TAX AUTHORITIES UNDER THE BLACK MONEY ACT – SECTION 6

From here onwards, we will study the procedural part of the Black Money Act like, tax authorities, assessments, penalties, etc. This part is similar to the provisions under the Income Tax Act, 1961, which is covered under the ‘Paper 7 of Direct Taxes’.

Let us first understand who all are tax authorities under the Black Money Act : –

The Income-tax authorities specified u/s 116 of the Income-Tax Act shall also be tax authorities for the purpose of BMA . Such authorities are given as under : –

- Central Board of Direct Taxes ;

- Principal Director General of Income-tax or Principal Chief Commissioners of Income-tax ;

- Directors-General of Income-tax or Chief Commissioners of Income-tax ;

- Principal Directors of Income-tax or Principal Commissioners of Income-tax ;

- Directors of Income-tax or Commissioners of Income-tax or Commissioners of Income-tax (Appeals) ;

- Additional Directors of Income-tax or Additional Commissioners of Income-tax or Additional Commissioners of Income-tax (Appeals) ;

- Joint Directors of Income-tax or Joint Commissioners of Income-tax ;

- Deputy Directors of Income-tax or Deputy Commissioners of Income-tax or Deputy Commissioners of Income-tax (Appeals) ;

- Assistant Directors of Income-tax or Assistant Commissioners of Income-tax;

- Income-tax Officers ;

- Tax Recovery Officers ;

- Inspectors of Income-tax .

PERSON ON WHOM TAX AUTHORITIES CAN EXERCISE JURISDICTION?

The jurisdiction of tax authority , is important as it provides which are the person to whom such authority can issue tax notice, for dealing with the cases, under the Black Money Act.

The jurisdiction of tax authorities, under the Black Money Act would be the same as that of income tax authorities under the Income-Tax Act.

JURISDICTION OF TAX AUTHORITY WHEN ASSESSEE HAS NO INCOME ASSESSABLE UNDER THE INCOME-TAX ACT – SECTION 6

In cases , where a person does not have any income assessable under the Income-Tax Act, or does not have PAN , the jurisdiction of tax authority would be decided on the basis of place of residence of taxpayer, place of business or principal place of business of taxpayer.

Accordingly, first of all we need to determine the area, where the assessee resides or carries on its business , or has its principal place of business. Then, the tax authority which exercises jurisdiction in that area , would be the tax authority which can exercise jurisdiction over that person.

CHANGE OF TAX AUTHORITY – SECTION 7

There may be a change in tax authority due to succession, due to change in jurisdiction or any other reason. At the time of such change, it is possible that certain proceedings are pending before the predecessor officer. In such cases, the succeeding officer shall continue the proceedings from the stage at which they were left by his predecessor.

Let us understand this provision with the help of an illustration.

Suppose, AO1 is handling proceedings of Mr. V under the Black Money Act. AO1 is transferred to another State and AO2 has taken charge of his jurisdiction, while the case of Mr. V was still pending for disposal. In such a case, AO2 shall continue the proceedings from the stage at which it was left by AO1 after considering enquiries made and information already submitted.

POWERS OF TAX AUTHORITY

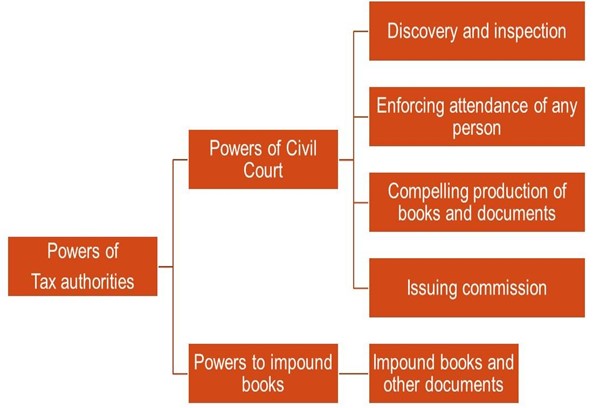

The Powers of the tax authorities are summarized as under : –

The prescribed tax authority (hereinafter referred as tax authority) has broadly two type of powers, i.e., power of civil court, and power to impound books. We will now discuss such powers in detail : –

i) Powers regarding discovery and production of evidence – Section 8(1)

Tax authorities are given certain powers, while trying a suit in a Court under the Black Money Act. These powers are same powers as are vested in a court under the Code of Civil Procedure, 1908 (5 of 1908). Such powers are given as under : —

- Discovery and inspection :- Tax authority have the power to discover or inspect any premises while trying a suit in a Court.

- Enforcing attendance of any person and examine him on oath :- The tax authority can enforce attendance of any person (including an officer of a banking company) and examine such persons on oath.

Examination on oath implies a person has to provide the details and statement while he swears under an oath. - Compelling the production of books of account and other documents :- If any person is not producing any books of account or other documents, then the tax authority can compel production of such books or documents while trying a suit.

- Issuing commissions – The tax authorities, may, in any assessment proceedings, issue a commission for the examination on interrogatories or otherwise of any person resident within the local limits of their jurisdiction , who is exempted under the Code of Civil Procedure from attending the Court or who is from sickness or infirmity unable to attend it.

USE OF POWERS FOR INQUIRY AND INVESTIGATION- SECTION 8(2)

In preceding paragraph, we have discussed powers of tax authority while trying a suit in Court. Now we will discuss its powers for the purpose of making an inquiry or investigation on any person, in connection with cases under BMA. For the purpose of making any inquiry and investigation, the prescribed tax authority shall be vested with following powers, namely : –

- Discovery and inspection :- The tax authority can make discovery and inspection on any premises in order to collect evidence in respect of potential black money.

- Examination on oath :- The tax authority can examine any person on oath.

- Compelling production of books :- The tax authority can ask for books of account from any person in order to identify black money. If any person is not producing books of account then it can compel production of such books.

- Issuing commission

Important Note :-

In order to decide whether any potential proceedings may lie under BMA, the prescribed tax authorities can make an inquiry and investigation on any person, even if any proceeding is not pending before it.

Let us understand this point with the help of an Example.

Example :- Mr. Jobo has not filed his return of income, and the tax authorities has information that such person may have undisclosed foreign income or undisclosed foreign asset. In such a case, the tax authority can make inquiry and investigation on Mr. Jobo, in order to decide whether a case of Black Money Act lies against him

iii) POWER TO IMPOUND BOOKS AND DOCUMENTS – SECTION 8(3)

Where the assessee has produced any books of account or other documents (like original bills, vouchers, etc.) before the prescribed tax authority, such tax authority may impound such books or documents and retain them in its custody for such period as it thinks fit.

However, in order to ensure that tax authority may not impound books of account or documents on its whims and fancies, there are certain restriction imposed on its power to impound books and documents. Any tax authority below the rank of Commissioner may : –

a) impound any books of account or other documents only after recording his reasons for doing so

Any tax authority below the rank of Commissioner should record the reasons for impounding books of account or other document. For example, the tax authority is of the view that any books of account or documents may be altered or damaged by the assesee, then it can impound such books of account after recording such reason.

b) retain in his custody any such books or documents for a period above 30 days only after obtaining the approval :-

After recording reasons for impounding books or documents, the tax authority (below the rank of Commissioner), may impound such books or documents only upto 30 days. Where such tax authority wants to impound such books of documents after 30 days, it has to take approval from the Principal Chief Commissioner or the Chief Commissioner or the Principal Commissioner or the Commissioner.

PROCEEDINGS BEFORE TAX AUTHORITIES TO BE JUDICIAL PROCEEDINGS – SECTION 9(1)

Any proceeding under the Black Money Act before a tax authority, shall be deemed to be a judicial proceeding within the meaning of within of Section 193, Section 196 and Section 228 of Indian Penal Code. In case of judicial proceedings, there are certain protections which are given to the tax authority, including no disrespect or insult , non furnishing of false evidence in judicial proceedings.

Section 193 of the IPC provides punishment for false evidence or fabrication of false evidence. Thus, as per these provisions, whoever intentionally gives false evidence, or fabricates false evidence , shall be punishable with imprisonment : –

- In any judicial proceeding – He shall be punished with imprisonment of upto 7 years, and shall also be liable to fine;

- In any other case – He shall be punished with imprisonment of upto 3 years, and shall also be liable to fine.

Section 196 of the IPC provides that whoever corruptly uses , or attempts to use any evidence which he knows to be false or fabricated, shall be punished in the same manner as if he gave or fabricated false evidence.

Section 228 of the IPC provides for imprisonment where any public servant sitting in judicial proceedings is insulted. Thus, as per this provision whoever intentionally insult, or causes any interruption to any public servant, while such public servant is sitting in any stage of a judicial proceeding, shall be punished with simple imprisonment of upto 6 months, or with fine of upto Rs 1,000, or with both.

TAX AUTHORITY DEEMED TO BE CIVIL COURT – SECTION 9(2)

A tax authority shall be deemed to be a civil court for the purposes of Section 195 of the Code of Criminal Procedure, 1973. Section 195 provides for prosecution for contempt of lawful authority of public servants, offences against public justice and offences relating to documents given in evidence.

However, it would not be so deemed for the purposes of Chapter XXVI of the Code of Criminal Procedure, 1973, containing the provisions as to offences affecting the administration of justice.

For any queries, please write them in the Comment Section or Talk to our tax expert