There are two types of relief from Double Taxation Relief – Unilateral Relief and Bilateral Relief , which are available to a non-resident who is a resident of one country (say USA) and operates in another country (say India) . In certain cases of international trade and commerce, income earned by a resident of one country (“may be an individual or a company”), from another country , may be taxable in both the countries, due to different tax rules. This is a case of Double Taxation of income. In order to address the situation of Double taxation, various countries generally provide credit for taxes paid in overseas jurisdiction, either under their domestic tax laws, or in view of specific provision in the Tax Treaty entered into with such foreign jurisdiction . For Example, if an Indian resident taxpayer has paid tax on income sourced from Foreign jurisdiction to Foreign Government, in such case, the taxpayer can take the credit for the taxes paid to Foreign Government against the taxes payable to Indian Government on such income.

It may however be noted that generally the credit is given only against the tax which may be payable against the foreign income in India. In case the income on which tax has been paid overseas is not liable to tax in India, or is liable to Tax at a lower rate , no credit may be given for taxes paid in the Overseas jurisdiction.

Double Taxation Relief Example 2 : –

| Particulars | USD | USD |

| Foreign income | 100 | 100 |

| Overseas tax | (20) | (20) |

| Balance | 80 | 80 |

| Tax in India | 20 | 10 |

| Tax credit | (20) | (10) |

| Net cash to taxpayer | 80 | 80* |

*The balance tax paid in overseas jurisdiction(20-10) in Case 2, will not be available as credit in India against tax payable on any other income .

The relief for tax may be given in the following two ways : –

- Relief, in accordance with the agreement between two countries, where the tax may be payable – Bilateral relief

- Relief by the country where the taxpayer is a resident – Unilateral Relief

Let us discuss these two in detail.

Bilateral Relief in Double Taxation

In case of bilateral relief, Governments of two countries , enter into an agreement to provide relief against Double Taxation , on mutually agreed basis.

Such a relief can be provided under either , or both of following methods : –

A. Exemption method of Bilateral Relief

Under this method, one of the two countries where Tax is payable, exempts such income from tax. The other country, has the rights to tax such income.

B. Tax credit method of Bilateral Relief

Under this method, income is taxed in both the countries as under : –

- If the income is not liable to tax in the country of source, the question of double taxation would not arise. If the income is taxable in the country of source, tax would have been paid therein , as per the domestic laws of that country or DTAA, whichever is more beneficial to the taxpayer ;

- The country of residence, computes the tax payable on such foreign soured income under its domestic law . Such tax is computed provided the country of residence has the right to tax such income under DTAA (where it exists) or under its domestic laws (where no DTAA exists). If the country of residence, is covered under the exemption method, no tax would be levied, on such foreign source income. in such a case, generally no credit is provided for tax paid in the country of source, against any other tax which may be payable by such taxpayer in the country of residence. However, if the country of residence, is covered under the credit method of exemption, then, from the tax payable in the country of residence, tax paid in the country where the income arises, is reduced. After such reduction, if any tax remains payable, the taxpayer pays that amount to the country of residence. However, if the tax paid in the country where the income arises is more than the tax payable in the country of Residence, no Tax is payable by the taxpayer to the country of residence . (Refer Example 2)

Under the Indian laws, depending on the nature of payment, both exemption method and the credit method are used to provide double taxation relief.

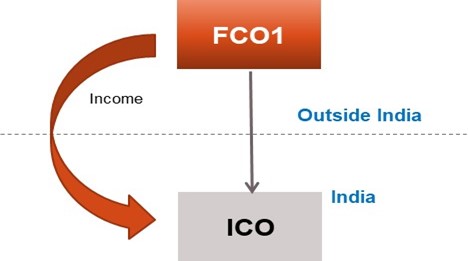

Unilateral Relief in Double Taxation

In certain cases, where there is no double taxation avoidance agreement, between the Country of source and Country of residence, the country of residence of the taxpayer, may provide tax relief under its domestic tax laws. Such a relief is known as Unilateral Relief.

For any queries, please write them in the Comment Section or Talk to our tax expert