Section 96 of Income Tax Act – Meaning of impermissible avoidance arrangement.

An arrangement is an impermissible avoidance arrangement, if its main purpose , of the arrangement, or step in an arrangement, is to obtain a tax benefit (“Main Purpose Test”) and it satisfies one or more of the conditions :

- Arrangement creates rights or obligations which are not ordinarily created between persons dealing on arm’s length.

- Arrangement results directly or indirectly in the misuse or abuse of provision of the Act

- Arrangement lacks commercial substance whether in whole or in part

- Arrangement has been executed in manners which are not ordinarily employed for bonafide purposes.

Onus to prove that arrangement entered into by an assesse is not an impermissible avoidance arrangement is first on the taxpayer.

Splitting of Contract (Overview of Indian GAAR Provisions – Section 96 of Income Tax Act)

Facts

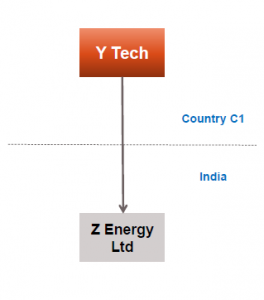

- Y Tech Ltd. is a company resident of country C1.

- It enters into an agreement with Z Energy Ltd., an Indian company for setting up a power plant in India.

- It is a composite contract for an agreed price of US$ 100million. The payment has been split in the following parts as per separate agreements

- US$ 10 million for design of power plant outside India (payment for which is taxable at 10% on gross basis)

- US$ 70 million for offshore supplies of equipment etc (not taxable as no role is played by any PE in India. There are not subject to import duty)

- US$ 20 million for local supplies and installation charges (taxable on net income basis)

It is found that the fair market value of offshore design is about USD 30 million; therefore it is under invoiced. On the other hand, offshore supplies were over invoiced. The arrangement resulted in significant tax benefit to the taxpayer.

Issue

Can GAAR be invoked in such a case

Interpretation

The allocation of price to different parts of the contract has been decided in such a manner as to reduce tax liability of the foreign company in India. Both conditions for declaring an arrangement as impermissible are satisfied. (1) The main purpose of this arrangement is to obtain tax benefit; and (2) the transactions are not at arm‘s length. Consequently, GAAR may be invoked and prices would be reallocated based on arm‘s length price of each part of the contract determined as per transfer pricing regulations under the Act. However, it is clarified that GAAR provisions in such cases may be invoked only where there is an overall benefit in reallocation of prices to different parts of the overall contract. For instance, where import duty is levied on offshore supplies, it may not result in any net gain on reallocation of prices; or where offshore designs are not taxable as per the relevant DTAA.

Splitting of Shareholding (Overview of Indian GAAR Provisions – Section 96 of Income Tax Act)

Facts

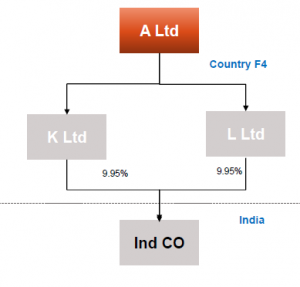

Under the provisions of a tax treaty between India and country F4, any capital gains arising from the sale of shares of Indco, an Indian company would be taxable only in F4, if the transferor is a resident of F4 except where the transferor holds more than 10% interest in the capital stock of Indco. A company, A Ltd., being resident in F4, makes an investment in Indco through two wholly owned subsidiaries (K Ltd. and L Ltd.) located in F4. Each subsidiary holds 9.95% shareholding in the Indian Company, the total adding to 19.9% of equity of Indco. The subsidiaries sell the shares of Indco and claim exemption as each is holding less than 10% equity shares in the Indian company.

Issue

Can GAAR be invoked in such a case ?

Interpretation

The above arrangement of splitting the investment through two subsidiaries appears to be with the intention of obtaining tax benefit under the treaty. Further, there appears to be no commercial substance in creating two subsidiaries as they do not change the economic condition of investor A Ltd. in any manner (i.e on business risks or cash flow), and reveals a tainted element of abuse of tax laws. Hence, the arrangement would be treated as an impermissible avoidance arrangement by invoking GAAR. Consequently, treaty benefit would be denied by ignoring K and L, the two subsidiaries, or by treating K and L as one and the same company for tax computation purposes.

MAT Exemption (Overview of Indian GAAR Provisions – Section 96 of Income Tax Act)

Facts

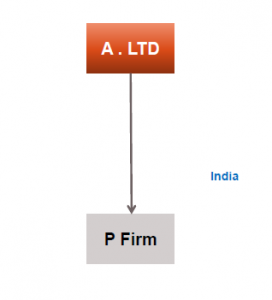

An Indian company A Ltd makes an investment of Rs 1 crore in shares of a listed company on 1st Jan 2020. After a year, the prices go up and fair market value of shares becomes Rs 11 crore. If A Ltd sells these shares, the long term capital gains of Rs 10 crore would be exempt but it would be liable to tax under MAT @ 20%. A Ltd forms a partnership firm with another person with nominal partnership. It transfers its shares in the firm at a cost price. No capital gain arises as per section 45 of the Act. After a year, the firm sells these shares and realises the gains of Rs 10 crore which is exempt from taxation and no MAT is payable. Subsequently, the firm is dissolved and share of A Ltd in the partnership firm is transferred back along with profits, which is exempt from tax under the Act.

India

Issue

Can GAAR be invoked in such a case ?

Interpretation

The only purpose of forming a partnership and transferring assets to such firm and selling the shares is to save tax from MAT liability of A Ltd. Further, there is no commercial substance in the formation of the partnership as it does alter the economic position of A Ltd in terms of business risks or cash flow. Moreover, the entire exercise is carried out in an abnormal manner. Even holding of shares by the partnership firm for a year or more is no significant economic risk to the company. Hence, GAAR may be invoked and the partnership firm may be disregarded and capital gains may be taxed under MAT in the hands of A Ltd.

Low Tax Jurisdiction – Interest Deduction (Overview of Indian GAAR Provisions – Section 96 of Income Tax Act)

Facts

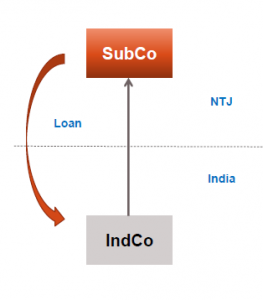

Indco incorporates a Subco in a NTJ with equity of US$100. Subco has no reserves; it gives a loan of US$100 to Indco at the rate of 10% p.a. which is utilized for business purposes. Indco claims deduction of interest payable to Subco from the profit of business. There is no other activity in Subco.

Issue

Can GAAR be invoked in such a case ?

Interpretation

The main purpose of the arrangement is to obtain interest deduction in the hands of Indco and thereby tax benefit. There is no commercial substance in establishing Subco since without it there is no effect on the business risk of Indco or any change in the cash flow (apart from the tax benefit). Moreover, it is a case of round tripping which means a case of deemed lack of commercial substance. Hence, it would be treated as an impermissible avoidance arrangement. Consequently, in the case of Indco, interest payment would be disallowed by disregarding Subco. No corresponding relief would be allowed in the case of Subco by way of refund of taxes withheld, if any.

Deemed Dividend – Low Tax Juristiction (Overview of Indian GAAR Provisions – Section 96 of Income Tax Act)

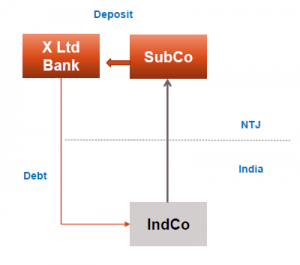

Facts

- X Ltd. is a banking institution in LTJ;

- A closely held company Subco in LTJ which is a wholly owned subsidiary of another closely held Indian company Indco;

- Subco has reserves and, if it provides a loan to Indco, it may be treated as deemed dividend under section 2(22)(e) of the Act.

- Subco makes a term deposit with X Ltd. bank and X Ltd. bank based on this security provides a back to back loan to Indco.

- Say, India-LTJ tax treaty provides that interest payment to a LTJ banking company is not taxable in India.

Issue

Can GAAR be invoked in such a case

Interpretation

This is an arrangement whose main purpose is to bring money out of reserves in Subco to India without payment of due taxes. The tax benefit is saving of taxes on income to be received from Subco by way of dividend or deemed dividend. The arrangement disguises the source of funds by routing it through X Ltd. bank. X Ltd. bank may also be treated as an accommodating party. Hence the arrangement shall be deemed to lack commercial substance. Consequently, in the case of Indco, the loan amount would be treated as dividend income received from Subco to the extent reserves are available in Subco; and no expense by way of interest would be allowed. In the case of bank X Ltd, exemption from tax on interest under the DTAA may not be allowed as X Ltd is not a beneficial owner of the interest, provided the DTAA has anti-avoidance rule of beneficial ownership. If such anti-avoidance rule is absent in DTAA, then GAAR may be invoked to deny treaty benefit as arrangement will be perceived as an attempt to hide the source of funds of Subco.

Intermediate Holding Company (Overview of Indian GAAR Provisions – Section 96 of Income Tax Act)

Facts

- Y Ltd. is a company incorporated in country C1. It is a non-resident in India.

- Z Ltd. is a company resident in India

- A Ltd. is a company incorporated in country F1 and it is a 100% subsidiary of Y Ltd.

- A Ltd. and Z Ltd. form a joint venture company X Ltd. in India after the date of commencement of GAAR provisions. There is no other activity in A Ltd.

- The India-F1 tax treaty provides for non-taxation of capital gains in the source country and country F1 charges no capital gains tax in its domestic law.

- A Ltd. is also designated as a ―permitted transferee‖ of Y Ltd. ―Permitted transferee means that though shares are held by A Ltd, all rights of voting, management, right to sell etc., are vested in Y Ltd.

- As per the joint venture agreement, 49% of X Ltd‘s equity is allotted to A Ltd. and 51% is allotted to Z Ltd..

- Thereafter, the shares of X Ltd. held by A Ltd. are sold to C Ltd., a company connected to the Z Ltd. group. As per the tax treaty with country F1, capital gains arising to A Ltd. are not taxable in India.

Issue

Can GAAR be invoked in such a case

Interpretation

The arrangement of routing investment through country F1 results into a tax benefit. Since there is no business purpose in incorporating company A Ltd. in Country F1, it can be said that the main purpose of the arrangement is to obtain a tax benefit. The alternate course available in this case is direct investment in X Ltd. joint venture, by Y Ltd. The tax benefit would be the difference in tax liabilities between the two available courses.

The next question is, does the arrangement have any tainted element? It is evident that there is no commercial substance in incorporating A Ltd. as it does not have any effect on the business risk of Y Ltd. or cash flow of Y Ltd.

As the twin conditions of main purpose being tax benefit and existence of a tainted element are satisfied, GAAR may be invoked. Additionally, as all rights of shareholders of X Ltd. are being exercised by Y Ltd instead of A Ltd, it again shows that A Ltd lacks commercial substance. Hence, unless it is a case where Circular 789 relating Tax Residence Certificate in the case of Mauritius, or Limitation of Benefits clause in

India Singapore treaty is applicable, GAAR can be invoked.

Learn More about International Taxation