Double Taxation Avoidance Agreement – Article 21 – Other Income

Double Taxation Avoidance Agreement – Article 21 – Other Income

APPLICABILITY OF ARTICLE 21 – OTHER INCOME

INCOME NOT COVERED UNDER FOLLOWING ARTICLE

- Article 6 – Income from Immovable property

- Article 7 – Business profit

- Article 8 – Shipping, inland waterways transport and air transport

- Article 10 – Dividends

- Article 11 – Interest

- Article 12 – Royalties

- Article 13 – Capital Gain

- Article 15 – Income from employment

- Article 16 – Directors’ fees

- Article 17 – Artistes and Sportsperson

- Article 18 – Pensions

- Article 19 – Government Service

- Article 20 – Students

ARTICLE 23(1) OF THE INDIA – US TREATY

Subject to the provisions of paragraph 2,

items of income of a resident of a Contracting State,

wherever arising,

which are not expressly dealt with in the foregoing Articles of this Convention

shall be taxable only in that Contracting State

KEY CHARACTERISTICS – ARTICLE 23(1) OF THE INDIA – US TREATY

- Income should not be covered under SPECIFIC Article of the Treaty

- Income may arise either within the Source State (India) or outside in a third State

- If the Non Resident has a PE/fixed base, income attributable thereto shall be covered by Paragraph 2

- If such conditions are satisfied, State of Residence has exclusive right to tax such income

WHAT IS MEANT BY “DEALT WITH”

Dealt with implies

- View 1 – Exclusion of a particular income from an Article implies, it is dealt with in that Article

- View 2 – An income item is dealt with when the concerned Article clearly provides whether, and which State has the right to tax income

INCOME COVERED UNDER ARTICLE 21

- Social Insurance and accident benefit payments

- Alimony/ Maintenance receipts from relatives

- Income from mutual funds/ financial instrument, if not taxable as business income

- Lottery winnings and income from gambling, etc

- Income taxable u/s 56 may also be a good reference point

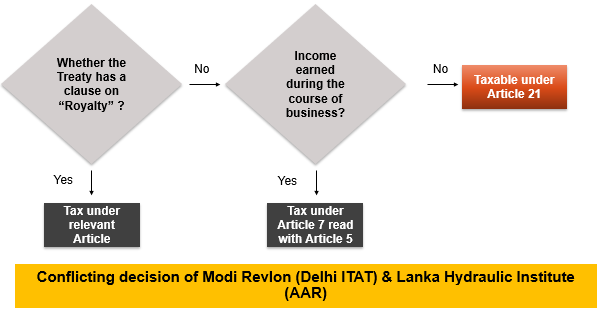

TAXABILITY OF INCOME AS “OTHER INCOME” WHEN RELEVANT CLAUSE ABSENT – ROYALTY

EXCESS PAYMENT TO RELATED PARTY

| Particulars | Amount |

| Royalty Paid to AE | $ 110 |

| Arm’s length Royalty | $ 100 |

| Computation of Tax | |

| Arm’s length Royalty of $ 100 | Apply WHT as per Article 12 or IT Act, whichever is more beneficial |

| Excess Amount Paid $ 10 | May be taxable as “Other Income” |

ARTICLE 23(2) OF THE INDIA – US TREATY

The provisions of paragraph 1 shall not apply to income, other than income from immovable property as defined in paragraph 2 of Article 6 [Income from Immovable Property (Real Property)],

if the beneficial owner of the income, being a resident of a Contracting State,

carries on business in the other Contracting State through a permanent establishment situated therein, or performs in that other State independent personal services from a fixed base situated therein, and

the income is attributable to such permanent establishment or fixed base.

In such case the provisions of Article 7 (Business Profits) or Article 15 (Independent Personal Services), as the case may be, shall apply

KEY CHARACTERISTICS – ARTICLE 23(2) OF THE INDIA – US TREATY

- Income (other than income from immovable property as defined in Article 6(2)) is derived

- Beneficial owner of income carries on business in other Contracting State through a PE/ Fixed Base

- Income is attributable to such PE or fixed base (some Treaty use the word effectively connected)

If such conditions are satisfied, Article 7 (Business Profits) or Article 15 (Independent Personal Services) shall apply

ARTICLE 21(3) OF THE INDIA US TREATY

Notwithstanding the provisions of paragraphs 1 and 2,

items of income of a resident of a Contracting State

not dealt with in the foregoing articles of this Convention and

arising in the other Contracting State

may also be taxed in that other State.

Learn More about “Double Taxation Avoidance Agreement (DTAA)”