Introduction of New Chapter of Equalization Levy

Considering the potential of new digital economy, and the rapidly evolving nature of business operations, it is essential that countries take necessary steps to address the challenges which arise relating to taxation of digital transactions. In order to address these challenges, a new Chapter titled “Equalization Levy” was inserted by the Finance Act, 2016, to provide for an Equalization Levy for specified digital services. CBDT issued a notification No. 38/2016, dated 27-05-2016 to enforce equalisation levy rules with effect from June 1, 2016.

a) Meaning of Equalisation Levy

Equalisation levy, means the tax leviable on consideration received or receivable for following services(termed as ‘digital advertisement services’) : –

a) Online advertisement,

b) Provision of digital advertising space, or

c) Any other facility or service for the purpose of online advertisement.

d)Any other service as may be notified by the Central Government (Till now no other service has been notified for equalization levy)

Note :- Equalisation Levy is not a part of income-tax as it is introduced by way of separate chapter in the Finance Act, 2016. Like STT, it will remain a separate tax.

b) Features of Equalization Levy

Charged only on online advertisement services

Equalisation levy shall be charged only on online advertisement services . It is not chargeable on other digital serviceslike provision of online content, online data, provisionof any facility or service for uploading, storing or distribution of digital content, etc.

Charged only for services

Equalisation Levy is charged only for specified services . There is no equalisation Levy on goods sold by the non-residents through e-commerce companies. Thus, Equalisation Levy is not required to be deducted on goods purchased through E-commerce websites, like Amazon, Ebay, etc.

Advertisement service should be provided by the non-resident

Equalisation levy shall be charged only when advertisement servicesare provided by the non-resident. Equalisation levy seeks to cover only non-resident who earns advertisement revenue from India and avoid payment of income-tax (like Facebook, Google, Yahoo, etc.). Equalisation levy shall not be charged where the covered advertisement services provided by residents , as such person are already liable to pay income-tax on his global income.

Charged only on business to business (b2b) transactions.

Equalisation levy will be charged only on Business to Business (B2B) transactions. Any advertisement services taken by Individual for his personal purposes will not attract Equalisation levy. Such business may be carried on by a resident person or non-resident having PE in India . Thus, advertisement services taken by non-resident (having a PE in India) from another non-resident will also attract Equalisation levy.

c) Charge of Equalization Levy – Conditions for Levy

Equalisation Levy is charged at the rate of 6% (w.e.f June 1, 2016) on payment for digital advertisement services (discussed above) provided all the following conditions are satisfied : –

- Consideration is paid or payable only for digital advertisement services;

- Consideration is paid or payable to non-resident person; and

- Consideration is paid or payable by a –

- Resident person carrying on business or profession ; or

- Non-resident having a PE in India.

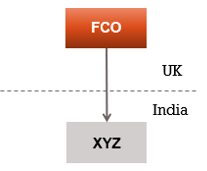

Example 1: –

XYZ Pvt. Ltd. (Indian Company) has to make payment to a UK based company for accessing online content relating to industrial experience. Whether Indian company would be liable to deduct Equalization Levy while making payment to such foreign company ?

Solution : –

Equalisation levy shall be deducted only when payment is related to advertisement services. Thus, Equalization levy shall not be deducted on such transaction. However, Indian company has to ascertain whether such payment is liable for withholding tax under Income-Tax Act.

Example 2: –

ABC ltd. (Indian company) has placed an order to buy goods from an E-Commerce website, Amazon.com. Whether ABC ltd. is liable to deduct Equalisation levy before making payment ?

Solution : –

Equalization levy is imposed only on advertisement services, and not on purchase of goods from E-commerce website. Thus, Indian company is not required to deduct Equalization levy on such transaction.

Example 3: –

An Indian company has booked an advertisement slot on Red FM 93.5, an Indian radio station. Whether it is liable to deduct Equalization levy while making payment for such services?

Solution : –

Equalisation Levy shall be charged only when it is made for online or digital advertisements, and the service provider is non-resident. In the instant case Red FM is a resident. Thus, Equalisation levy shall not be deducted in this case.

Example 4: –

Mr. A wants to publish advertisement in matrimonial column of New York Times newspaper. Whether he is liable to deduct Equalisation levy?

Solution : –

Mr. A is not liable to deduct Equalisation levy while making payment of matrimonial advertisement. Equalisation levy is deducted only on Business to Business (B2B) transactions. Advertisement in matrimonial column is not intended to serve any business purpose of Mr. A.

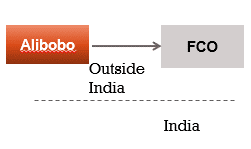

Example 5: –

Alibobo (foreign company) makes payment of Rs 5 lakhs to another foreign company for online advertisement. Alibobo does not have any PE in India. Whether it is liable to deduct Equalisation Levy from such payment to the foreign company ?

Solution : –

Foreign company is liable to deduct Equalisation levy for advertisement payments, only when it has PE in India. In this case Equalisation levy is not chargeable as Alibobo does not have any PE in India.

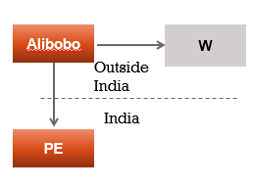

Example 6: –

X International (foreign company) makes payment of Rs 5 lakhs to W International (another foreign company) for online advertisement. X International Ltd. has PE in India and such advertisement is relating to the operations of the PE in India . Whether X is liable to deduct Equalisation Levy?

Solution : –

Foreign company would be liable to deduct Equalisation levy for advertisement payments only when it has PE in India. In this case Equalisation levy is chargeable as X International has PE in India.

d) Person liable to deduct Equalisation Levy – Section 166

The following person , who avails services which are liable to equalisation levy , are liable to deduct such levy : –

a) Person who is a resident, and is carrying on business or profession; or

b) Non-resident having a permanent establishment in India

The equalisation levy shall be deducted from the amount paid or payable to a non-resident , where such payments are made for digital advertisement services . Equalisation levy shall be deducted at the rate of 6%.

e) Whose income is liable for deduction of Equalisation Levy? – Illustration

Foreign internet companies (such as social media companies), search engines, media websites, that do not have any physical presence in India shall be liable to pay Equalisation Levy.

However, Equalisation levy shall not be charged if any of the following conditions are satisfied –

a) Non-resident providing advertisement service has a PE in India

Where the non-resident providing advertisement service has a PE in India and the advertisement service is effectively connected with such PE. Equalisation levy intends to tax advertisement revenue of the non-residents, which escape from Indian income-tax. When advertisement revenue of non-resident is liable to income-tax in India due to existence of its PE in India, then there is no need to apply Equalisation levy on such income.

b) Aggregate consideration is less than the prescribed threshold

Where the aggregate amount of consideration for advertisement services received or receivable,fromeach of the non-resident is Rs 1 lakh or less during the year. Such threshold limit of Rs 1 lakh is specified for equalisation levy, so as to limit its impact and reduce the compliance burden on taxpayers.

c) Purpose of services is non business

Where the payment for the advertisement service is not for the purposes of carrying out business or profession. The intention of the legislation is to cover only only Business to Business (B2B) transactions under Equalisation levy .

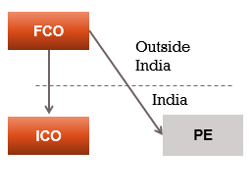

Example 1 : –

An Indian company made payment for advertisement space to foreign company. Such foreign company has PE in India and advertisement revenue is effectively connected to with such PE. Whether Indian company is liable to deduct Equalisation levy while making payment to foreign company ?

Solution : –

Advertisement revenue of foreign company which has a PE in India are taxable in India under the IncomeTax Act. Thus, Indian company is required to withhold tax on such payment under the Income-Tax Act. Such payment is not chargeable to Equalisation levy.

Example 2 : –

During a particular financial year, an Indian company made payment of Rs 99,000 for advertisement space to foreign E-commerce Company. Whether Indian company is liable to deduct Equalisation levy on such payment ?

Solution : –

Indian company is not liable to deduct Equalisation Levy as the aggregate amount of payment received by the foreign company does not exceed Rs 1lakhs.

Example 3 : –

During a particular financial year, an Indian company made payment of Rs 1,20,000 to a foreign company for online advertisement. Whether Indian company is liable to deduct Equalisation levy on such payments?

Solution : –

Indian company is liable to deduct Equalisation Levy on such payments as theaggregate amount of consideration exceeds one lakh rupees.

Example 4 : –

An Indian company made payment of Rs 99,000 each, to 10 foreign E-commerceCompanies for digital advertisement. Whether Indian company is liable to deduct Equalisation levy on such payments?

Solution : –

Indian company is not liable to deduct Equalisation levy as the payment received by each E-commerce company does not exceed Rs 1 lakh.

f) Due date for payment of Equalisation Levy

Equalisation levy deducted during any calendar month, is required to be paid to the credit of the Central Government by the 7th day of the month immediately following the said calendar month. For example, Equalisation levy deducted in the month of April, 2018 shall be paid on or before May 7, 2018. Such levy has to be deposited to the credit of the Central Government by remitting it into the Reserve Bank of India or in any branch of the State Bank of India or of any authorised Bank accompanied by an equalisation levy challan

g) Rate of Equalisation Levy

Equalisation levy shall be charged at 6% of the amount of consideration paid or payable to non-resident person for digital advertisement services.

Note : – The amount of consideration for digital advertisement, equalisation levy, interest and penalty has to be rounded off to the nearest multiple of Rs 10 [Rule 3 of Equalisation Levy Rules, 2016]

h) Consequences of failure to pay Equalisation Levy

Where a person who is required to deduct equalisation fails to deduct such levy, or after deduction fails to pay such levy to the credit of Central Government, it would have following consequences : –

a) Disallowance of expenditure : -Any payment liable to Equalisation Levy shall be disallowed if

- Such levy has not been deducted during the previous year, or

- After deduction, has not been paid on or before the due date of filing return of income.

However, where in respect of any such consideration, the equalisation levy has been deducted in any subsequent year or has been deducted during the previous year but paid after the due date specified in sub-section (1) of section 139, such sum shall be allowed as a deduction in computing the income of the previous year in which such levy has been paid.

b) Penalty on failure to deduct equalisation levy: –

Where assessee fails to deduct the whole, or any part of the equalisation levy , then such assesee shall be liable for penalty equivalent to the amount of equalisation levy that he has failed to deduct.

c) Penalty of Rs 1,000 per day on failure to pay Equalisation Levy

Where an assessee deducts equalisation levy, but after such deduction, fails to pay such levy to the credit of the Central Government before the due date, then such assesee shall be liable for penalty of Rs 1,000 for every day during which the failure continues. However, the total penalty so levied shall not exceed the amount of equalisation levy that he has failed to pay.

Note : – No penalty shall be imposable if the assessee proves to the satisfaction of the Assessing Officer that there was reasonable cause for the said failure.

d) 1% Monthly interest for failure to pay Equalisation Levy : –

Every assessee, who fails to credit the equalisation levy to the account of the Central Government within due date, shall pay simple interest at the rate 1% of such levy for every month or part of a month for which such payment of tax is delayed.

NOTE : – Any assessee who fails to deduct the Equalisation Levy would still be liable to pay the levy to the credit of the Central Government by due date.

i) Exemption from Income Tax to Non Resident – Section 10(50) of the IT Act, 1961

Any income arising from digital advertisement service, which is chargeable to Equalization levy, shall be exempt from Indian Income-Tax Act under Section 10(50). This would avoid double taxation of same income within India.

j) Equalisation Levy vs. Withholding Tax

The main differences between equalization levy and withholding tax are as under : –

| Equalisation levy | Withholding tax |

| Equalisation levy is not a part of income-tax Act | It is a part of Income-Tax Act |

| Non-resident service provider cannot claim credit of Equalisation Levy | Non-resident service provider can claim credit of withholding tax while filing return of income . |

| Default in deduction/payment of Equalisation Levy would attract disallowance of whole expenditure | Default in deduction/payment of withholding tax would attract disallowance of whole expenditure |

| There is no requirement to furnish 15CA/15CB for making payment to non-resident for digital advertisement which is liable to Equalisation levy | There is a requirement to furnish 15CA/15CB for making payment to non-resident. |

| Any income arising from digital advertisement service is exempt from income-tax when it is liable to Equalisation Levy | Such kind of exemption is not available in case of withholding tax. |

| Equalisation Levy will be deducted only when the aggregate amount of consideration exceeds Rs 1 lakh | There is no threshold limit. Any payment made to non-resident which is chargeable to income-tax would suffer withholding tax. |

| Provisions of tax treaty (Double Taxation Avoidance Agreements) will not be considered to determine the rate of Equalisation Levy. | Provisions of tax treaty will be considered to determine the rate of withholding tax on payments made to non-resident. |

| Payer is liable to return of Equalisation levy annually in Form No. 1 | Payer is liable to file TDS return quarterly |

| Equalisation levy deducted in the month of March shall be paid till April 7 | Withholding taxes for the month of March shall be paid till April 30 |

k) Prescribed form to file return of Equalisation Levy – Rule 5 of Equalisation Levy Rule, 2016

Every person, who is liable to deduct Equalisation Levy in a financial year shall furnish a return of equalization levy in Form No. 1 for such financial year in any of the following mode : –

a) Electronically under digital signature, or

b) Electronically through electronic verification code

Such return has to be filed on or before the 30th June immediately following that financial year.

l) Belated or revised return of Equalisation Levy – Section 167(2)

Every person who has not furnished the return of equalization levy on or before due date(i.e., 30th June of the FY) can furnish such return before expiry of 2 years from the end of FY in which the online advertisement service was provided .

Further, a person who has furnished return of equalization levy, notices any omission or wrong statement in such return, he may furnish revised return before expiry of 2 years from the end of FY in which the online advertisement service was provided.

m) Notice to furnish return of Equalisation Levy – Rule of Equalisation Levy Rules, 2016

Where an assessee fails to furnish the return of equalisation levy within the due date[ i.e., on or before 30th June], the Assessing Officer may issue a notice, requiring him to furnish return of equalisation levy in Form 1 within 30 days from the date of service of the notice.

n) Processing of Statement – Section 168

Where a return of Equalization levy has been furnished by the assessee, it shall be processed in the following manner: –

a) Equalisation levy shall be computed after adjustment for any arithmetical error in the return of equalisation levy;

b) Interest, if any , shall be computed on the basis of sum deductible as computed in the statement;

c) Sum payable by, or refund due to, assessee shall be determined after adjustment of the amount computed under clause (b) against any amount paid as : –

- Equalisation levy or interest ; and

- Any amount paid otherwise by way of tax or interest.

d) An intimation shall be sent to the assessee, specifying the sum determined to be payableby, or the amount of refund due to, him; and

e) Refund due to the assessee shall be granted.

Note : –

However, no intimation shall be sent after the expiry of one year from the end of the financial year in which return of equalization levy is furnished.

o) Prescribed form for notice of demand – Rule 7

Where any levy, interest or penalty is payable in consequence of any order passed under the provisions of Equalization levy, the AO shall serve a notice of demand in Form No. 2 to the assessee, specifying the sum so payable.

Any intimation issued u/s 168 after processing of return of equalization levy, shall be deemed to be a notice of demand.

p) Rectification of mistake apparent from record – Section 169

Where the AO finds that any intimation issued under section 168, has any mistake apparent from therecord, Assessing Officer may amend such intimation, either on its own motion, or if any such mistake is brought to his notice by the assessee. Such rectification can be made within a period of one year from the end of the financial year, in which the intimation sought to be amended was issued.

q) Procedure to be followed by AO to rectify and mistake apparent from record – Section 169

Where any amendment to the intimation has the effect of increasing the liability of the assessee or reducing a refund, AO cannot make such an amendment unless the AO has given notice to the assessee to make such an amendment and has also provided him with a reasonable opportunity of being heard.

r) Penalty for default in furnishing return of Equalisation Levy – Section 172

Where an assesseefails to furnish the return of Equalisation levy –

a) On or before June 30 of the immediately succeeding FY in which equalisation levy was deducted or

b) within 30 days from the date of service of the notice by Assessing Officer, he shall be liable to pay a penalty of Rs 100 for each day during which the failure continues.

s) Penalty not to be imposed in certain cases – Section 172

Where the AO proposes to levy any penalty on the assesseefor any failure, such penalty canoe be levied unless the assessee has been given a reasonable opportunity of being heard . During such hearing if the assessee proves to the satisfaction of the Assessing Officer that there was reasonable cause for the saidfailure, no penalty can be levied.

t) Appeal to commissioner of Income Tax (Appeals) Section 174

An assessee, aggrieved by an order imposing penalty under the provisions of Equalisation levy, may appeal to the Commissioner of Income-tax (Appeals) within a period of30 days from the date of receipt of the order of the Assessing Officer.

Prescribed form and fee for filing appeal before commissioner of income-tax (appeals) – section 174 :- An appeal before the Commissioner of Income Tax (Appeals) shall be made in Form No. 3 and shall be accompanied by a fee of Rs 1,000.

Other provisions for filing appeal before commissioner of income-tax (appeals) – section 174 :- An appeal before CIT(A) , or any document accompanying Form No.3 , shall be made electronically under digital signature, or electronically through electronic verification code.

Where appeal has been filed before the Commissioner of income-tax (Appeals), the provision of Sections 249, 250 and 251 of the IT Act, 1961 , which prescribe the procedure in appeal before CIT(A) and powers of CIT(A) would, as far as may be, apply to such appeal.

u) Appeal to Appellate tribunal – Section 175

Appeal

Appeal before the Appellate Tribunal can be filed by –

a) An assessee aggrieved by an order made by the Commissioner of Income-tax (Appeals)under section 174, or

b) The Assessing Officer against the order passed by the Commissioner of Income-tax (Appeals) under section 174, on directions of Commissioner of Income-tax.

Time-limit for filing appeal before the appellate tribunal

An appeal before the Appellate Tribunal shall be filed, within a period of 60 days from the date, on which the order sought to be appealed against is received by –

a) The assessee – Where assessee files an appeal against the order of Commissioner (Appeals) ; or

b) The Commissioner of Income-tax – Where AO files an appeal against the order of Commissioner (Appeals) on the directions of Commissioner of Income-Tax.

Prescribed form and fee for filing appeal before the appellate tribunal

An appeal before the Appellate Tribunal shall be made in Form No. 4 and it shall be accompanied by a fee of Rs 1000.

Where the appeal is made by the assessee,

a) the form of appeal,

b) the grounds of appeal and

c) the form of verification appended thereto shall be signed by the person specified in Form No.4, as applicable to the assessee.

Sections 253 to 255 of the IT Act, 1961 , which prescribe the procedure in appeal before ITAT and powers of ITAT would, as far as may be, apply to such appeal.

v) Punishment for false statement – Section 176

A person shall be punishable with imprisonment for a term of upto 3 years with fine if : –

a) He makes a false statement in any verification under this Chapter or any rules made there under, or

b) Delivers an account or statement, which is false, and which he either knows or believes to be false, or does not believe to be true.

Note :-

An offence so punishable shall be deemed to be non-cognizable within the meaning of Code of Criminal Procedure

w) Institution of Prosecution – Section 177

No prosecution shall be instituted against any person for any offence under section 176, except with the previous sanction of the Chief Commissioner of Income-tax.

x) Application of certain provisions of income Tax Act – Section 177

The following provisions of the Income-tax Act shall so far as may be, apply in relation to equalization levy, as they apply in relation to income-tax: –

Section 120 – Jurisdiction of income-tax authorities

Section 131 – Power regarding discovery, production of evidence, etc.

Section 156 – Notice of demand

Section 220-227 – Collection and recovery of income-tax

Section 229 – Recovery of penalties, fine, interest and other sums.

Section 232 – Recovery by suit or under other law not affected

Section 260A – Appeal to High Court

Section 261 – Appeal to Supreme Court

Section 262 – Hearing before Supreme Court

Section 265 – Tax to be paid notwithstanding reference, etc.

Section 266 – Execution for costs awarded by Supreme Court

Section 267 – Amendment of assessment on appeal

Section 268 – Exclusion of time taken for copy

Section 269 – Definition of “High Court”

Section 278B – Offences by companies

Section 280A – Special Courts

Section 280B – Offences triable by Special Court.

Section 280C – Trial of offences as summons case

Section 280D – Application of Code of Criminal Procedure, 1973 to proceedings before Special Court

Section 282 – Service of notice generally

Section 288 – Appearance by authorised representative

Section 289 – Receipt to be given

Section 290 – Indemnity

Section 291 – Power to tender immunity from prosecution

Section 292 – Cognizance of offences

Section 293 – Bar of suits in civil courts.

For any queries, please write them in the Comment Section or Talk to our tax expert