Taxation of Non-resident sportsperson , is dealt with in Section 115BBA of the Income Tax Act, 1961, which provides that the following incomes of non-resident sportsman (including an athlete), who is a foreign citizen are taxable at 20%:

- Income from participation in India in any game (other than winnings from crossword puzzles, races including horse races, etc. u/s 115BB) or sport; or

- Income from advertisement; or

- Income from contribution of articles relating to any game or sport in India in newspapers, magazines or journals (For text of Section 115BBA of the Income Tax Act, 1961, please refer the end of this Case Study.

Taxation of Non-resident sportsperson – International Taxation Case Study

David, a foreign national and a cricketer came to India as a member of Australian cricket team in the year ended 31st March, 2019. He received ₹ 5 lakhs for participation in matches in India. He also received ₹ 1 lakh for an advertisement of a product on TV. He contributed articles in a newspaper for which he received ₹ 10,000. When he stayed in India, he also won a prize of ₹ 10,000 from horse racing in Mumbai. He has no other income in India during the year.

i. Compute tax liability of David for Assessment Year 2019-20.

ii. Are the income specified above subject to deduction of tax at source ?

iii. Is he liable to file his return of income for Assessment Year 2019-20?

iv. What would have been his tax liability, had he been a match referee instead of a cricketer?

Taxation of Non-resident sportsperson – International Taxation Case Study – Solution:-

As per section 115BBA, following incomes of non-resident sportsman (including an athlete), who is a foreign citizen are taxable at 20%:

- Income from participation in India in any game (other than winnings from crossword puzzles, races including horse races, etc. u/s 115BB) or sport; or

- Income from advertisement; or

- Income from contribution of articles relating to any game or sport in India in newspapers, magazines or journals.

Computation of tax liability of David for the A.Y.2019-20

| Particulars | ₹ | ₹ |

| Income taxable under section 115BBA | ||

| Income from participation in matches in India | 5,00,000 | |

| Advertisement income | 1,00,000 | |

| Income from contribution of articles in newspaper | 10,000 | |

| Total income | 6,10,000 | |

| Tax [20% u/s 115BBA on Rs 6,10,000] | 122,000 | |

| Tax [30% u/s 115BB on income of Rs 10,000 from horse races ] | 3,000 | |

| 125,000 | ||

| Add: Cess @4% | 5,000 | |

| Total tax liability of David for the A.Y. 2019-20 | 130,000 |

ii)Yes, aforesaid income would be subject to withholding tax. Section 194E provides for deduction of tax at source @ 20% in respect of any income referred to in section 115BBA payable to a non-r resident sportsman (including an athlete) or an entertainer or non-resident sports association. However, in respect of winning from lotteries, horse races, etc., TDS shall be deducted u/s 194BB @ 30%. Accordingly, income of David of Rs 6,10,000 would be subject to withholding tax @ 20% and his income from horse race shall be subject to withholding tax @ 30% u/s 194BB. Such withholding tax under section 194E and under section 194BB shall be increased by a cess of 4%.

iii) As per section 115G, it shall not be necessary for a non-resident Indian to furnish a return of his income u/s 139(1) if —

- his total income consisted only of investment income or income by way of long-term capital gains or both; and

- the tax deductible at source has been deducted from such income.

However, in this case, Mr. David has earned income from horse races as well. Therefore, he cannot avail the benefit of such exemption from filing of return of income. Accordingly, Mr. David shall be required to file his return of income for A.Y.2019-20.

(iv) In case of Indcom v. CIT (TDS) (2011) 335 ITR 485, the Calcutta High Court has held that ,payments made to umpires or match referees do not come within purview of section 115BBA because umpires and match referee are neither sportsmen (including an athlete) nor are they non-resident sports association or institution so as to attract provisions contained in section 115BBA and, therefore, liability to deduct tax at source under section 194E does not arise.

Thus, on the basis of aforesaid ruling, we can conclude that payment to non-resident match referee are not covered under section 194E, thus, they shall be subject to the normal rates of tax .

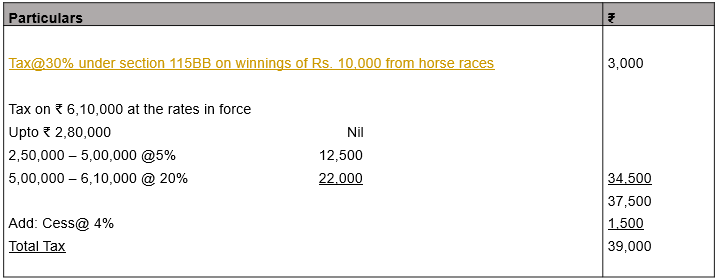

Computation of tax liability when Mr. David is a match referee for AY 2019-20

For any queries, please write them in the Comment Section or Talk to our tax expert

Bare Text of Section 115BBA – Taxation of non-resident sportsperson

(1) Where the total income of an assessee,—

(a) being a sportsman (including an athlete), who is not a citizen of India and is a non-resident, includes any income received or receivable by way of—

(i) participation in India in any game (other than a game the winnings wherefrom are taxable under section 115BB) or sport; or

(ii) advertisement; or

(iii) contribution of articles relating to any game or sport in India in newspapers, magazines or journals; or

(b) being a non-resident sports association or institution, includes any amount guaranteed to be paid or payable to such association or institution in relation to any game (other than a game the winnings wherefrom are taxable under section 115BB) or sport played in India; or

(c) being an entertainer, who is not a citizen of India and is a non-resident, includes any income received or receivable from his performance in India,

the income-tax payable by the assessee shall be the aggregate of—

(i) the amount of income-tax calculated on income referred to in clause (a) or clause (b) or clause (c) at the rate of twenty per cent; and

(ii) the amount of income-tax with which the assessee would have been chargeable had the total income of the assessee been reduced by the amount of income referred to in clause (a) or clause (b) or clause (c) :

Provided that no deduction in respect of any expenditure or allowance shall be allowed under any provision of this Act in computing the income referred to in clause (a) or clause (b) or clause (c).

(2) It shall not be necessary for the assessee to furnish under sub-section (1) of section 139 a return of his income if—

(a) his total income in respect of which he is assessable under this Act during the previous year consisted only of income referred to in clause (a) or clause (b) or clause (c) of sub-section (1); and

(b) the tax deductible at source under the provisions of Chapter XVII-B has been deducted from such income.