Bird’s Eye view of the ‘Fee for technical services’

| Concept of taxation | Non-Resident Taxation |

| Provision of Income Tax Act, 1961 | Section 9(1)(vii) |

| Provision deals with | Fee for technical services |

Fee for Technical Services – Section 9(1)(vii) of Income Tax Act 1961 – Summary of Key Provisions and Taxability

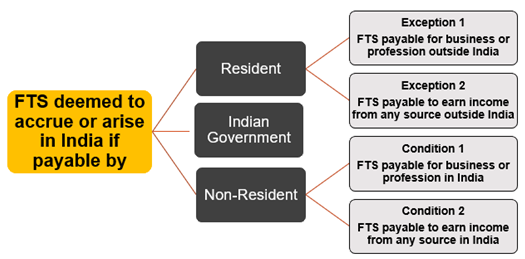

FTS payable to the non- resident , could be from the following Payors : –

- FTS payable by Indian Government ;

- FTS payable by resident to non-resident ; and

- FTS payable by one non-resident to another non-resident

The circumstances under which such FTS is deemed to accrue or arise in India are discussed as under : –

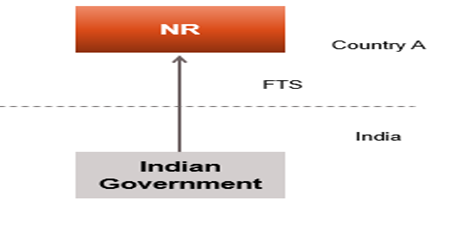

A. Fee for Technical Services payable by Indian Government to Non resident Deemed to accrue or arise in India – Section 9(1)(vii) of Income tax Act.

Under section 9(1)(vii), FTS, payable by the Indian Government to any non-resident, shall always be deemed to accrue or arise in India, without any exception. In such a case, the Government could be the Central government or the State government

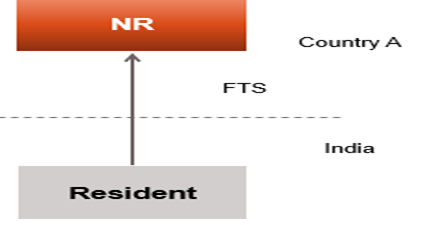

B. FTS by Resident deemed to accrue or arise in India – Section 9(1)(vii) of Income Tax Act

Under section 9(1)(vi), FTS payable by a person , who is a resident in India, to a non-resident , shall be deemed to accrue or arise in India , unless it falls under the following two exceptions : –

-

- Where the FTS is payable by a resident in respect of technical services utilized in a business or profession carried on by the resident outside India,

- Where FTS is payable in respect of technical services utilised for the purpose of earning any income from any source outside India .

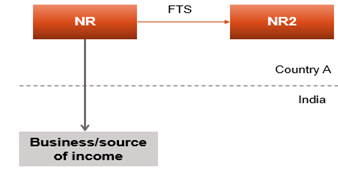

C. Fee for Technical Services payable by Non resident deemed to accrue or arise in India – Section 9(1)(vii) of Income tax Act

FTS payable by a one non-resident to another non-resident shall be deemed to accrue or arise in India only when any one or both the following conditions are satisfied : –

- Where the fees are payable in respect of services utilised in a business or profession carried on by the non-resident in India ; or

- Where such services are utilised for the purpose of making or earning any income from any source in India .

Meaning of Fee for Technical Services – Explanation 2 to Section 9(1)(vii) of Income Tax Act

In terms of the above explanation, Fees for Technical Services means any consideration (including any lumpsum consideration) for the rendering of any –

- Managerial services,

- Technical services or

- Consultancy services

It also includes providing the services of technical or other personnel .

NOTE :

FTS does not include :

- Consideration for any construction, assembly, mining or like project undertaken by the recipient or

- Consideration which is chargeable under the head ‘salaries’ in the hands of the recipient .

Points to consider

In order to be covered in the definition of FTS, consultancy or technical services should be rendered by someone who has special skill and expertise in rendering such services . Both managerial and consultancy services involve human element as both are provided by humans . The term technical is sandwiched between the terms managerial and consultancy . Thus, the technical services would have construed as involving human element . [CIT v . Bharti Cellular Ltd . [2008] 175 Taxman 575 (Delhi)]

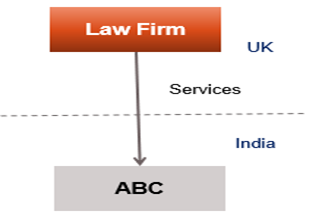

Example 1

ABC Private Ltd. an (Indian Company) , had a dispute with a customer in India, for violation of copyright which was subject to the Indian Courts at Delhi, but involved interpretation of certain international Terminology for which it availed the services from a UK based law firm, for which it paid a fee amounting to USD 30,000 per quarter ? You are required to comment whether such periodic payments would be treated as Royalty or Fees For Technical Services under Section 9 of the IT Act ?

Solution

Fees For Technical Services, includes payment for availing of any consultancy services, especially from a person having special skill and expertise . In this case, the UK law firm has special skill and expertise to provide consultancy services . The term FTS includes both lump-sum payments and periodic payments . Thus, periodic payments made by ABC Private Ltd would also be treated as FTS under the IT Act .

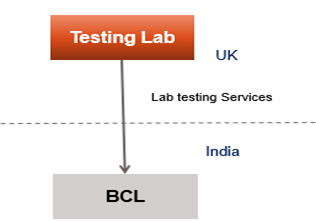

Example 2

BCL India Private Limited (Indian Company) makes payment to a testing laboratory in UK for carrying out quality testing on products manufactured by it . Lab reports are generated by machines without any human intervention . Whether such payment by ICO would be treated as FTS ?

Solution

Foreign lab has rendered technical services to ICO but in order to be treated as FTS, human intervention is required. Since the testing services rendered by foreign lab do not involve any human intervention , payment for such services could not be treated as FTS .

Example 3

GLF Private Limited is engaged in real estate business . It has employed non-resident civil engineers to work on its commercial projects in India who carry out designing work . Whether remuneration paid to civil engineers can be treated as Fees for Technical Services ?

Solution

Consideration paid for technical services, which would be taxable under the head Salaries, is specifically excluded from the definition of Fees For Technical Services under the IT Act . Accordingly, such payment would be taxable as salary in the hands of engineer .

Example 4

Badaani Power Private Limited makes payment to BY Inc . (USA) for construction of power project . Whether such payment would be considered as Fees For Technical Services ?

Solution

Consideration paid towards construction, mining and like project is specifically excluded from the definition of Fees For Technical Services . Thus, payment made for construction of power project would not be considered as FTS .

Example 5

Coal Limited secures a project for extraction of mineral oil in Madhya Pradesh . It avails services of CCS Inc. to be used in prospecting or extraction of mineral oil . Whether payment for such services would fall in the definition of Fees For Technical Services ?

Solution

Consideration paid on construction, mining and like project is specifically excluded from the definition of FTS . Thus, payment made to avail services on such project would not be considered as FTS . However, such payments would be taxable as per provisions of Section 44BB.

NOTE :

In all the aforesaid examples, it should be checked whether it would be treated as Fees For Technical Services under the DTAAs. Generally, if the definition of FTS under the Treaty is narrow, and the non-resident recipient is eligible for the benefit of the Treaty, search payments would not be chargeable to tax in India.

Factors that do not effect taxation of interest, Royalty and FTS – Explanation to Section 9(2)

Interest, royalty and FTS shall be deemed to accrue or arise in India to non-residents and, shall be included in their total income and the following facts shall not make any difference in tax treatment –

- Whether non-resident has a

- Residence of Non Resident in India; or

- Place of business of Non Resident in India; or

- Business connection of Non resident in India; or

- Rendering of services by Non Resident in India(as applicable).

For any queries, please write them in the Comment Section or Talk to our tax expert

1 thought on “Fee for Technical Services”

How Example 2 will be treated (Foreign Lab), if it is not considered as Fees for Technical Services?