What is Global Minimum Tax?

In order to attract international business and investments, tax rates are kept at very low level in many countries. These low tax rates result in an outflow of funds and business from economies that have a proper tax structure in place, to countries with a lower rate of tax or Nil rate of tax. This resulted in creating a severe disadvantage to nations that were charging appropriate taxes on income.

In order to deal with this issue, the concept of Global Minimum Tax was introduced by the Organization for Economic Cooperation and Development (hereinafter referred to as the “OECD”) Inclusive Framework on Base Erosion and Profit Sharing (hereinafter referred to as “BEPS”) in December 2021. In a gist, this tax is aimed at taxing Multi-National Enterprises which escape tax liability or pay tax at a lower rate than the proposed tax rate i.e. 15%. The key idea is, that if a company earns profit, then such profits should be liable to be taxed at a minimum rate. If the country where profits are generated does not tax them, the Ultimate parent entity shall have the obligation to pay tax on such profits in its jurisdiction. This would prevent enterprises from shifting profit from one country to another, i.e. parking them in the country where there is a lower rate of tax.

Let’s understand this with an example.

A US-based company wants to incorporate an Indian Company. However, if it does so directly then in case it wishes to sell the Indian company a few years later, capital gains earned from such transaction shall be liable to be taxed in the USA. But, if it establishes a company in Mauritius, (where let’s assume, that no tax is charged on capital gains and there is a treaty in place between India and Mauritius that capital gains will not be taxed), the US based company won’t have to pay any tax on sale of the company. In this manner a company successfully shifts its profits from a tax-paying jurisdiction, or an economic activity jurisdiction to a jurisdiction with lower or nil rate of tax. With the introduction of GMT, the US based company i.e. the Ultimate Parent Entity will have to pay tax on sale of shares of Indian company in US.

Developments on GMT on the International Front

Although this concept has been gaining ground for the past few years, recently it has gained momentum, with countries taking a renewed interest in concretizing this into law. This is so because most of them are victims of tax evasion due to the modern use of conducting business through technological means, bringing down tax revenues for economies around the world.

Bird’s eye view of the journey so far:

- 2018: Difficulty in taxation of profits of the Digital Economy led to efforts for a new approach to tax MNCs.

With the advent of technology, many companies changed their business structures from brick and mortar to digital business models. Thoroughly unprepared for such a drastic shift, the current tax laws were not adept enough to evolve with the global change.

- October 2020: OECD released blueprints of Pillar 2 – MNCs should pay Global Minimum Tax (GMT)

Although still in its early stages, it has provided for certain MNCs who are above the prescribed revenue threshold, to pay the minimum rate of tax that will be decided upon i.e. all MNCs would not be covered under these Global Minimum Tax Rules, but only certain MNC that meet the defined criterion.

- June 2021: The G7 countries confirmed commitment to US backed GMT-Proposed Rate of 15%.

- October 2021: 136/140 OECD Inclusive Framework members agreed to 15% tax rate

Objectives and Scope of Application of Global Minimum Tax

The objective of GMT Rules

The key objective of the Global Minimum Tax Rules is to introduce a number of interlocking rules, which seek to ensure at least a minimum rate of taxation to be levied on Multi-National Enterprises on their profits while avoiding the following :

- Double taxation

The tax will be levied only at the rate, which would be the difference of the GMT – Tax actually suffered. For instance, if an MNC earns income that is subject to tax at a rate of 10%, the GMT Rules will kick in and the MNC will have to pay additional tax at the rate of 5%, not at 15%.

- No Tax where No Economic Profit

In cases of genuine loss or other similar circumstances, if a transaction is not generating any economic profit, then it would not be liable to GMT.

- Address different tax systems of jurisdiction and operating models of businesses.

No two countries have a similar tax structure, other than the ones that operate on 0% tax regime. Therefore the GMT Rules would accommodate not only the diverse tax structures followed by different countries but also take into account, the various business models within their scope.

- Ensure transparency and a level playing field

Information should be provided so as to ensure transparency and make sure it doesn’t distort competition amongst businesses.

- Minimum Administrative and Compliance Cost

Compliance with the GMT Rules is intended so that it does not act as a burden on the taxpayer by increasing costs and compliance.

Scope of Application of GMT Rules

The entities, which will be covered under the application of the GMT Rules shall include the following:

- MNE Groups and their constituent entities with consolidated global group revenue of more than EUR 750 million (or AED 3.15 billion) .

- If the Ultimate Parent Entity is any of the following, then these groups will not be covered under the scope of the Rules:

- Funds – Pension and Investment funds

- Governmental Entities

- International Organizations

- Non-Profit Entities

- Entities subject to tax neutrality regimes

- Calculation of ETR for MNEs whose Effective Tax Rate (ETR) is below the proposed tax rate i.e. 15%: –

ETR = Amount of covered taxes (including ‘STTR’ taxes)/ Amount of Global Income

Key Rules for GMT Application

The following are the key rules relating to the application of Global Minimum Tax:

- Subject To Tax Rule (STTR): Subject To Tax Rule is the simplest method for GMT application and is found in many treaties across the globe. Subject To Tax Rule provides that where payments are taxed at a rate below GMT in the hands of the recipient, these payments are subjected to withholding tax in Payor jurisdiction, and/or treaty benefits are denied to such payments. It allows for source country taxation when there is a low rate of tax in the recipient country.

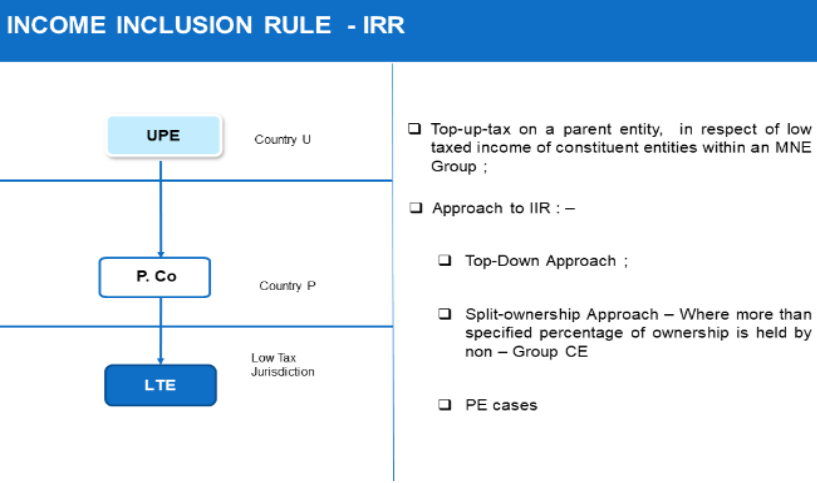

- Income Inclusion Rule (IRR) – Main Rule: It provides for a Top-Up tax on the parent entity with respect to low-taxed income of constituent entities within the MNE Group. This means that if a Ultimate Parent Entity , has a low taxed entity which is suffering a tax rate of 0% or lower than the GMT rate, on its income in its jurisdiction, the UPE shall be liable to pay a top-up tax at the rate of (15% – tax suffered). Thus, this liability will be reduced to the extent of tax paid by the subsidiary.

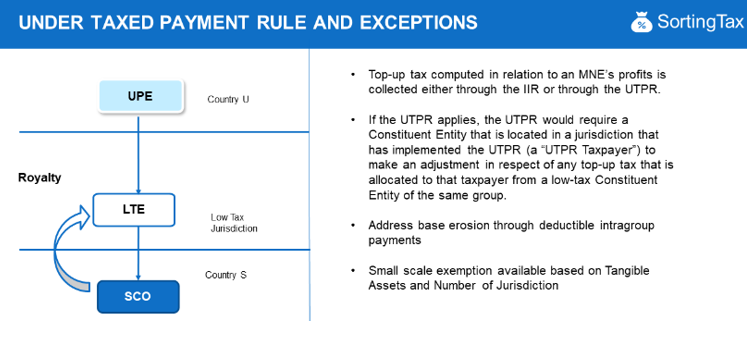

- Under Taxed Payments Rule (UTPR) – Backstop Rule: UTPR protects payor’s jurisdiction against base erosion of taxes, through intra-group payments to other entities in the low-taxed jurisdiction. For instance, if a Parent Company makes a royalty payment to a low-taxed entity, and the IIR is not applicable in the jurisdiction where the UPE is incorporated, then the UTPR becomes applicable.

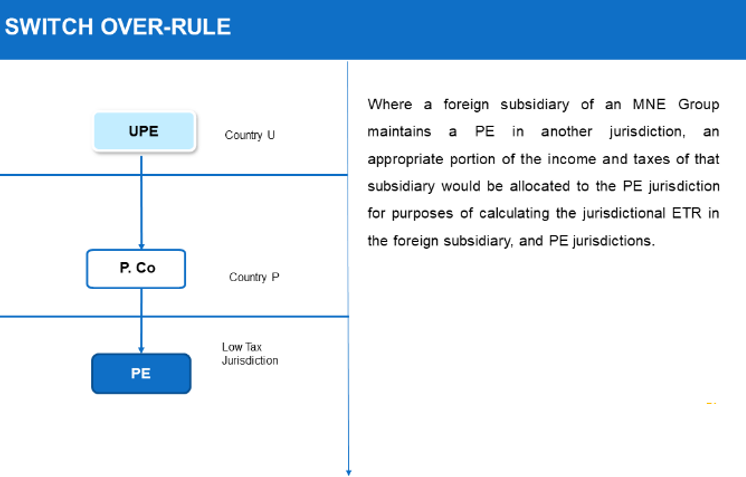

- Switch Over Rule: This Rule supports the IIR which would allow for a switch from an exemption to credit method where the income of a Permanent Establishment (hereinafter referred to as “PE”) is taxed locally at a rate that is below GMT.

This means that let’s suppose there is a Parent Company that has a PE in another jurisdiction. The income from the PE is subject to a 0% tax in the jurisdiction of the Parent Company. However, the tax rate at the Parent Company’s jurisdiction is 20%. The tax rate in the PE’s jurisdiction is lower than the GMT. In such a case, the Parent Company has the option to switch over from the exempt tax rate to a credit method. Therefore, the net effect would be [Tax Rate at Parent Company’s jurisdiction i.e., 20%- Tax Rate at PE’s jurisdiction i.e., 0%] 20%.

Let’s take a detailed look at the Rules discussed above.

I. Income Inclusion Rule

To understand Income Inclusion Rule better, let’s take an example. There is an Ultimate Parent Entity (UPE), a 100% subsidiary of the UPE, and a Low-Taxed Entity (LTE) in three different jurisdictions. The LTE operates in a jurisdiction where the rate of tax charged on its operations is 0%. The UPE in this case, on behalf of the LTE shall have to pay a top-up tax of 15%.

If the rate of tax at the LTE’s jurisdiction is 5%, then, since the tax rate is still below the proposed GMT (i.e.,15%), the UPE shall be required to pay tax at the rate of [15% – the tax rate at the LTE i.e., 5%] 10%. However, one must take note that it must be the Ultimate Parent Entity bearing this burden, not the Parent Company of the Low-Taxed Entity or any other company. This means that the Rule is applicable to the entity highest in the hierarchy of the business model.

There are various approaches to IIR:

- Top-Down Approach- This involves the UPE i.e. the Parent Entity at the top of the hierarchy to bear the burden of the tax of the LTE.

- Split–Ownership Approach- Please add an image In this case, for instance, the UPE has a 100% owned subsidiary (P Co.). P Co. has a 55% stake in the LTE. Let’s assume that 55% is more than the specified percentage of ownership. Thus, the portion of income relating to the Non-Group will not be included in the Top-Up tax.

Income Inclusion Rule: Top –Down Approach

The Top-Down approach is applicable to the parent closest to the top of the ownership chain. If the UPE is 100% owned by “Another company”, then that “Another company” shall be termed as the Ultimate Parent Entity, not the former one.

The UPE and the jurisdiction in which it is incorporated, for the purposes of this Rule, have to fulfill the following conditions:

- Equity Interest- The UPE should have an equity stake in the LTE. Investment in debentures, or preference shares of the LTE by the UPE shall not be considered.

- IIR Implementation- The UPE jurisdiction should have implemented the IIR. If this Rule is not implemented there then the UPE will not be able to pay tax for its LTE.

II. Switch Over Rule

To understand the concept of Switch Over Rule better, let’s look at an example. A company in which a UPE is incorporated in a country. It has a 100% subsidiary P Co. in another country. P Co. has a permanent establishment (PE) in a third country. Let’s assume that the profit earned by PE is 100 and the standalone profit earned by P Co. is 100 as well. The rate of tax in the PE’s jurisdiction is 0% and in the P Co. jurisdiction is 15%.

Then, the total tax to be paid on the cumulative profit of the PE and P Co. (i.e. 100+100 = 200) shall be 15%, wherein, 0% tax will be paid on 100 and 15% on the other 100 making the overall effective tax rate to be 7.5% [15/200=7.5]. This is well below the GMT rate. The question that arises is – How will the profits of the PE be taxed then?

To answer this question, two points have to be considered:

- How are the profits to the PE taxed in the hands of the Parent Company?

There can be situations where the profits of the PE are not taxable in the jurisdiction of the Parent Company.

- Either the jurisdiction of the P Co. exempts tax on the profits of the PE or;

- The countries of Parent Co. and PE have signed a treaty for such tax exemption.

If the tax exemption is because of (I), then IIR will not be applicable. The profit of P Co. only will be considered i.e., an aggregate amount of 100, and the tax rate would be 15%. If the tax exemption is because of (II), then both the profits of the P Co. and the PE will be considered for calculation of tax liability i.e., an aggregate amount of 200. As a result, the tax rate would be effective [15%/200= 7.5%]. Then IIR will become applicable and the top-up tax to be paid in this case would be [the GMT rate] i.e., 15% – [the effective tax rate] i.e., 7.5% = 7.5%. The top-up tax to be paid would be 7.5% of 200 will be 15. This 15 shall be paid by the UPE as additional tax under the GMT Rules.

III. Under Taxed Payment Rule and Exceptions

Under the GMT Rules, top-up tax has to be collected either through the IIR or, if IIR is not applicable, in the jurisdiction of the UPE, UTPR becomes applicable. UTPR is applicable only in cases where a Constituent Entity (CE) is located in a jurisdiction that has implemented the UTPR. The CE will then be liable to adjust in respect of any top-up tax that is allocated to it from a low-tax Constituent Entity of the same group.

Let’s take a look at this concept with an example. The LTE has earned an income of 500, wherein it received 250 from P Co. and 250 from S Co. It is to be noted that both companies are located in two separate jurisdictions. Let’s assume that both jurisdictions provide for UTPR to be applicable within their respective territories. Now, the rate of tax in the LTE’s jurisdiction is 0%, making the top-up tax to be 15% (since the GMT rate is 15%). Therefore, both the companies i.e. P Co. and S Co. are liable to pay the tax liability calculated on the total amount i.e. 500 at the rate of 15%, equally. This would mean that both P Co. and S Co. shall pay [500 * 15%= 75 i.e. 75/2= 37.5] each.

This rule also addresses base erosion through deductible intra-group payments.

Exception

A small-scale exemption has been provided to MNE’s under the UTPR on the basis of Tangible Assets and Number of Jurisdictions. MNEs that have overseas tangible assets worth EUR 50 million or less and are operating in 5 jurisdictions or less shall be given a grace period of 5 years.

Income Inclusion Rule v Under Taxed Payment Rule

IIR is applicable where the Ultimate Parent Entity whose jurisdiction has implemented the IIR and it controls the LTE (or LTCE- Low Tax Constituent Entity). However, if these conditions are not met, i.e. IIR is not applicable in the jurisdiction of the UPE, then UTPR becomes applicable.

FAQs on Global Minimum Corporate tax rate

Q1. What is the Global Minimum Corporate tax rate ?

Answer : – The Global Minimum Corporate tax rate is 15% .

Q2 . What are the Safe Harbor Rules under Global Minimum Corporate tax rate ?

Answer : -Under the Globe rules, jurisdictions, where the MNE has revenues of less than Euro 10 mn and profit of less than Euro 1 mn are excluded from the application of such Rules.

For any queries, please write them in the Comment Section or Talk to our tax expert