Short Term and Long Term Capital Asset

For the purpose of, computing capital gains, a Capital Asset is divided into two categories : –

- Short term Capital Asset

- Long term Capital Asset

The importance of classifying capital assets into these two categories lies in the fact that long term capital gains are generally chargeable to tax at a lower rate, as compared to short term capital gains.

Let us understand each one of these in detail :-

Short Term Capital Asset – Section 2(42A)

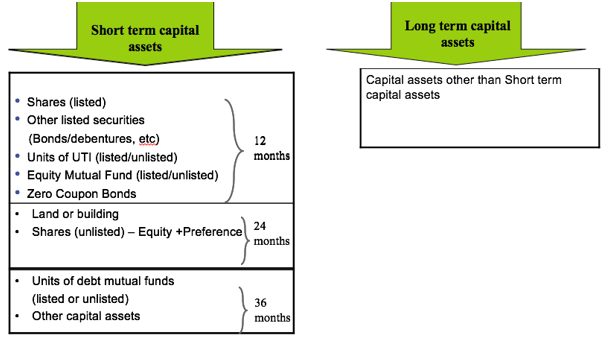

Short-term capital asset is a capital asset held by an assessee for a period of 36 months or less, immediately preceding the date of its transfer . However, in certain cases , the period of holding could be less than the period of 36 months . In the following cases, period of holding would be considered as 12 months instead of 36 months to ascertain if the following assets are short term capital assets:

- Listed shares

- Other listed securities (like listed debentures, bonds, government securities, derivative, etc .)

- Units of UTI (listed or unlisted)

- Units of Equity oriented mutual funds (listed or unlisted)

- Zero coupon bonds (listed or unlisted)

These Assets would be considered as short-term capital asset if they are held for 12 months or less immediately preceding the date of transfer:

Note : – In case of debt oriented mutual funds, normal period of holding of 36 months will be considered .

Period of holding would be considered as 24 months , instead of 36 months for following assets, to ascertain if they are short term assets : –

- Unlisted Equity shares

- Unlisted Preference shares

- Immovable property (Land or building) – AY 2018-19 onwards

Thus, unlisted shares and immovable property, would be considered as short-term capital assets if they are held for 24 months or less immediately preceding the date of transfer .

Long Term Capital Asset – Section 2(42A)

Capital asset held for more than 36 months (immediately preceding the date of its transfer) would be considered as long-term capital asset . However, in certain cases , the period of holding required to constitute a long term Capital Asset could be less than the period of 36 months .

Zero Coupon Bond (ZCB) – Section 2(48)

Zero coupon bond means a bond which is issued by any infrastructure capital company or infrastructure capital fund or a public sector company or a scheduled bank on or after 1st June, 2005. In case of such Bonds, no payment or benefit is received or receivable by the holder of such bonds, before maturity or redemption of such bonds by the issuing entity. Such Bonds have to be notified by the Central Government.

Income on transfer of a ZCB (other than those which are held as stock-in-trade) is taxable as capital gains .Maturity or redemption of a ZCB shall also be treated as a transfer , for the purposes of capital gains tax under Section 2(47)(iva).

Summary of Short Term Capital Gains & Long Term Capital Gains – Period of Holding

Period of Holding of Shares Acquired on Redemption of Global Depository Receipt

Where share(s) of a company are acquired by the non-resident assessee , on redemption of Global Depository Receipts [referred to in Section 115AC(1)(b)] held by such assesse, the period of holding of such shares shall be reckoned from the date on which the request for such redemption was made .

Example : –

Newton Inc. acquire Global Depository Receipt (GDR) of Diksha India on April 1, 2016.Newton Inc. requested for redemption of GDR on April 12, 2018, in Lieu of which it received shares on April 20, 2018. It sold such shares on July 1, 2018. Determine the Period of holding of shares ?

Solution : –

In this case, the period of holding of shares shall be reckoned from the date on which a request for redemption of GDR was made, i.e., from April 12, 2018.Thus, period of holding shall be April 12, 2018 to July 1, 2018

For any queries, please write them in the Comment Section or Talk to our tax expert

Related Content

- Capital Gains – Section 45 of Income Tax Act

- No Exemption u/s 10 on Urban Agricultural Land – Explanation 1 to Section 2(1A)

- Section 47 of Income tax act – Transactions not regarded as transfer

- Section 48 of Income Tax Act – Mode of Computation of Capital Gains

- Section 111a of Income tax act

- Section 112a of Income tax act