The provisions of “Chapter XII A of Income Tax Act – Special provisions relating to certain incomes of non-residents”contains sections 115C, 115D, 115E, 115F, 115G, 115H and 115-I. These provisions are applicable to a Non-resident Indian who has certain investment from which he derives : –

- Certain investment income; and/ or

- Long term capital gains on transfer of such investment.

Various provisions covered under Chapter XII-A of Income tax act are as under : –

Meaning of certain terms for the purpose of Chapter XIIA of Income Tax Act

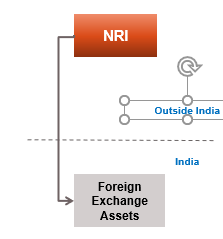

Non Resident Indian :-

“Non-resident Indian” means an individual, who is either a citizen of India, or a person of Indian origin, and who is not a “resident“.

A person shall be deemed to be of Indian origin if he, or either of his parents or any of his grand-parents, was born in undivided India.

Investment Income :-

Investment income” means any income derived [other than dividends referred to in section 115-O ] from a foreign exchange asset.

Foreign Exchange Asset

“Foreign exchange asset” means any of the following specified assets which assessee has acquired or subscribed to in convertible foreign exchange:-

- Shares in an Indian Public Company or Private Company) ;

- Debentures issued by an Indian company which is not a private company (i.e., Public Indian Company)

- Deposits with an Indian Public company ;

- Any security of the Central Government ;

- Such other assets as the Central Government may specify.

Meaning of Convertible Foreign Exchange

“Convertible foreign exchange” means foreign exchange which is for the time being treated by the RBI as convertible foreign exchange for the purposes of the Foreign Exchange Management Act, 1999, and any rules made thereunder .

Meaning of Long Term Capital Gains

“Long-term capital gains” means income chargeable under the head “Capital gains” relating to a capital asset, which is both a long term capital asset and a foreign exchange asset .

Computation of Total Income of Non Resident Indian – Section 115D – Deduction of Expenditure/Chapter VIA

The following provisions will be applicable, in computing the income of a non-resident Indian : –

1. No deduction of any expenditure or allowance

No deduction of any expenditure or allowance shall be allowed in computing the investment income of a non-resident Indian.

2. No indexation benefit and no deduction under Chapter VIA :-

Where the gross total income of the NRI, consists only ofinvestment income, or long-term capital gains, or both investment income and long-term capital gains–

- No deduction shall be allowed to the assessee under Chapter VI-A ; and

- Benefit of indexation shall not be available for computing capital gains.

Tax Rate (Excluding Surcharge and Cess) of NRI – Section 115E

Income of a non-resident Indian, would be chargeable to tax that the following rates : –

- Investment income from foreign exchange asset would be chargeable to Tax at 20%.

- Long term capital gains from foreign exchange asset would be chargeable to Tax @ 10%.

- Any income other than the above two income would be chargeable to Tax at the rate applicable to individual taxpayers.

Exemption from Long Term Capital Gains – Section 115E

Conditions to be satisfied to claim benefit of Section 115E :-

Where the NRI satisfies the following conditions , long-term capital gains shall be exempt from tax : –

- Assessee should be a non-resident Indian at the time of sale of capital asset . If the assesse was an NRI at the time of acquisition, but not at the time of sale, exemption shall not be available ;

- Long-term capital gains should arise from the transfer of a foreign exchange asset (original asset), and

- The assessee should, within 6 months from date of transfer, invest the whole or any part of the net consideration [i.e., Sales consideration – Expenses on transfer] in any of the following assets :

- Shares in an Indian company (Public or Private Company) ;

- Debentures issued by an Public Indian company ;

- Deposits with an Indian Public company ;

- Any security of the Central Government ;

- National Saving Certificates VI and VII issue.

Amount of Exemption

Where the assessee , invest in any of the specified assets, the amount of exemption would depend upon,cost of acquisition of new asset , as compared to the Net Sales consideration as under :-

When cost of acquisition of new asset ≥ Net consideration

Entire Capital gains shall be exempt from tax.

When cost of acquisition of new asset ≤ Net consideration

Exemption shall be computed by following formula : –

= (Capital gains/Net Consideration) x Cost of acquisition of new asset

Withdrawal of exemption on transfer of new asset

Capital gains exemption claimed by the assesse on original asset shall be deemed to be income chargeable under the head “Capital gains” in the year which the new asset is transferred or converted into money, where the new specified asset, in which the investment is made by the assesse is : –

- Transferred by the assessee within a period of 3 years from the date of its acquisition ; or

- Converted (otherwise than by transfer) into money, within a period of 3 years from the date of its acquisition,

Chapter XII A of Income tax act – Example 1

Mr. James, a non-resident Indian acquired 50,000 preference shares on 1.1.2014 @ 10 per share by utilizing foreign currency.These shares are sold on 30.03.2017 @ 30 per share. Brokerage @ 1 per share is paid on sale of these shares. He purchased 1,45,000 preference shares @ Rs 10 per share on May 1, 2017.Analyze tax implications ?

Solution –

Computation of Long-term Capital gains for the AY 2017-18

| Particulars | Amount |

| Sale consideration (Rs 50,000*30) | 15,00,000 |

| Brokerage (Rs 1 * 50,000) | (50,000) |

| Net Consideration | 14,50,000 |

| Cost of Acquisition (50,000*10) [Note 1] | (5,00,000) |

| Capital Gains | 9,50,000 |

| Exemption u/s 115F [Note 2] | (9,50,000) |

| Long-term capital Gain | Nil |

Notes : –

- Benefit of indexation is not available under chapter XII-A of Income tax act.

- James is entitled to full exemption from capital gains u/s 115F as he has invested the entire net consideration of Rs 14,50,000 for investment in new shares.

Chapter XII A of Income tax act – Example 2

Discuss the tax implication in previous Example, assuming that Mr. James has purchased only 1,00,000 preference shares @ Rs 10 per share for the purpose of investing sale consideration.

Further, if Mr. James has sold such 1,00,000 shares on April 30, 2018, what would be the tax implication ?

Solution –

Computation of long-term capital gains for the AY 2017-18

| Particulars | Amount |

| Net Consideration | 14,50,000 |

| Cost of Acquisition (50,000*10) | (5,00,000) |

| Capital Gains | 9,50,000 |

| Exemption u/s 115F [Note] | (6,55,172) |

| Long-term capital Gain | 2,94,828 |

Note : –

Computation of exemption u/s 115F

= (Capital Gains/Net Consideration) x Cost of new asset purchased

= (9,50,000/14,50,000) x 10,00,000

If Mr. James has sold such 1,00,000 shares on April 30, 2018, the specified asset would have been transferred within a period of 3 years from the date of its acquisition . This would result in long-term capital gains of Rs 6,55,172 being taxable in AY 2018-19.

Exemption from filing returns of Income – Section 115G

Anon-resident Indian, may chose not to file his return of income u/s 139(1) if —

- his total income consisted only of investment income or income by way of long-term capital gains or both; and

- the tax deductible at source has been deducted from such income.

Benefits of Chapter XIIA available even after Non resident Indian becomes Resident – Section 115H

Where a person, who is an NRI in any previous year, subsequently becomes assessable as resident,he has the following options : –

a) Through a written declaration to the Assessing Officer, along with his return of income, NRI can opt to continue to be governed by provision of Chapter-XIIA of Income tax act, in relation to the investment income from any foreign exchange asset. Such provision shall then apply to him for that and all subsequent assessment year until the transfer or conversion (otherwise than by transfer) into money of such assets.

b) An NRI may elect to opt out from the provisions of Chapter XII-A while filing his return of income . Thereafter, such provisions shall then apply to him for that and all subsequent assessment year until the transfer or conversion (otherwise than by transfer) into money of such assets.

Related Content

- Section 115a of Income Tax Act

- Section 115ab of Income tax act

- Section 115AC of Income tax act

- Section 115AD of Income tax act – Tax on Income of Foreign Institutional Investors

- Tax on Non Resident Sportsmen or Sports association

For any queries, please write them in the Comment Section or Talk to our tax expert