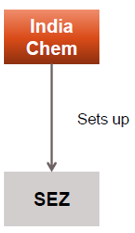

GAAR EXAMPLES – 1 : TAX MITIGATION SETTING UP AN UNDERTAKING IN AN SEZ

Facts

- India Chem, an Indian company sets up a unit in a Special Economic Zone (SEZ) in F.Y. 2013-14 for manufacturing of

- It claims 100% deduction of profits earned from that unit in F.Y. 2021 -22 and subsequent Sets up years as per section 10AA of the Act

Issue

Whether GAAR is applicable ?

Interpretation by Committee

- Setting up production facilities in an SEZ to claim tax deduction on sale of such production is a case of Tax mitigation, wherein a tax payer is availing the benefit provided by Statute, submitting to the conditions and economic consequences of the provisions in the legislation

- GAAR cannot be invoked in such a case.

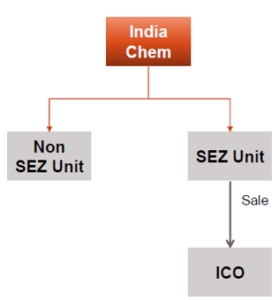

GAAR EXAMPLES – 1A:- TAX MITIGATION DIVERTING PRODUCTION TO AN UNDERTAKING IN AN SEZ

Facts

- India Chem, an Indian company sets up a unit in a Special Economic Zone (SEZ) in F.Y. 2013-14 for manufacturing

- It claims 100% deduction of profits earned from that unit in F.Y. 2021 -22 and subsequent years as per section 10AA of the Act

- India Chem has a unit in Non SEZ area as well

- It diverts its production from non SEZ manufacturing unit and shows the same as manufactured in the tax exempt SEZ unit, while doing only process of packaging in the SEZ unit ?

Issue

Whether GAAR is applicable ?

Interpretation by Committee

- This is a case of misrepresentation of facts by showing production of non-SEZ unit as production of SEZ unit. and amounts to tax evasion and not tax avoidance

- This case should be dealt with directly by establishing correct facts.

- GAAR provisions will not be invoked in such a case

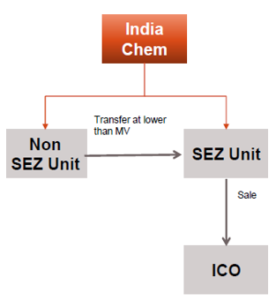

GAAR EXAMPLES – 1 : TAX MITIGATION – SELLING BY NON-SEZ TO SEZ UNIT AT LESS THAN MARKET VALUE

Facts

- India Chem, an Indian company sets up a unit in a Special Economic Zone (SEZ) in F.Y. 2013-14 for manufacturing of

- It claims 100% deduction of profits earned from that unit in F.Y. 2021 -22 and subsequent years as per section 10AA of the Act

- India Chem has a unit in Non SEZ area as well

- It sells goods to SEZ unit at a lower price , which after performing insignificant activity sells the goods to customer

Issue

Whether GAAR is applicable ?

Interpretation by Committee

- This is not a case of misrepresentation of facts and does not amount to tax evasion

- This case should be dealt with through transfer pricing provisions

- GAAR provisions will not be invoked in such a case.

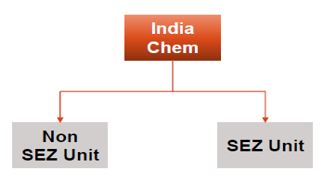

GAAR EXAMPLE 1A – TAX MITIGATION – SHIFTING EXPORTS TO SEZ UNIT

Facts

- India Chem, an Indian company has an SEZ and non SEZ units for manufacturing of

- Both the units operate independently

- It claims 100% deduction of profits earned from that unit in F.Y. 2021 -22 and subsequent years as per section 10AA of the Act

- India Chem starts taking new orders from existing and new customers in SEZ and sales of non SEZ decline

Issue

Whether GAAR is applicable on the ground of shifting or reconstruction of business from unit B to unit A for the main purpose of obtaining tax benefit

Interpretation by Committee

- Tax avoidance through shifting/reconstruction of existing business from one unit to another has been specifically dealt with in section 10AA of the Act.

- GAAR provisions will not be invoked in such a case.

For FAQs ON GAAR Click here

For any queries, please write them in the Comment Section or Talk to our tax expert