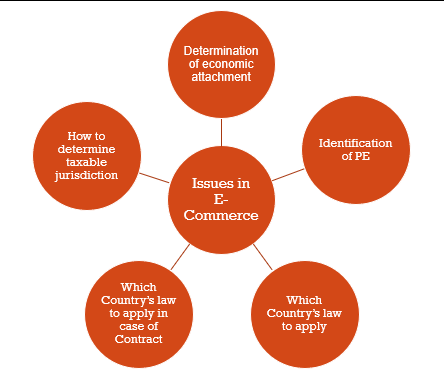

Issues in E-commerce Transactions

Determination of Economic Attachment

Taxation rules are based on either place of attachment (in case of individuals) or economic attachment. In order to identify economic attachment , the location where the transaction has taken place should be clearly determined.

In traditional commercial transaction, the place of the transaction could be easily determined , due to physical presence of seller and physical delivery of goods/services. This, helped in the application of Source rule laid down in Section 5 and Section 9 of the IT Act, 1961 in case of traditional commercial transaction.

However, in the case of E-Commerce transactions,these are completed in online in cyberspace. Hence, it is quite difficult to determine the location of transaction. Due to these reasons, it is often impossible to apply source rule in case of E-Commerce transactions.

Identification of PE

Under the existing rules of international taxation, the Source State can exercise right to tax business profits of foreign company , only when such foreign company does business in the Source State , through its Permanent Establishment situated in Source State.

Given that the e-commerce transactions take place online, the place of business is Virtually invisible and therefore the traditional rules of taxation may not be applicable on such transactions. In view of this, many taxpayers are able to avoid paying taxes in the source country, and at times do not pay any taxes in the country of residence.

The BEPS initiative has highlighted such issues and has provided recommendations to solve such issues relating to E-Commerce Transactions.

NOTE: – Permanent Establishment means a fixed place of business through which the business of enterprise, is wholly or partly carried on.

Which Country’s Law to Apply?

In case of E-Commerce transactions, the contracting parties in a transaction (i.e., buyer and seller or service receiver and service provider) are located in two different Countries. In many cases, the actual transaction may take place on servers which might be located in a third country.

Therefore, there is a need to determine which country’s law would be applicable in the case of e-commerce transaction so that the country get their fair share of taxes.

Which Country’s Law to Apply in case of Contract?

Under the laws dealing with contract, a contract can be both in writing or oral, and each of them would carry equal weighted in the eyes of law. In certain cases, e commerce transactions can be done through oral contract as well. In such a case it would create difficulty in determination of the fact as to which Country’s law would apply in case of disputes ? While in case of immovable property, generally the law relating to the country where the immovable property is situated are applicable, such problems would mostly arise in respect to transactions relating to movables.

How to determine Taxable Territory?

Under the provision of the domestic tax laws of a country, income arising in the taxable jurisdiction of such country is liable to tax therein. The taxable jurisdiction of any Country , covers its national boundary and includes territorial sea and airspace above , continental shelf, exclusive economic zone and other Maritime Zones Act, 1976. In case of traditional transaction, it is easy to identify the place where the transaction has taken place, and ascertain whether it lies within the taxable jurisdiction of a country. However in the case of E-Commerce transactions, it is quite impossible to determine the taxable jurisdiction since such transactions take place online through internet.

For any queries, please write them in the Comment Section or Talk to our tax expert