Bird’s Eye view of the ‘Scope of Total Income on the basis of Residential Status’

| Concept of taxation | Non-Resident Taxation |

| Provision of Income Tax Act, 1961 | Section 5 |

| Provision deals with | Calculation of Total Income on the basis of Residential Status |

Scope of total income on the basis of Residential Status – Section 5 of Income Tax Act

The quantum of tax levied on any person, in a country, depends upon his residential status.

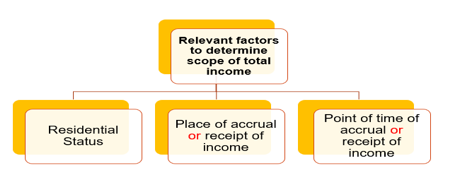

The total taxable income of a Person depends upon the following considerations: –

- Residential status of Assessee (i.e., resident or non-resident or resident and ordinarily resident or resident but not ordinarily resident). Generally, in case of a resident, their global income is taxable. However in case of a non-resident, only income which is sourced in a particular country is liable to tax in that country.

- Place of accrual or receipt of income (in India or outside India), whether actual or deemed. If the income accrues or is received in India, it is liable to tax in India. However, if an income, need accrues not received in India, it would generally not be liable to tax in India ; and

- the point of time of accrual or receipt of income by or on behalf of the Assessee.

Scope of Total income of Non-Resident – Section 5(2) of Income Tax Act

The income of the non-resident, which is liable to tax in India would include the following . [Such income, refers only to the Indian income as foreign income of a non-resident is not liable to tax in India] : –

- Income received in India in the previous year – Refer Paragraph ; or

- Income deemed to be received in India during the previous Year – Refer Paragraph ; or

- Income which accrues or arises in India during the PY– Refer Paragraph ; or

- Income which is deemed to accrue or arise in India– Refer Paragraph

Points to consider :-

- Generally Indian income is always taxable in the hands of an Assessee irrespective of his residential status, (i.e., Indian income is taxable in the hands of both resident, and non-resident Assessees), subject to permitted exceptions.

- Resident Assessee is liable to pay tax on global income (including foreign income).

Scope of total income on the basis of Residential Status – Section 5 of Income Tax Act – Examples

Example 1 : –

Mr. Alexender is a non-resident individual. He received an interest income of Rs 2,40,000 in India during the previous year 2016-17. Whether such income is includible in the total income of Mr. Alexender under the IT Act, 1961 ?

Solution : –

Interest income is received in India during the previous year 2016-17. Any income which is received in India is taxable in the hands of all Assessees, i.e., (residents and non-residents). Thus, interest income would be included in the total income of Mr. Alexender for PY 2016-17 and hence taxable for AY 2017-18.

Example 2 : –

Mr. Gogo is a non-resident Assessee. He received interest income of Rs 55,000 outside India during the previous year 2016-17, but the interest accrued in India. Whether such interest income is includible in the total income of Mr. Gogo?

Solution : –

Interest income of Mr. Gogo is taxable in India as it accrues in India. Receipt of interest income outside India is not relevant when such income accrues or arise in India.

For any queries, please write them in the Comment Section or Talk to our tax expert