2 shall not apply if the beneficial owner of the interest, being a resident of a Contracting State, carries on business in the other Contracting State in which the interest arises through a permanent establishment situated therein and the debt-claim in respect of which the interest is paid is effectively connected with such permanent establishment. In such case the provisions of Article 7 shall apply. | 4. The provisions of paragraphs 1 and 2 shall not apply if the beneficial owner of the interest, being a resident of a Contracting State, carries on business in the other Contracting State in which the interest arises, through a permanent establishment situated therein, or performs in that other State independent personal services from a fixed base situated therein, and the debt-claim in respect of which the interest is paid is effectively connected with (a) such permanent establishment or fixed base, or with (b) business activities referred to in (c) of paragraph 1 of article 7. In such cases the provisions of article 7 or article 14, as the case may be, shall apply. | |||||||||||||||

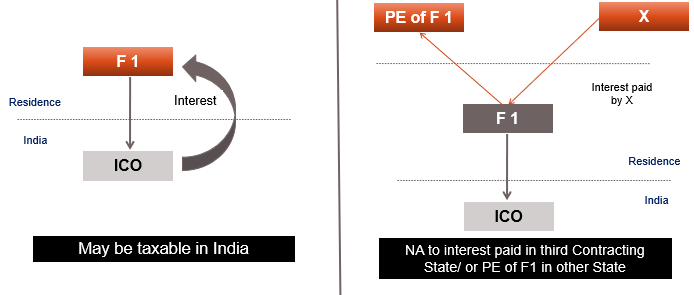

| • Article 7(4) provides that the provision of Article 11(1) & (2) will not apply if the beneficial owner of the interest has a PE in the Source State, which carries on business and debt claim is effectively connected with that Source State PE. In such a case, Article 7 – Business Profits or Article 14 – Independent Personal Services (in case of UN Model) will apply.

Article 11(4) of OECD Model is similar to Article 11(4) of UN Model, with certain differences as under: – • UN Model Convention refers to interest connected to a fixed base (independent personal services) as well as a PE (Business profits). • Un Model also applies to activities of same or similar kind as those effected through the PE in the Source State (unlikely to create any material difference) If an Indian company takes a loan from Indian branch of a foreign bank, and pays interest, such interest shall be taxable as business profits in the hands of Foreign bank in India as it is effectively connected with the PE in India.

|

|||||||||||||||||

| 5 | Interest shall be deemed to arise in a Contracting State when the payer is a resident of that State. Where, however, the person paying the interest, whether he is a resident of a Contracting State or not, has in a Contracting State a permanent establishment in connection with which the indebtedness on which the interest is paid was incurred, and such interest is borne by such permanent establishment, then such interest shall be deemed to arise in the State in which the permanent establishment is situated. | 5. Interest shall be deemed to arise in a Contracting State when the payer is a resident of that State. Where, however, the person paying the interest, whether he is a resident of a Contracting State or not, has in a Contracting State a permanent establishment or a fixed base in connection with which the indebtedness on which the interest is paid was incurred, and such interest is borne by such permanent establishment or fixed base, then such interest shall be deemed to arise in the State in which the permanent establishment or fixed base is situated. | |||||||||||||||

| This paragraph provides that Interest shall be deemed to arise in a Contracting State in the following two situations : –

• Payer is a resident of that State; • A non resident (may even be a resident of third country), has a permanent establishment in the source state, and the borrowing was for the PE, which had also borne such interest. Example – A UK Co., had an Indian PE for which it took a loan from US Co. While interest was paid by UK Co. to the US Co., it was borne by the branch in India. Interest in such case would arise in India and India-US tax treaty will apply. |

|||||||||||||||||

| 6 | Where, by reason of a special relationship between the payer and the beneficial owner or between both of them and some other person, the amount of the interest, having regard to the debt-claim for which it is paid, exceeds the amount which would have been agreed upon by the payer and the beneficial owner in the absence of such relationship, the provisions of this Article shall apply only to the last-mentioned amount. In such case, the excess part of the payments shall remain taxable according to the laws of each Contracting State, due regard being had to the other provisions of this Convention. | 6. Where, by reason of a special relationship between the payer and the beneficial owner or between both of them and some other person, the amount of the interest, having regard to the debt-claim for which it is paid, exceeds the amount which would have been agreed upon by the payer and the beneficial owner in the absence of such relationship, the provisions of this article shall apply only to the last-mentioned amount. In such case, the excess part of the payments shall remain taxable according to the laws of each Contracting State, due regard being had to the other provisions of this Convention. | |||||||||||||||

Learn More about “Double Taxation Avoidance Agreement – Article 11 Taxation of Interest” – Subscribe International Tax Course

Taxation of Interest – Article 11

MECHANICS

COMPONENTS OF INTEREST TAXATION

- Right of State of Residence to tax interest

- Right of State of Source (India) to tax interest

- What is covered/excluded under Interest?

- PE in India – Impact on taxation

- Source of Interest

- Arm’s length interest

RESIDENCE BASED DEDUCTION

Interest due to FCO not allowed / Only interest due to M Co allowed ?

May be covered under Non Discrimination and allowance may be claimed by ICO for interest to FCO.

KEY ISSUES AROUND ARTICLE 11

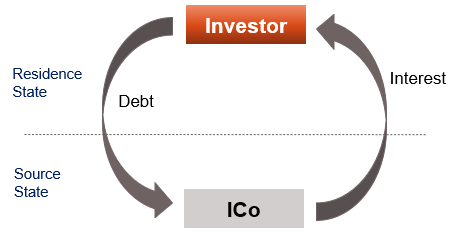

Facts:

Investor lends to ICO which pays interest on such loan .

Issues:

- Whether interest should be taxed in : –

- Source State only ?

- Residence State only ?

- Both Source State and Residence State ?

- What is meant by Interest ?

- Whether only Interest “paid” should be taxed or remaining unpaid should be taxed as well ?

ARTICLE 11 (1) – INDIA USA TREATY – RIGHT OF STATE OF RESIDENCE TO TAX INTEREST

Interest arising in a Contracting State (Source State)

and

paid to a resident of the other Contracting State (Residence State)

may be taxed in that other State (Residence State) .

KEY CHARACTERSTICS

- Interest should be both (a) Arise in Source State (b) Paid

- Recipient should be a Resident of the other Contracting State

- Both Source and Resident State have right to tax

- To ascertain whether interest has arisen which provisions should be applicable ?

Definition of interest as per Article 11 should apply, unless the provision of IT Act are more beneficial

ARTICLE 11 (2) INDIA USA – RIGHT OF SOURCE STATE TO TAX INTEREST

However, such interest may also be taxed

in the Contracting State in which it arises,

and according to the laws of that State,

but if the beneficial owner of the interest is a resident of the other Contracting State,

the tax so charged shall not exceed :

a. 10 per cent of the gross amount of the interest if such interest is paid on a loan granted by a bank carrying on a bona fide banking business or by a similar financial institution (including an insurance company) ; and

b. 15 per cent of the gross amount of the interest in all other cases.

KEY CHARACTERSTICS

- Source State also has a right to tax interest – According to its own laws

- If the recipient is a beneficial owner of interest + Resident of Other Contracting State, right to tax in Source State limited to a specified %

- “Tax” shall include surcharge

- Tax rate applies to gross interest, irrespective of available deductions to recipient on such interest in State of Residence

- Rate of tax may differ if the Lender holds more than a specified % in certain Treaties

Credit for tax so withheld available in State of Residence

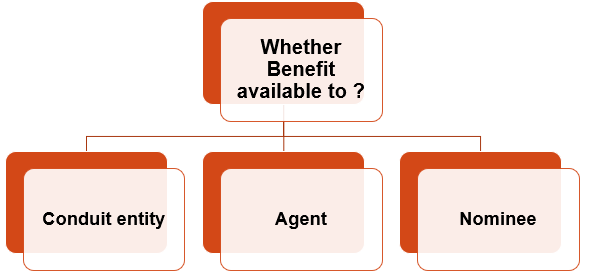

TEST OF BENEFICIAL OWNERSHIP ?

- Legal documents

- Right to use and enjoy interest in unconstrained manner

- Beneficial ownership of interest and not debt

- Interposing beneficial owner by third Contracting State owner ?

- Facts and circumstances

BENEFICIAL OWNERSHIP OF INTEREST AND NOT DEBT CLAIM

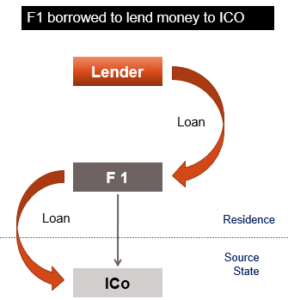

CONDUIT CASE

If F1 is a conduit company, it cannot be a beneficial owner and hence may not be allowed to enjoy preferential treatment.

DISADVANTAGE OF GROSS TAXATION – EXAMPLE – BANKS

Even though the net profit of F1 would be minimal, tax withheld in Source State at gross basis would distort things for F1

ARTICLE 11 (3) INDIA USA – EXEMPTION IN SOURCE STATE FOR CERTAIN INTEREST

Notwithstanding the provisions of paragraph 2 of this Article, interest arising in a Contracting State

a. and derived and beneficially owned by the Government of the other Contracting State, a political subdivision or local authority thereof, the Reserve Bank of India, or the Federal Reserve Bank of the United States, as the case may be, and such other institutions of either Contracting State as the competent authorities may agree pursuant to Article 27 (Mutual Agreement Procedure) ;

b. with respect to loans or credits extended or endorsed

• by the Export Import Bank of the United States, when India is the first-mentioned Contracting State ; and

• by the EXIM Bank of India, when the United States is the first-mentioned Contracting State, and

• to the extent approved by the Government of that State, and derived and beneficially owned by any person, other than a person referred to in sub-paragraphs (a) and (b), who is a resident of the other Contracting State, provided that the transaction giving rise to the debt-claim has been approved in this behalf by the Government of the first-mentioned Contracting State ;

shall be exempt from tax in the first-mentioned Contracting State.

Certain Categories of interest are also exempt u/s 10(15)(iv) of IT Act, 1961

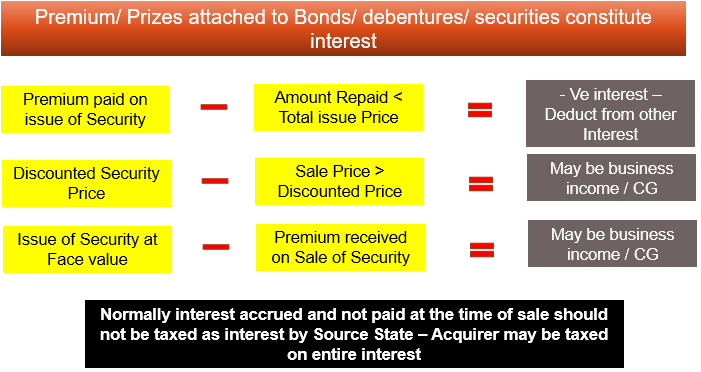

ARTICLE 11(4) INDIA USA – DEFINITION OF INTEREST

The term “interest” as used in this Convention means

income from debt-claims of every kind, whether or not secured by mortgage, and whether or not carrying a right to participate in the debtor’s profits,

and in particular, income from Government securities, and income from bonds or debentures, including premiums or prizes attaching to such securities, bonds, or debentures.

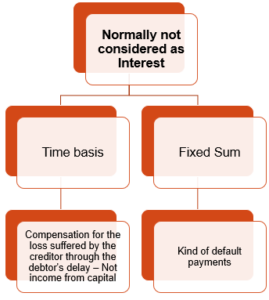

Penalty charges for late payment shall not be regarded as interest for the purposes of the Convention.

However, the term “interest” does not include income dealt with in Article 10 (Dividends)

Learn More about “Double Taxation Avoidance Agreement – Article 11 Taxation of Interest” – Subscribe International Tax Course

ARTICLE 11(4) – ISSUES FOR CONSIDERATION

Exhaustive or Inclusive ?

Definition is exhaustive

Inclusions

Income from Government securities/ bonds or debentures ( including premiums or prizes attached thereto)

Which are irrelevant criterion ?

Secured or not /carrying a right to participate in the debtor’s profits

Penalty charges for late payment

Not considered as interest

INTEREST – WHAT ALL IS COVERED UNDER DOMESTIC PROVISION ?

Interest

- Payments for money borrowed :-

- Deposit

- Claim

- Similar right or obligation

- Service fees or charges in respect of

- Money borrowed

- Debt incurred or

- Unutilized credit facility

Interest on securities

- Interest on security of Central Government or a State Government

- Interest on –

- Debentures; or

- Other securities for money issued by or on behalf of a :-

- Local authority; or

- Company; or

- Corporation established by a Central, State or Provincial Act.

PREMIUM/ DISCOUNT/ PROFIT ON INSTRUMENT

PENALTY

ARTICLE 11 (5) INDIA USA – PERMANENT ESTABLISHMENT CASE

The provisions of paragraphs 2 and 3 shall not apply if the beneficial owner of the interest,

being a resident of a Contracting State,

carries on business in the other Contracting State in which the interest arises,

through a permanent establishment situated therein,

or performs in that other State independent personal services from a fixed base situated therein,

and the interest is attributable to such permanent establishment or fixed base.

In such case the provisions of Article 7 (Business Profits) or Article 15 (Independent Personal Services), as the case may be, shall apply

PE SITUATION

Held:

- Interest paid by ICO to F1, which is effectively connected to PE of F1 in India : –

- Loan contracted by the PE which shows it as an Asset – Receives interest income

- Loan contracted by HO – proceeds used exclusively by PE – Loan paid by HO but borne by PE

- Loan contracted by HO – proceeds used by several PE

In bullet 1 and 2, interest arise in Source State

- Interest taxable as Business Profits under Article 7, after deduction of all expenses

Learn More about “Double Taxation Avoidance Agreement – Article 11 Taxation of Interest” – Subscribe International Tax Course

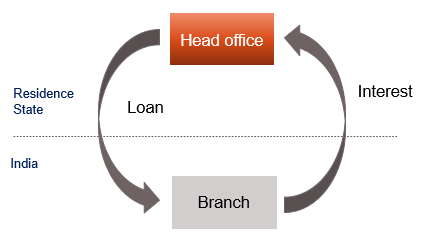

INTEREST PAID BY BRANCH OF FOREIGN BANK

Facts:

- Foreign bank gives a loan to its Indian Branch.

Held:

- Not deductible/chargeable to tax under local laws of India, as its payment to self.

- Certain treaty allows deduction in computing taxable income.

- Special Bench in Sumitomo case held no liability to withhold tax

- WHT applicable for interest payments from FY 2015-16 under domestic tax laws, but shall be subject to the beneficial provision of the Treaty

ARTICLE 11 (6) INDIA USA – WHEN SHALL INTEREST ARISE IN A CONTRACTING STATE

Interest shall be deemed to arise in a Contracting State

when the payer is that State itself or a political sub-division, local authority, or resident of that State.

Where, however, the person paying the interest, whether he is a resident of a Contracting State or not, has in a Contracting State a permanent establishment or a fixed base, and such interest is borne by such permanent establishment or fixed base,

then such interest shall be deemed to arise in the Contracting State in which the permanent establishment or fixed base is situated

DOMESTIC TAX LAW – SECTION 9(1)(V)

The following incomes shall be deemed to accrue or arise in India : –

(v) income by way of interest payable by –

a) the Government ; or

b) a person who is a resident, except where the interest is payable in respect of any debt incurred, or moneys borrowed and used, for the purposes of a business or profession carried on by such person outside India or for the purposes of making or earning any income from any source outside India; or

c) a person who is a non-resident, where the interest is payable in respect of any debt incurred, or moneys borrowed and used, for the purposes of a business or profession carried on by such person in India ;

COMPARISON OF TREATY AND ACT ON “ARISE”

| Payor | Act | Treaty |

| Government | Always | Always |

| Indian resident | Always except when for purposes of business or profession carried outside India or earning any income from any source outside India | Always |

| Non resident | interest is payable for the purposes of an Indian business or profession | If NR has a PE/ Fixed base in India and interest is borne by such permanent establishment / Fixed base |

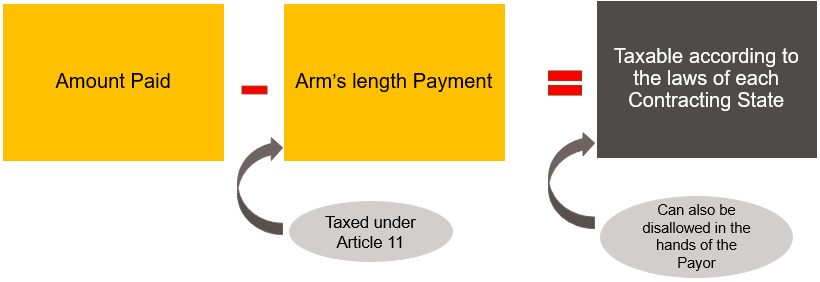

ARTICLE 11 (7) INDIA USA – EXCESS INTEREST PAYMENT TO RELATED PARTY

Where, by reason of a special relationship between the payer and the beneficial owner or between both of them and some other person,

the amount of the interest, having regard to the debt-claim for which it is paid,

exceeds the amount which would have been agreed upon by the payer and the beneficial owner in the absence of such relationship,

the provisions of this Article shall apply only to the last-mentioned amount.

In such case the excess part of the payments shall remain taxable according to the laws of each Contracting State, due regard being had to the other provisions of the Convention.

SPECIAL RELATIONSHIP ?

IMPLICATIONS OF RELATED PARTY

EXCESS PAYMENT TO RELATED PARTY

| Particulars | Amount |

| Interest Paid to AE | $ 110 |

| Arm’s length Interest | $ 100 |

| Computation of Tax | |

| Arm’s length Interest of $ 100 | Apply WHT as per Article 11 or IT Act, whichever is more beneficial |

| Excess Amount Paid $ 10 | Taxable as “Other Income” |

Learn More about “Double Taxation Avoidance Agreement – Article 11 Taxation of Interest” – Subscribe International Tax Course