Evolution of Transfer Pricing in India

Before the amendments introduced in the Financial Act 2001, cross border transactions between MNEs were unregulated and sufficient taxation laws were not in place to curb unscrupulous acts such as tax evasion and ease conducting of international transactions. The Evolution of Transfer Pricing in India pre and post the 2001 Amendment has helped identify the lacunas (pre Amendments 2001) and address the issues (post Amendment 2001).

| Principle of International Taxation | Transfer Pricing |

| Transaction between | International Parties |

| Transfer Price | Price charged between two international parties |

| Time frames for the Era of Transfer Pricing |

|

| Shortcomings addressed by Financial Act, 2001 Amendment |

|

Evolution of Transfer Pricing in India [Pre 2001 ERA] – Section 92 of Income Tax Act

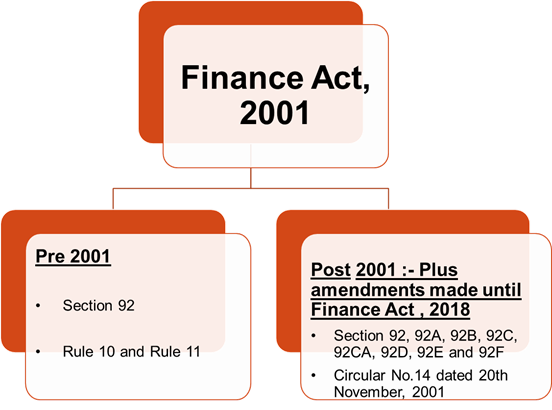

The Transfer Pricing rules and regulations in India can be broadly covered under two time frames : –

- The provision existing prior to the amendments made by Finance Act 2001 ; and

- The provisions after the amendments made by Finance Act 2001.

The provisions which governs the law relating to transfer pricing prior to the amendments made by Finance Act 2001 , were section 92 of the IT Act, 1961 and Rule 10 and 11 of the Income Tax Rules 1962.

The provisions which governs the law relating to transfer pricing after to the amendments made by Finance Act 2001 are covered by Section 92, and circular number 14 dated November 20, 2001

A. TRANSFER PRICING RULES AND REGULATIONS IN INDIA – EXISTING PRIOR TO THE AMENDMENTS MADE BY FINANCE ACT 2001

Prior to such amendments by Finance Act, 2001, Section 92 of the IT Act, 1961 dealt with cross border taxation in case of MNEs and was applicable when the following conditions were satisfied:

- There was a business transaction between a resident and a non-resident;

- There was a close connection between a resident and a non-resident;

- Due to close connection, the resident and non-resident arranged their business in such a manner , that there were either no profit / or less than normal profit to the non-resident in India.

Where these conditions were satisfied, the Assessing Officer was empowered to determine the reasonable amount of profits, that could have been derived from such business by the non-resident and tax them under the provision of Indian IT Act . In order to compute such reasonable profits, AO was under an obligation to apply the provision and methodology provided under Rule 10 and Rule 11 of the Income Tax Rules 1962. If such an application resulted in difference between the amount reported by the non-resident as profits, and the profits computed by the AO, the AO would consider such differences in arriving at the total taxable income of the non-resident in India.

COMPUTATION OF NORMAL PROFIT AS PER THE PROVISIONS OF RULE 10

As per Rule 10 and 11, normal profits were to be calculated as under : –

a) Normal profits could be such % of the turnover , which accrues or arise to the non-resident, as the AO may consider reasonable. It may be noted that under this clause, the AO computed the reasonable profits based on turnover, and not the arm’s length price. Under the new transfer pricing regime , the AO computes the arm’s length price for transaction undertaken by the non-resident ;

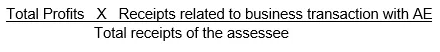

b) Normal profits could be any amount which bears the same proportion to the total profits and gains of the business of such person, as the receipts so accruing or arising bear to the total receipts of the business : –

c) Normal profits could be computed in such other manner , as the AO may deem suitable.

SHORTCOMINGS OF THE PRESCRIBED METHOD

- Adjustment of profits vs Arm’s length price

The method provided for ascertainment of profits . It did not involve computation of arm’s length prices of transaction and then computing profits. Since every business transaction may not necessarily result in profits, this method did not take into consideration the fact that there could be business losses as well, as it always resulted in computation of taxable profits.

- No detailed rules for documentation to substantiate ALP

No detailed rules were provided for maintaining necessary documentation, that could help assessee to substantiate basis of price at which the transaction were undertaken between parties. In the absence of any specific guidelines, the assessment were more prone to be governed by the outlook of the respective AO, as against standard International practices, resulting in a bias towards high adjustment assessments.

- Isolated transactions

Since these rules were applicable for taxation of “business” profits, and existence of business requires a continuity of relationship, isolated transactions undertaken by non-resident where they earned profits from transaction with India were outside Section 92 , and hence were not considered taxable.

- Transfer of services or intangibles

Transfer of services or intangibles were not covered within the scope of the above provisions, as they were applicable for taxation of “business” profits.

- Transaction between two non-resident

Transfer Pricing provisions did not provide for taxation of profits earned by a non-resident from transaction with another non-resident, for which income was generated from Indian sources.

B. TRANSFER PRICING RULES AND REGULATIONS IN INDIA – AFTER THE AMENDMENTS MADE BY FINANCE ACT 2001

With a view to provide detailed statutory framework, which would address the issues discussed above, and curb tax avoidance by Multinational Enterprises, the detailed law dealing with Transfer Pricing was introduced by making the following changes to the existing law/incorporating new provisions : –

- Substituting the then existing Section 92 , with new Section 92, Section 92A, Section 92B, Section 92C, Section 92CA, Section 92D, Section 92E and Section 92F; and

- Detailed Circular No.14 explaining the Transfer Pricing provisions introduced through the above Section 92.

ROLE OF OECD TP GUIDELINES IN INDIAN CONTEXT

While the Indian Transfer Pricing regulations are not completely aligned with OECD Transfer Pricing (OECD TP) Guidelines , the OECD TP Guidelines have been referred to, and extensively considered by the Indian courts, in connection with rendering decisions under the Indian Transfer Pricing provisions.

For any queries, please write them in the Comment Section or Talk to our tax expert