Resale Price Method Transfer Pricing

The application of Arm’s Length Principle while implementing the provisions of Transfer Pricing, to arrive at the price of a transaction between unrelated parties is essential. However different situations call for application of different methods of the ALP principle, depending on the mitigating factors in every transaction. One such method is the Resale Price Method. Let’s take an in- depth look into this concept.

| Principle of International Taxation | Transfer Pricing |

| Transaction between | International Parties

|

| Transfer Price | Price charged between two Associated Enterprises |

| Arm’s Length Price Principle | Price charged between two unrelated parties |

| Governing Provision | Section 92C, Income Tax Act, 1961 |

| Type of Method | Traditional Transaction Method |

| Application in cases | Product or services acquired from related parties and sold to independent parties without adding substantial value to the product or service. |

| Application of method | Comparison of gross margin (Gross profit over sales) earned in transactions between related and unrelated parties. |

Resale Price Method (RPM) Transfer Pricing

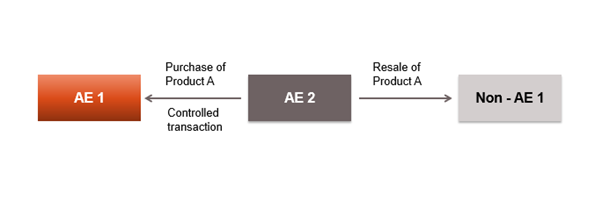

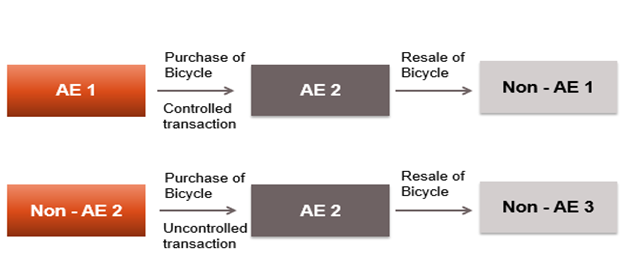

In the case of, resale price method, there are three parties to a transaction : –

- Non-resident related enterprise – AE1

- Resident importer and reseller – AE2

- Resident Buyer – Non – AE1

Under the resale price method, when a resident importer and reseller (AE2), and a related enterprise (AE1), enter into a transaction, and the purchaser or service recipient in that transaction (AE2) , resells the product/ provides services to an unrelated enterprise (Non – AE1), the ALP has to be calculated by deducting a “normal profit of the purchaser/recipient of services” from that resale price . The price so arrived at is deemed to be the arm’s length price applicable to the transaction between the related parties.

RPM compares the gross margins (i.e. gross profit over sales) earned in transactions between related and unrelated parties for determination of Arm’s length price.

RPM is generally used in case where the tested party (AE2) purchases products or acquire services from related parties and sells the same to independent parties without adding substantial value to the product or services. For example in case of distribution function.

Steps involved in Resale Price Method (RPM) to determine the ALP

Step 1 : –

Identify the Resale Price, i.e, the price at which property are resold , or services are provided to an unrelated party

Step 2 : –

Less :-

Reduce Normal gross (not net) profit margin, which are derived BY THE ENTERPRISE (AE 2) from the resale price of such property or services in comparable uncontrolled transactions (internal comparable). (Normal Net profit margin should not be considered as we need to reduce only gross profit margin)

Note : – The gross profit margin earned by an independent third party in comparable uncontrolled transactions (i.e, transaction with external parties) may serve as a guide (such transaction are known as “External Comparable”).

Step 3 : –

Less :-

Reduce any expenses incurred by the enterprise (AE 2) in connection with the purchase of goods /property, or obtaining of services (For example, if customs duty is borne by purchaser, the same should be reduced in Step 3).

Step 4 : –

Add/Less:-

- Impact of Functional and other differences, (including accounting practices) between international transaction (or SDT) and the comparable uncontrolled transactions,

- Impact of differences, between the companies/enterprises entering into such transactions, which could materially affect the amount of gross profit margin in the open market (Adjustments affecting only net profit margin should not be considered). For example cost of extended warranty, should not be considered as it impacts only net profit margin.

Resale Normal Gross Profit Margin

The resale normal gross profit margin (Step 2 above) is the margin which the enterprise would earn if it : –

- Purchases similar product from an independent unrelated third party ; and

- Resells such product to another independent unrelated third party.

The resale margin is the margin, which the reseller, would try to obtain to cover the cost of sales and other charges.

This comparable gross margin is determined by reference to either : –

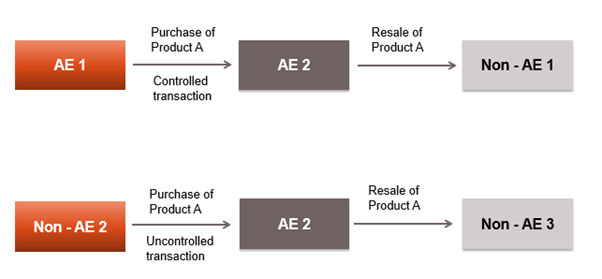

- The resale price margin earned by re-seller itself (Sale by AE 2 to Non – AE 3), in comparable uncontrolled transactions (internal comparable) or

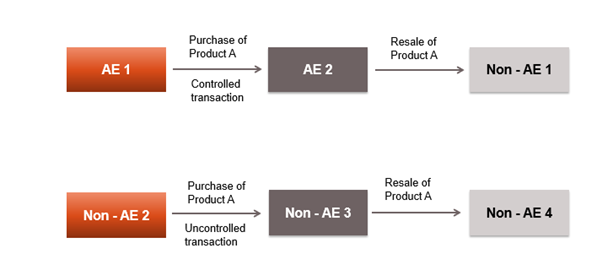

- The resale price margin earned by an independent enterprise (Sale by Non AE 3 to Non – AE 4) in comparable uncontrolled transactions (external comparable)

Internal Comparable – Resale Price Method (RPM) Transfer Pricing

Gross profit Earned by AE 2 on Resale of product A to Non – AE 3 would be Internal Comparable.

External Comparable – Resale Price method – Internal Comparable

Gross profit Earned by Non – AE 3 on Resale of product A to Non – AE 4 would be External Comparable.

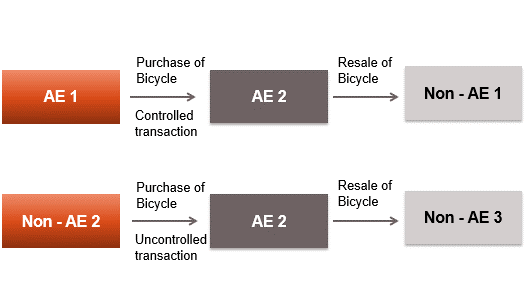

Example – Resale Price Method – Internal Comparable

Gross profit Earned by AE 2 on Resale of Bicycle to Non – AE 3 would be Internal Comparable.

Facts:

Sunil Limited , purchases bicycles from its parent company , Anil UK, an at Rs. 4,50,000 and resold these bicycles to Jumman Limited , an independent third party for Rs. 5,00,000.

Sunil Limited purchases bicycle from Amaanat Limited , another Non – AE and resold the same to Sammanit Limited , a WOS of Amaanat Limited. Sunil Limited earned gross profit margin of 20% on sales on such transaction.

There are no expenses in connection with purchase of bicycles and no functional or other differences which could affect the gross profit margin earned by Sunil Limited ?

Issue:

Compute Arms’ length price under Resale Price Method ?

Solution : –

| Particulars | Amount |

| Resale price of bicycle to Jumman Limited | Rs. 5,00,000 |

| Less: – | |

| Normal gross profit margin earned by internal comparable (5,00,000 * 20%) | Rs. 1,00,000 |

| Expenses in connection with purchase of bicycle | Nil |

| Add/ Less: – | |

| Adjustment for functional and other differences | Nil |

| ALP of bicycle purchased from Anil UK | Rs. 4,00,000 |

Example – RPM – Internal Comparable

Gross profit Earned by AE 2 on Resale of Bicycle to Non – AE 3 would be Internal Comparable.

Facts: –

AE 2 purchases bicycles from AE 1 at Rs. 4,50,000. AE 2 resold these bicycles to Non – AE1 at Rs. 5,00,000. AE 2 purchases bicycles from Non – AE 2 and resold the same to Non – AE 3. AE 2 earned gross profit margin of 20% on sales on such transaction. AE 2 offers extended warranty of one-year to Non – AE 1. The estimated cost of extended warranty is Rs. 2,000.

Issue : –

Compute Arms’ length price under Resale Price Method (RPM) Transfer Pricing?

Solution : –

| Particulars | Amount |

| Resale price of bicycle to Non – AE 1 | Rs. 5,00,000 |

| Less: – | |

| Normal gross profit margin earned by internal comparable (5,00,000 * 20%) | Rs. 1,00,000 |

| Expenses in connection with purchase of bicycle | Nil |

| Add/ Less: – | |

| Adjustment for extended warranty (Note) | Nil |

| ALP of bicycle purchased from AE 1 | Rs. 4,00,000 |

Note : –

Cost of extended warranty would not affect the gross profit margin as warranty costs are only charged to profit and loss account. Thus, no adjustment would be made for extended warranty as it has no effect on gross profit margin earned by AE 2.

Gross profit Earned by AE 2 on Resale of Bicycle to Non – AE 3 would be Internal Comparable.

Facts:

AE 2 purchases bicycles from AE 1 at Rs. 4,50,000. & resold these to Non – AE 1 at Rs. 5,00,000. AE 2 purchases bicycles from Non – AE 2 and resold the same to Non – AE 3. AE 2 earned gross profit margin of 20% on sales on such transaction before any discount. Differences in comparable transactions : –

- AE 2 incurred freight of Rs. 20,000 on purchase from AE 1. However, no freight was incurred on purchases made from Non – AE 2.

- Non – AE 1 purchased a larger order due to which it was given quantity discount by AE 2. Such quantity discount reduces the gross profit margin (as above) with Non – AE 1 by 3% on sales.

Issue:

Compute Arms’ length price under Resale Price Method (RPM) Transfer Pricing?

Solution : –

| Particulars | Amount |

| Resale price of bicycle from Non – AE 1 | Rs. 5,00,000 |

| Less: – | |

| Normal gross profit margin earned by internal comparable (5,00,000 * 17%) (Note) | Rs. 85,000 |

| Expenses in connection with purchase of bicycle from AE 1 | Rs. 20,000 |

| Add/ Less: – | |

| Adjustment for extended warranty | Nil |

| ALP of bicycle purchased from AE 1 | Rs. 3,95,000 |

Note : –

Comparable gross profit margin is 20%. However, due to quantity discount gross profit margin with Non – AE 1 is reduced by 3%. Thus, comparable gross profit margin should also be reduced by 3% (i.e., from 20% to 17%).

Judicial Rulings on Resale Price Method (RPM) Transfer Pricing

| Case laws | Held |

| Sanyo India Private Limited vs. ACIT – [2015] 45 CCH 98 (Bang. – Trib.) | Sanyo India Private Limited distributed electronic and electrical products imported from its related party in Japan. It adopted RPM as the most appropriate method using gross profit margin on sales as profit level indicator. It was observed that Sanyo India Private Limited was selling goods in local market without any value addition. Hence, it was held that RPM is the most appropriate method. |

| CIT vs. L’Oreal India Private Limited – [2015] 53 taxmann.com 432 (Bombay) | L’Oreal India Private Limited was engaged in the business of manufacturing and distribution of cosmetics and beauty products and has exclusive rights to import, manufacture, market, distribute and sell branded products, consumer products and professional products relating to L’Oreal group. Court placed reliance on OECD guidelines. L’Oreal India Private Limited bought products from its AE’s and sold to unrelated parties without any further processing. Hence it was held that RPM can be adopted. |

Related Content

- Comparable Uncontrolled Price Method (‘CUP’)

- Cost Plus Method (‘CPM’)

- Profit Split Method (‘PSM’)

- Transactional Net Margin Method (‘TNMM’)

For any queries, please write them in the Comment Section or Talk to our tax expert