Section 91 of Income Tax Act with Example

Countries With Which No Agreement Exists – Unilateral Agreements – Section 91 of Income Tax Act

i. Conditions for claiming relief u/s 91(1) of Income Tax Act : –

While India has double taxation avoidance agreement with many countries in the world, there may be certain countries, with which, India does not have a tax treaty, whether Limited or Comprehensive .

Where any income arises, to an Indian tax resident, in a country with which India does not have any DTAA, the question which arises is, if such assessee has paid tax in the foreign country, would the same income be taxed again in India ? The answer to this question lies in section 91 of the Income Tax Act, which provides relief from double taxation in such cases.

In such cases, the relief would be granted under Section 91, where all the following conditions are fulfilled . Failure to satisfy even one of these conditions would result in denial of the benefit under section 91. : –

- Residential status – India :- Assessee is a tax resident in India , during the relevant PY , in which the income is taxable in India .

- Income accrues or arises outside India :- Income accrues or arises to him outside India , and is not deemed to accrue or arise in India during the previous year. If the income is , deemed to accrue or arise in India during the previous year, it would be taxable under the provisions of the Income Tax Act. No benefit of section 91 would be given in such a case.

- Payment of tax overseas :- Assessee has been subjected to income-tax on such income in foreign country and has paid tax thereon in foreign country. This would imply, that if no tax paid in the Overseas jurisdiction, these provisions will not be applicable.

- No Indian DTAA :- India does not have any agreement for relief from double taxation with the country where income has accrued or arisen.

ii) Computation of Relief under section 91(1) of Income tax Act

Assessee shall be entitled to a DEDUCTION from the Indian income-tax payable as under : –

Where the tax rates in India are different from the tax rate in the other country

- A sum calculated on such doubly taxed income at the Indian rate of tax (i. e., average rate of income-tax) or the rate of tax in the said country, whichever is lower, or

Where the tax rates in India and other country are equal at the Indian rate of tax if both the rates are equal .

Section 91 of Income Tax Act – Example 1 – No DTAA With Country

A received certain consultancy income which accrued and arose in Country X, wherein tax @ 10% has been withheld under local laws of Country X, as no Treaty exist between India and Country X. As A is tax resident of India, he is liable to tax in India , on his global income in India. Can he claim credit for tax withheld in Country X ?

Solution: –

Section 91 specifies that if a person resident in India, has paid tax in any country with which no DTAA (Treaty) under section 90 exists, then, for the purpose of relief or avoidance of double taxation, a deduction is allowed from income-tax payable by him, of a sum calculated on such doubly taxed income –

- At Indian rate of tax or the rate of tax of such foreign country, whichever is lower, or

- At the Indian rate of tax, if both the rates are equal .

In the present case, the assessee shall be allowed a deduction from the Indian income-tax payable by him as per Section 91 since : –

- A is a resident of India;

- He has paid tax in Country X

- India does not have a DTAA (Treaty) with Country X

- Such income accrued or arises to him outside India during the previous year.

Section 91 of Income Tax Act – Example 2 – No DTAA With Country – Relief Average Rate of Tax

Mahesh, an Individual resident in India, is a famous anchor and host deriving income of Rs 2,00,000 from work performed outside India during the PY 2017-18 on which tax of Rs 20,000 has been deducted. India does not have any DTAA with that country where tax has been deducted. His income in India amounted to Rs 4,00,000. He has contributed Rs 1,00,000 in PPF and paid a life insurance premium of Rs 1,00,000. Compute the tax liability of Mahesh for the Assessment Year 2018-19?

Solution: –

Where any income arises to an assessee in countries, with which India does not have any double taxation agreement, relief would be granted under Section 91 provided all the following conditions are fulfilled : –

- Assessee is a tax resident in India during the previous year in which the income is taxable .

- Income accrues or arises to him outside India .

- Income is not deemed to accrue or arise in India during the previous year .

- Such income has been subjected to income-tax in the foreign country in the hands of the assessee .

- Assessee has paid tax on the income in the foreign country.

Since all the above conditions are satisfied, Mahesh is eligible for deduction u/s 91 .

Computation of total income of Mahesh for the AY 2018-19

| Particulars | Amount | |

| Indian income | 4,00,000 | |

| Foreign income | 2,00,000 | |

| Total | 6,00,000 | |

| Less: Deduction under Section 80C | ||

| Contribution in PPF | 1,00,000 | |

| LIC premium | 1,00,000 | |

| Total payment | 2,00,000 | |

| Aggregate Deduction should be restricted to Rs 1,50,000 | 1,50,000 | |

| Total Income | 4,50,000 |

Tax on Total income

| Particulars | Amount | Amount |

| Total Income | 4,50,000 | |

| Income Tax | 10,000 | |

| Add: Education Cess | 200 | |

| Add: SHEC | 100 | |

| Total Tax | 10,300 | |

| Average rate of tax in India

(10,300/4,50,000) X 100 |

2 .289% | |

| Average rate of tax in foreign Country

(20,000/2,00,000) X 100 |

10% | |

| Rebate u/s 91

Rs 2,00,000 X 2 .289% (lower of 2 .289% and 10%) |

4,578 | |

| Tax payable in India (10,300 -4,578) | 5,722 |

Section 91 of Income Tax Act – Example 3 – No DTAA With Country – Relief – Average Rate of Tax – Two Countries Deduction

Ramesh, an Individual resident in India, earned following income in India, Country A and Country B:

| Income from business carried out in India (Net income after deducting expenditure) | 9,00,000 |

| Gross royalty income from Country A | 5,00,000 |

| Expenses incurred to earn royalty | 10,000 |

| Rental income from house situated in Country B | 4,00,000 |

| Municipal taxes paid on aforesaid house | 30,000 |

India does not have a DTAA with Country A and Country B . Tax rates in Country A and Country B are 5% and 20%, respectively . Compute the total income and tax payable by Ramesh for AY 2018-19 ?

Solution: –

Where any income arises to an assessee in countries, with which India does not have any double taxation agreement, relief would be granted under Section 91 provided all the following conditions are fulfilled : –

- Assessee is a tax resident in India during the previous year in which the income is taxable .

- Income accrues or arises to him outside India .

- Income is not deemed to accrue or arise in India during the previous year .

- Such income has been subjected to income-tax in the foreign country in the hands of the assessee .

- Assessee has paid tax on the income in the foreign country .

Since all the above conditions are satisfied, Mahesh is eligible for deduction u/s 91 .

Computation of Total Income of Ramesh for the AY 2018-19

| Particulars | Amount | Amount |

| INCOME FROM HOUSE PROPERTY | ||

| Gross Annual Value* | 4,00,000 | |

| Less: Municipal tax | 30,000 | |

| Net Annual Value | 3,70,000 | |

| Less: Standard deduction u/s 24 [30% X 3,70,000] | 1,11,000 | |

| 2,59,000 | ||

| PROFIT AND GAINS FROM BUSINESS OR PROFESSION IN INDIA | 9,00,000 | |

| INCOME FROM OTHER SOURCES | ||

| Royalty income from Country A (after deduction Rs 10,000 expenditure) | 4,90,000 | |

| Gross Total Income | 16,49,000 | |

| Less: Deduction under Chapter VIA u/s 80QQB | 3,00,000 | |

| Total Income | 13,49,000 |

* Rental income has been assumed as Gross Annual Value

Computation of tax liability of Ramesh for the AY 2018-19

| Particulars | Amount | Amount |

| Tax on total income | 2,17,200 | |

| Add: Education Cess | 4,344 | |

| Add: SHEC | 2,172 | |

| 2,23,716 | ||

| Less: Rebate u/s 91 (See Working note) | 52,442 | |

| Tax payable | 1,71,274 | |

| Tax payable (Round off) | 1,71,270 |

Working Note

| Particulars | Amount | Amount |

| Average rate of tax in India

(2,23,716/13,49,000) X 100 |

16 .58% | |

| Average rate of tax in Country A | 5% | |

| Doubly taxed income pertaining to Country A | ||

| Royalty income [ Rs 5,00,000 – Rs 10,000 – Rs 3,00,000] | 1,90,000 | |

| Rebate u/s 91 on Rs 1,90,000 @ 5% [lower of 5% and 16 .58%] | 9,500 | |

| Average rate of Tax in Country B | 20% | |

| Doubly taxed income pertaining to Country B | 2,59,000 | |

| Rebate u/s 91 on Rs 2,59,000 @ 16 .58% (lower of 16 .58% and 20%) | 42,942 | |

| Total rebate u/s 91 | 52,442 |

Deduction of tax paid on agricultural income in Pakistan – Section 91 of Income Tax Act

Any person, who is resident in India, who proves that he has agricultural income in Pakistan, and such person paid tax in Pakistan (by deduction or otherwise), such person shall be entitled to a deduction from the Indian income-tax payable by him.

Deduction shall be lower of following amounts : –

- The amount of the tax paid in Pakistan under any law on such income which is also taxable under IT Act ; or

- Sum calculated on that income at the Indian rate of tax (i.e., average rate of income-tax).

Deduction in Respect of a Non resident share in the income of a registered firm resident in India – Section 91(3) of Income Tax Act

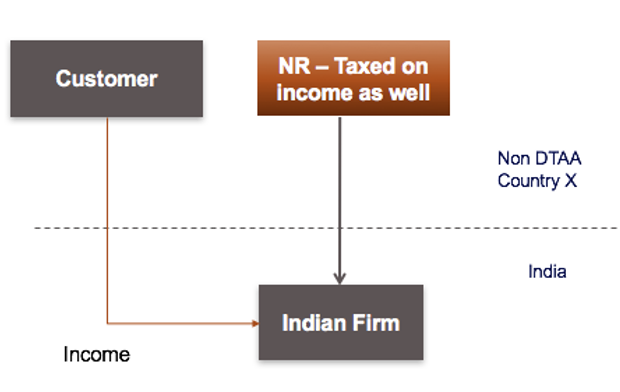

In order to understand this case, let us take an example : –

- An Indian Firm , tax resident in India, derives certain income from Country X, with which India does not have a DTAA, and pays tax on such income in country X ;

- A non-resident, has a share in the income of the Indian firm ;

- The non-resident has paid tax in Country X, on such income of the Indian firm. ;

In light of the above, lets evaluate the provision of Section 91(3).

Section 91(3) provides that where a non-resident assesse (NR), has a share in the income of a registered firm (Indian Firm), which is assessed as resident in India in any previous year, and such NR has paid income-tax in respect of such income derived by registered firm in country where the income had arisen (Country X) , he shall be entitled to a deduction of tax provided all the following conditions are fulfilled –

- The share income from the firm should include income accruing or arising outside India during that previous year;

- Such income should not be deemed to accrue or arise in India;

- The income should accrue or arise in a country with which India has no agreement under section 90 for the relief or avoidance of double taxation;

- The assessee should have paid income-tax in respect of such income according to the law in force in that country.

Where the above conditions are satisfied, the assessee will be entitled to a deduction as under : –

- Sum calculated on such doubly taxed income so included, at the Indian rate of tax or the rate of tax of the said country, whichever is lower, or

- at the Indian rate of tax, if both the rates are equal .