Meaning of Mutual Agreement Procedure (MAP) Transfer Pricing

Mutual Agreement Procedure (MAP) is a special facilitative procedure set out in various tax treaties that allows designated government representatives of Treaty partners (”referred to as Competent Authorities”) to work together, and resolve international tax disputes, including cases of double taxation arising out of application of the Convention.

MAP can be used to eliminate double taxation that could arise from a transfer pricing adjustment.

Application of Mutual Agreement Procedure (MAP)

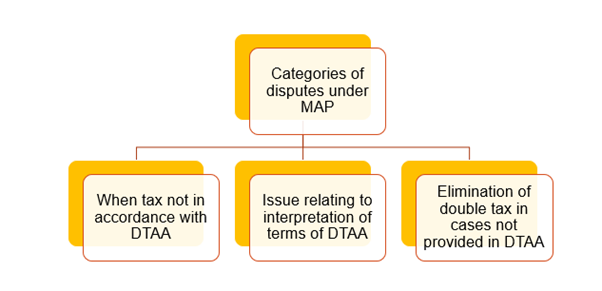

As per Article 25 of the OECD Model tax convention, mutual agreement procedures are generally used in the following cases:

- Where taxation is not in accordance with the provisions of the convention (Generally initiated by the taxpayer)

- Resolve the Questions of Interpretation or application of the convention and the elimination of double taxation in cases not otherwise provided for in the convention

MAP can be used to resolve problems of juridical double taxation and economic double taxation arising from transfer pricing adjustments made pursuant to paragraph 1 of Article 9 (Article 9 – Associated Enterprises)

Categories of Disputes covered under MAP

Juridicial Double Taxation and Economics Double Taxation Meaning of MAP

- Jurisdictional double taxation: It may arise when tax is imposed by two or more countries as per their domestic laws, in respect of the same transaction.

- Economic double taxation: It may arise when the same transaction, item of income or capital is taxed in two or more states but in hands of different person.

Mechanism under MAP

Need for Mutual Agreement Procedure (MAP)

MAP provides relief in cases of economic double taxation as Tax treaties (i.e., DTAAs) generally do not cover instances of economic double taxation.

MAP also provides relief in cases where automatic relief are not available, such as tax credits, tax exemption, etc.

Application for giving effect to MAP

Where a person considers that the actions of one or both of the Contracting States result or will result for him in taxation not in accordance with the provisions of this Convention, he may, irrespective of the remedies provided by the domestic law of those States, present his case to the competent authority of the Contracting State of which he is a resident or national.

This case must be presented within three years of the date of receipt of notice of the action which gives rise to taxation not in accordance with the Convention.

Steps involved in the Mutual Agreement Procedure (MAP) Application Process

- Brief facts and background of the case should be summarized.

- Contentions of Indian Revenue should be summarized in the MAP application.

- The net tax and interest impact by virtue of transfer pricing adjustment is computed.

- Take note of transactions only relating to one country (in one application), e.g. USA, UK, etc.

- All documents including tax returns, TP study, notices, submissions, orders, etc. should be furnished.

- Relevant judicial precedence and their applicability to taxpayer’s case must be demonstrated.

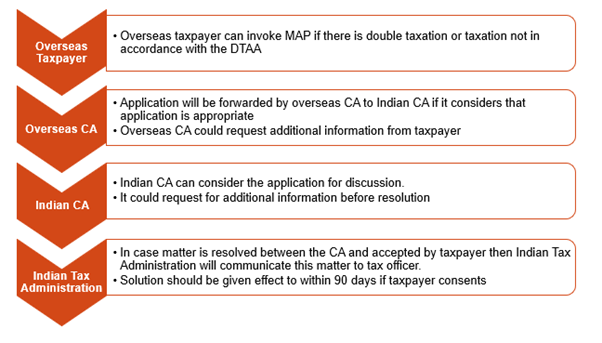

Typical Mutual Agreement Procedure (MAP) Process in India

INDIAN STATUTORY REGIME – MAP [RULE 44H] – ACTION BY INDIAN COMPETENT AUTHORITY ON REFERENCE FROM FOREIGN COMPETENT AUTHORITY

![INDIAN STATUTORY REGIME – MAP [RULE 44H]](https://sortingtax.com/wp-content/uploads/2021/05/INDIAN-STATUTORY-REGIME-%23U2013-MAP-RULE-44H.png)

Outcome of Mutual Agreement Procedure (MAP) Process

- The Assessing Officer gives effect of the decision of the MAP within 90 days of receiving instructions from the CCIT / DGIT

- If taxpayer is not satisfied with the decision of the Competent Authority, he may reject the decision and go ahead with the remedies under the domestic law

- If remedies are not granted under the domestic law, the taxpayer may apply to the Competent Authorities again for subsequent years.

- Decision of a Competent Authority is case specific and not a precedent for the taxpayer for subsequent years or other taxpayers on same issues.

Drawbacks of the Mutual Agreement Procedure (MAP) Process

- Time limits under domestic law may make corresponding adjustments unavailable if limits are not waived in the relevant tax treaty.

- MAP may take too long to complete.

- Taxpayer participation may be limited.

- Published procedures may not be readily available to instruct taxpayers on how the procedure may be used; and

- There may be no procedures to suspend the collection of tax deficiencies or the accrual of interest pending resolution of the MAP.

For any queries, please write them in the Comment Section or Talk to our tax expert